Natural Products Expo West’s 44th annual conference brought over 80,000 industry leaders, retailers, and innovators to the Anaheim Convention Center from March 3-7, all eager to explore the latest in CPG. With a consumer-first mindset driving innovation and marketing strategies, the show floor was packed with brands showcasing new ways to meet evolving shopper demands.

The Numerator team identified several standout trends shaping the industry during Expo West 2025, focusing on three key themes: protein’s continued dominance in snacking, enhanced innovations in hydration, and the rapid growth of better-for-you beverages. As brands strive to capture consumer attention in an increasingly competitive market, these trends highlight the most impactful areas for growth and innovation.

Protein’s Dominance in Snacking

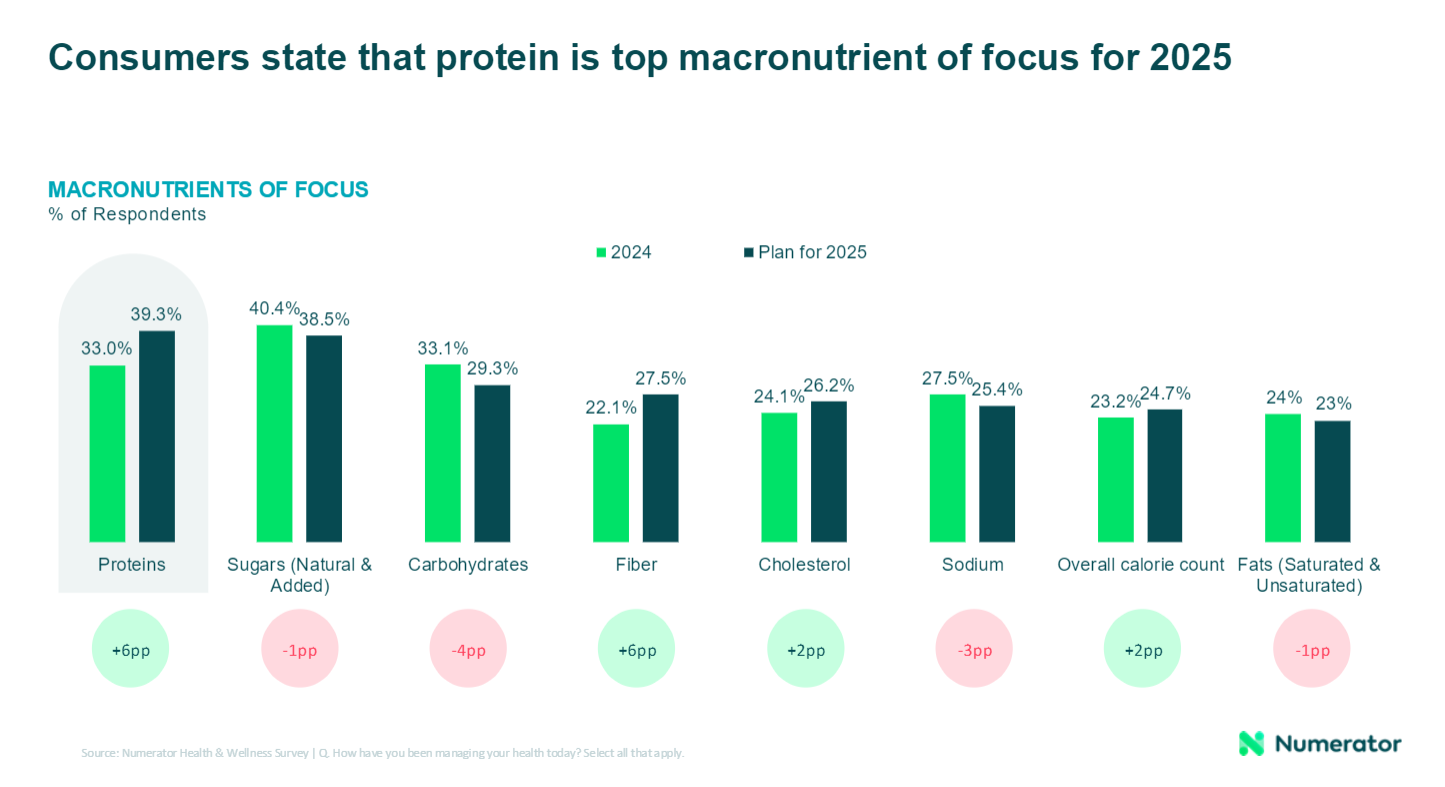

High-protein snacks maintained a commanding presence at Expo West across categories, from cookies and crackers to meat snacks. As protein remains closely linked to fitness, satiety, and overall health, high-protein snack brands are doubling down on innovation to deliver protein options that fit into consumers’ everyday lives. According to Chomps and Numerator’s presentation at Expo West, Fueling the Future: The Rise of Protein in the $126B Snacking Industry, protein-based snacking occasions could account for over a third of snacking occasions. Brands that have successfully tapped into this demand—including Quest (+85%), Skinny Dipped (+94%), Wilde Chips (+109%), and Chomps (+137%)—have seen exponential buy-rate growth from 2019-2024, proving the staying power of protein-forward innovation. As high-protein remains the most sought-after macronutrient, brands must consider how and when consumers reach for high-protein snacks and ensure they deliver the right formats, flavors, and functional benefits to keep shoppers engaged.

Hydration innovation is redefining the beverage aisle

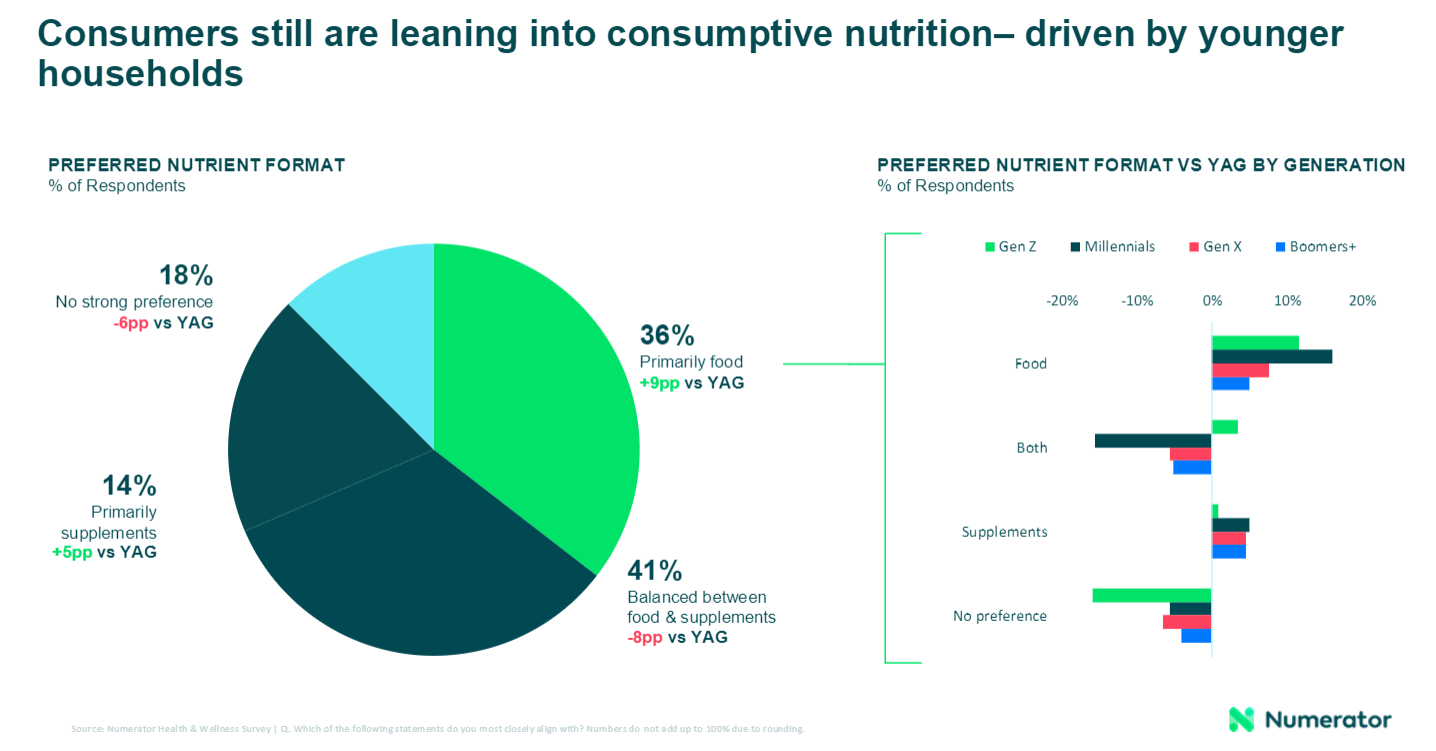

Beverage brands showcased a new wave of functional water enhancers, signaling a shift beyond basic performance messaging toward more targeted nutritional benefits. Klass introduced VIDA agua frescas, touting benefits such as hydration, energy, and immunity. Sunkist entered the space with collagen-infused water mixes, while DryWater boldly expanded into hydration multipliers, differentiating itself with real fruit and added vitamins and minerals. This surge in functional hydration drinks aligns with growing consumer demand for consumptive nutrition—particularly among younger households seeking food and beverages that provide more nutrients as mentioned in Numerator Visions ‘25. According to data from Numerator’s consumer panel, this trend is clear in the Functional Powdered Drink Mixes category: there’s been an 18.7% change in projected sales for the category vs. a year ago, and half of that growth is sourced from adjacent categories like Bottled Water, Energy Drinks, Fruit Juice, and Dry Coffee. With $80M in new-to-powdered-drinks shopper spending driving category growth, consumer demand for health-focused beverages such as hydration drinks is reshaping the market, pushing brands to deliver greater functional benefits.

The Next Wave of Better-for-You Beverages

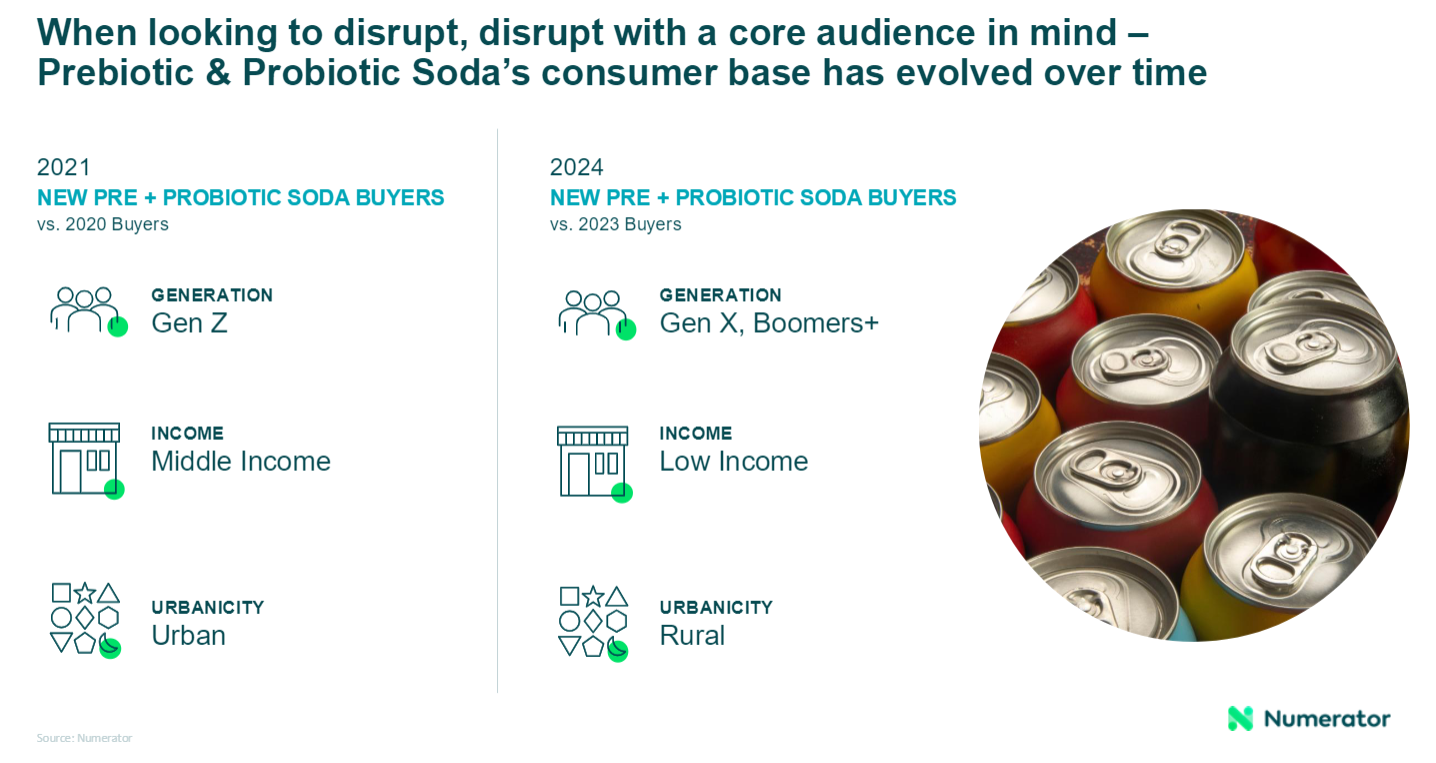

The rapid expansion of better-for-you (BFY) sodas continues to reshape the beverage industry, as brands like Poppi and Olipop have paved the way for new entrants looking to carve out their own space. As the category becomes increasingly competitive, brands are leaning into bold branding, real fruit juice, and functional benefits to stand out. Slice revived a retro soda feel with a health-forward twist, while Culture Pop promoted real fruit juice, delivering “flavor as real as its ingredients.” However, the driving force behind BFY beverages isn’t just flavor—it’s function. Consumer interest in gut health is surging, with 24% of consumers now citing digestion as a key factor in their overall well-being. Prebiotic and probiotic sodas have seen a +11pp increase in household penetration, far outpacing traditional probiotic supplements, which grew just +0.6pp YoY. Kombucha (+1.8pp) and fermented foods like kimchi (+1.3pp) are also benefiting from the rising demand. Beyond the products, the consumer base for prebiotic and probiotic sodas is expanding. Once primarily purchased by Gen Z, middle-income, and urban consumers, these beverages are now seeing increased adoption among Gen X, Boomers+, low-income, and rural shoppers—creating new opportunities for brands to reach previously untapped demographics and drive further category growth.

Expo West 2025 proved once again to be a powerhouse for networking, industry insights, and brand innovation. The trends on display reinforce shifting consumer expectations and the strategies brands are implementing to meet them head-on. For brands looking to capitalize on these shifts, understanding consumer behavior and anticipating category evolution will be critical to staying ahead. If you’re interested in exploring how these trends impact your brand specifically, reach out to our team today to learn more.