Last holiday season, 64% of US households made an alcohol purchase, spending an average of $102 on alcohol between November and December. Numerator surveyed 1,100 of these consumers to get a better idea of the intentions and attitudes behind holiday alcohol purchases.

Parties and Presents

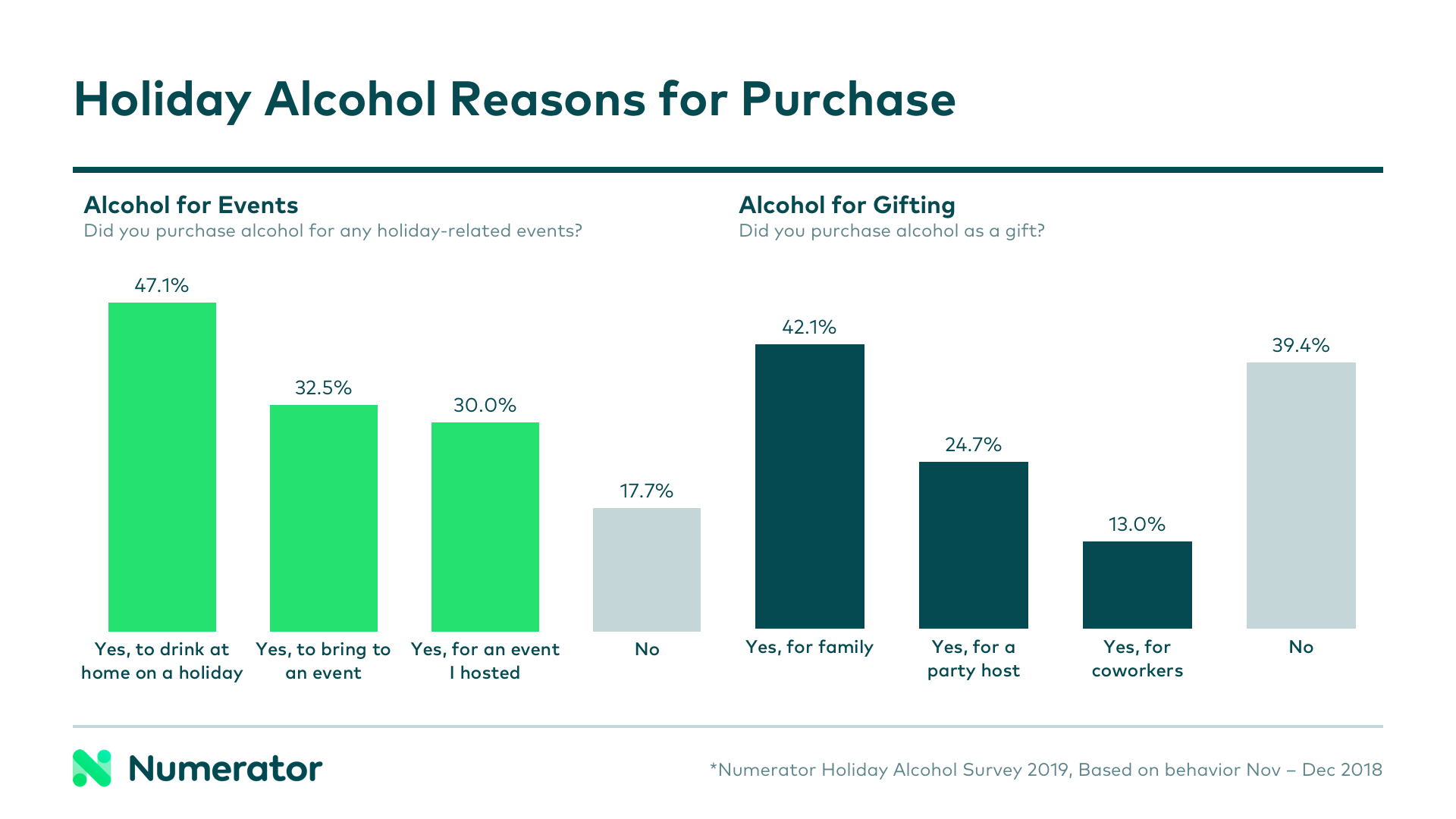

The vast majority of those surveyed— 85.9% of respondents— purchased alcohol during this time frame for a holiday-related event or to give as a gift. 82.3% said they purchased alcohol to consume at a holiday event, and 60.6% purchased alcohol to give as a gift. Drinking at home with family on a holiday was the top occasion for alcohol purchases, followed by events attended and events hosted. Alcohol was primarily given as a gift to family members, but nearly one-in-four also gave it as a gift to the host of a party they attended.

Knowing why consumers are buying alcohol can also help us to figure out where they are likely to buy it. According to Numerator Insights data, food, mass, drug and convenience channels all lose share to liquor and club stores during the holiday season. If we break out behavior between those who purchased alcohol for holiday events and those who purchased for gifts, we begin to see some differences in channels shopped. While those shopping for events spent more of their alcohol dollars in the club channel, gift buyers tended to spend more in liquor stores. Selection and availability of specific products may make a liquor store more valuable for gift givers, while buying in bulk could be more appealing to event participants, especially those hosting.

Brand Buying

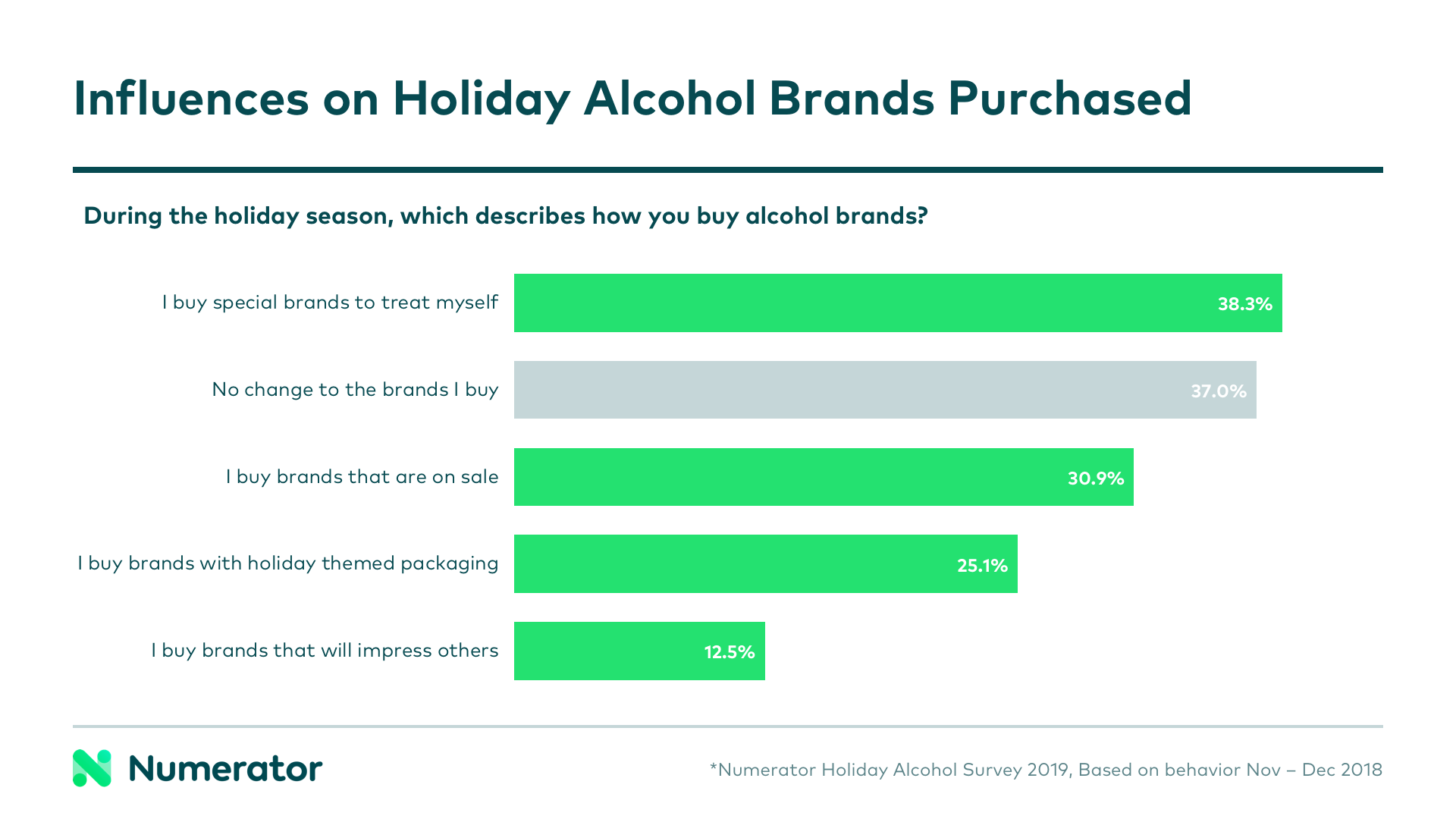

When it comes to brand selection, 38.3% said they buy special brands to treat themselves during the holidays, which was only slightly higher than the 37% whose brand choices don’t change. 30.9% buy brands that are on sale, and 25.1% like to go for brands with holiday-themed packaging.

Though consumers may be willing to switch up the brands they purchase, they are less likely to move out of their general price tier. 80.8% stay in the same price range that they do throughout the year, while only 10.8% go for more expensive brands— individuals who opted for more expensive brands were also three times as likely to say they buy brands that “will impress others” during the holidays. These findings were reflected in Numerator Insights data, as well; the average spend per unit in November and December was only about 5% higher than it was any other month of the year.

Holiday Alcohol All-Stars

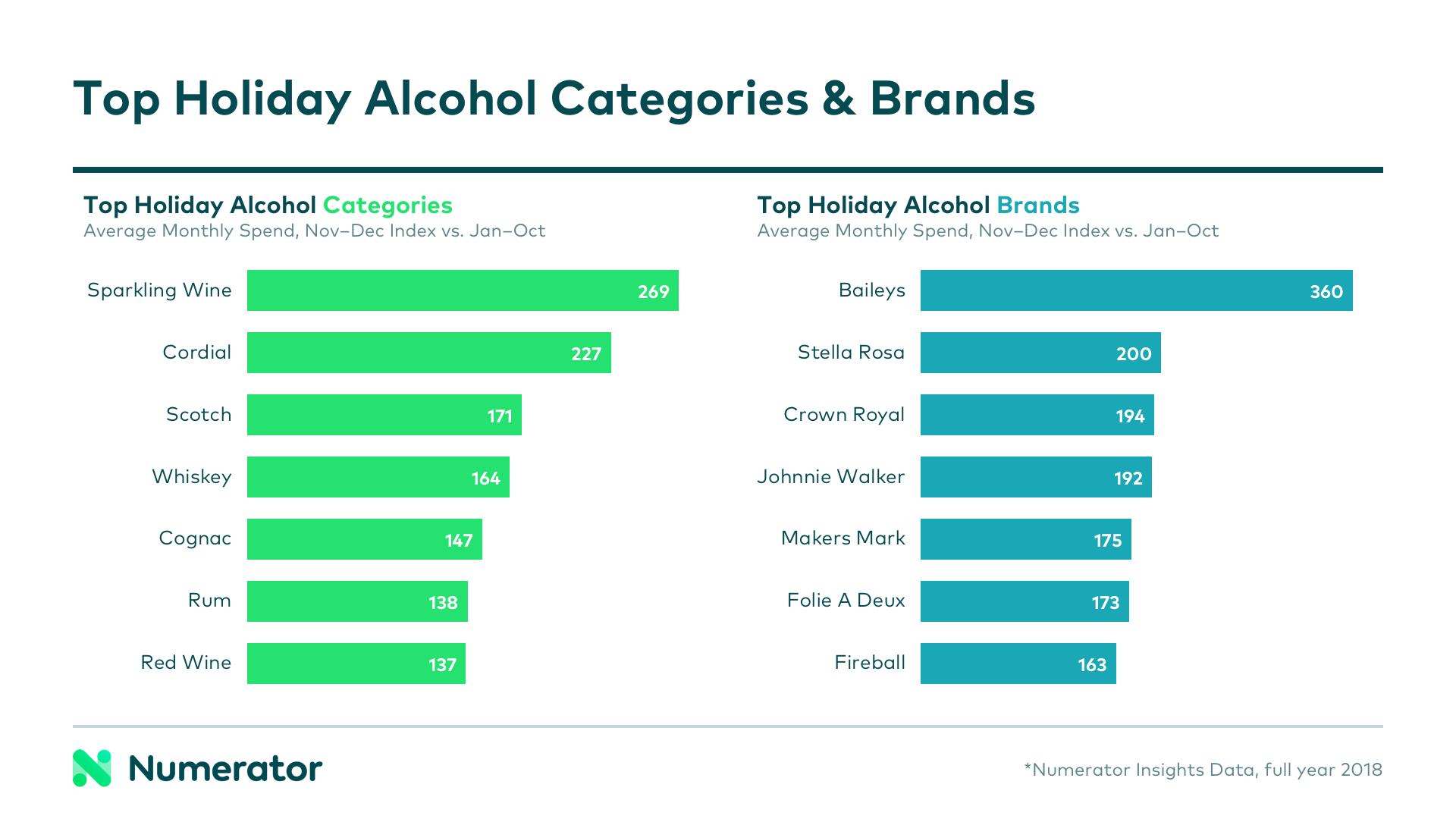

Last year, we analyzed alcohol sales specifically around Christmas and New Year’s. We found that wine and spirits— specifically sparkling wine, cordial, whiskey and red wine— stole share from beer. Looking at the full holiday season— November through December— we saw very similar trends. Though nearly every category within wine and spirits received a boost in sales during the holidays, sparkling wine and cordial were the clear leaders.

Red wine brought in the most dollar sales out of any other alcohol last holiday season. And despite not receiving quite the same “boost” as other alcohol types, premium and high end beers rounded out the top three highest grossing holiday alcohols.

Only 21.5% of those surveyed associate a specific brand or type of alcohol with the holidays; among those who do, many mentioned Bailey’s— which was also the clear leader of brands experiencing a holiday sales boost— in addition to eggnog and champagne. When asked about what their favorite holiday beverage was, though, nearly everyone had an answer, and overwhelmingly, the responses were wine and eggnog.

Consumers have many choices when it comes to alcohol this holiday season. To ensure their spiked drinks result in your brand’s spiked sales, give us a jingle and let Numerator help you ramp up your holiday consumer insights.