From category leaders like Hello Fresh and Blue Apron, to retailer integrations like Walmart & Gobble and Kroger & Home Chef, the meal kit industry is sizzling with competition. Using Numerator Premium People groups, we have the ability to analyze thousands of buyers who have shared information on their meal kit usage, including which kits they’ve tried, and their reasons for use.

Who’s buying meal kits?

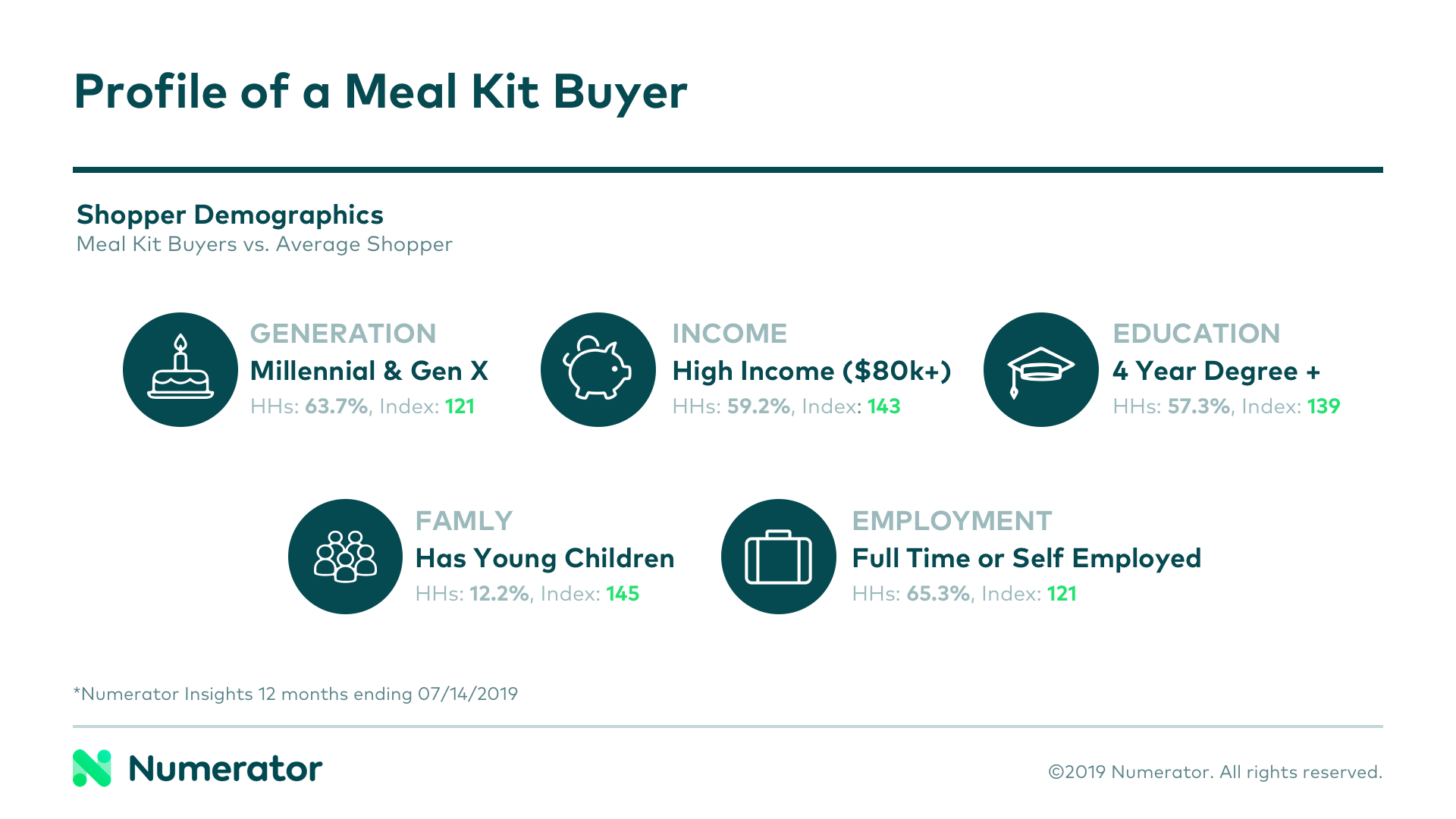

Meal kit demographics showcase they are most popular among Millennials and Gen X’ers, with 63.7% of buyers falling into one of these age groups. These shoppers also tend to have high incomes— 59.2% make over $80k per year— and high levels of education— 57.3% have a bachelor’s degree or higher. Nearly two-thirds (65.3%) of this group work full-time or are self employed, and about 12.2% have young children under the age of five.

Particularly for parents of young children and full-time workers, meal kits may serve as a time-saving option for an already hectic schedule.

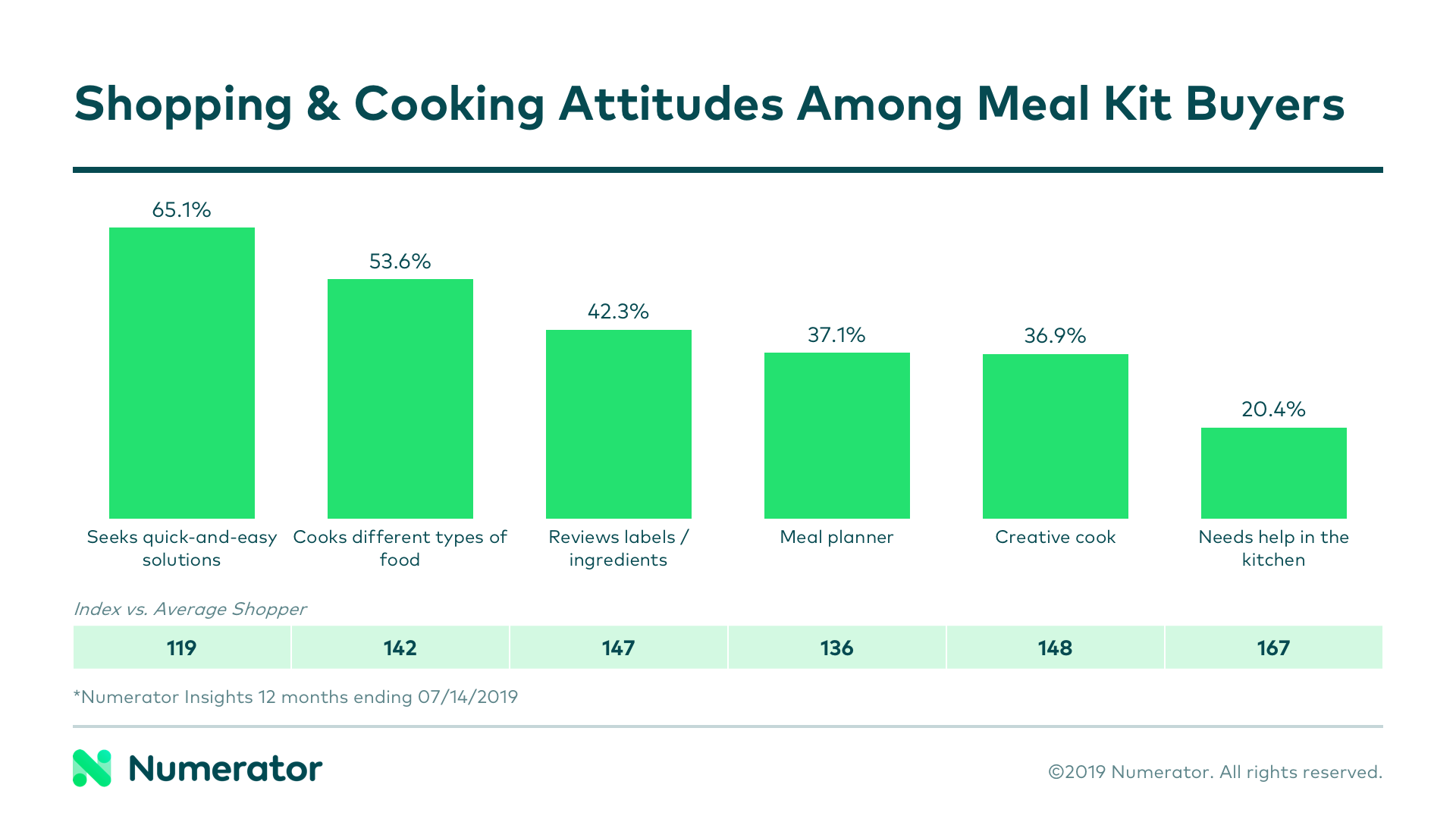

Numerator Psychographics data tells us that when it comes to dining in, meal kit buyers are 1.2x more likely to seek quick-and-easy meal solutions, 1.4x more likely to partake in meal planning, and 1.7x more likely to admit they need a little help in the kitchen. When they cook, they like preparing different types of food and consider themselves creative cooks; for these groups, the variety and new recipes provided by meal kits may be the main draw.

Why do people buy meal kits?

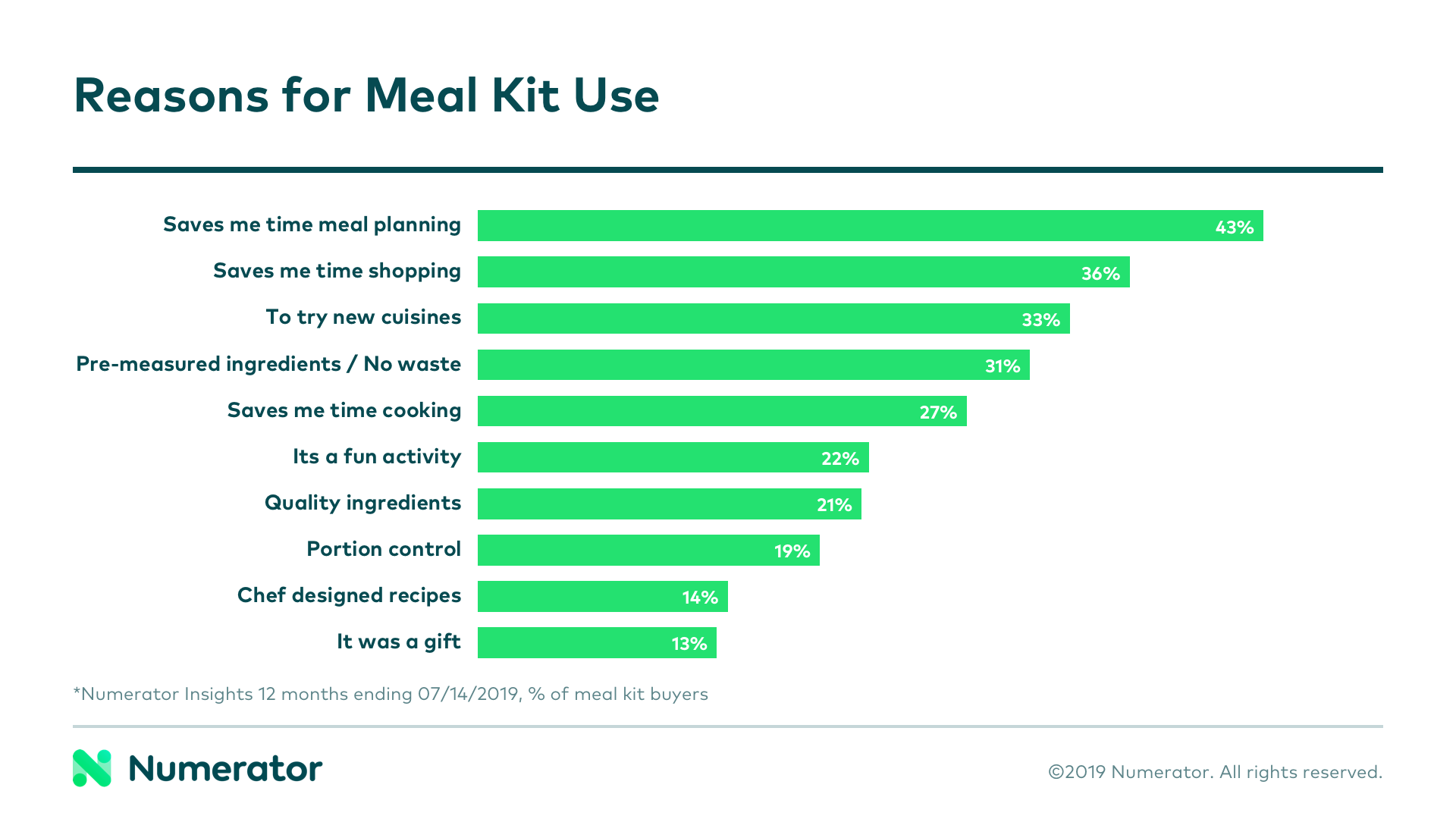

Based on their general attitudes and behaviors, we’d expect time saving and food variety to be top reasons for meal kit purchases, but what did the buyers have to say about their reasoning? Exactly that! The top two reasons for meal kit purchases were “saves me time meal planning” (43.4%) and “saves me time shopping” (36.0%), followed by the number three option “to try new cuisines” (32.7%).

Interestingly, “saves me time cooking” fell a bit farther down the list. However, it’s probably fair to assume that some meal kits provide recipes that are more complex than individuals would otherwise be preparing.

Where else do meal kit buyers get their food?

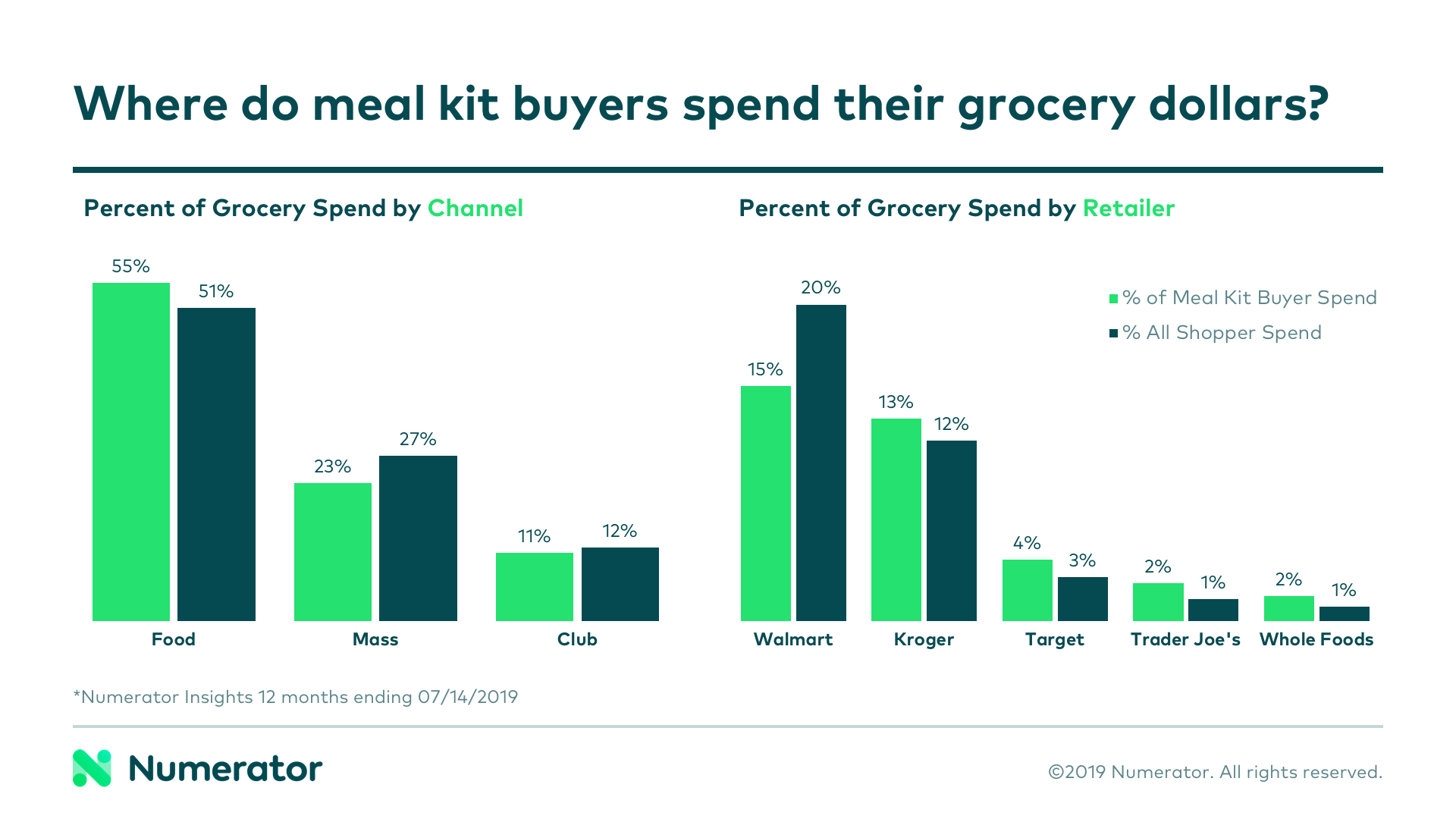

Obviously, meal kits are not the only source of food this group is purchasing. Outside of kits, these shoppers tend to spend more of their grocery dollars in the food channel than their non-kit-buying counterparts, who spend a bit more in mass and club. Specifically, this group spends more at chains like Kroger, Target, Trader Joe’s, and Whole Foods.

According to Numerator Psychographics data, this group also dines out more frequently than the average shopper, with 43.0% indicating they dine out 2-5 times per week versus 32.9% of all shoppers. Their QSR / Fast Casual restaurant preferences also appear to differ, with meal kit buyers preferring chains like Chipotle and Starbucks over Subway or McDonald’s.

Food For Thought

There’s always more to learn about shopper behavior, especially in exciting categories like meal kits. Do meal kits impact buying in adjacent categories like kitchen utensils and appliances? Are buyers of meal kits more interested in healthy and organic options? Are most buyers just testing the waters, or are they interested in meal kits for the long term?

For answers to these questions and more, drop us a line and let us serve up some insights that will get your team thinking outside the box.