In today’s competitive retail landscape, protecting and expanding shelf space requires a data-driven strategy based on shopper behavior. Retailers continually assess their assortments, making it crucial for brands to demonstrate their value. This is especially true in categories facing declining sales or shifting consumer behaviors.

For brands looking to defend their presence, leveraging first-party consumer data is essential. While this article explores how Ortho in the Weed Control category can use consumer-sourced data to secure its shelf space at Lowe’s, the same approach can be leveraged by any general merchandise brand looking to build a compelling retailer sell-in story.

Understanding the Competitive Landscape

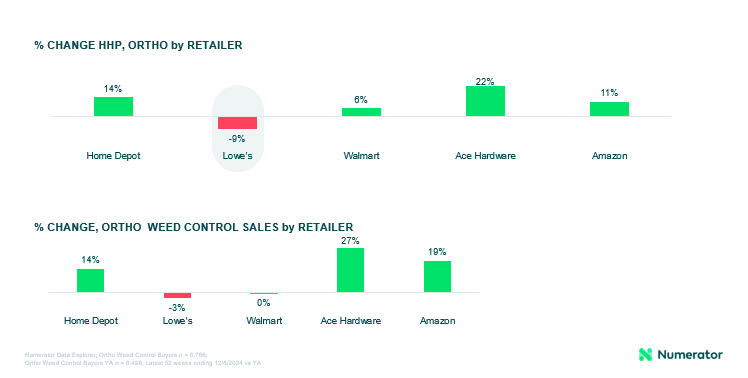

Before entering a line review, brands must understand their competitive position within the target retailer. Consider weed control products at Lowe’s—while the category has declined from its pandemic peak, consumer demand persists. However, Lowe’s has attracted fewer buyers than last year, losing shoppers to Walmart and Home Depot. This trend means Lowe’s may consider limiting its category assortment, making it critical for Ortho to prove its value.

For Ortho, this scenario presents both a challenge and an opportunity. Although Lowe’s has seen a decline in weed control sales, this trend is more about Lowe’s ability to attract shoppers than a decline in category demand. All brands were either flat or growing at Lowe’s, but Ortho experienced the largest decrease in weed control buyers year-over-year. Acknowledging this up front allows Ortho to address the drivers of this trend and reposition itself as an underrepresented rather than an underperforming brand. By showing its competitive strength at other retailers, Ortho can shift Lowe’s perception of its performance and argue for maintaining or expanding shelf space.

Identifying Leakage and Growth Opportunities

After establishing that its performance is influenced by retailer-specific factors rather than overall brand weakness, Ortho must demonstrate how Lowe’s can capture lost sales. One of the most effective tools in a line review is quantifying leakage—when a retailer’s shoppers purchase the category elsewhere.

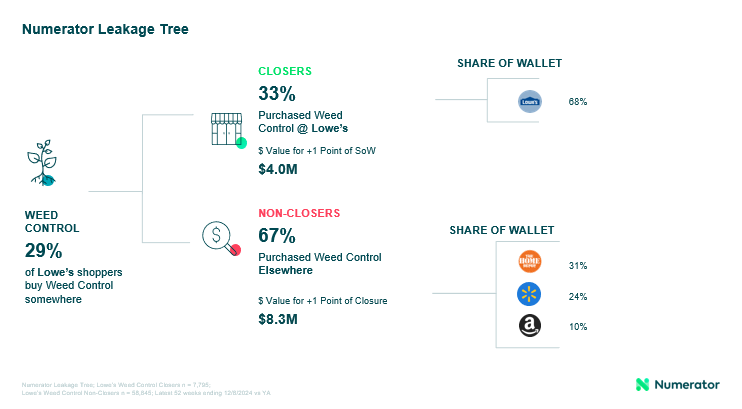

Numerator’s Leakage Tree analysis found that while 29% of Lowe’s shoppers purchase weed control, two-thirds buy from Home Depot, Walmart, or Amazon. This represents an $8.3 million opportunity for Lowe’s to recapture lost sales. To guide Lowe’s, Ortho can present two strategies to increase conversion: either they can focus on capturing new buyers (closure rate) or encouraging existing buyers to spend more (share of wallet, or SoW).

For Lowe’s, increasing the closure rate by just 1% would be worth $8.3 million—more than double the $4 million gained by increasing share of wallet. The key message to Lowe’s: increasing closure rate presents a greater opportunity than extracting more dollars from existing buyers. This supports Ortho’s shelf defense strategy by guiding Lowe’s to maintain or expand category assortment.

Home Depot is the primary competitor attracting Lowe’s lost shoppers, as Ortho does well at Home Depot. If Lowe’s converts just 10% of Ortho buyers leaking to Home Depot (170K households out of 1.7M), it could gain over $4 million in incremental sales. Ortho can further strengthen its case by identifying top-selling Ortho products at Home Depot and making a data-backed recommendation to Lowe’s on which SKUs to stock and help to drive total category growth as converting more shoppers is a larger dollar opportunity for Lowe’s.

Activating Insights to Drive Retailer Value

To secure its place on the shelf, Ortho must prove it is the best brand to help Lowe’s drive conversion. While not all insights will favor Ortho, the brand can tailor its sell-in story to be centered on shopper behavior accordingly.

An analysis of non-closers—Lowe’s shoppers who buy weed control elsewhere—reveals that RoundUp (47%) is the top brand purchased by those leaking to Home Depot, while Ortho (20%) significantly trails. Additionally, Home Depot and Walmart hold a combined 55% share of wallet from these non-closers, making them the primary targets for limiting leakage.

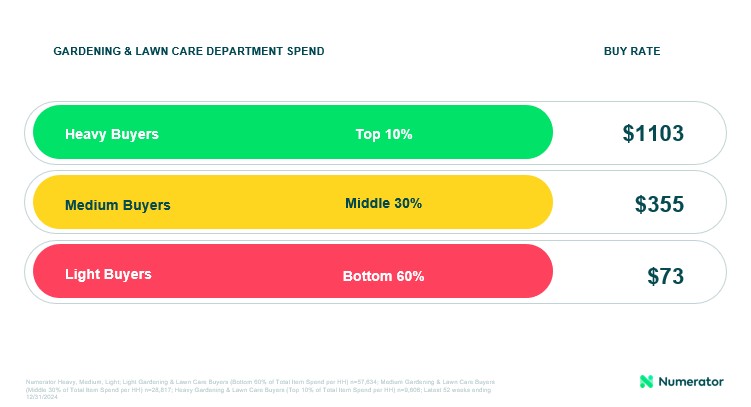

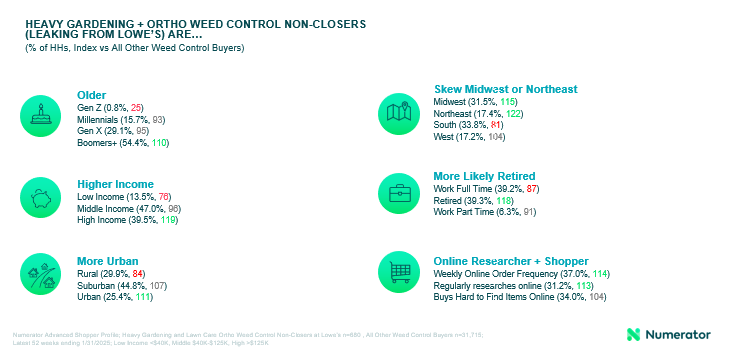

Another challenge is that Ortho buyers currently generate less total store value for Lowe’s than RoundUp or Spectracide buyers. However, instead of focusing on total store metrics, Ortho can pivot to where it wins—among Heavy Gardening & Lawn Care Buyers.

Heavy buyers—who spend over $1,100 annually in the category—account for nearly half of all Gardening & Lawn Care sales across all retailers and 31% of total store sales at Lowe’s. Ortho outperforms Spectracide in capturing share of spend from heavy buyers, even though it has fewer total shoppers. So while Ortho may appear to underperform broadly, it attracts more spending from the most valuable segment. This insight strengthens Ortho’s case for maintaining or expanding shelf space at Lowe’s.

Leveraging Consumer Sentiment to Strengthen the Case

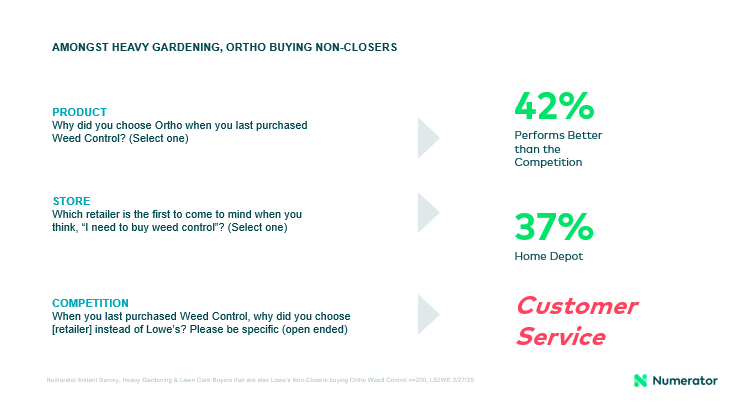

To further support its position, Ortho can layer consumer sentiment data into their argument. A Numerator AskWhy Survey of Lowe’s non-closers who buy Ortho elsewhere reveals they do so primarily because of convenience and, surprisingly, perceptions of poor customer service at Lowe’s. This insight suggests that addressing in-stock availability and enhancing customer experience could help Lowe’s recapture lost shoppers.

Additionally, when heavy buyers leak to other retailers, they consistently purchase three specific Ortho products at a higher rate than others—products Lowe’s does not currently prioritize. By adding top-selling Ortho SKUs on the shelf, Lowe’s could reduce leakage and capture more spend.

Optimizing Promotional Strategies

Heavy buyers are most likely to purchase weed control in March, making early-season promotions critical. Optimizing promotional schedules to align with their buying patterns can help Lowe’s win back spend from Home Depot. Survey data further supports this, with verified buyers reporting that they plan their weed control purchases weeks in advance, mostly between January and March—earlier than the category average. With the timing identified, Ortho can also introduce the most effective advertising touchpoints for this audience including Television, Online (Mobile Devices), and In-Store Signage.

Ortho also appeals to a valuable segment of established, higher-income, suburban/urban homeowners compared to competitive brands. This helps Lowe’s identify what shopper demographics to target to convert the heavy ortho non-closers and how they can optimize their promotional strategy by focusing on the channels that resonate most with heavy weed control buyers.

The Path Forward

A successful product line review hinges on a brand’s ability to make a compelling, data-backed case for its place on the shelf. In Ortho’s case, the key takeaways include:

- Lowe’s is losing weed control shoppers, creating a multi-million-dollar opportunity to improve conversion.

- Ortho may not be the top choice overall, but it is a strong option to attract Heavy Gardening & Lawn Care buyers.

- Lowe’s can win back category share from Home Depot and Walmart by improving its closure rate, with Ortho playing a key role in this strategy.

- Ortho deserves its place on the shelf, with maintaining or expanding its assortment helping Lowe’s increase overall sales.

- Promoting Ortho weed control earlier in the season via Television, In-store signage, and Online (Mobile Devices) can help Lowe’s secure category spend from high-value shoppers.

By leveraging first-party consumer insights, brands can shift from a defensive stance in line reviews to a proactive growth strategy. Whether defending existing shelf space or seeking expansion, the key is to provide retailers with clear, actionable steps that drive category performance.

At Numerator, we help brands craft compelling line review stories by combining omnichannel purchase data with comprehensive promotions data and direct feedback from consumers based on their verified behaviors. Want to learn how we can help your brand secure its retail presence? Reach out to our team today to learn more.