There’s nothing quite like carrying a product that consumers love: one that drives notable sales, creates a buzz, and keeps your shoppers coming back for more. The only thing better, perhaps, is when that product happens to be one of your private label items, meaning higher margins for you and an exclusive claim to fame. Beyond item sales, these fan-favorites have a notable impact on shopper behavior, and retailers need to take note in order to capitalize on additional opportunities.

What do Costco’s rotisserie chickens and Trader Joe’s cauliflower gnocchi have in common— aside from the fact that they’d pair well with a nice wine and make for a lovely dinner? If you said, “They’re both best-selling private label items at their respective retailers,” you’d be right on the money. The sales alone are a clear indicator of their success, but the buzz surrounding the items is also a testament to their popularity. What can retailers learn from these two successful examples?

Buyers of popular private label items are more loyal

Although buyers of these popular private label items only make up a portion of each retailer’s shopper bases— 33.2% of Costco shoppers buy the Kirkland Signature rotisserie chicken and 6.1% of Trader Joe’s shoppers buy the cauliflower gnocchi— these groups appear to be heavy shoppers at their respective retailers. Both groups shop more frequently and spend more than the average shopper at each given retailer. Rotisserie chicken buyers shop at Costco 1.7x more frequently, with a 1.7x higher buy rate, and cauliflower gnocchi buyers shop at Trader Joe’s 2.2x more frequently with a 2.7x higher buy rate.

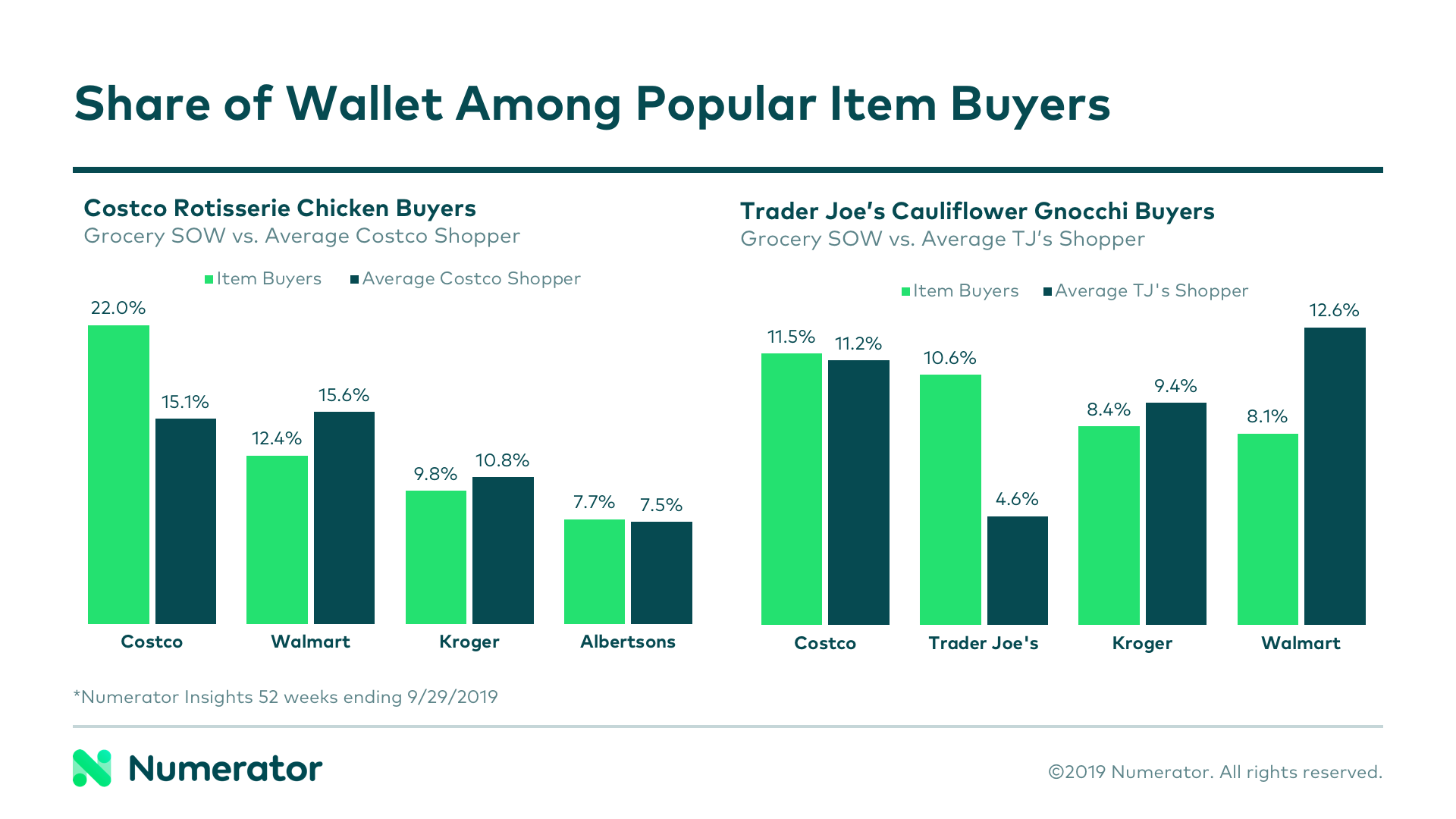

Not only do they shop and spend more, they are also more loyal. Costco holds a 22% grocery share of wallet among their rotisserie chicken buyers, significantly higher than the average Costco shopper, who only spend 15.1% of their grocery dollars at Costco. The same held true for cauliflower gnocchi buyers at Trader Joe’s, who spent 10.6% of their grocery dollars at TJ’s, versus the average shopper who only spends 4.6%.

Costco rotisserie chicken inspires bigger baskets

This isn’t Costco’s first rodeo. In placing their popular rotisserie chickens at the back of the store, they hope to increase traffic throughout the store and inspire more buying. And it seems to be working exactly as they intended. Though the chicken itself is only $5— a feat Costco has fought adamantly to maintain— a basket containing a rotisserie chicken is $25 larger than the average Costco basket. Other retailers should pay particular attention to the placement of their hot-ticket items; if done correctly, they may be able to draw their most loyal shoppers to areas of the store they don’t typically frequent.

Trader Joe’s cauliflower gnocchi buyers share distinct characteristics

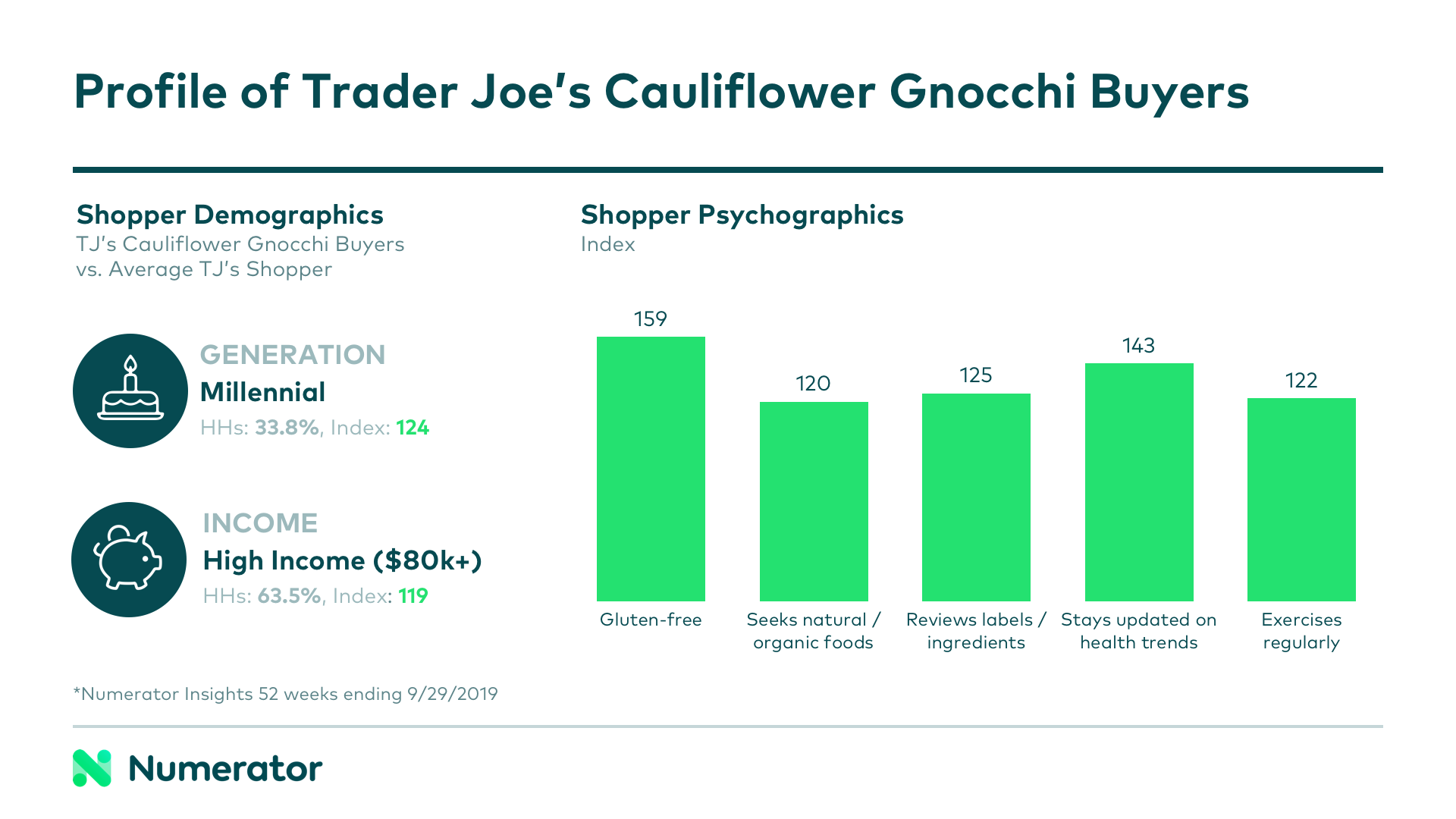

In addition to being loyal Trader Joe’s shoppers, TJ’s cauliflower gnocchi buyers have a lot of similar demographic and psychographic traits. They’re 33.8% millennial (index 124 vs. all TJ’s shoppers), 63.5% are high income (index 119), and 76.4% white (121). The cauliflower gnocchi is very popular among young couples (10.1%, 159) and urban affluent (23.5%, 133) individuals.

According to Numerator Psychographics data, these shoppers are more likely to be gluten-free, to consider themselves a creative cook, and to seek natural and organic products. They are highly committed to organic goods and are willing to pay a premium for them. When it comes to health and fitness, they like to lead active lifestyles, are concerned with eating healthy, and try to stay up to date on current health trends. Knowing specific character traits and motivators allows you to more accurately target and appeal to your core groups of shoppers.

Would Costco shoppers still buy the rotisserie chicken if it cost more than $5? Are Trader Joe’s cauliflower gnocchi buyers satisfied with the current offerings, or are they already looking for the next best health trend? Accurate identification of consumers not only allows for better engagement, it also allows you to reach out to specific groups with targeted surveys for important insights.

You probably know which of your private label items are most successful, but do you know who is buying them and how their behavior differs from your average shopper? Deeper consumer understanding is critical, especially when it comes to your most popular products. Drop us a line and let us help you get the insights you deserve.