When it comes to buying behavior, what distinguishes shoppers who are ready to commit versus those who are simply looking for a fling? On holidays like Valentine’s Day, brands and retailers have the opportunity to build relationships with consumers, drawing them in with timely deals and promotions. Today, it feels only fitting to take a look at this through the lens of a top Valentine’s Day category. Sit back and pour yourself a glass— we’re talking about wine.

There are two main ways to grow sales of a brand: growing penetration and growing spend. One way to increase spend among existing buyers is to increase loyalty, getting them to buy your brand whenever they have a need for the category. But what really drives loyalty, and how can we measure it? Brand perceptions are a great place to start.

To All The Brands We’ve Loved Before

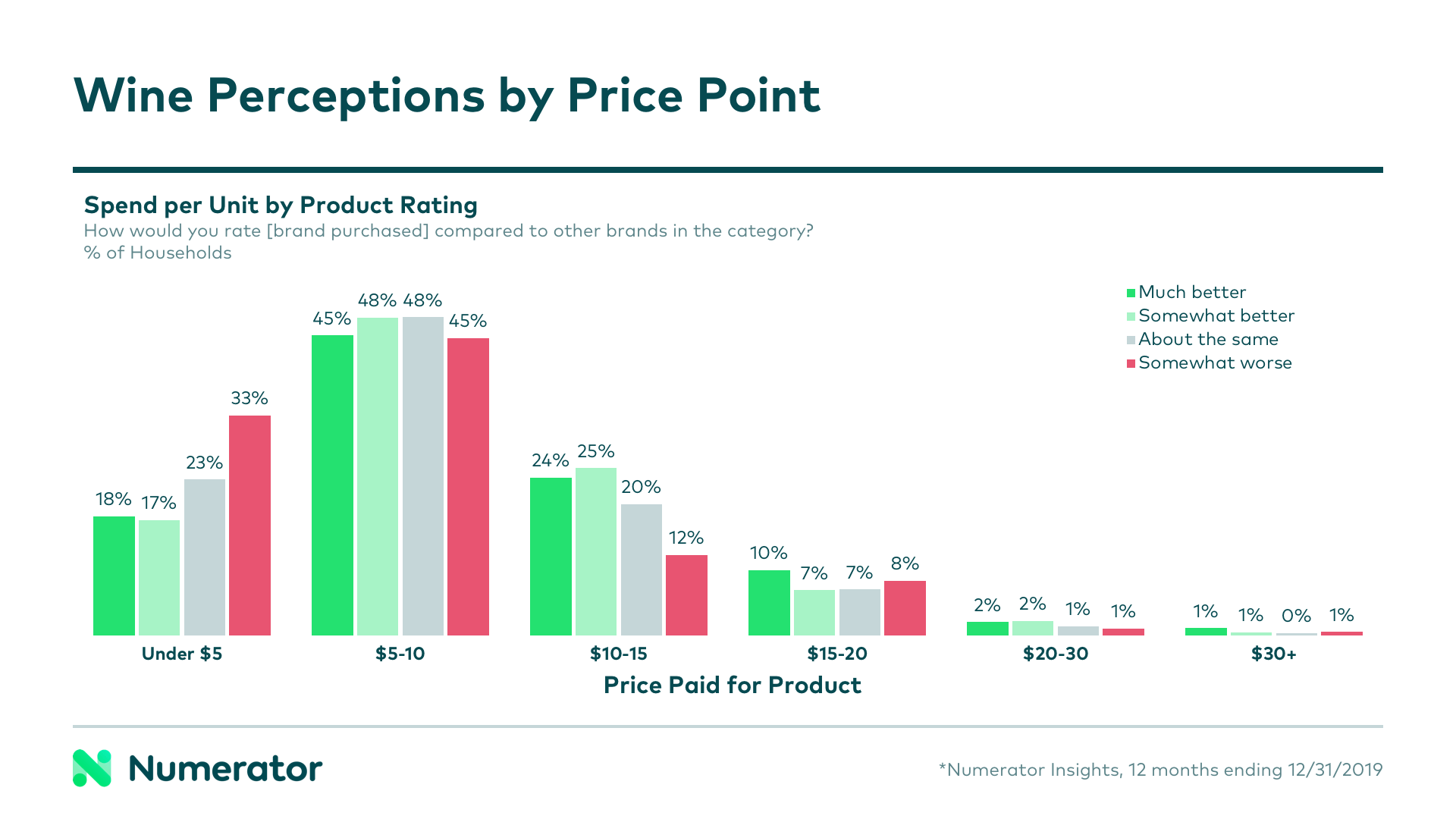

According to Numerator Insights data, there is a link between perceived quality and performance of a brand and loyalty to that brand— although perceived quality does not necessarily mean expensive, in the case of wine.

In a category with such a wide range of options, one might expect high priced, niche brands to capture the best ratings from consumers. Most of us aren’t sommeliers, but we know a highly coveted bottle of wine can go for a pretty penny. Interestingly, though, half of wines that were rated as “much better” than other brands were under $10— and 18% were under $5. Additionally, there wasn’t much relationship between brand size and average ratings; big brands and niche brands fell into the same range of favorability among consumers.

Timing is Everything

Those who planned their brand purchases ahead of time were the most likely to be loyal to that brand, but impulse buyers were more loyal than those who intended to buy the category with no brand in mind. Brands like Martini & Rossi, Franzia and Lindemans win these planned purchase occasions while Folie a Deux, Josh Cellars and Cupcake were the most likely to be purchased impulsively.

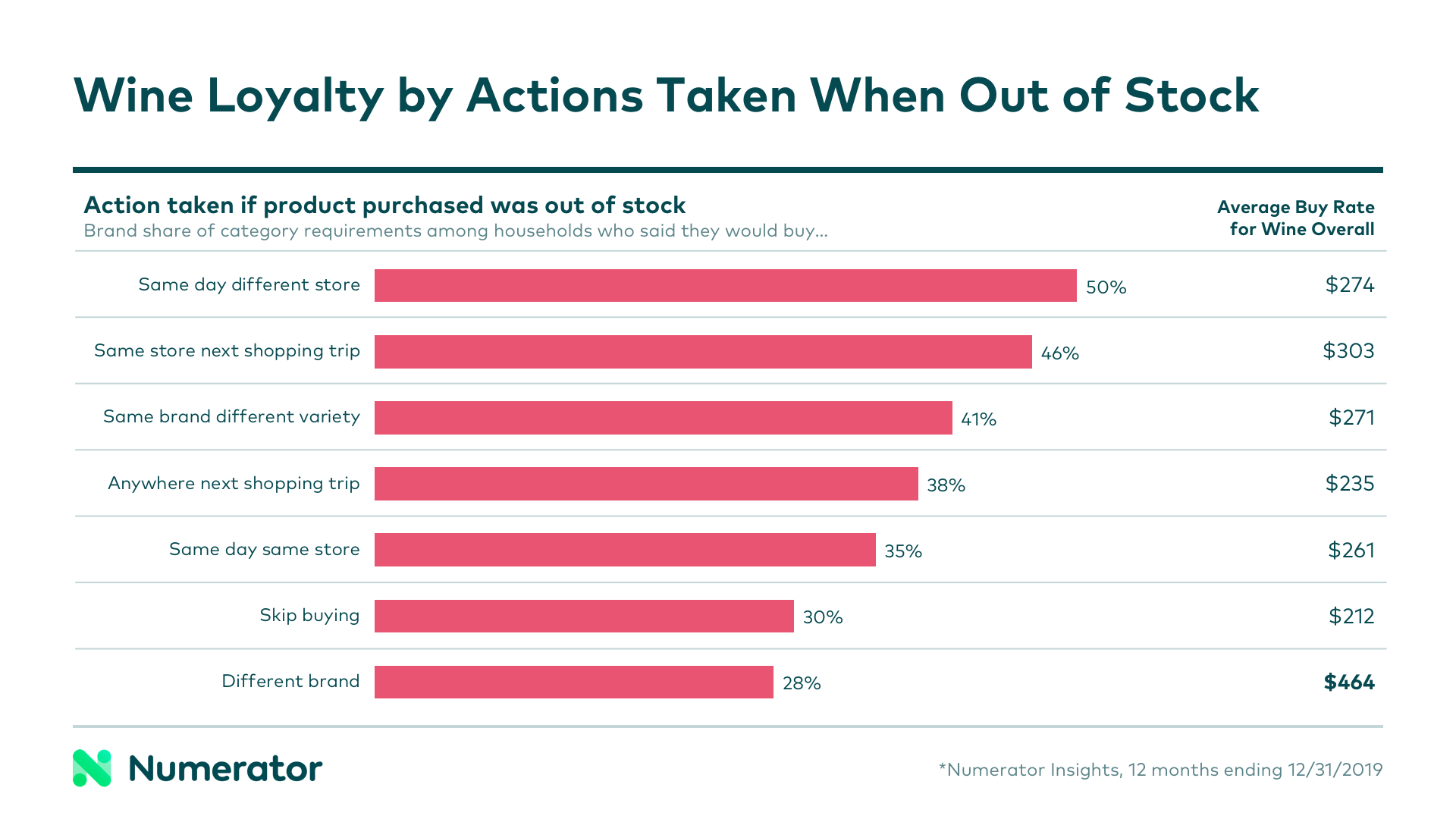

Loyalty can also be segmented by the actions a shopper takes when preferred product is out of stock— do they miss you when you’re away sold out? The most loyal shoppers were those who said they’d go to another store that day to buy the brand and those who would wait until their next shopping trip to purchase the brand. Those who said they’d skip buying or choose a different brand were far less loyal. However, these shoppers with limited loyalty should not be overlooked: those who said they’d simply buy a different brand were the heaviest category buyers.

The Perfect Pair: Wine & Chocolate

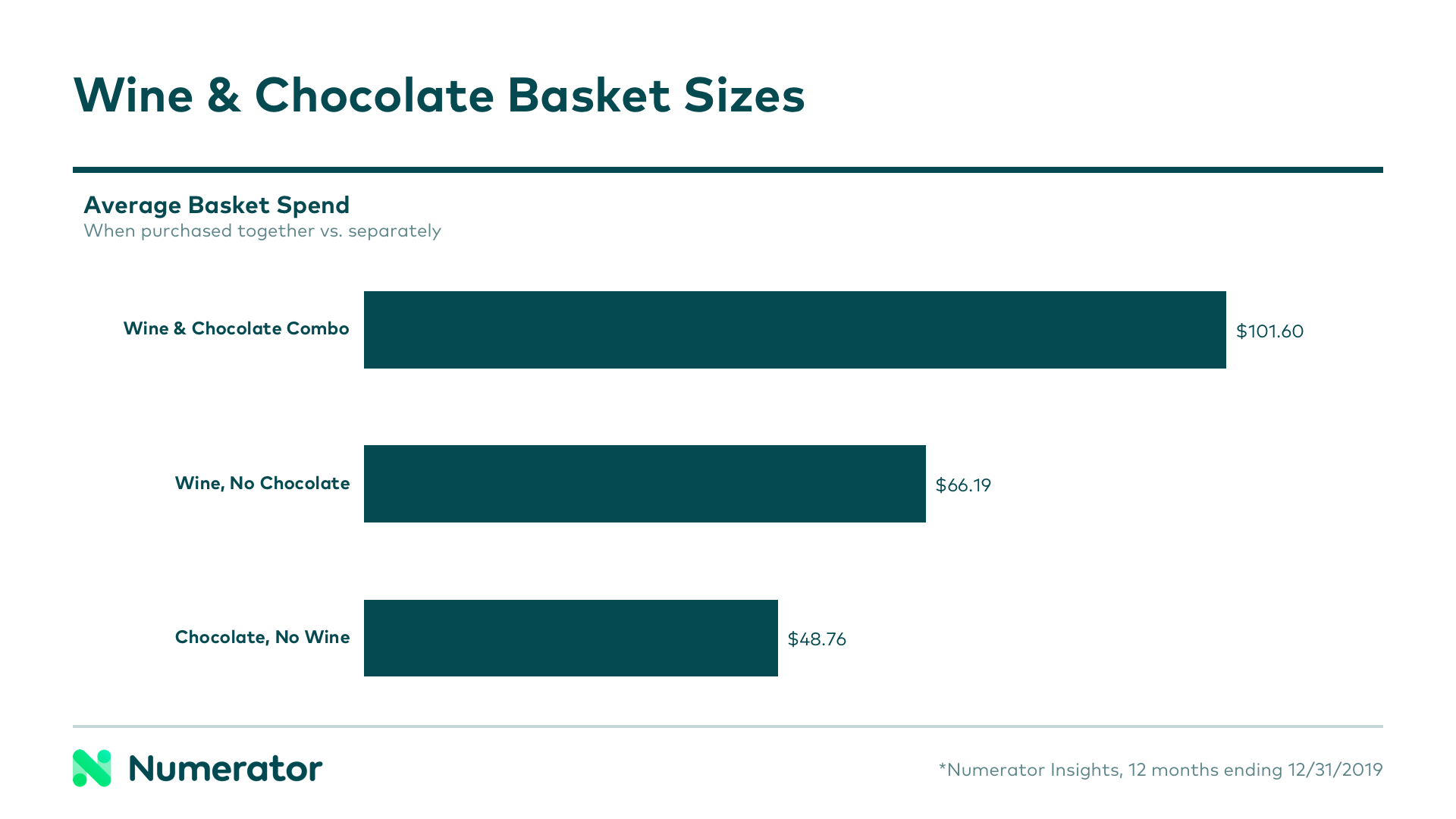

While there’s nothing wrong with flying solo, sometimes coupling up has its advantages. In the past 12 months, 17.6% of US households have purchased wine and chocolate together. When purchased together, shoppers spend an average of $40.29 on the two items in a single trip— $29.49 on wine and $10.80 on chocolate.

These combo trips drive more basket value overall— trips with both wine and chocolate result in an average basket size of $101.60, nearly twice as large as baskets where only one of the two items are present. Cross-promotion of wine and chocolate can help attract higher income, established households as well, as buyers tend to be slightly older with higher incomes.

Occasions like Valentine’s day present big opportunities for brands and retailers. Winning major shopping holidays can help to drive additional basket spend and continued loyalty to a brand or retailer during non-holiday periods.

Are you looking for better, insights-driven answers to your business questions? We’d love to help partner up— reach out to Numerator today.

—-

Analysis contributed by Shelly Smith (Numerator Consultant) and Irene Jia (Numerator Senior Consultant)