Consumers are increasingly moving from meals to snacking. “Three square meals a day” has become a concept of the past, with recent findings suggesting 86% of Americans instead opt for two meals and three snacks daily.* With this shift, traditional meal times are no longer the bread and butter of the restaurant industry, something particularly impactful for Quick Service Restaurants. In the fight to win a greater share of stomach, QSRs must focus on more than just meals and set their eyes on the snacks.

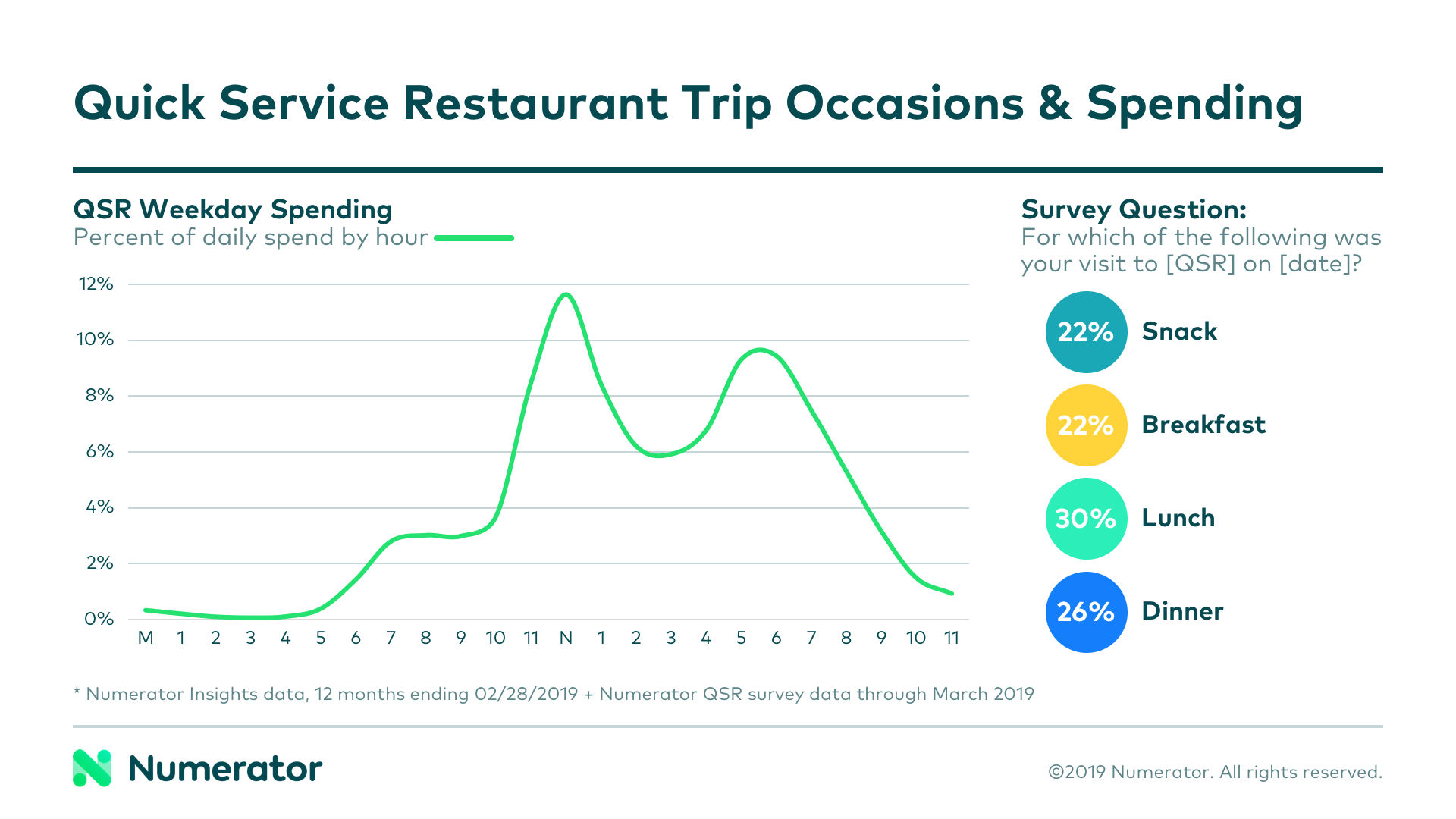

Snacking occasions are making a rumble at Quick Service Restaurants. Numerator Insights data tells us that 31% of QSR spending happens outside of traditional meal times. And in a Numerator survey of QSR consumers, 22% of QSR trips were identified as snack trips.

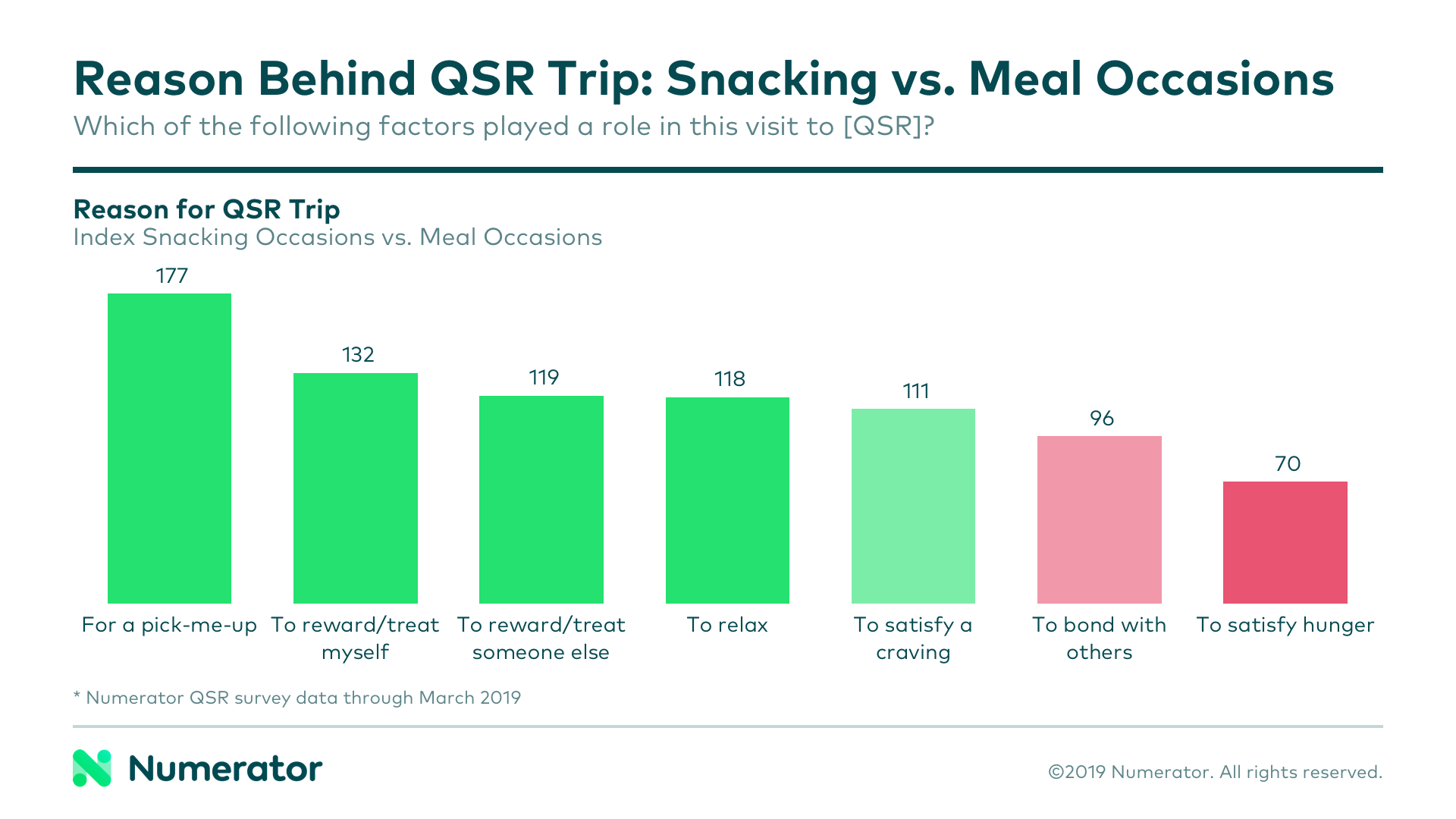

Snack trips to QSRs tend to be spontaneous and indulgence-oriented. 61% of survey respondents said their snack trip was “purely impulsive,” a slightly higher proportion than the 53% of meal-buying QSR consumers who reasoned the same. When identifying influential factors in their decision to grab their snack at a QSR, 14% said they were looking for a pick-me-up and 29% were looking to reward/treat themselves or someone else. Satisfying hunger was also far less likely to be a consideration in the QSR snack trip than it was in a meal trip.

Focusing menu innovation on indulgent treats is a major strategic shift for some QSRs, one that that is not always feasible. To that end, brands can leverage other daypart innovations to test products and drive snacking visits. McDonald’s Donut Sticks limited time offer is a good example; while the product is promoted as a breakfast item, it is an affordable (under $2 for 6 sticks) sweet indulgence, everything consumers want from a great snack.

Unsurprisingly, speed and proximity were driving factors in QSR snack trips; 35% of respondents selected their given QSR because it was close by or on the way to their final destination, and 20% visited because they knew they could be in and out quickly. If QSRs capitalize on menu items that lend themselves to a grab-and-go model— potentially adding drive-thru, walk-in or order-ahead offerings— they may be able to capture even more snacking occasions.

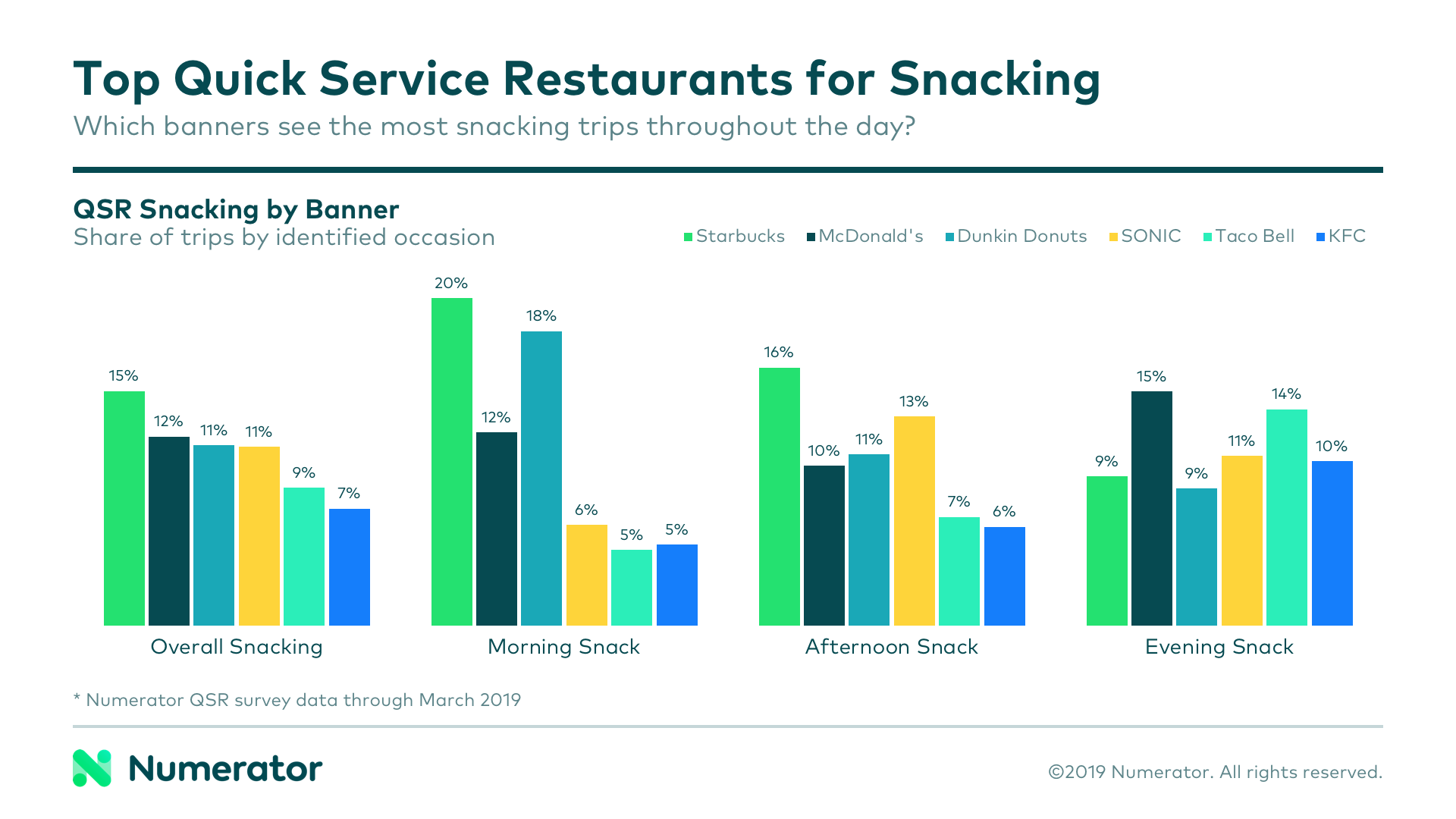

So, which QSRs are currently crushing the snack game? Starbucks comes in at number one, capturing 20% of morning snacks and 16% of afternoon snacks. Dunkin Donuts also rises to shine in the morning, Sonic has its moment with the afternoon snack crowd, and Taco Bell and McDonald’s dominate late-night.

While the ‘right’ approach to growing the snacking occasion varies by brand, its undeniable that QSRs need strong insights to understand their consumers and stay competitive. For more information on the QSR channel and how to establish yourself as a go-to ‘on-the-go’ snacking option, reach out to Numerator today.

—

*Source from Intro: Snacks Becoming “Meal of Choice” (Farm Rich + OnePoll)