Since its launch in November 2010, the Instant Pot brand has seen tremendous growth, nearly doubling its share of the slow, pressure and multi-cooker category in the past two years alone. With its rise, the cooker category, historically dominated by Crock-Pot slow cookers, has seen a drastic shift to multi-function cookers, as shoppers put their dollars towards the little appliance that can do it all. As former category leaders respond to pressure from newcomers, we decided to take a closer look at the shoppers behind the shift.

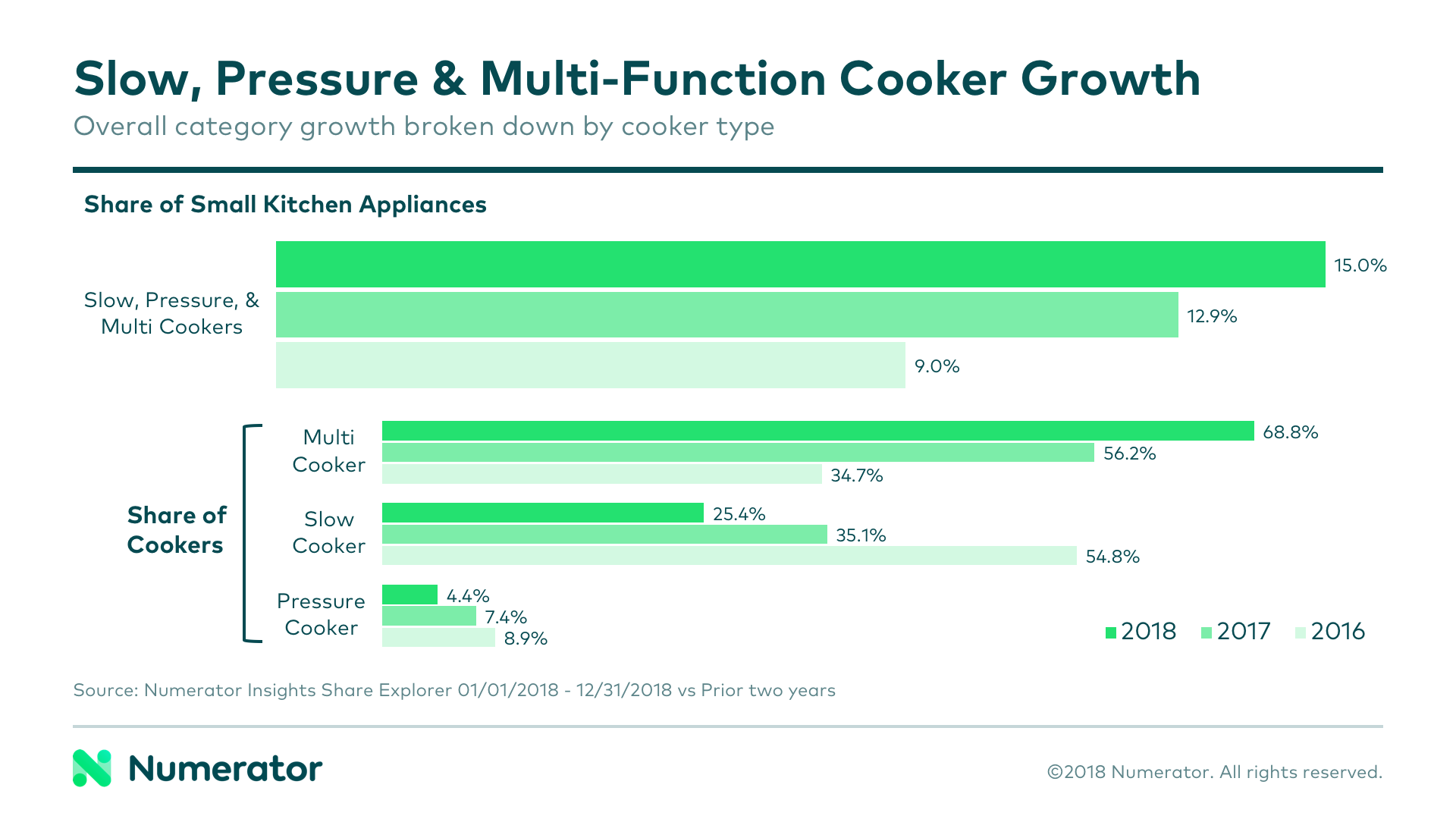

In the past two years, cookers have grown from a 9% to 15% share of the small kitchen appliance category. Within the cooker category, we saw this growth driven by multi-function cookers, which overtook slow cookers in 2017 and then continued to grow through 2018. Though Crock-Pot introduced their “Crock-Pot Express” to compete in the multi-function space, they have yet to regain lost share from Instant Pot, which currently boasts a 63% share of wallet in the cooker category. And with yesterday’s announcement of the upcoming Instant Pot – Corelle Brands Merger, the budding brand may just have solidified itself as a kitchen staple alongside its newest sibling brands like Pyrex and CorningWare.

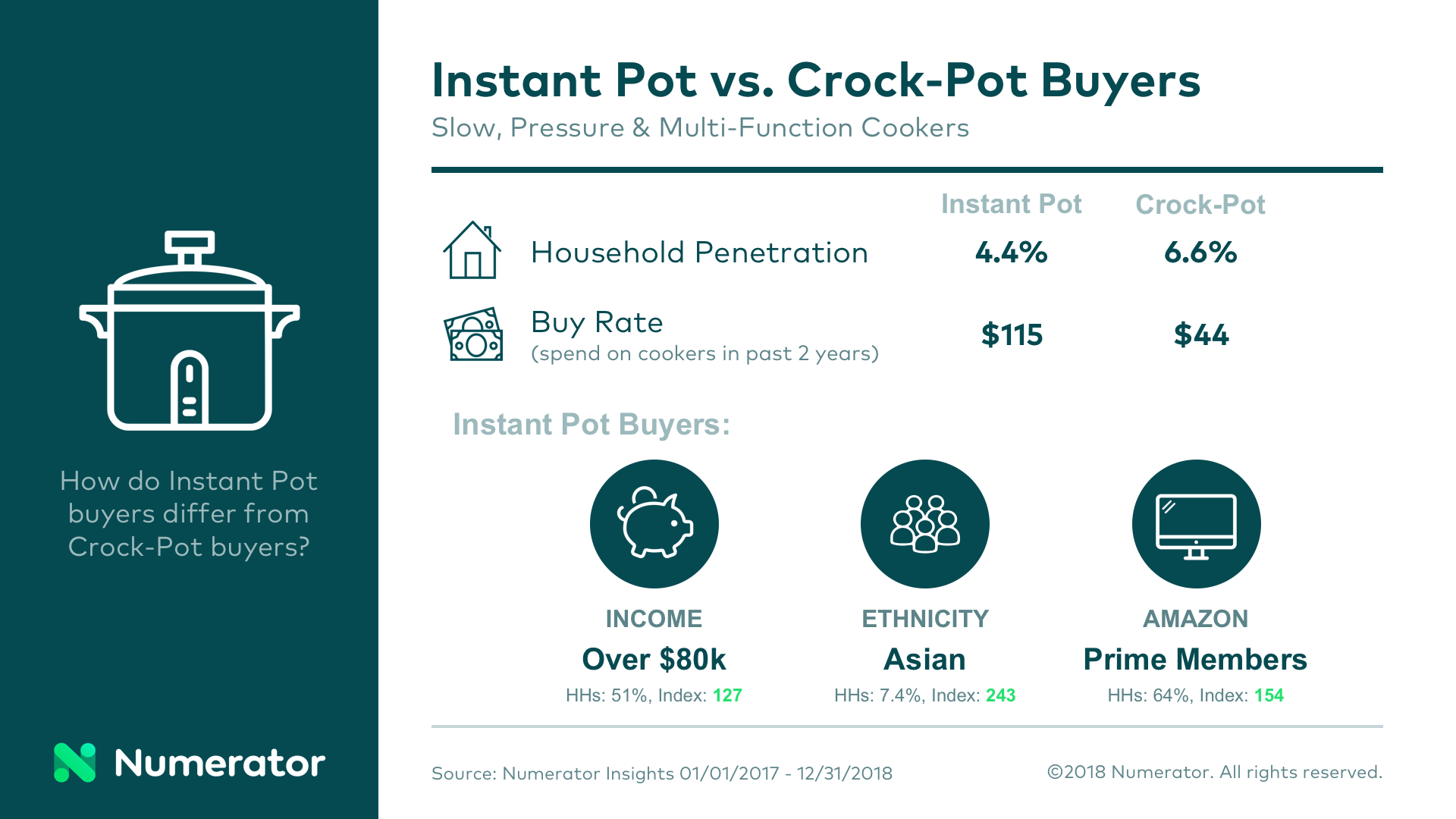

Given the high growth rate of the category, and the fact that the top two brands account for roughly 85% of category sales, we wanted to take a closer look at the individuals buying Instant Pots and Crock-Pots to see how they differed. In a comparison between the two buyer groups, we saw Instant Pot over-indexing with Millennials and Gen X, but only slightly. More significantly, Instant Pot buyers were 1.5x as likely to be Amazon Prime members, 1.3x as likely to be High Income (Over $80k), and 2.5x as likely to be Asian. Instant Pot buyers spent nearly 2.5x more on cookers in the past two years compared to Crock-Pot buyers, shelling out $115 versus $44 for Crock-Pot buyers.

According to Numerator Promotions data, Crock-Pot and Instant Pot have both increased their share of promotions for the cooker category in the past year. But while Instant Pot holds the top spot for web promotions (8.4%), with Crock-Pot coming in second (7.0%), Crock-Pot is by far the leader in circular promotions share of voice (27%) with more than twice that of Instant Pot (10.5%). This promotional analysis is in-line with panel findings, which tell us 61% of Instant Pot buyers purchase their cookers on Amazon, while Crock-Pot buyers favor brick-and-mortar stores like Walmart (29%) and Target (15%).

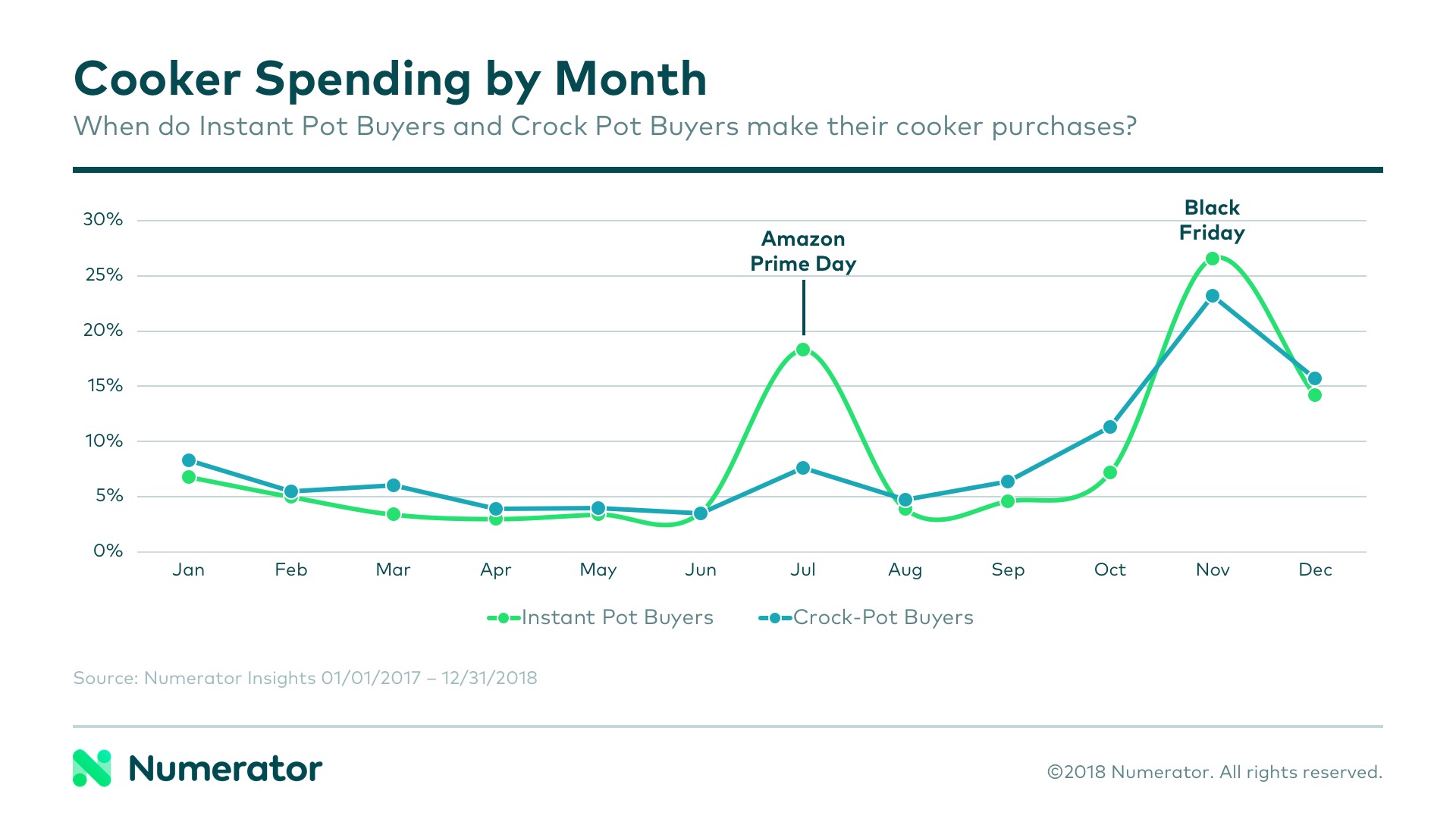

Both buyer groups saw a spike in cooker spending in November, as shoppers purchased one of the hottest gifts of the holidays. Instant Pot buyers also made a significant number of cooker purchases in July thanks to Amazon Prime day, at which the Instant Pot has become a staple, ranking in the top three Prime Day items of 2018.

As it stands, there is roughly a 3% overlap between Instant Pot and Crock-Pot buyers. We’re interested to see how brand preferences shift as the category continues to develop. Will shoppers remain loyal to a single brand? Will sales continue to dominate online? Will consumers purchase new models as they’re released, or will sales decline as the market becomes saturated?

Contact us today and let Numerator help you thrive under pressure in the omnichannel world.