For retailers to score big wins at the private label level, it’s vital they delve into buyer behavior and ask one very important question: What do our customers really want? The answer will vary from group to group, but this awareness goes a long way toward creating private label brands that grab consumer attention. One mass retailer using these insights to great effect is Target. Target has formulated a three-tiered, private label approach that is successfully attracting a diverse range of shoppers.

In Part 1 of our analysis on the private label evolution, we explored how retailers are raising their game in the marketplace by stocking shelves with premium private label products. This shift toward developing unique, higher-end retailer-owned brands stems from a shift in consumer preferences; many shoppers are beginning to place greater significance on quality over cost. This knowledge is helping big-box stores better compete in the ever-changing retail landscape.

Now, let’s take a look at an example of this evolution in action by focusing on Target and how the multi-level expansion of their private label brands in the household essentials department is paying off. Their results illustrate that the premium private label path isn’t the only road for retailers to travel.

The New Brands on the Block

While Target’s generic Up&Up private label brand has proven alluring to budget-conscious buyers, these “copycat” versions of national brands weren’t capturing two key consumer demographics purchasing household essentials: young shoppers and thrifty families. To contend for the attention and affection of both younger shoppers willing to spend more for premium products as well as families seeking to save more with bargain buys, Target launched two additional private label brands: Everspring and Smartly.

Everspring: Appealing to Ideals

Everspring is an excellent example of a premium private label brand. By positioning Everspring as equal to national, niche brands, Target attracts younger, wealthier shoppers who value healthy, sustainable products. This group of consumers is status-driven, concerned about the environment, and committed to natural and organic goods. They’re much more likely to purchase brands that are in line with their ideals and will pay more for them, too.

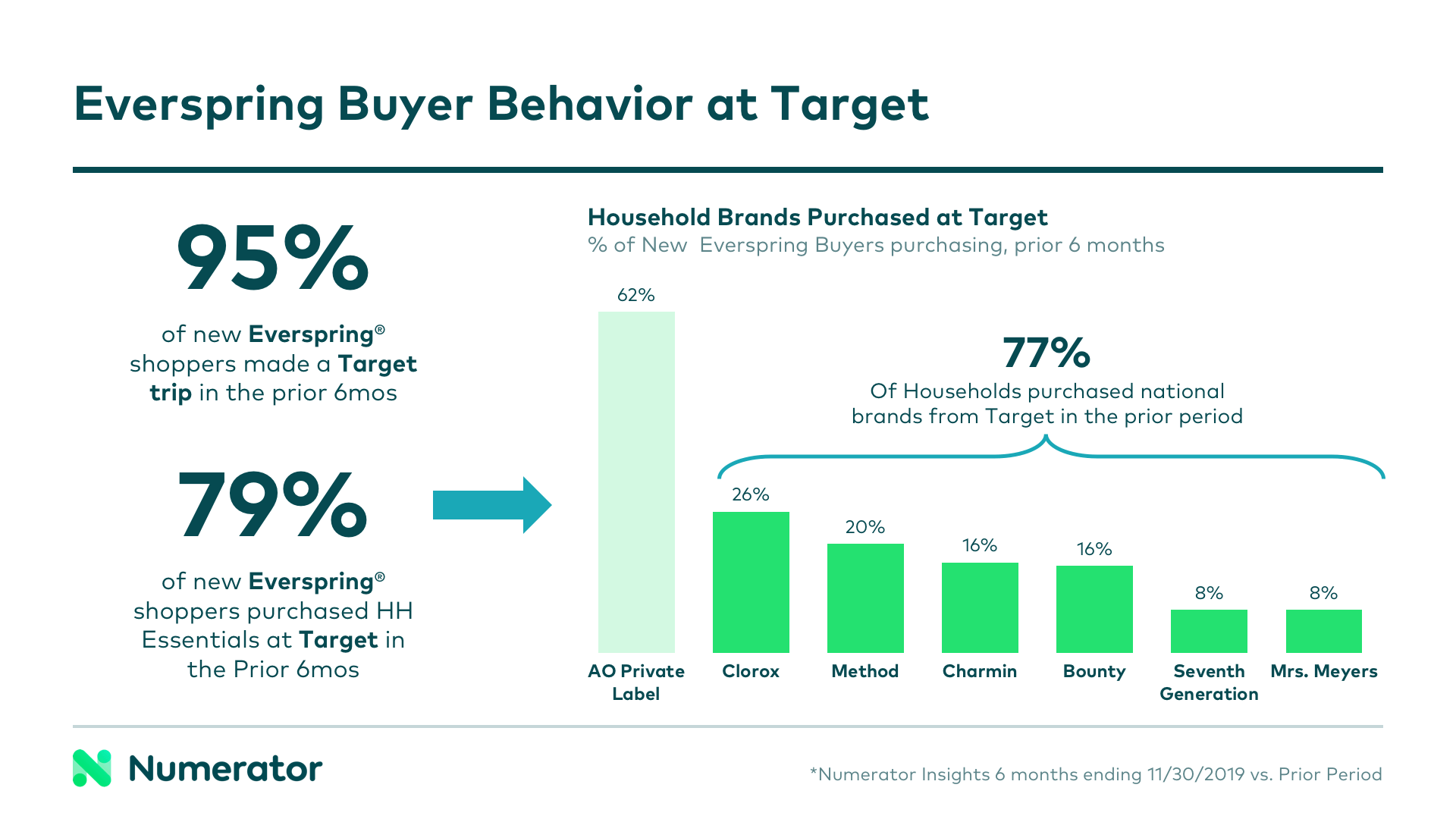

Numerator Insights data details not only the affinity these shoppers have for high-quality products, but how their spending habits gave Target a perfect opportunity to introduce a new private label brand. With 95% of Everspring buyers already making trips to Target, and 79% buying household essentials during their visits, the retailer had a large, built-in audience open to and eager for the arrival of an option like Everspring.

Smartly: A Family-Friendly Supersaver

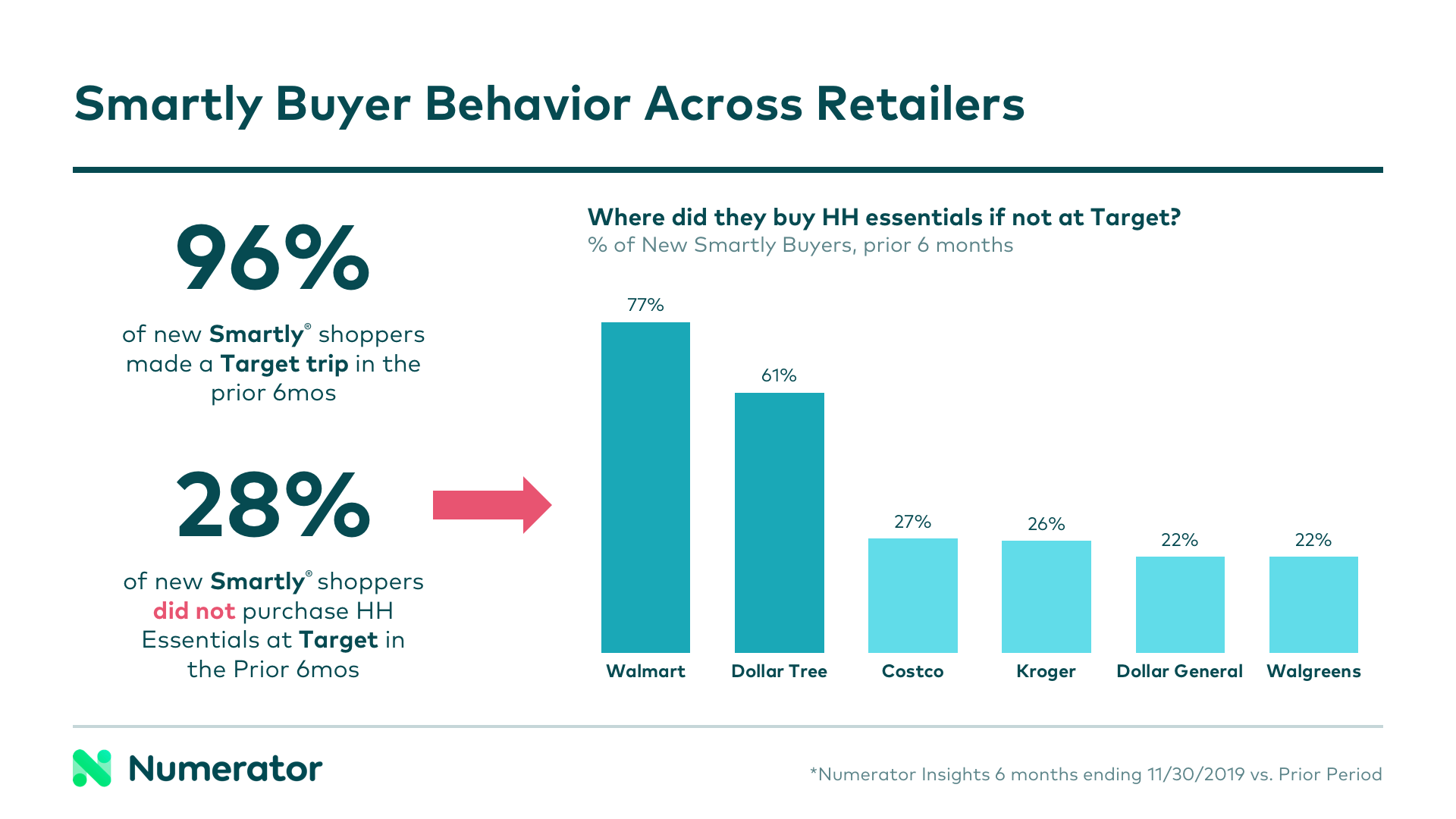

Target’s deeply discounted brand, Smartly, is proof that private labels can also cater to a category of consumers on the hunt for even lower price points than those of generic brands. These bargain shoppers are typically parents of larger families who do a lot of spending in order to keep up with their kids’ needs. Though Target trips are included among their many errands, these customers favored dollar retailers when purchasing household essential items.

Once again, Numerator data shows 96% of these shoppers were Target regulars, but 28% were not purchasing household essentials there, instead spending those dollars at low-cost retailers like Walmart and Dollar Tree. To compete, Target created a private label brand that delivers on that reduced price tag and helps families find what they need in one place. Succeeding on both fronts, Smartly saves these busy parents time and money.

Tiered Branding Builds Loyalty

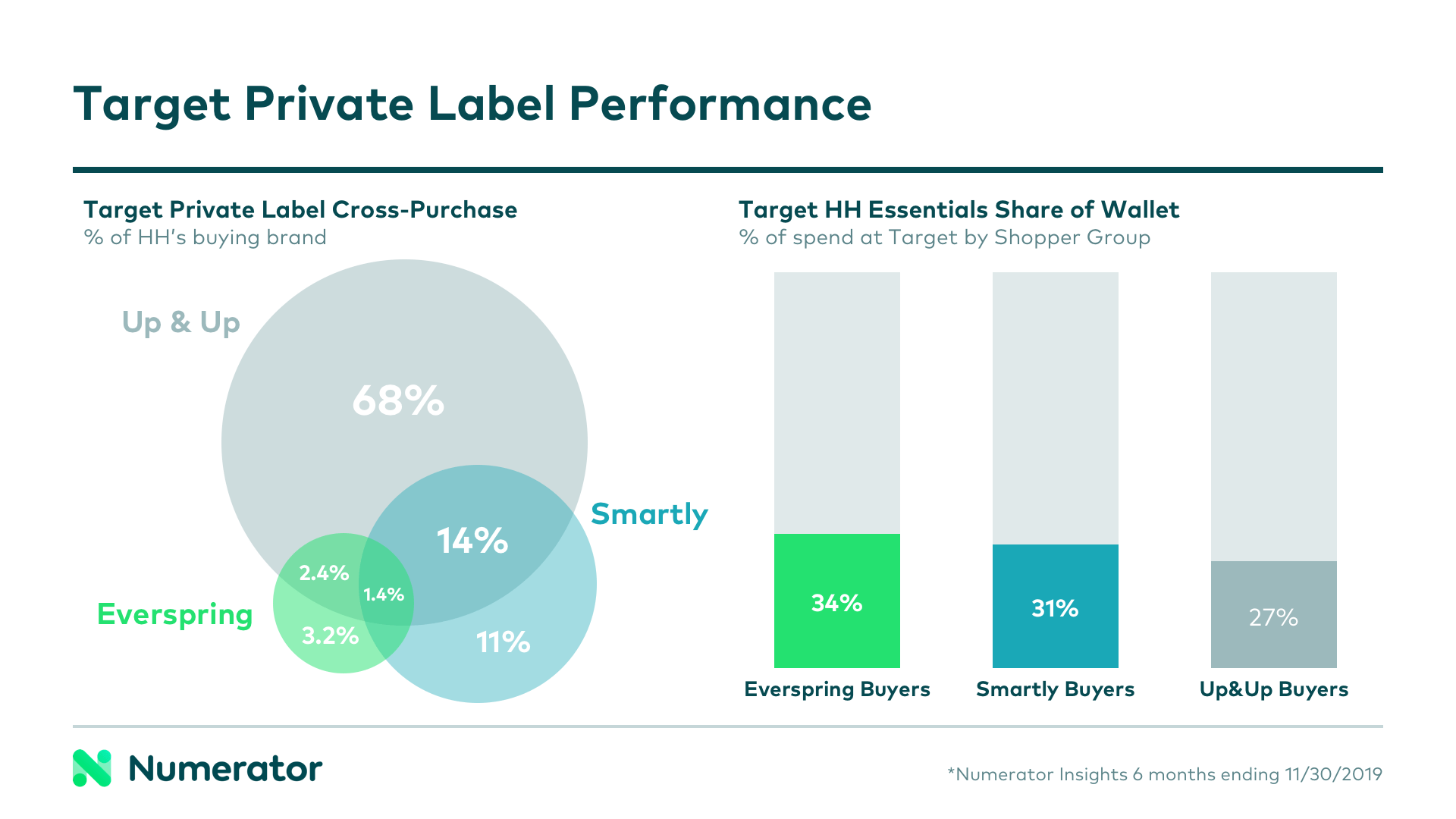

Target’s private label expansion with Everspring and Smartly has brought the retailer significant gains in the sale of household essentials. It has also brought in new buyers to their private labels, with one-in-seven households purchasing Everspring or Smartly exclusive of Up&Up. Everspring and Smartly buyers also spend more of their household essentials category dollars at Target than Up&Up buyers.

More importantly, with multiple private label lines satisfying the distinct needs of different types of shoppers, Target is bringing more buyers into their stores. As a result, the retailer is experiencing a dramatic increase in the number of trips these shoppers are making, and this higher purchase frequency is driving even greater spending.

Shoppers appreciate having choices that match their perspectives as well as their pocketbooks. Retailers moving beyond generic and launching niche brands are reaching more consumers and keep them coming back.

When retailers are equipped with a greater understanding of buyer behavior, they can invest more wisely in the development of private label brands and win over more shoppers. Reach out to us and find out how Numerator data can help benefit and build your business around the evolving world of consumer attitudes and spending.