When Harry’s launched in 2013, they had all the makings of a hit: quality products, competitive pricing, and the convenience of a doorstep delivery. Like many other direct-to-consumer brands, Harry’s thrived by spoiling their consumers, building strong relationships and a loyal customer base. But also like many direct-to-consumer brands, their digital-first strategy meant there was only so far they could grow on their own.

According to Numerator Insights data, 54% of US households have been exposed to brands via social media in the past year, while 99% of US households have shopped in the mass channel. With nearly double the reach, mass retailers enable direct-to-consumer brands to scale. And so, Harry’s entered the mass channel, expanding their distribution to Target in August of 2016.

Harry’s and Target Hit it Off

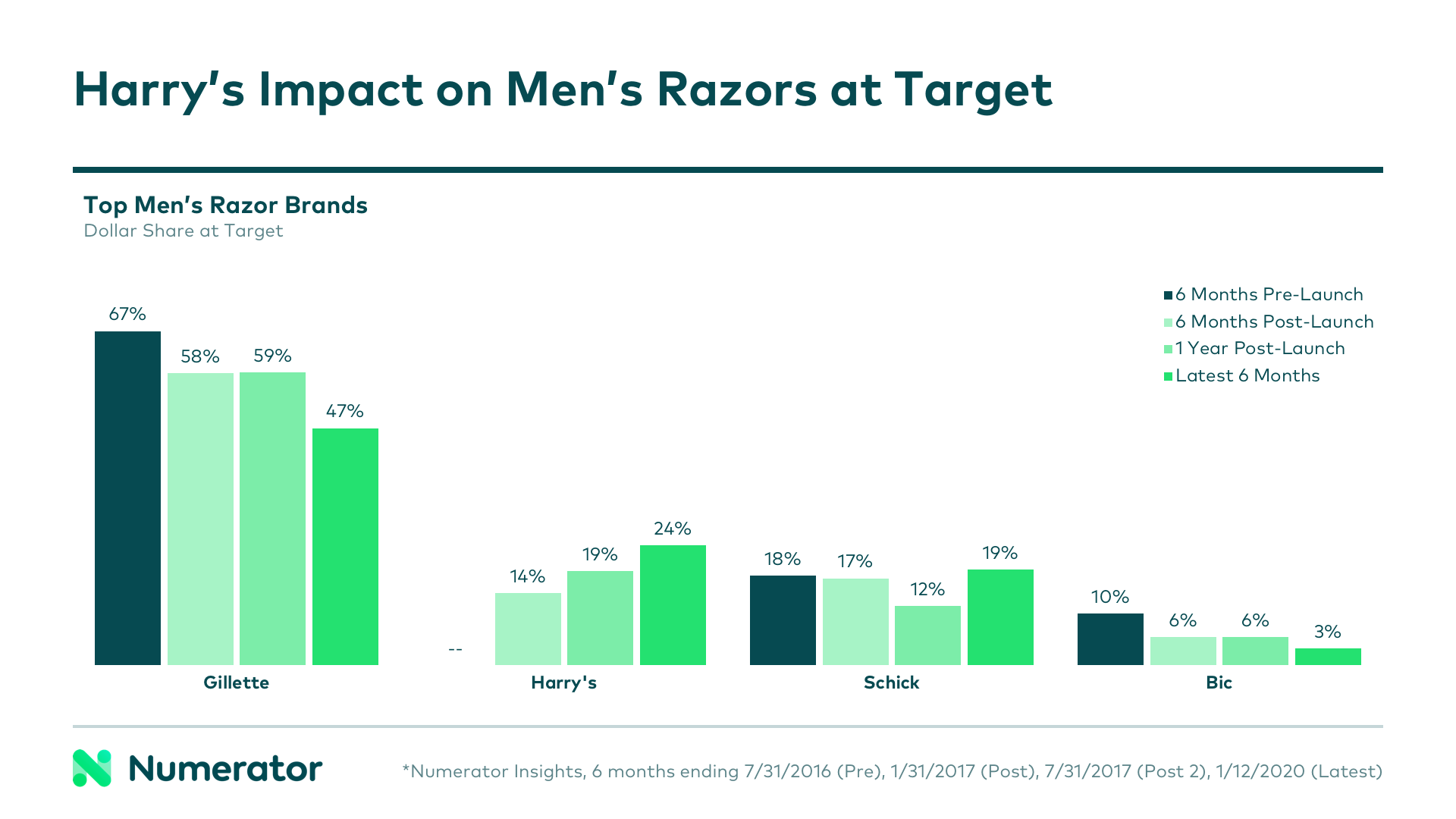

Within the first eight months of launching at Target, Numerator Insights data shows that Harry’s sales roughly tripled, as did their household penetration numbers, while their share of category dollars quadrupled. At Target, Harry’s quickly captured 14% of category dollars, snagging the third highest share of category dollars in their first six months and the second highest within their first year. Market-leader Gillette saw the most substantial decline in share when Harry’s hit the shelves in Target, but proportionally, smaller brands were more heavily impacted.

A Mutually Beneficial Relationship

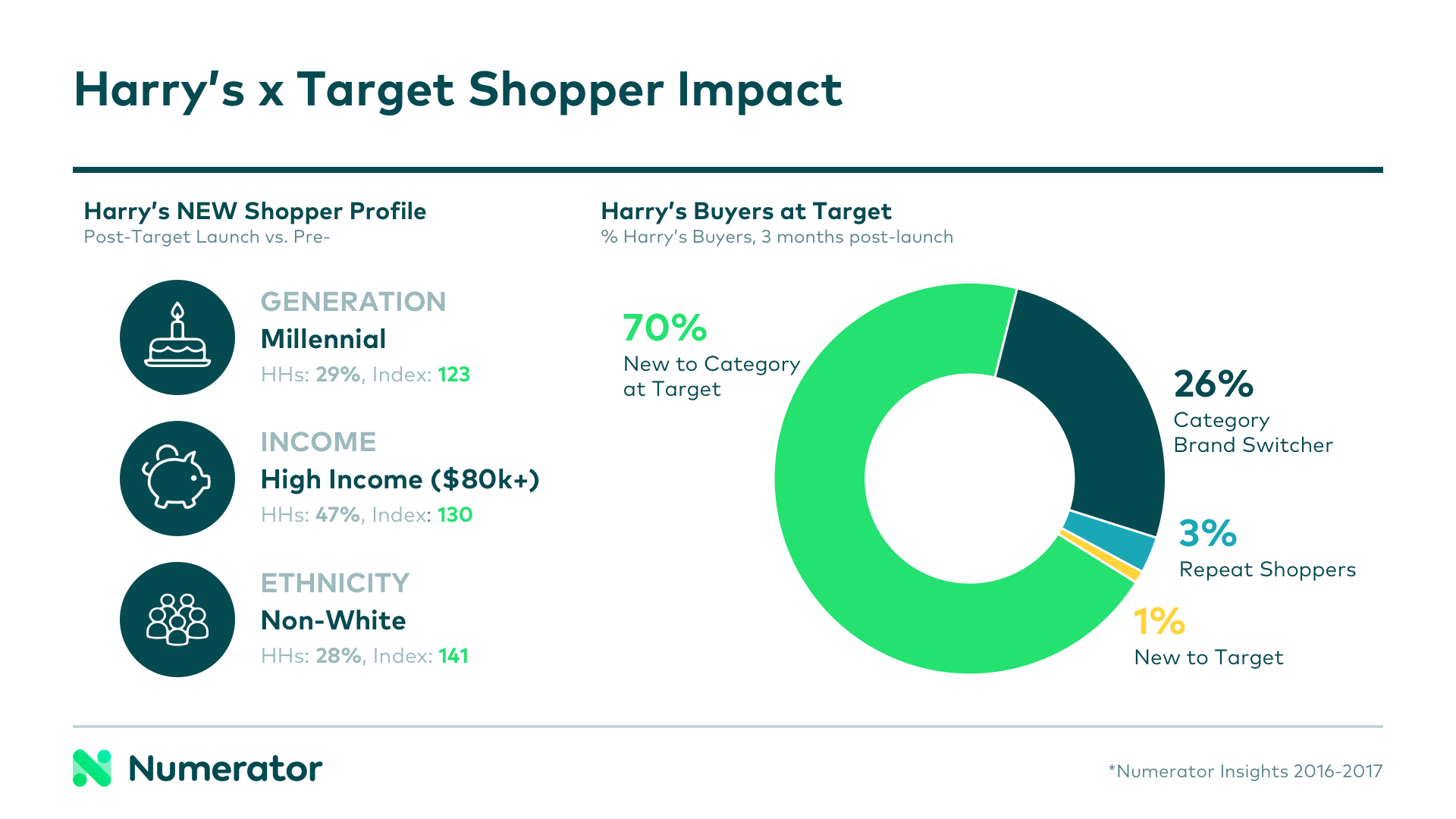

As their consumer base grew, the typical profile of a Harry’s shopper shifted. In expanding to Target, Harry’s attracted more millennials, individuals with higher incomes, and a wider variety of multicultural consumers. The benefit of new buyers wasn’t limited to Harry’s, though. While Harry’s grew in popularity with many strategic consumer groups, Target grew in popularity in the men’s razor category: more than two-thirds of Harry’s buyers in those first three months were first-time category buyers at Target.

A New Tale as Old as Time

The Harry’s – Target coupling is hardly one-of-a-kind… even for Harry’s and Target. In 2018, Harry’s extended distribution to Walmart stores as well. And Target has had its fair share of DTC brand partnerships, welcoming brands like Casper, BarkBox, Native and Quip to its shelves. As DTC brands continue to pop up and gain traction, expanding distribution to brick-and-mortar retailers will be a natural step towards growth.

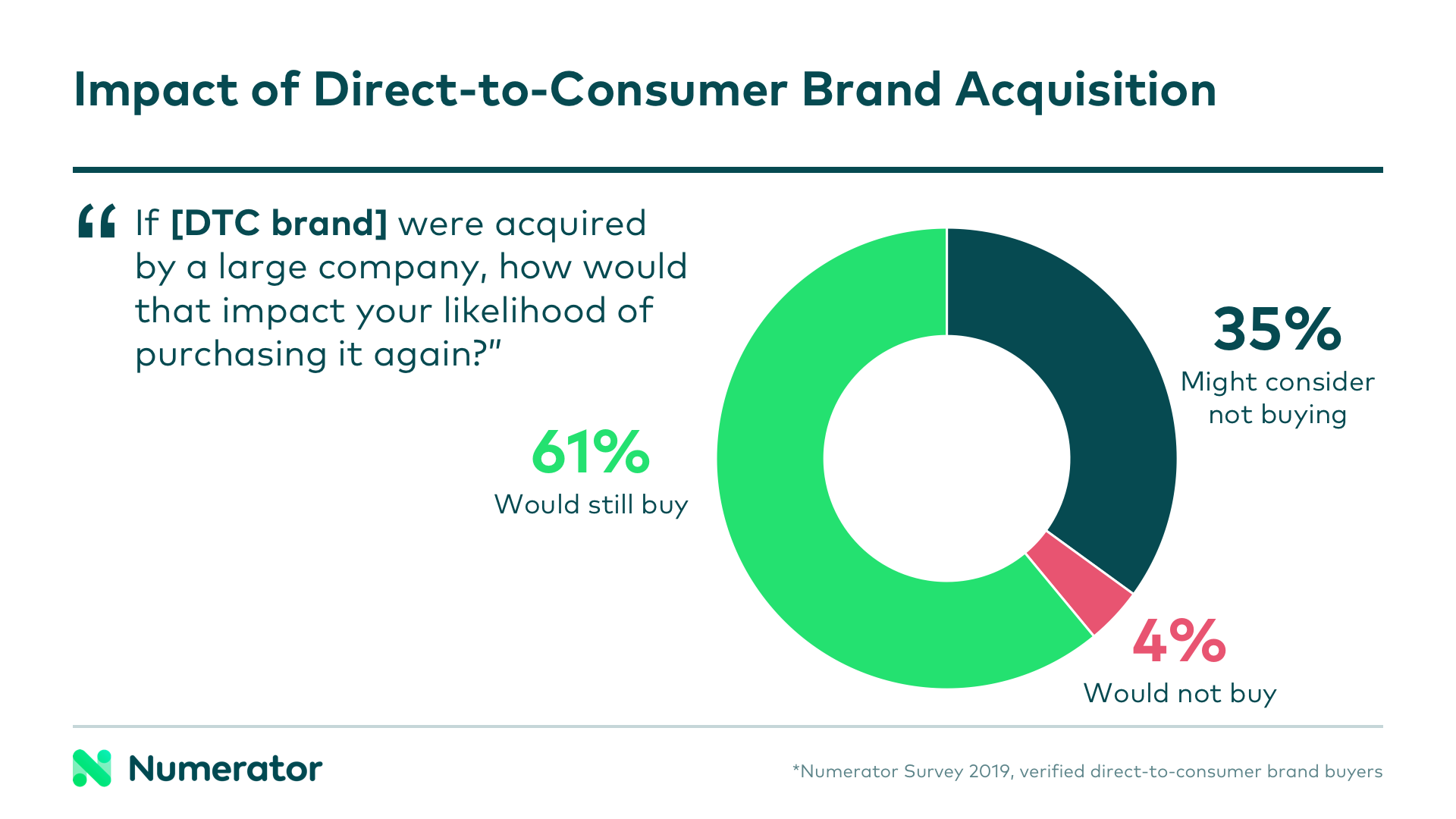

Another growth opportunity for direct-to-consumer brands is acquisition by larger, more mainstream companies. In a Numerator survey of verified DTC brand buyers, 61% of individuals said they would still purchase their DTC brand if it were acquired by a larger company, while only 4% said they’d stop buying— 35% were on the fence, saying they’d have to consider whether or not to purchase. Clearly, losing a potential 40% of buyers is not ideal for a DTC brand or the acquiring party, but the risk can be minimized if consumer preferences and perceptions are well-understood and respected in the process. Maintaining brand values and continuing the direct-to-consumer option for those who want it are both important aspects of DTC success after an acquisition.

Mr. Steal Your Consumer

For established brands who find themselves competing with these new, nimble DTC brands, the obvious option may be to buy them. Eliminate the threat, bring their success under your roof, and capitalize on mutually beneficial synergies and opportunities. For many big brands— like Unilever with Dollar Shave Club, and P&G with Native— this approach has already proved popular and successful.

But when acquisition is out of the question, what other methods might help you hold on to your consumers? They say imitation is the sincerest form of flattery, and some mainstream brands are finding success in creating their own direct-to-consumer offerings. Take Clorox, for example, who is building their own DTC business in-house. Though the undertaking requires a bit of an internal shake-up— thinking like a startup, hiring individuals with DTC experience, tweaking your supply chain— it also offers benefits like less pressure for immediate growth, a larger pool of resources, and higher margins. And thinking like a DTC doesn’t apply only to big brands— it includes retailers, as well, who have the opportunity to offer private label or owned brand DTC offerings.

Direct-to-consumer brands have raised the bar for traditional brands not only by delivering unique, high quality products at a great value, but also by leveraging control over every aspect of the consumer experience to build trust and loyalty. Despite the disruptive nature of many DTC brands, traditional brands and retailers have the opportunity to take advantage of DTC momentum, just like Target did with Harry’s.

Numerator is here to help you determine the impact of DTC on your business and to help you identify the value propositions and buyers of these brands. Drop us a line to find out what’s happening with DTC in your category, and let us help you create a strategy to retain and expand your consumer base.

—-

Analysis contributed by Fleur Liu (Numerator Consultant) and Lisa Cavanaugh (Numerator Associate Director, Survey Research)