As summer winds down and fall quickly approaches, consumers and brands alike are turning their focus toward all things autumn. One question on many minds is what 2020 holds for Halloween, a holiday certain to look different amidst the COVID-19 pandemic. Will there be trick-or-treating? If not, will consumers still look for some way to celebrate? And what might the implications be for candy and snack brands who rely on Halloween as a core sales period?

Halloween Survey 2020: Consumer Behavior Predictions

To help brands and retailers set expectations when so much is unexpected, Numerator fielded a survey to over 2,000 consumers to get a sense of how they plan to celebrate and shop for upcoming holidays like Halloween. We combined this with a look at last year’s shopping behaviors and COVID-19 buying patterns to help predict what this Halloween may have in store.

Given the public and communal nature of most Halloween celebrations, it’s no surprise that nearly 3 in 4 consumers (73%) expect to celebrate the holiday differently this year. In a time when most are being asked to stay home and limit social interactions, a holiday marked by door-to-door visits for treats may not feel right to many families. And in some places like Los Angeles County, the Department of Health has already banned trick-or-treating, Halloween parties, carnivals and haunted houses in order to curb the spread of COVID-19.

Candy sales will be different this Halloween

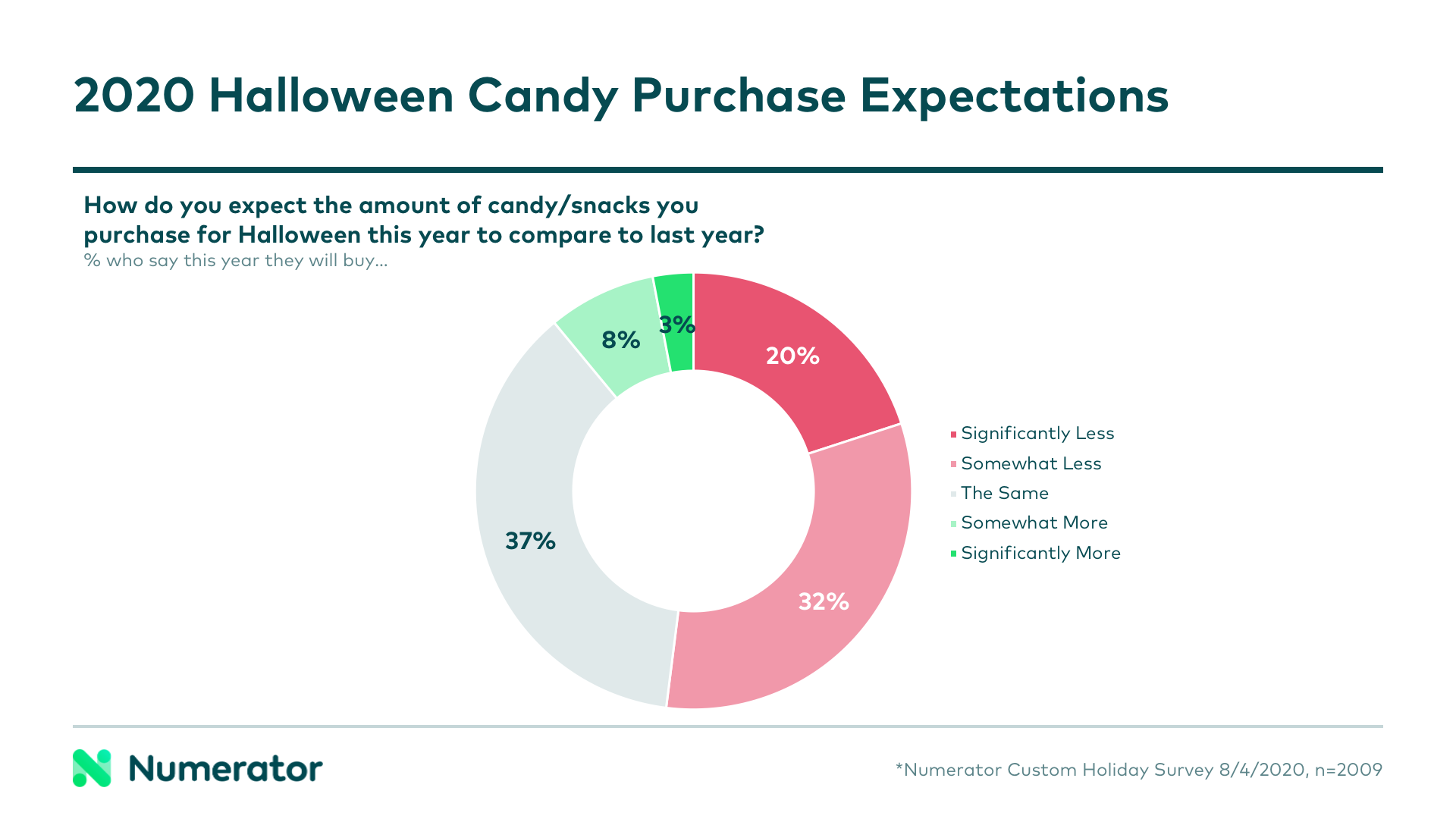

Based on our survey, over half (52%) of shoppers say they will buy less candy this Halloween than they did last. At least one in three (37%) expect to buy the same amount, though, and one in ten (11%) think they will buy more. We are also likely to see a shift in spend to ecommerce, as we have seen in many other areas of CPG since the onset of the COVID-19 pandemic.

Consumers are skeptical about trick-or-treating

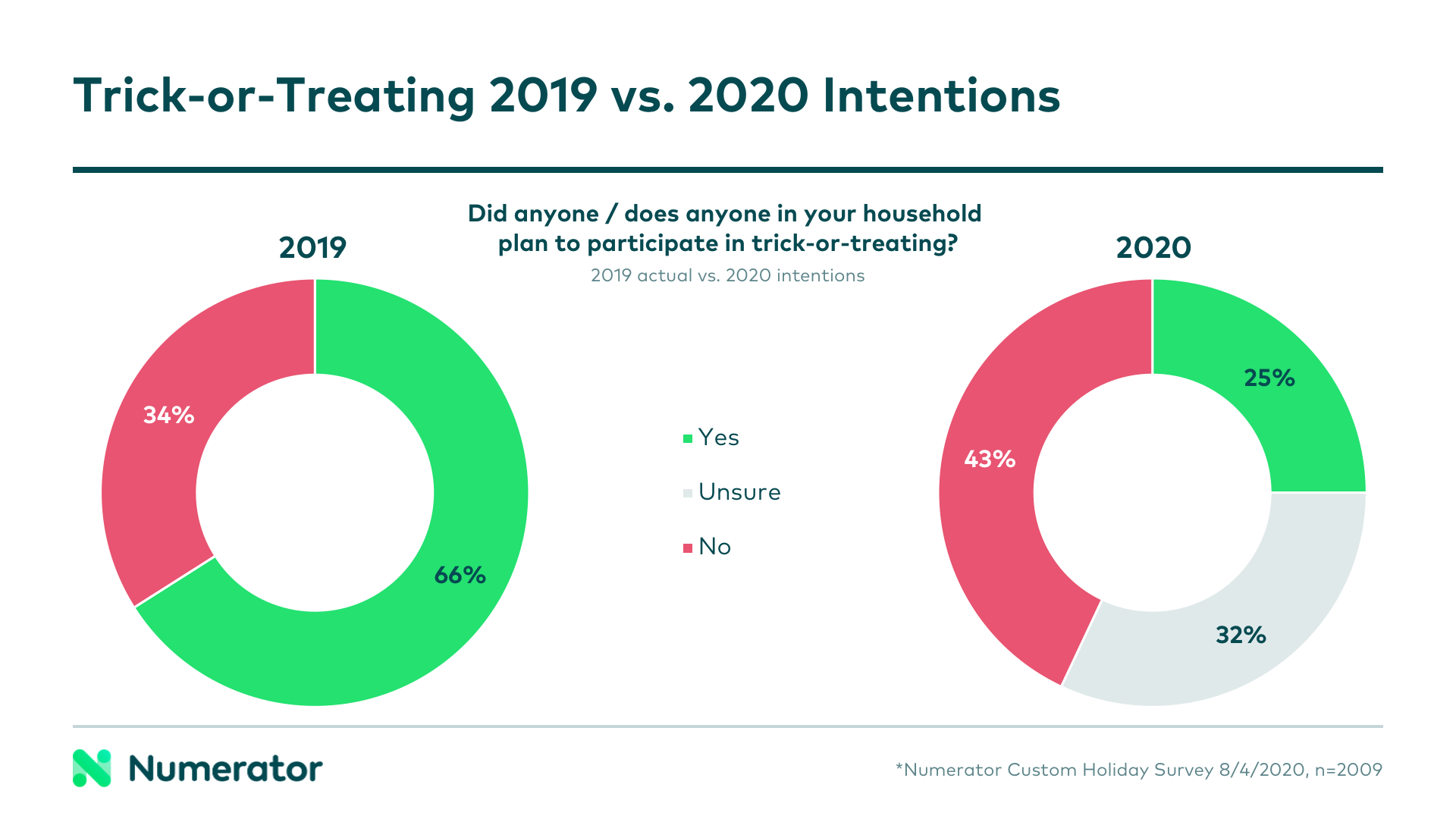

Even if most cities and counties avoid a formal ban on trick-or-treating, it is unlikely consumers will participate to the same extent as years past, underscoring the expected decline in candy sales. When asked if anyone in their household participated in trick-or-treating last year— either handing out treats or going door-to-door— 66% said yes. This year, only 25% said they planned to participate, with another 32% still unsure. 43% said they would not be participating this year.

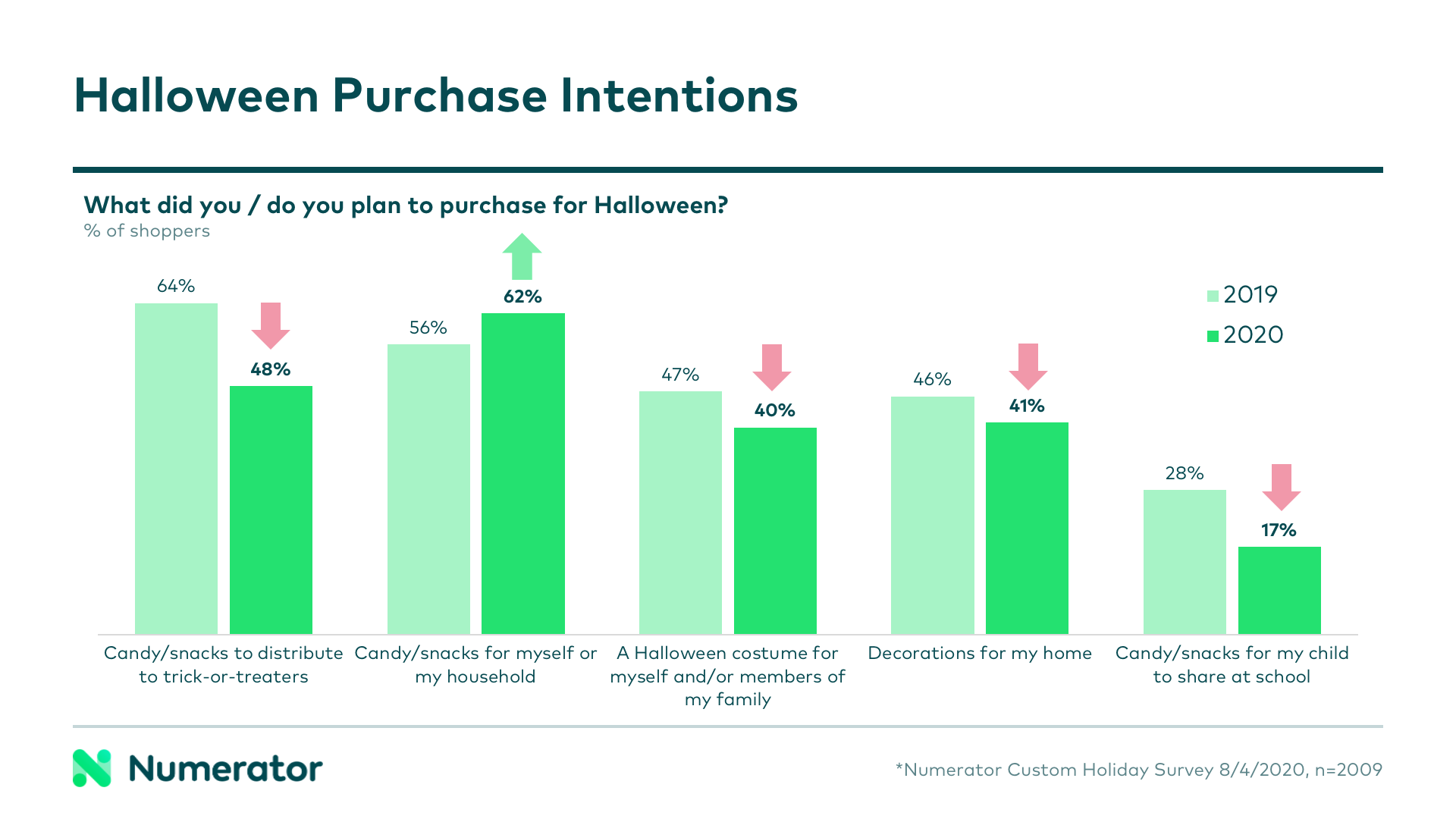

Halloween candy will still be purchased for household consumption

While trick-or-treating may be on the chopping block, candy will still be a must this Halloween. The number of households planning to purchase Halloween candy & snacks to distribute is down significantly this year versus last. At the same time, those intending to purchase for household consumption is up, likely to compensate for missed trick-or-treating opportunities. Brands and retailers should keep this shift in mind when advertising and promoting their Halloween treats; an appeal to family indulgences will be more fitting than stocking up on treats to share. Additionally, consumers may be willing to spend slightly more to get the brands and items preferred by members of their household.

Looking Ahead

Although there are still many unknowns about what this Halloween will bring, the good news is that consumers do plan to celebrate and shop for the holiday, and candy is still at the top of their list. For more information on holiday consumer intentions and predicted trends through the end of 2020— covering Halloween, Thanksgiving, Christmas/Hanukkah and New Year’s— check out our 2020 Holiday Intentions Dashboards or download the full holiday report.

To learn more about how your business can navigate Halloween and beyond, reach out to your Numerator customer success team or drop us a line, we’re here to help!