When the pandemic prevented consumers from getting to-go meals from their go-to Quick Service Restaurants, they turned to 3rd-party delivery services to bring those dishes to their front door. As a result, in-store QSR trips sank while 3rd-party delivery QSR trips soared. Today, with a majority of American adults vaccinated against COVID-19 and resuming at least some normal behaviors, has 3rd-party delivery become part of a long-term consumer behavioral shift?

While 3rd-party delivery services are proving to have staying power, fully vaccinated consumers are also returning to their pre-COVID levels of in-store QSR purchases. Digging into Numerator Insights data, we look back at the pandemic’s impact on QSR in-store and 3rd-party delivery trips, which consumer groups rely on 3rd-party delivery the most, and whether the increase in fully vaccinated consumers is leading to a drop in 3rd-party delivery usage.

Trips Tell the Tale of COVID’s Impact on QSR Take-Out Versus Delivery

Just how dramatic was the decline of in-store QSR trips during COVID? Projected in-store trips dropped from over 4.2 billion in the 13 weeks ending February 2020 to 2.8 billion in the 13WE June 2020, and purchase frequency fell from roughly 36 trips per household to approximately 26 trips during that same time period, although spend per trip did increase from $10.50 to $12.50. The good news for QSRs is that consumers are gradually coming back. In the 13 weeks ending August 2021, in-store trips were projected at 4.1 billion and purchase frequency averaged around 35 trips per household.

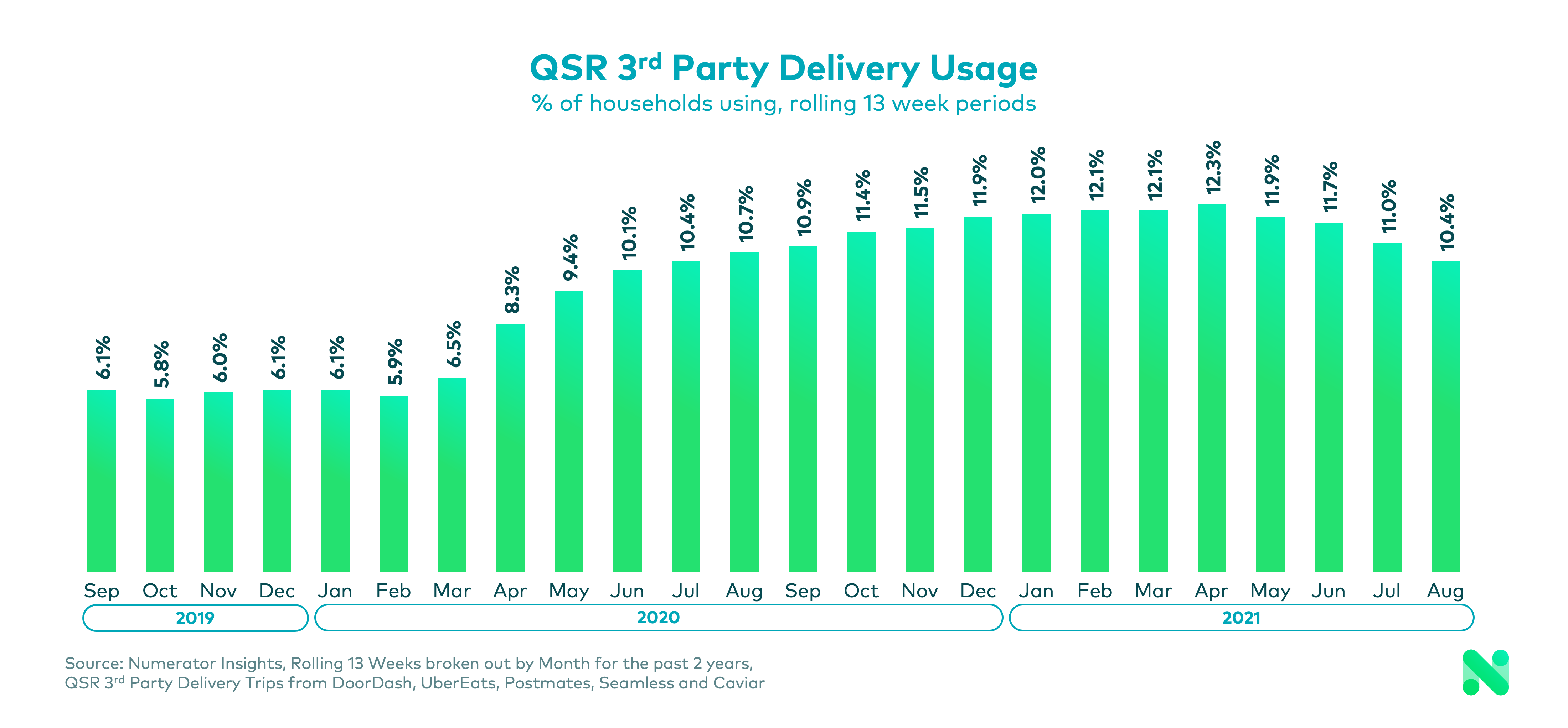

For 3rd-party delivery providers, COVID had the opposite effect. Uber Eats, Grubhub, and DoorDash are among the 3rd-party delivery providers that saw the most growth throughout the crisis, with UberEats growing exceptionally over this period. Household penetration doubled from 6% prior to the pandemic to 12% during the crisis. And by September 2021, trips were projected to grow from about 30 million (the pre-COVID baseline) to over 95 million. Additionally, purchase frequency increased from an average of 4 trips per quarter to 7, and spending has risen as well from $21 to over $26 per trip.

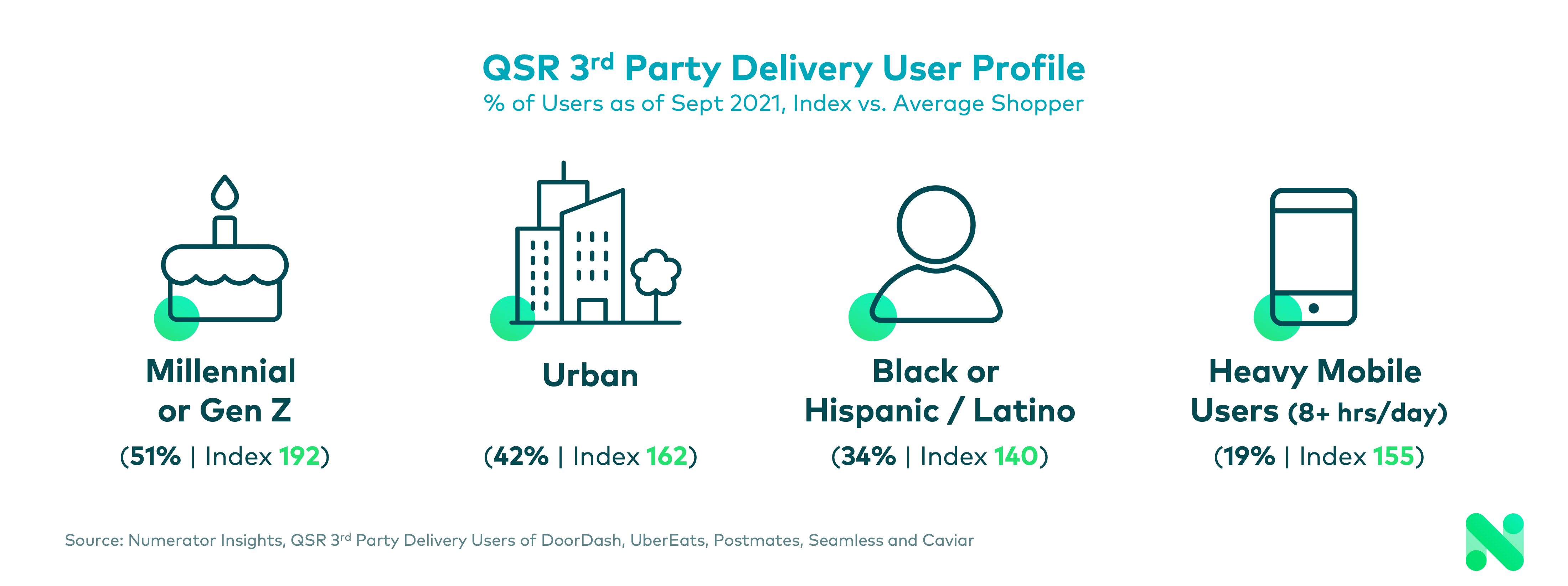

3rd-Party Delivery Proves Most App-etizing with Younger Consumers

Given 3rd-party delivery for QSRs is accessed through websites and mobile apps, these services are most appealing to younger, multicultural consumers in urban areas who are very active and easily reached on social media. These consumers lean heavily on online shopping to stock up and prefer to eat out more frequently because they don’t particularly like cooking. Using 3rd-party delivery apps quickly satisfies their cravings while also meeting any dietary needs or restrictions they may have and allowing them to try new things.

That said, each 3rd-party delivery provider caters to a unique set of consumers. GrubHub over-indexes with Baby Boomers and consumers with greater purchasing power, while Seamless attracts more Millennial and lower-income users. Postmates is popular with Boomers too, though it also enjoys a strong Gen Z following and over-indexes with BIPOC and low-income consumers. UberEats captures a large share of BIPOC users as well, and is a favorite among single consumers of all ages. And Caviar significantly over-indexes with high-income users and is often the 3rd-party delivery provider of choice for White, Gen X, and Millennial consumers.

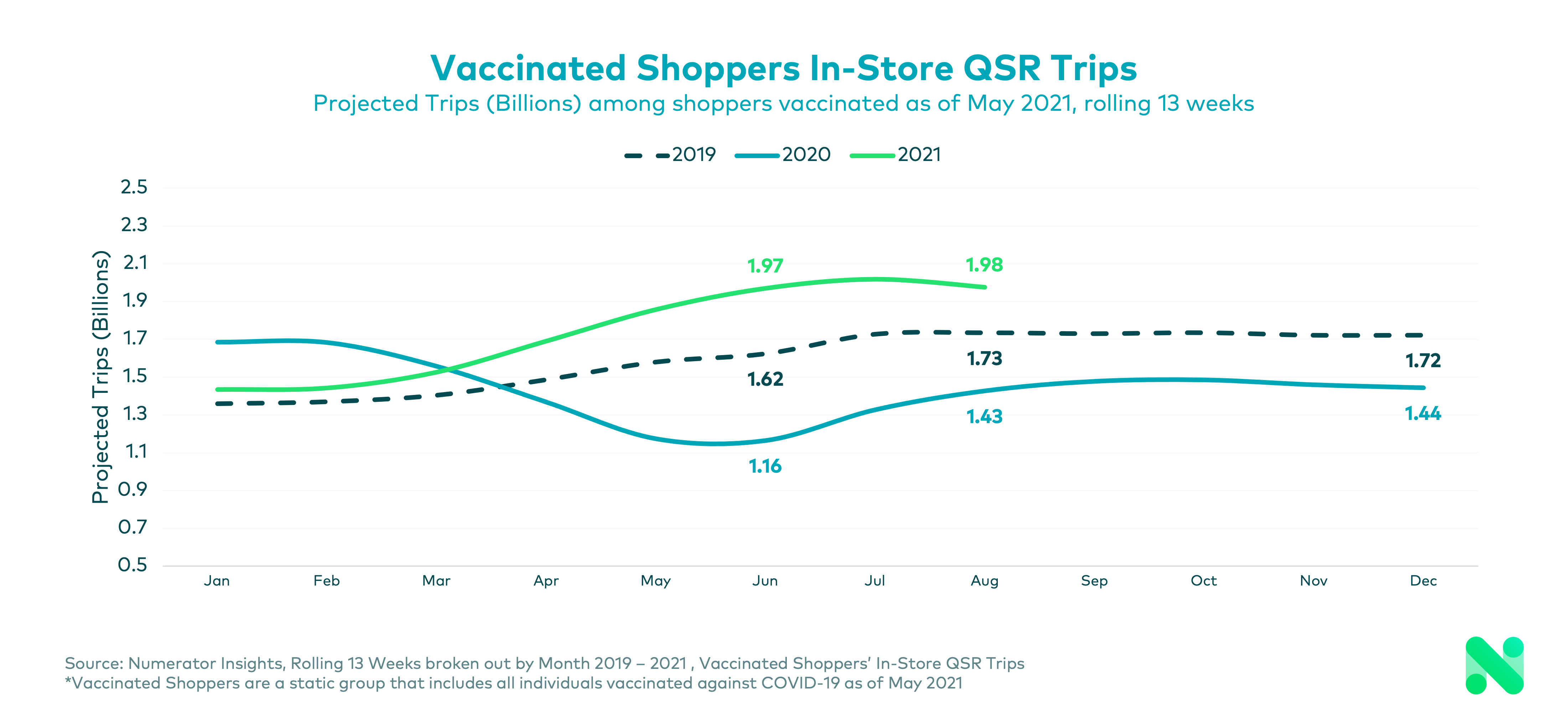

Fully Vaccinated Consumers Returning to In-Person Pick-Up Over Ordering Online

Vaccinated consumers are beginning to resume their former QSR shopping behaviors. Pre-COVID, these consumers made 1.7 billion quarterly in-store QSR trips. By the summer of 2020, their in-store trips had dropped to 1.2 billion and remained well below pre-COVID levels through the end of the year. During the COVID period, the percentage of this group using 3rd-party QSR delivery services doubled from 5.5% to 11%, with purchase frequency also rising from 3 orders to 6.5 orders per household per quarter.

As vaccination ramped up, so did in-store QSR visits. In-store QSR trips among vaccinated shoppers rose to pre-pandemic levels in spring 2021, and continued to climb through the summer. In fact, these consumers’ in-store QSR trips are now at levels higher than in their pre-COVID days. At the same time, the percentage of fully vaccinated consumers ordering 3rd-party QSR delivery has only slightly declined, and their purchase frequency and spend per trip using these services remain relatively unchanged.

Looking Ahead

Overall, younger consumers in particular, who enjoy the ease and convenience of online ordering, will continue to rely on 3rd-party delivery for QSRs. And though 3rd-party delivery hasn’t seen a significant decline in popularity just yet, QSRs are regaining ground on in-store trips and can look forward to increased stability as vaccinated consumers return to their pre-COVID routines.

Numerator will continue monitoring the situation and the effect vaccination rates, COVID-19 comfort levels, and a return to normal activities have on 3rd-party delivery usage. To learn more about how your consumers are engaging with 3rd party delivery services, please contact your Numerator Consultant or get in touch with us.