In early summer 2023, McDonald’s rolled out a brand new deal to honor the 52nd birthday of one of its iconic original characters: big purple Grimace. Originally known as “Evil Grimace,” the now lovable creature and his Grimace Birthday Meal soon went viral on TikTok and generated serious business impact for McDonald’s. In Q2 earnings, the fast food giant reported that the Grimace Birthday Meal contributed to overall sales growth this year.

To explore the impact on consumer behavior, the Numerator Restaurant team ran an analysis on the Grimace Birthday Meal and Shake campaign. We found that not only did the promotion generate enthusiasm among consumers, it engaged key demographic groups—especially Gen Z and Millennials—and drove McDonald’s customers to spend more overall at McDonald’s than they did in the prior 12 weeks.

Everything Old is Grimace Again

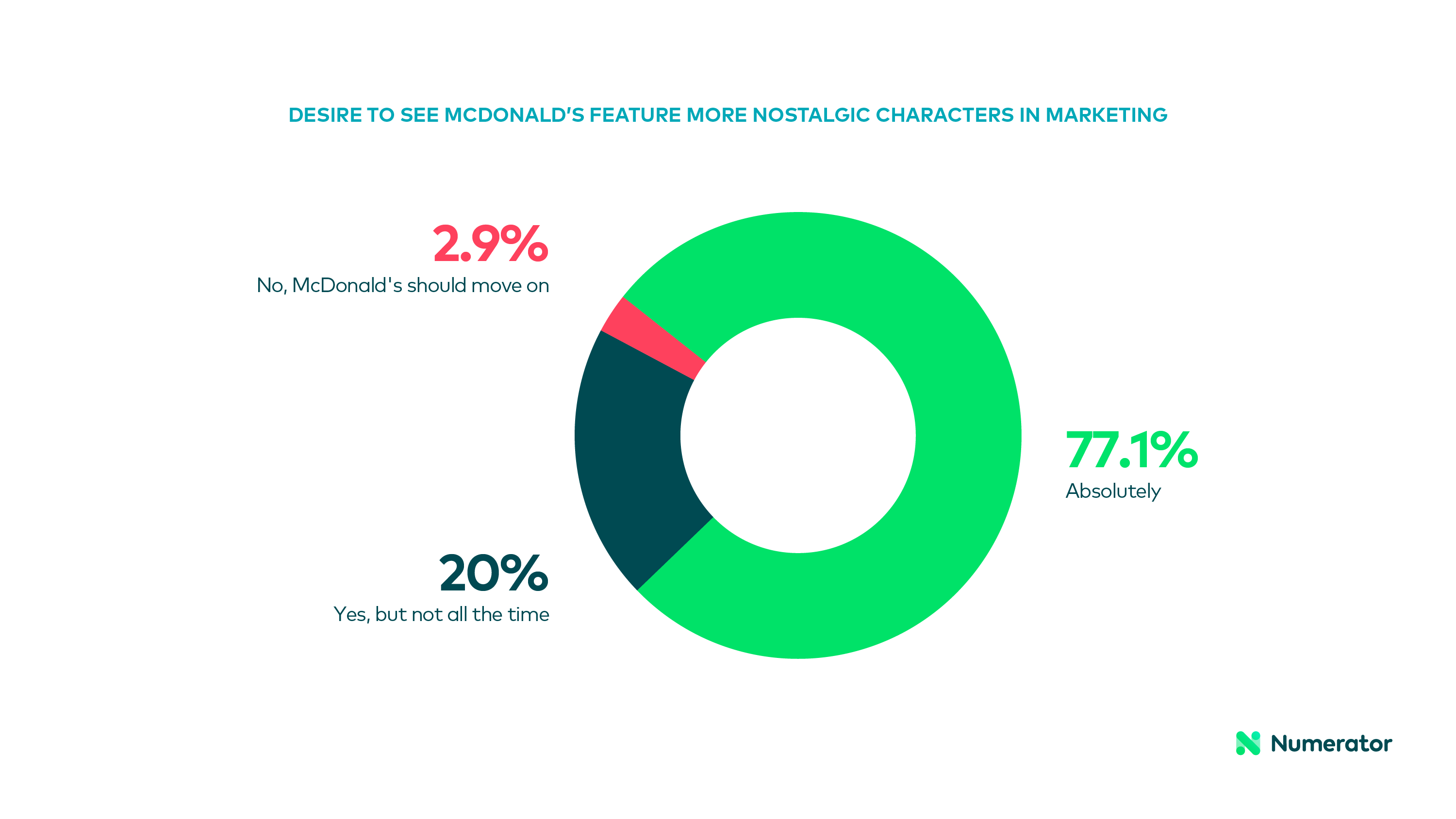

Consumer sentiment surrounding the Grimace Birthday Meal & Shake was overwhelmingly positive— 77.1% of buyers said they “absolutely” think McDonald’s should feature nostalgic characters in the future, with only 2.9% responding that McDonald’s should “move on.”

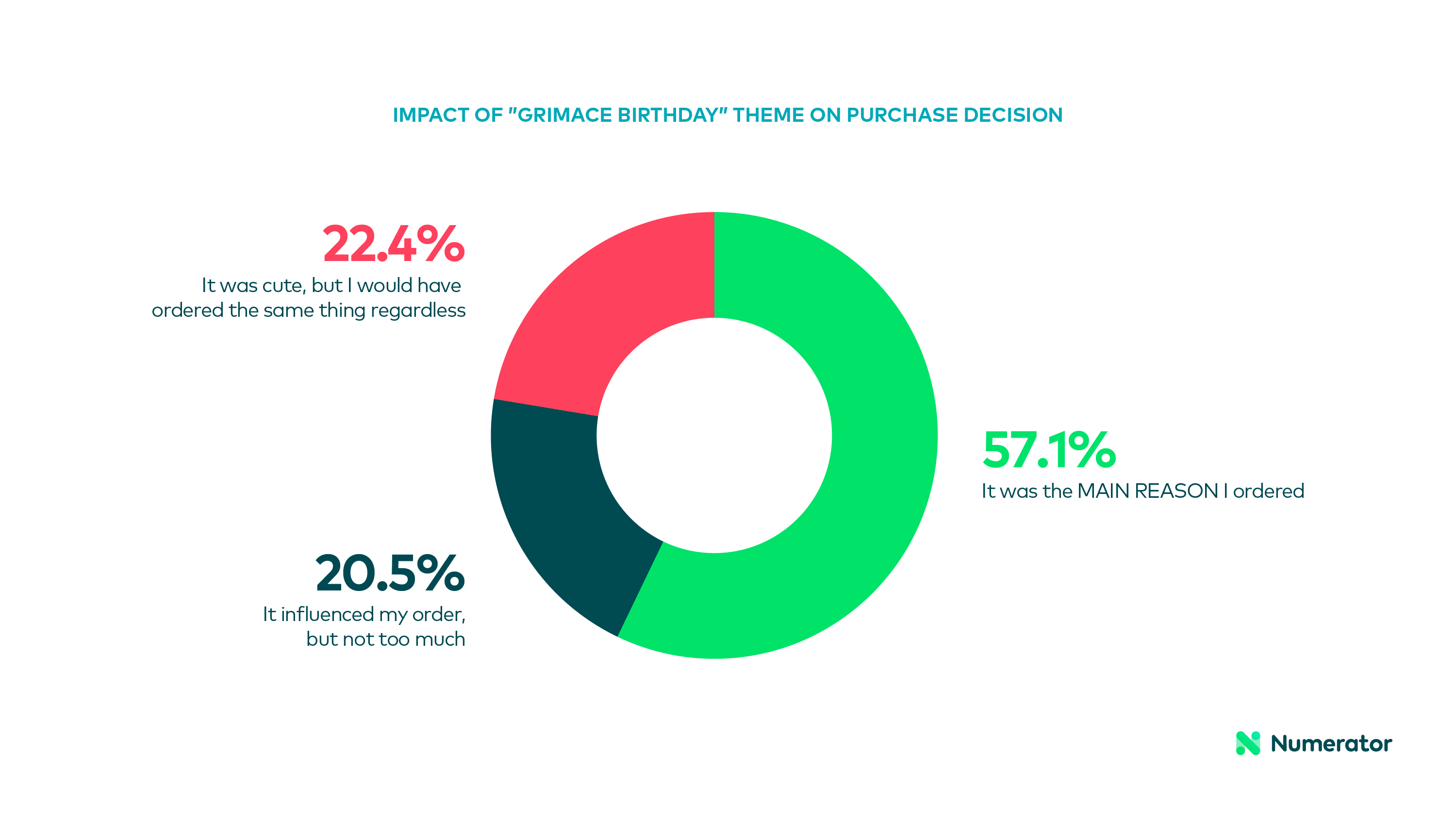

What’s more, over half (57.1%) of people said the Grimace Birthday theme was the driving force behind their purchase decision, which is unsurprising given the buzz generated on social media and in the press. Less than one in four consumers (22.4%) said they would have ordered the same thing regardless of the campaign, and another 20.5% said the campaign affected their purchase decision slightly— suggesting that the Birthday Meal itself was a hit.

Who is Grimace?

Grimace clearly holds a fond spot in the heart of consumers. An overwhelming majority of buyers (92%) said they had at least a basic understanding of who the character is. When asked “Who is Grimace?,” some buyers even had a very detailed understanding of the character and his backstory, with respondents reporting the following knowledge:

- “A berry-hued, blob-like bestie. Grimace is from Grimace Island and comes from a huge family (including his Grandma Winky, aunts Millie and Tillie and his Uncle O’Grimacey!) (Uncle O’Grimacey was once the Shamrock Shake’s mascot.)”

- “He is the big purple mascot that represents what was, in my opinion, the golden age of McDonald’s. He is a friend of the Hamburglar.”

- “Big purple blob thing that used to steal people’s milkshakes, then he became nice and was best friends with Ronald McDonald.”

The vast majority— 97.1%— of Grimace Meal & Shake buyers would like to see McDonald’s bring back retro/nostalgic characters at least some of the time, suggesting that branded items like the Grimace Meal and Shake will stay a profitable growth lever for McDonald’s.

Move Over Shamrock Shake

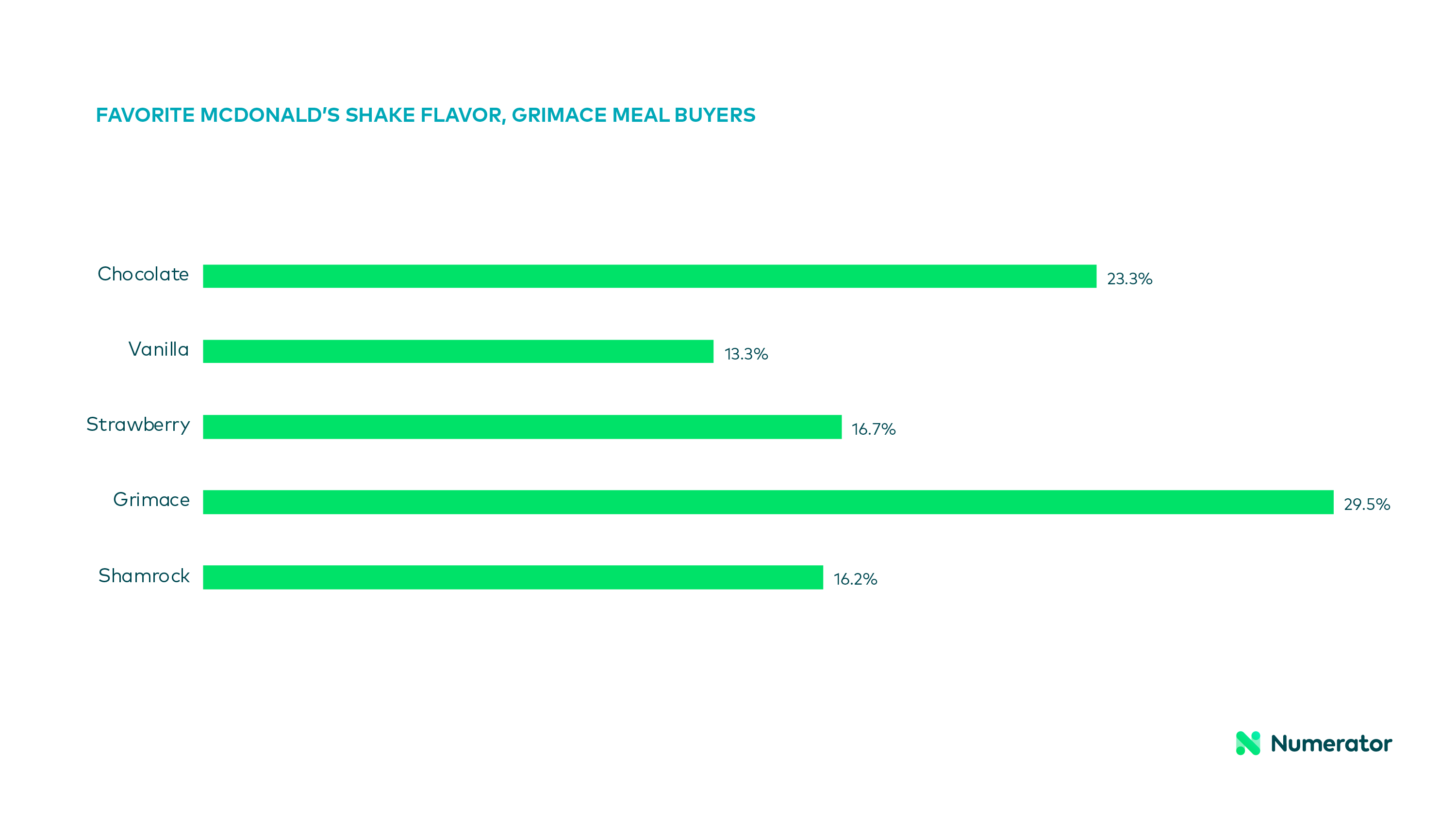

The campaign clearly resonated, and the big story was the overwhelming popularity of the Grimace Shake which outperformed all other shake flavors by at least 6.2 percentage points. Nearly one in three (29.5%) consumers called the Grimace Shake their favorite shake flavor. The closest competitor was the chocolate shake (23.3%) followed by strawberry (16.7%).

The Shamrock shake came in at a respectable fourth place, with 16.2% of the audience calling it a favorite–a strong showing considering it only makes its appearance every March. Vanilla came in fifth place with 13.3% of consumers calling it a favorite.

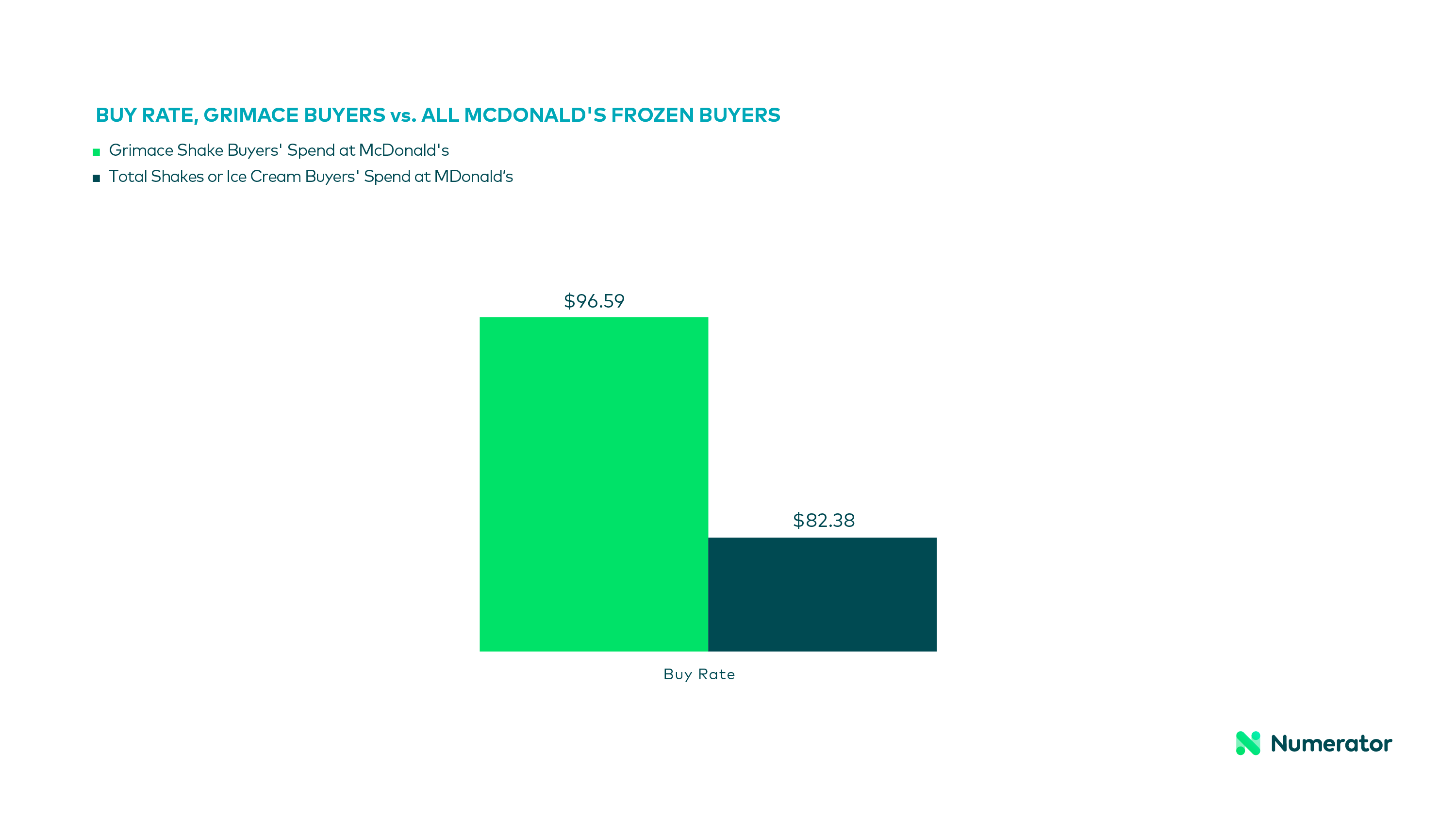

The Grimace Shake performed especially well among Millennials, who tend to be Shamrock Shake loyalists. More than 8% of Grimace Shake buyers were Gen Z households, which was 30+% higher than Gen Z buyers of other shakes and ice cream at McDonald’s. Notably, Grimace Shake buyers were a more valuable customer than the average McDonald’s ice cream and shakes buyer. On average, Grimace Shake customers spent 17% more at McDonald’s during the period the Grimace shake was in-market.

New to McDonald’s

The Grimace shake also successfully attracted new customers to McDonalds. Given how ubiquitous the McDonald’s brand is, “new to McDonald’s” is defined as consumers who hadn’t made a McDonald’s purchase in March, April, or May, but did buy once the Grimace Meal and Shake launched in June. Nearly one in four (22%) Grimace Shake buyers were new to McDonald’s as compared to the prior three-month period. Nearly 63% of Grimace Shake buyers were new to frozen desserts at McDonald’s versus the prior three-month period.

Share of Spend

The Grimace Shake also helped McDonald’s increase their share of Gen Z, Millennial, and Gen X consumers’ wallets, as all three groups increased their share of spend at McDonald’s compared to the prior year (for the 12-week period ending 7/9/23). In turn, Gen Z decreased their spend at Starbucks, KFC, Popeyes, and Shake Shack during the same period versus the prior year.

Our study found that bringing back a nostalgic character and tying it to products that resonate with consumer tastes will continue to drive success for McDonald’s. The Numerator Restaurant team is excited to see which nostalgic characters— from the Hamburgular to the Fry Kids and Birdie— may make an appearance in the future.

About Our McDonald’s Analysis

Our analysis compared the period the Grimace Birthday Meal and Shake was in market versus the prior three months to understand how the product(s) impacted consumer behavior. We also compared the in-market period and the prior three months vs. the corresponding period in 2022 to understand how the Grimace Birthday Meal drove market share shifts.

Numerator’s Restaurant solutions help restaurants identify opportunities for share growth, develop strategies with a deep understanding of omnichannel behavior, and connect to verified buyers for concept testing, in-market feedback, and insights on competitive offerings. In addition to tracking the top product launches of 2023, we maintain a library of over 100 new restaurant items launched in 2022 to enable granular analyses. Reach out today to get the insights you need to optimize your new item strategies.