Numerator Visions

Consumer trends

for 2026.

Welcome to our 2026 release of Numerator Visions, an annual perspective that looks back at consumer trends during the past year, provides forward-looking insights into the year to come, and serves as a starting point to prepare for the future.

Every year, our report shares several visions on what to expect for the top US consumer trends and how industry leaders and executives should act. These visions are drawn from our comprehensive understanding of the consumer, which we gain through Numerator’s full suite of products and industry expertise.

Year in Review: Growth Unexpectedly Continues

Despite widespread expectations of a pullback, consumer spending in 2025 grew at roughly the same pace as last year, with the summer of 2025 even outpacing 2024. For many, this ran counter to the narrative of consumer retrenchment that seemed inevitable heading into the year. When we peel back the layers of spending, two primary forces are driving growth:

Persistent inflation. Inflation remains stubborn and is expected to continue into 2026. Based on Numerator’s forecasts, core PCE inflation could range between 2.3% and 4.8% in the year ahead, depending on how labor markets, tariffs, tax cuts and other government policies ultimately land.

More trips—mostly digital. Consumers are making more shopping trips, but those trips are increasingly digital. Total store traffic share online across consumer packaged goods (CPG), general merchandise (GM) and quick-service restaurants (QSR) is up 2 full percentage points, accounting for nearly 2.6 billion trips.

But growth was not unbounded. Units per trip continued their multi-year decline, and mix shifted downward—clear signals that consumers may be reaching a breaking point, buying fewer products to offset higher prices.

What drove consumer choices in 2025?

To understand the path ahead, Numerator conducted an analysis of consumer behaviors through a max differential, revealing four primary influences in how consumers purchase. As brands look to 2026, aligning strategies with these influences can help build on growth. Whether through financial flexibility, product innovation, or retail partnerships, the future belongs to those who can adapt with agility and insight.

Explore these four influences to get a taste of what is in the full report—providing actionable guidance for brands seeking to navigate uncertainty, capture growth, and thrive in an ever-evolving consumer landscape.

Consumer Divergence

Inflation has become the defining force shaping consumer behavior heading into 2026. By late 2025, 37% of U.S. consumers cited rising prices as their primary concern—up sharply since midyear. While expectations for personal finances appear evenly split between stability, improvement, and decline, the lived reality is far more uneven.

Numerator data reveals a bifurcating, K-shaped economy. Higher-income households retain spending flexibility, showing less discomfort with discretionary categories like travel, entertainment, and services, and growing inflation-adjusted base spending by 6% versus 2019. Lower-income households, by contrast, are falling behind: base spending has declined in recent months, and financial stress is intensifying. This divide is most pronounced in discretionary retail, while everyday staples and QSR remain comparatively stable.

Spending continues to concentrate among households with the most purchasing power, with lower-income consumers losing share of everyday spend—representing billions in displaced dollars. At the same time, low-income shoppers face added pressure from SNAP disruptions and potential policy changes that directly affect their ability to afford essentials.

Broader policy forces add further strain. Higher tariffs are increasingly flowing through to shelf prices, and slower population growth tied to immigration policy tempers long-term demand. As growth shifts from category expansion to share capture, brands and retailers must sharpen their focus on income-driven behavior, value perception, and portfolio resilience.

The Health Continuum

Health and wellness remains a core consumer priority, but its momentum has shifted. After years of growth-driving innovation across food, beverage, beauty, and pet, health behaviors in 2025 largely stabilized rather than accelerated. Consumers are not abandoning health—they are redefining it. A growing majority now prioritize both physical and mental wellbeing, reflecting a more balanced mindset shaped by uncertainty, not optimism.

Growth within health is increasingly concentrated in specific spaces. Consumptive nutrition continues to perform strongly, led by protein, gut health, and functional hydration. Protein and pre-/probiotic beverages are expanding rapidly, while water-forward choices signal a shift toward lighter, simpler forms of nourishment. At the same time, consumers are moving away from rigid, numbers-driven health metrics toward diet quality, nutrient density, and balance—though signs suggest functional foods may be nearing saturation for some shoppers.

Clean living is emerging as a broader, cross-category expression of health, centered on transparency, ingredient minimization, and “less but better” consumption. This mindset spans food, personal care, and the home, with generational differences shaping which claims resonate most.

Looking ahead, GLP-1 medications represent a structural shift in consumption, not a temporary disruption. Adoption continues to rise, behavior changes persist even after lapsing, and potential price reductions could expand access. Combined with heightened concern over healthcare costs, 2026 is shaping up to reward brands that deliver health benefits with clarity, value, and credibility.

Winning Brands: Growth, Trends & Tactics

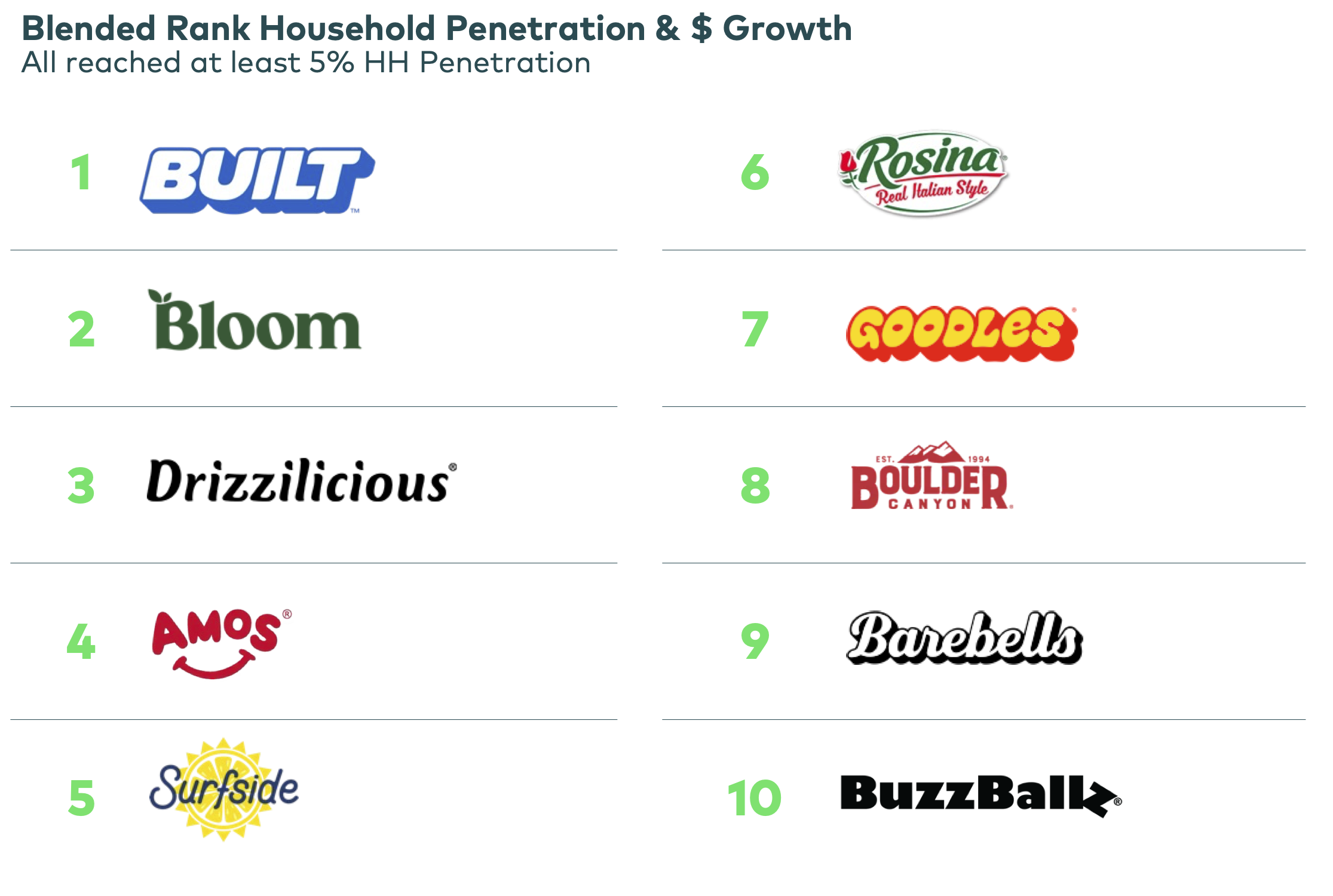

Sustained brand growth in today’s fragmented consumer landscape requires both scale and precision. To understand what differentiates breakout performers, Numerator analyzed thousands of brands, identifying the Top 100 based on gains in both penetration and sales. The results point to a consistent formula: growth is driven by winning new households and giving them reasons to return.

On average, the fastest-growing brands expanded household penetration by 1.5 percentage points and increased household spending by 5.7%, fueled primarily by higher purchase frequency and spend per unit. A broader analysis of the top 1,000 brands confirms this dynamic. Penetration and purchase frequency show the strongest relationship to sales growth, while spend per trip plays a far smaller role. Growth comes from expanding the buyer base and increasing trip relevance—not simply extracting more value from existing baskets.

A closer look at the 10 fastest-growing brands of 2025 reinforces these insights. These brands succeed by appealing across generations, over-indexing on both Gen Z (cultural momentum) and Boomers (purchasing power). Distribution strategy also proves decisive. Breakout growth is concentrated in mass, club, and health-oriented retail, where scale, visibility, and high-volume assortments matter most. Amazon plays a more limited role, reflecting the challenge of differentiation in infinite aisles.

The lesson for brand leaders is clear: identify the next consumers to win, unlock repeatable occasions, and secure the right distribution to scale growth in an increasingly uncertain 2026.

Meeting Consumers Where They Are

Retail in 2025 is being reshaped less by convenience alone and more by values, identity, and digital behavior. Nearly 1 in 5 consumers changed their shopping habits to actively avoid certain retailers, reflecting a growing willingness to “vote with dollars.” Political and social stances now carry measurable commercial consequences, with purchasing data showing that traffic and share shifts can be durable—penalizing some retailers while rewarding those with clarity, consistency, and value alignment.

Retail is also entering a new digital phase. Omnichannel is now table stakes; the next frontier is AI-enabled commerce. Consumer use of AI for shopping is rising—led by Gen Z—and GenAI is increasingly shaping discovery, comparison, and deal-seeking, particularly in general merchandise and foodservice. This elevates the importance of how brands surface within AI ecosystems, while ethical and job-related concerns signal the need for thoughtful execution.

Price pressure remains central. Consumers are leaning harder on promotions, which remain elevated and increasingly digital, creating opportunities for personalization and loyalty. Private label continues to evolve, gaining traction with younger shoppers while softening among older ones. Looking to 2026, retail leaders face a clear mandate: define what you stand for, modernize digital discovery, and sharpen value strategies for a more polarized, price-sensitive consumer.

Get the full report and watch the webinar on demand.

In the full report and webinar, you will discover more about these top four consumer trends and what it means for your brand. More insights include:

- How potential policy shifts like SNAP, tariffs and immigration could affect consumers

- Which macronutrients consumers care most about

- Which retail industry is set to be transformed by AI

- What is the secret recipe to the fastest growing brands of 2025