Days before the launch of Smartly, we discussed what makes Target’s new private label brand so appealing– bulk discount pricing on small quantities of everyday essentials such as cleaning supplies, household items, and grooming products. In other words, you don’t have to buy 60 rolls of toilet paper to get a low price per roll.

A more heavily discounted alternative to Target’s Up & Up brand, most Smartly products cost $2 or less (Smartly spend per unit is just $1.81). However, Target didn’t skimp on product development or packaging. The goal is to appeal to budget-conscious, space-constrained shoppers with the right combination of quality, style and, of course, price.

Smartly is still in its infancy, but it’s not too early to start analyzing its impact. Who is buying Smartly? What factors are driving Smartly awareness and purchases? What are the first impressions of Smartly products from the consumer’s perspective?

Analysis of InfoScout OmniPanel™ data and a survey of Smartly buyers revealed eye-opening insights into shopping behavior and how brands and categories are already being affected by Smartly.

Who Is Buying Smartly?

Early demographic trends show that the people buying Smartly aren’t consistent with who Smartly is targeting, no pun intended. Smartly is positioned to attract, for example, budget-conscious millennials living alone or with a partner in small, urban spaces. As expected, there is over-indexing for Gen Z, Millennials and urban settings.

However, there is also significant over-indexing for Gen X, high-income households, households with four or five people , and fill-up or pantry-stocking trips. Older, higher-income shoppers from larger households weren’t expected to gravitate toward Smartly, but they are indeed buying, and they’re making Smartly part of larger shopping trips to take advantage of the low prices.

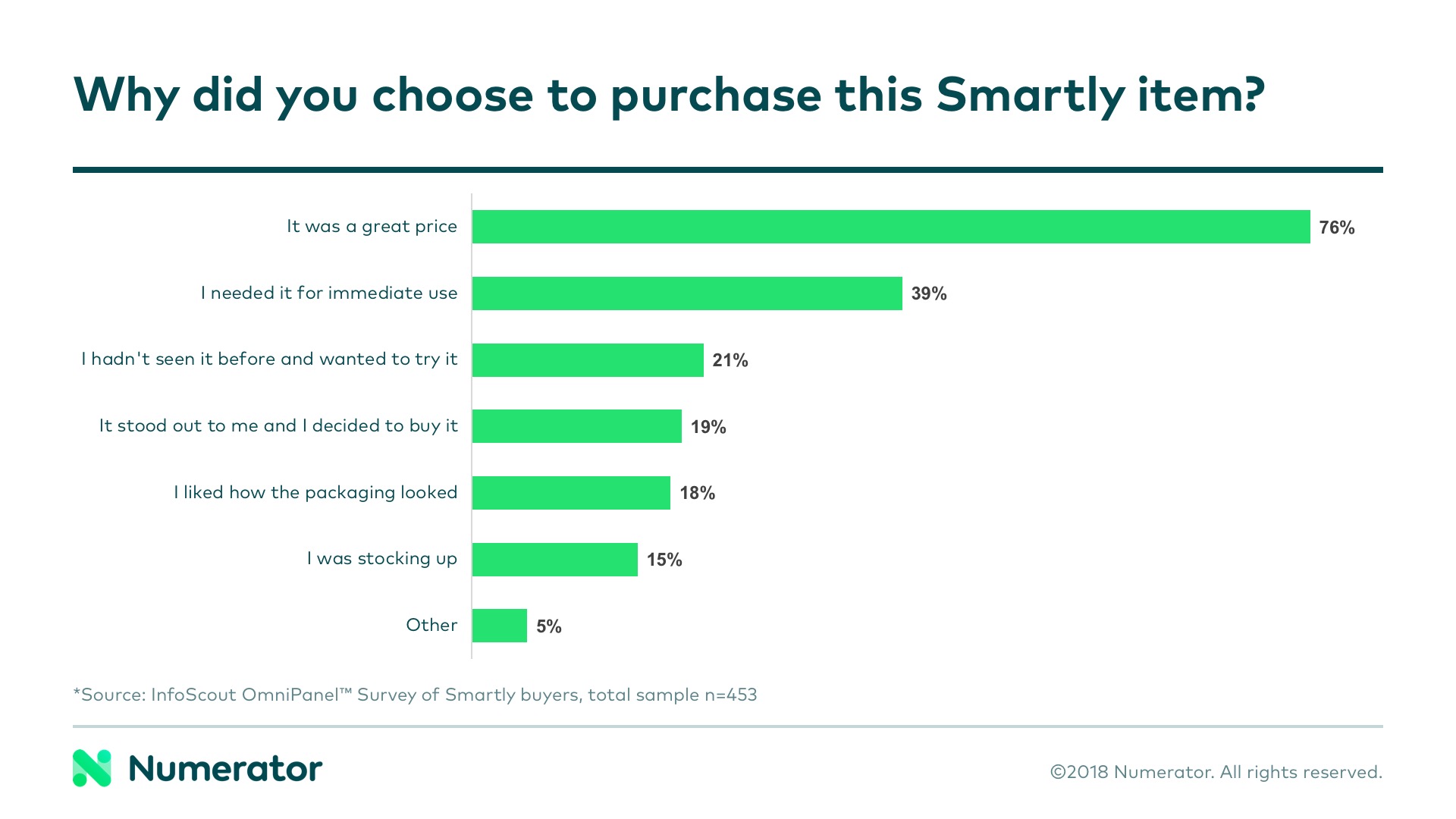

Not surprisingly, price was the top purchase driver, according to our survey, with 76% of Smartly buyers reporting the item purchased “was a great price.”

How Is Smartly Affecting Up & Up?

There is definitely some swapping between Target’s two private label brands. In fact, Up & Up is the top shifting brand for the Health & Beauty and Household sectors across both branded and private label categories– 11.5% of Smartly’s Health & Beauty dollars and 15.1% of Smartly’s Household dollars are sourced from Up & Up.

However, offering these products in smaller pack sizes at bulk prices could create even more opportunities for Target. Shoppers no longer have to go to Club retailers and buy in bulk to get the lowest prices. They can get what they need during a routine trip to Target.

Wait… I Bought What?

Not only is Smartly taking dollars from Up & Up, but most purchasers aren’t even aware that they’ve purchased the Smartly brand. 21% of Smartly buyers said they’ve heard of Smartly but never purchased the brand, and 45% said they’ve never even heard of Smartly!

Only 34% of surveyed Smartly buyers have unaided recall of purchasing Smartly. These shoppers have a much higher purchase recall of competitive brands such as Great Value, Up & Up, and Equate.

The most frequently purchased Smartly items are toiletries, liquid hand soap, plastic utensils, dishwasher detergent, and a tie between lunch bags, paper napkins and plastic cups. But at this stage of the game, Smartly brand awareness is very low, even among those who have purchased Smartly products. This reinforces the fact that price is driving Smartly sales.

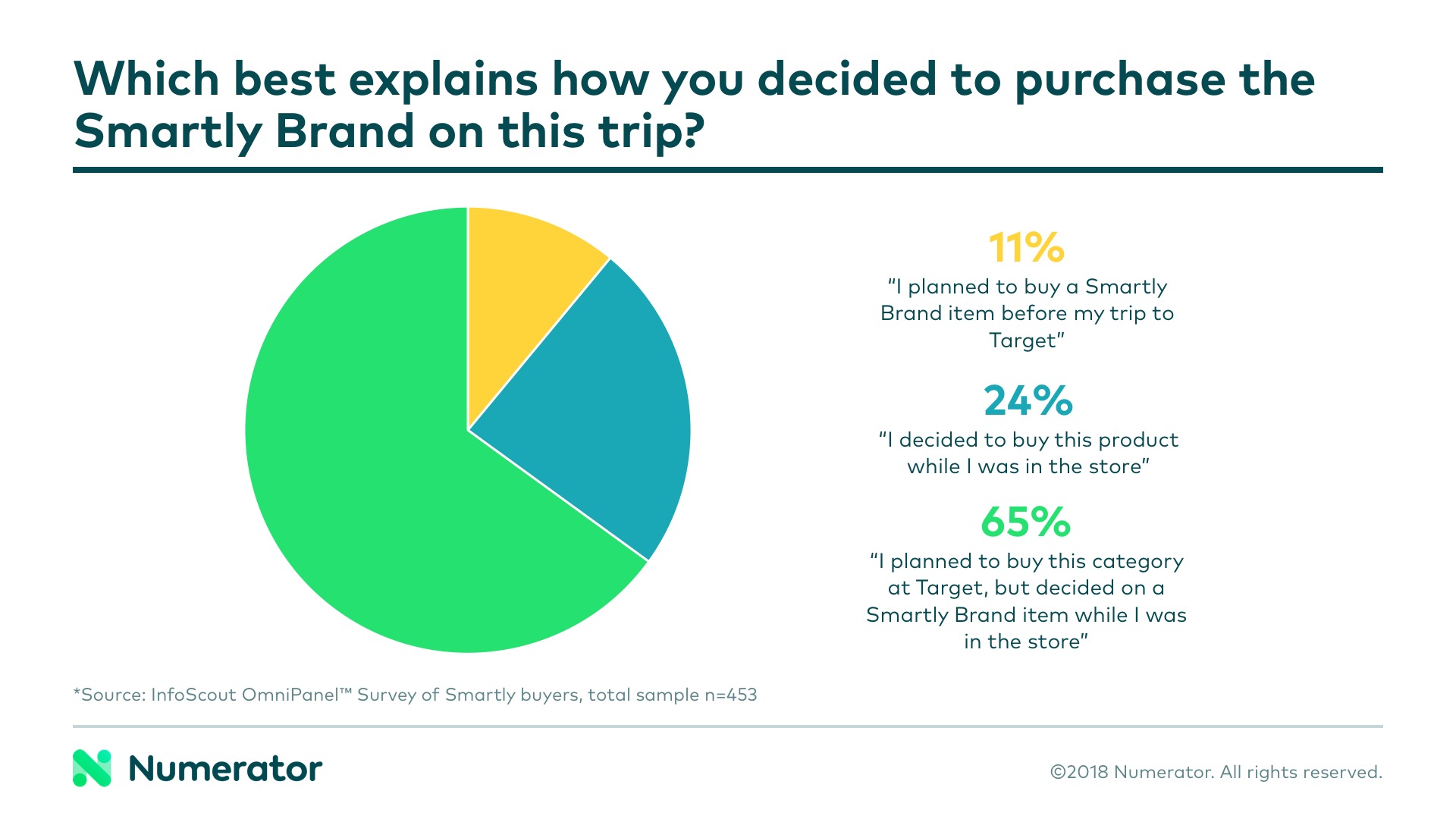

Smartly Opportunistic

65% of Smartly purchasers planned to buy a category before the trip but didn’t decide on a specific brand until they got to the store. Seeing Smartly items in the store was far and away the number one awareness driver of the brand, as 19 out of 20 survey respondents said they heard of Smartly for the first time while shopping in the store.

Smartly is an opportunistic brand, and low price points drive that opportunism. As mentioned previously, price was the top purchase driver for Smartly. A whopping 92% of survey respondents said affordability was a very important or important factor in their decision to buy Smartly.

20% of Smartly buyers said they considered Up & Up before purchasing Smartly, making Up & Up the most considered brand. As for retailer consideration, 25% considered a grocery store and 23% considered Walmart. 49% didn’t consider any other retailer – only Target.

The Early Reviews Are Positive

60% of Smartly buyers said the products exceeded their expectations, while just 4% said the products performed worse than expected. 94% said Smartly items performed about the same or better than comparable brands, and 87% said Smartly delivered a very good or good value.

Comments from Smartly buyers include:

- “For as cheap as it was I didn’t expect it to be awesome, but it was”

- “I didn’t expect to love it as much as I did”

- “Value was excellent at the price point and the quality and functionality are superb”

- “For 99 cents, I got 3 more ounces than the other two name brands, which were the same price. The Spring Meadow scent is fantastic!!!”

- “Very inexpensive but great quality”

- “Sometimes a lower price can equal lower quality but that wasn’t the case”

86% of Smartly buyers will definitely or probably purchase more Smartly products, and 77% are very or somewhat likely to recommend Smartly to others.

Price and Convenience Rule

We’ve never seen prices this low on certain products in small pack sizes from a convenient mass retailer like Target. Our data shows that shoppers across demographics are noticing. They might not recall the Smartly brand, at least not yet, but they’re buying the brand. They enjoy the convenience of getting these products at a low price during one of their regular Target shopping trips, and they’re happy with the brand so far.

Although Smartly is stealing share from Up & Up in some categories, Target’s newest private label brand is set up for success. What does that mean for your brand or category? What is the potential impact of private label as a whole? What additional data and analysis do you need to inform your growth strategies?

Click here to set up a demo and learn more about how Numerator, powered by the InfoScout OmniPanel, can provide insights into current shopping data and trends from the full omnichannel market.