For the latest Inflation Insights, check out our regularly updated dashboards:

Consumers resuming their pre-pandemic activities this summer are feeling the heat both in the weather and their wallets. As the country gradually returns to normal, a supply shortage is competing with an increased demand for goods and services. Inflation soared to 5.4% in June, according to the U.S. Bureau of Labor Statistics*, its highest rate since the 2008 financial crisis. How are consumers responding to this marked change in the cost of the essentials they need and non-essentials they want?

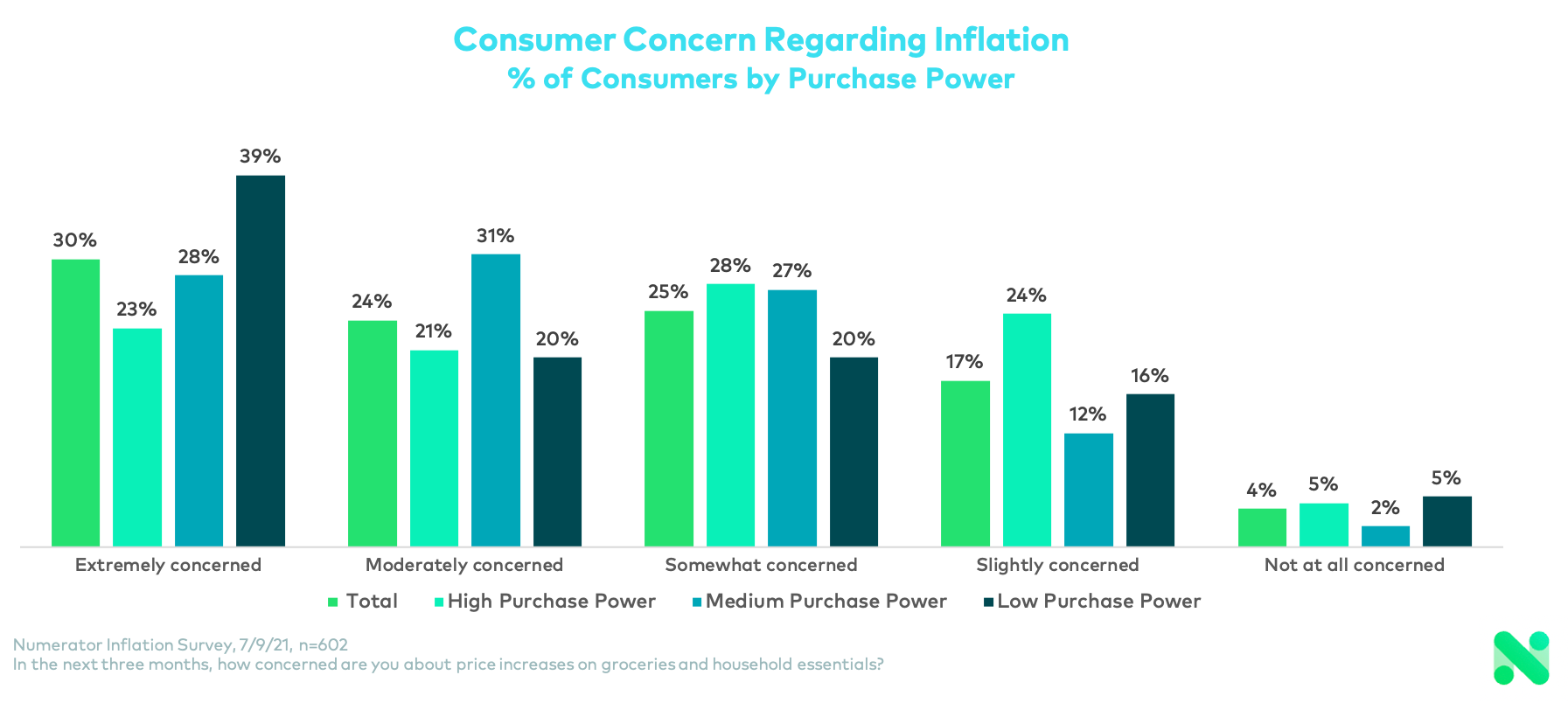

To gauge the degree of awareness and concern around the current inflation rate, Numerator surveyed a segment of consumers in both June and July. Taking into account their income level, cost of living, and household size, respondents were divided into three purchase power groups: low (bottom 30%), medium (middle 40%), and high (top 30%). While there are degrees of difference in beliefs and behavior among the three groups, consumers as a whole are paying close attention and making alternate spending plans as prices rise.

Consumer Concern Grows Along with Costs

Numerator found that 83% of consumers noticed an increase in price on commonly purchased groceries and household items in the past month. And 66% of consumers expect prices to continue rising in the coming months, though 50% anticipate it will only be a slight increase. The number of consumers expecting a significant tug on their purse strings dropped from 21% in June to 16% in July, though low purchase power consumers were slightly more likely to expect significant price jumps.

With this expectation for rising prices, consumers are growing increasingly concerned over the potential cost of everyday products and services in the months to come. Although levels of concern vary, 54% of consumers are moderately or significantly worried about future price increases. Low purchase power consumers were 1.7x more likely to be extremely concerned, but that level decreased slightly for both low and high purchase power consumers between June and July. Where inflation weighs most heavily is on the minds of mid-level consumers; this group showed an increase in concern over the last two months.

Inflation Puts Pressure on Consumer Purses and Purchasing Behavior

As prices rise, consumers are feeling the pinch on their pocketbooks. In the past month, 55% of survey respondents say they have already made changes in their buying behavior. These shifts are more pronounced among low purchase power consumers, with 64% having adjusted their shopping habits. Only 41% of high purchase power consumers have done the same.

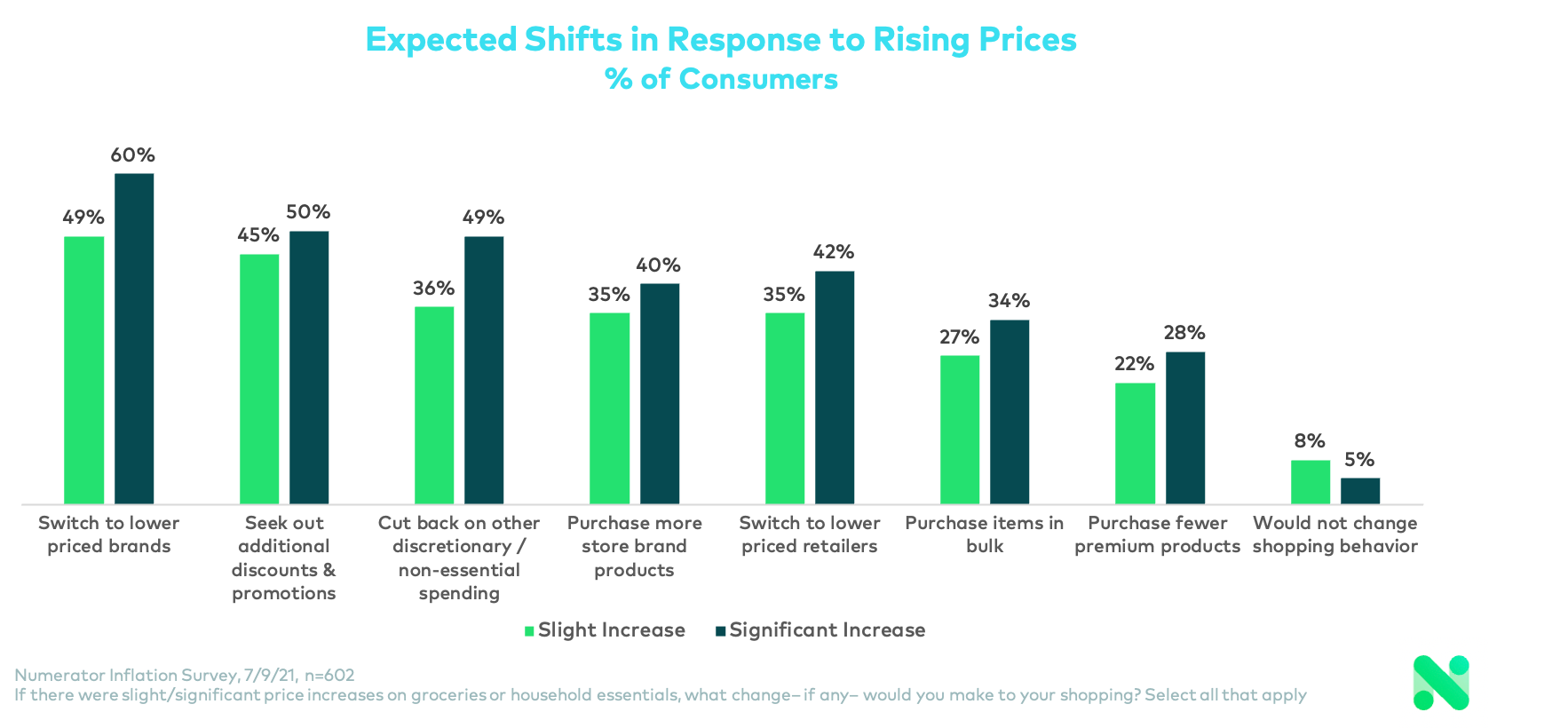

However, due to their general level of concern and expectation that costs will continue to increase, consumers are planning ahead. If prices increase significantly, 95% of consumers say they’ll change their purchasing patterns. But even a slight increase in the coming months would result in 92% of consumers pursuing cost-saving measures, such as switching to lower-priced brands or retailers, seeking out discounts and promotions, and cutting back on discretionary spending.

Discretionary spending is likely to take a hit should prices surge, though consumers may explore other money-saving avenues first. Switching to low-cost brands is unlikely among high purchase power consumers, but tops the list of changes low purchase power consumers would choose to make. Consumers in the medium purchasing power range are least likely to change their behavior at all, aside from potentially shifting to lower-priced retailers.

Climbing Costs Could Drive Cuts in Discretionary Spending

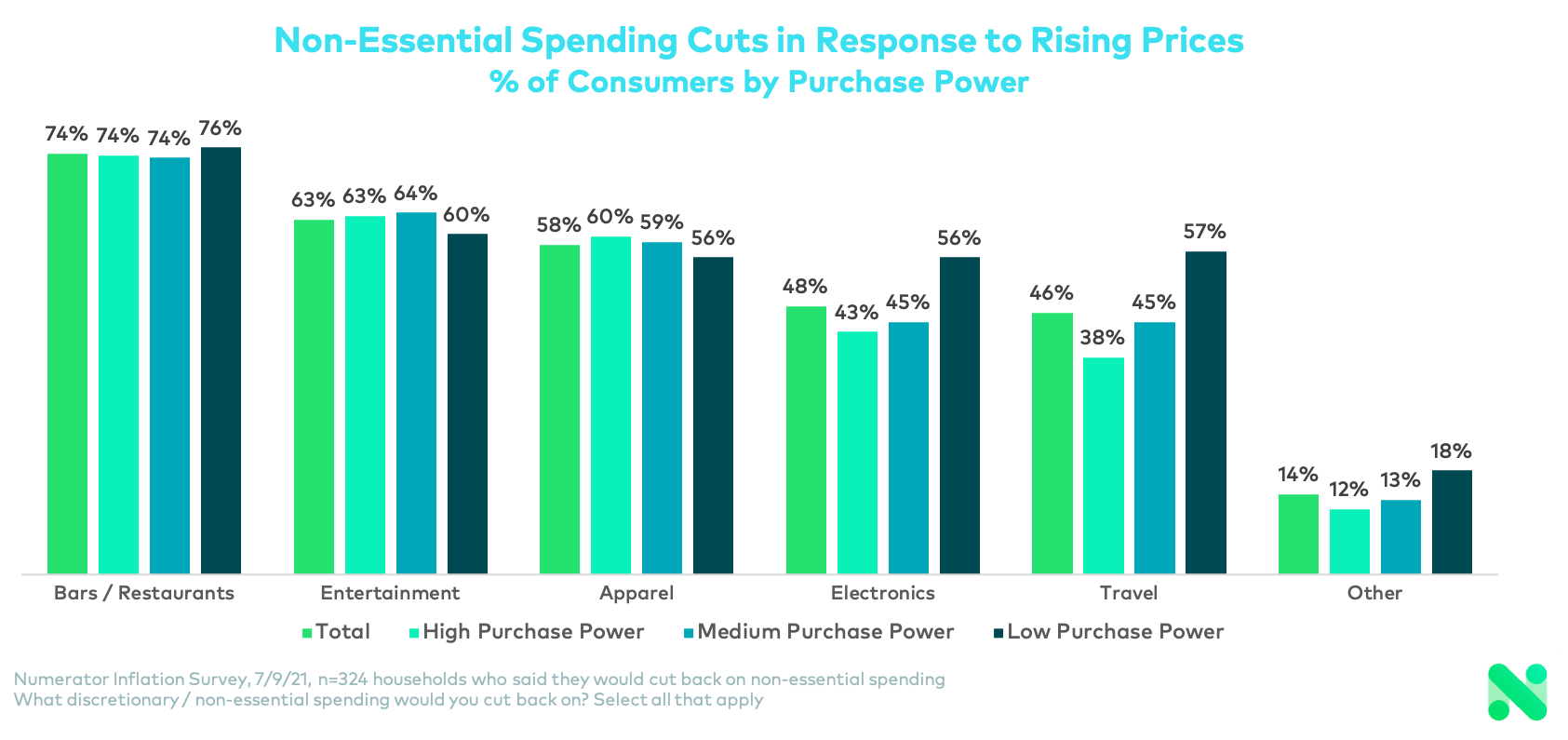

If inflation rates continue to rise, where would consumers make cuts in non-essential spending? The answer varies by degree of purchasing power. In general, bars and restaurants would likely see the biggest drop in discretionary consumer dollars. In fact, high purchase power consumers are most likely to nix dining out, entertainment, and apparel from their non-essentials agenda. While lower purchase power consumers share that sentiment, they would also cut back on travel and electronics as well as other non-essential categories.

Looking Ahead

Consumers are planning ahead as they take note of inflation’s effect on the increasing cost of the products and services they count on. Currently, price increases have led to shifts in low purchase power consumer behavior and deepening concern among mid-level consumers. However, consumers at all purchasing levels are prepared to make shifts in their shopping behavior in anticipation of prices continuing to climb.

Numerator will continue to monitor inflation’s impact on consumer attitudes and purchasing habits. To learn more about how your buyers are affected by rising prices, reach out to your Numerator consultant, or get in touch with us.

*Source for 5.4% June inflation statistic: U.S. Bureau of Labor Statistics