With his new movie, Unfrosted, comedian Jerry Seinfeld has gone from a show about nothing to a film about something very specific: Pop-Tarts. The fanfic flick debuted May 3 on Netflix and tells a fictional tale of the race between Post and Kellogg to create the world’s first shelf-stable toaster pastry.

With Pop-Tarts currently in the spotlight, we decided to take a deeper look at the buyers of this beloved breakfast item. Leveraging verified purchase data from our 150K household panel and a Numerator Instant Survey fielded in advance of the film’s premiere, we dove into Pop-Tart purchasing and consumption habits and… yada yada… here’s what we found.

Who is the Pop-Tarts Shopper, Anyway?

According to Numerator Insights data, 39.7% of US households purchased Pop-Tarts toaster pastries in the last 52 weeks, an average of 3.6 times per year. Compared to the average consumer, Pop-Tarts buyers are middle-aged— they are 12% more likely to be Gen X and 8% more likely to be Millennial— and more often live in rural areas. They are also more likely to be married with children and are 19% more likely to have picky eaters in their household (Serenity now, parents. Serenity now).

When it comes to dining out, Pop-Tart buyers are driven by a need for fast options to feed busy families. The most common considerations when deciding to eat out include getting food for my child(ren) (33% more likely), eating on the run (14% more likely), treating their family (10% more likely), and being too busy to cook (9% more likely).

Pop-Tart Purchase Drivers

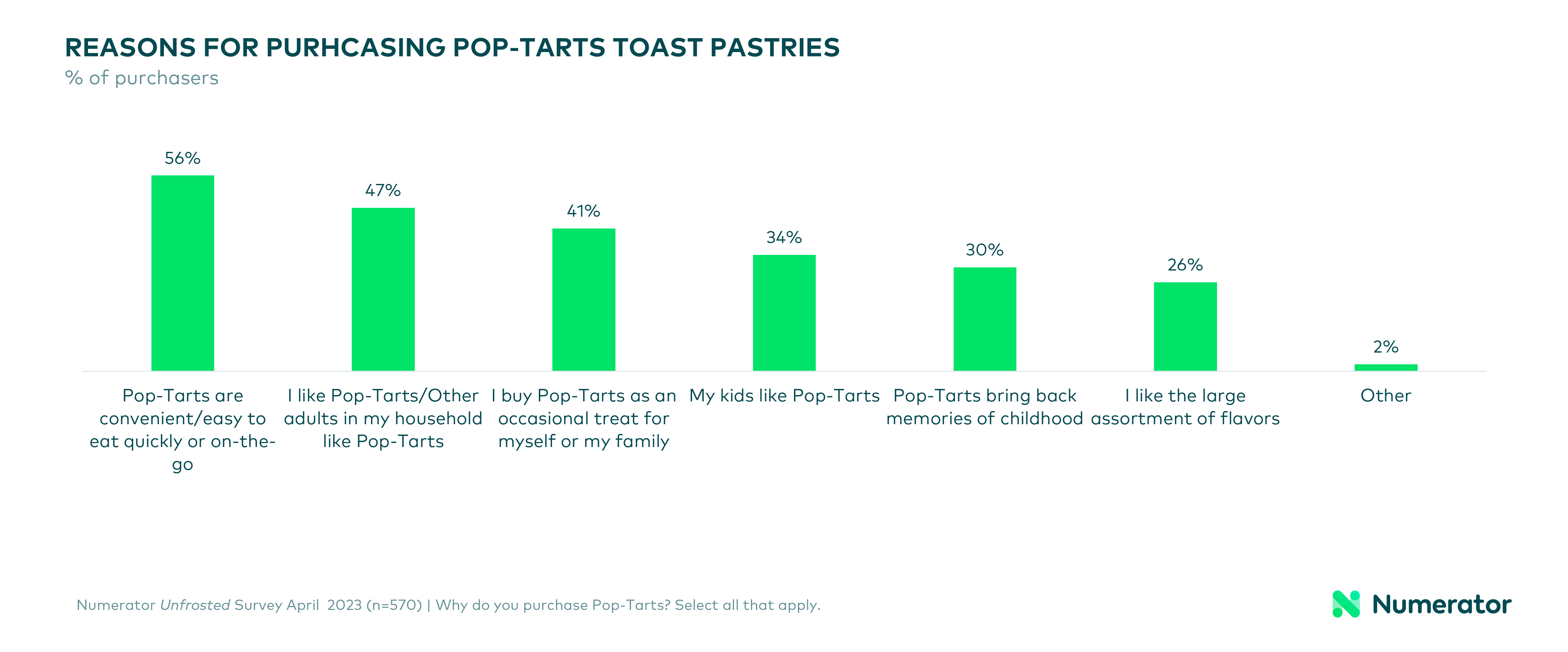

Our Pop-Tarts instant survey showed that convenience is the top driving factor for Pop-Tart purchasers— 57% cited the ease and convenience of grabbing a quick bite on-the-go as a reason for buying. For others (42%), they may not necessarily be a breakfast staple but rather an occasional treat for their household. Throughout Unfrosted, there is a palpable sense of nostalgia that may resonate with purchasers; though not a top factor, 31% of consumers said they buy Pop-Tarts because they bring back memories of childhood.

Among consumers who do not purchase Pop-Tarts, reasons are varied but the top motivations center around nutritional concerns. Half (50%) of non-purchasers cited the amount of sugar as a reason for not buying the toaster pastries. ‘Lack of nutritional value’ (41%) and ‘too many calories’ (31%) were also among their top reasons for steering clear.

Toasted or Frozen? Pop-Tart Consumption Patterns

While Unfrosted paints Pop-Tarts as a breakfast item for children, it turns out that the primary consumers are adults. 72% of Pop-Tarts buyers said they themselves ate Pop-Tarts and another 54% said other adults in the household eat them. Only 25% claimed that children ages 5-12 years in their household consume them.

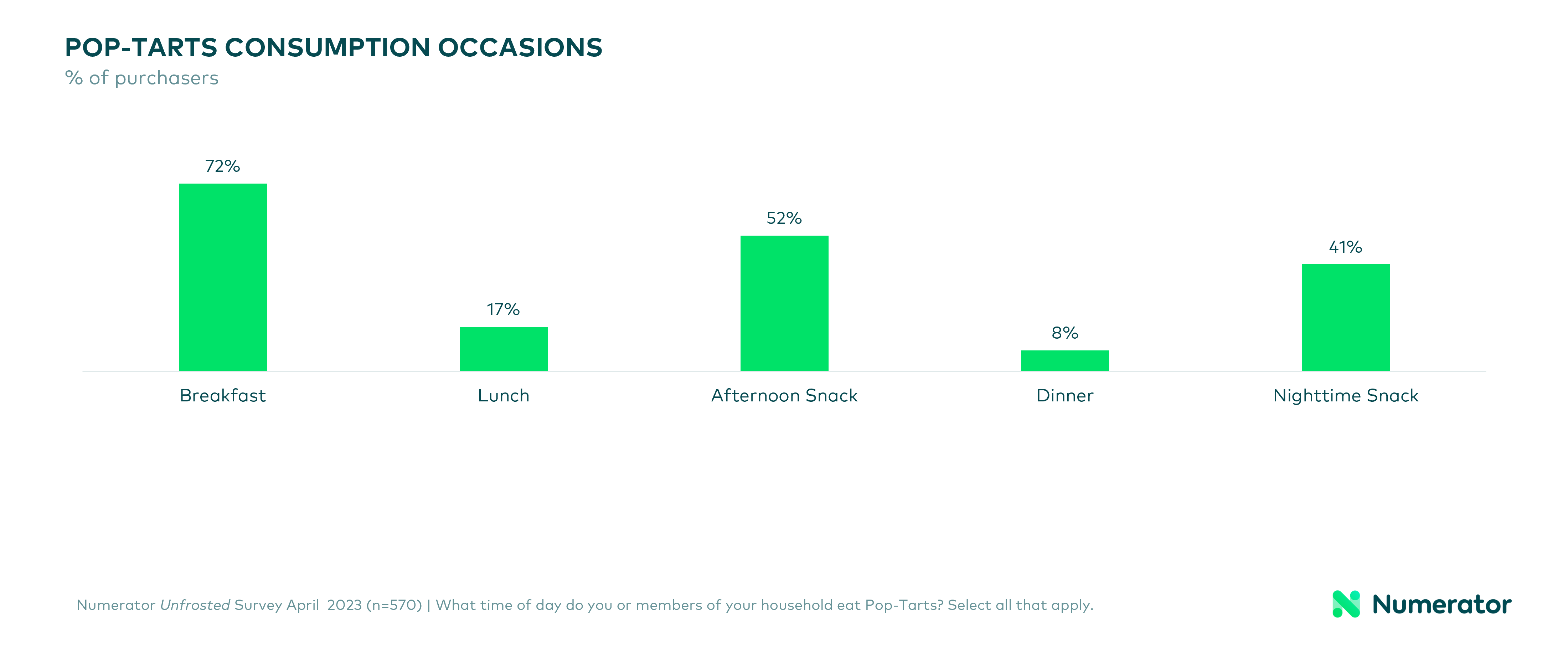

Consumers who buy Pop-Tarts are enjoying them semi-regularly— 44% said they eat them at least once per week—but a few diehard enthusiasts claim to eat them every day (9%). Unsurprisingly, breakfast is the most popular time for eating Pop-Tarts (72% of Pop-Tarts buyers), but a considerable portion of consumers also view them as a tasty afternoon snack (52%) or nighttime treat (41%). And while ‘ease of eating on-the-go’ was a top purchase driver for Pop-Tart buyers, they’re primarily eating them at home (84%), with only 40% saying they eat them while they’re bustling about.

And how do buyers prefer their Pop-Tarts? While 68% say they typically eat their Pop-Tarts warmed up (toasted, microwaved, etc.), many are not toasting their toaster pastries at all—61% eat them at room temperature straight from the package, and 12% eat them cold from the refrigerator or freezer. As for favorite flavors, frosted brown sugar cinnamon came out on top (37%), followed by frosted cherry (28%), frosted s’mores (28%), frosted blueberry (26%), and frosted chocolate fudge (21%).

The Unfrosted Effect

Despite only 20% of consumers being aware of Seinfeld’s “Unfrosted” movie at the time of our survey, 71% expressed interest in watching it. Since hearing about the movie, the majority of consumers (83%) said it would not influence their likelihood of purchasing Pop-Tarts— still, 12% of respondents indicated they would be more likely to purchase the toaster pastries now.

While Kellanova was by all accounts not involved in the making of the movie, that hasn’t stopped them from leveraging the marketing opportunity it presents. The snack manufacturer has since released a digital short featuring an airing of grievances between Pop-Tarts executives and a visibly unconcerned Seinfeld. They’ve also launched a limited-edition box for their unfrosted strawberry variety featuring jokes from the movie.

Kellanova’s decision to lean in on the hype surrounding Seinfeld and his movie could present both risks and rewards for the manufacturer. Recent Numerator research on influencer marketing shows that hitching your brand wagon to A-list public figures can be a highly effective marketing tool— so long as sentiment around the celebrity and their work remains positive. Our findings suggest sentiment toward a public figure is highly correlated with shoppers’ perception of the product they represent. Moreover, the more revered a figure is, the harder the drop in repurchase intent will be should negative news emerge.

While you may never have a celebrity comedian randomly make a feature-length film based entirely on a key product in your portfolio, Numerator Instant Surveys can help you connect quickly with consumers on timely topics that matter most for your business, like the holidays, retailer sales events, and more. Our easy-to-use, in-platform solution gives you the power to combine verified behavioral data with attitudinal responses to get high-quality responses within hours. To learn more about how we can help you draw up a playbook for a winning business strategy, reach out today.