The economic repercussions of the COVID-19 crisis are still unfolding. Consumers are understandably concerned about their financial futures. Though the latest job numbers offer a glimmer of hope for some industries, the experts agree: the country is in a recession, and we’re not out of the woods yet. Facing increased economic pressure, a greater number of consumers on tight budgets will likely find their decision-making and purchasing behavior impacted going forward.

In addition to the current economic impact, consumers are worried about a second wave of the virus and the extent to which that could further impact the economy. With all these concerns in mind, Numerator has taken a look at the trends we’ve seen over the past few months, and predictions as to what we may see in the future, to help retailers and brands plan for upcoming consumer behavior and spending patterns.

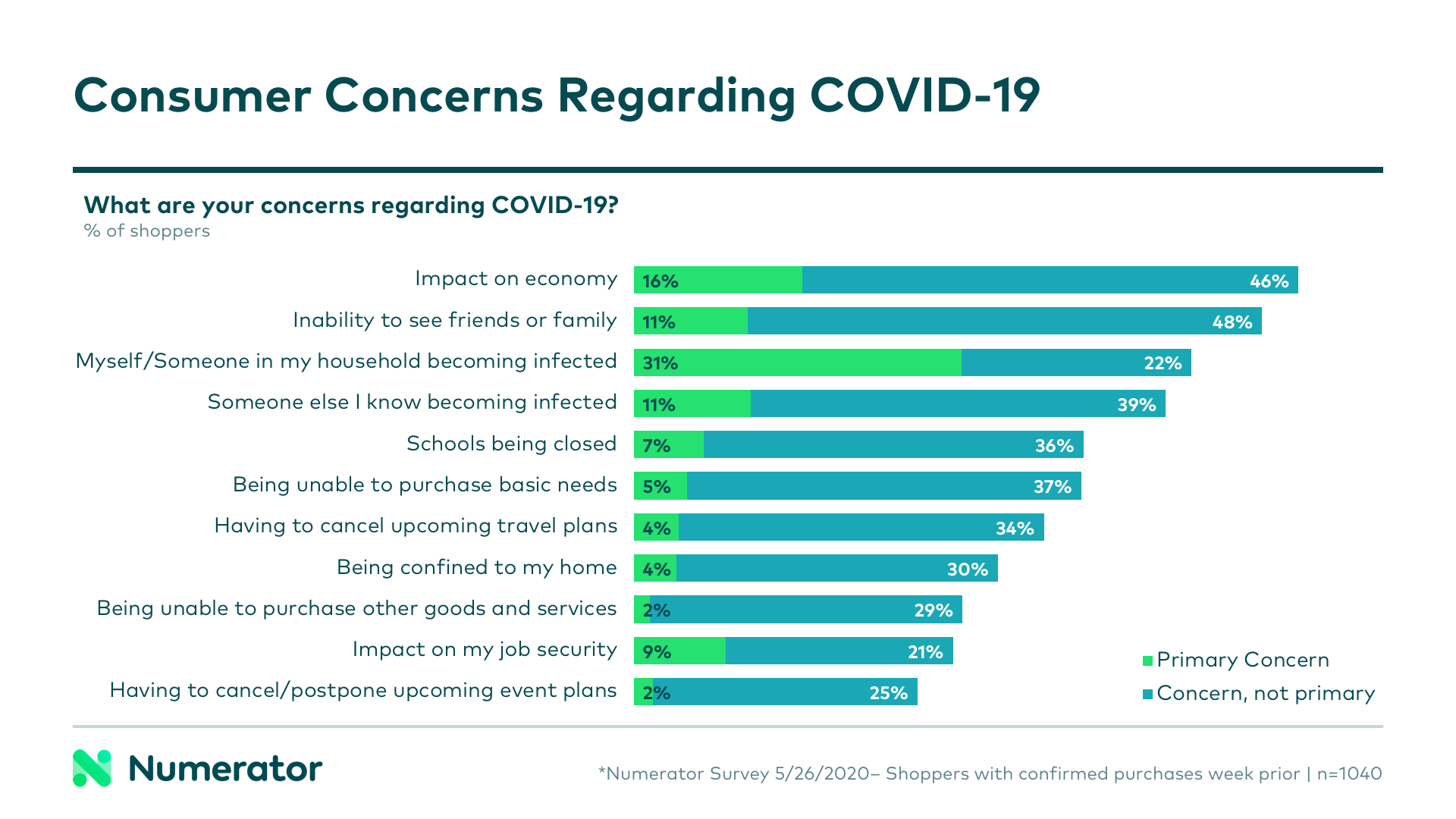

Economy is a Top Consumer Concern

Though shoppers miss in-person social interactions with friends and family and worry about contracting the Coronavirus, 62% of those surveyed listed the economic fallout from the COVID-19 crisis as one of their biggest concerns. This is for good reason, as over 44 million unemployment claims have been filed since mid-march. Low income and other vulnerable groups are particularly concerned about whether they’ll receive financial assistance, and the concern is spreading into middle and upper income brackets as well.

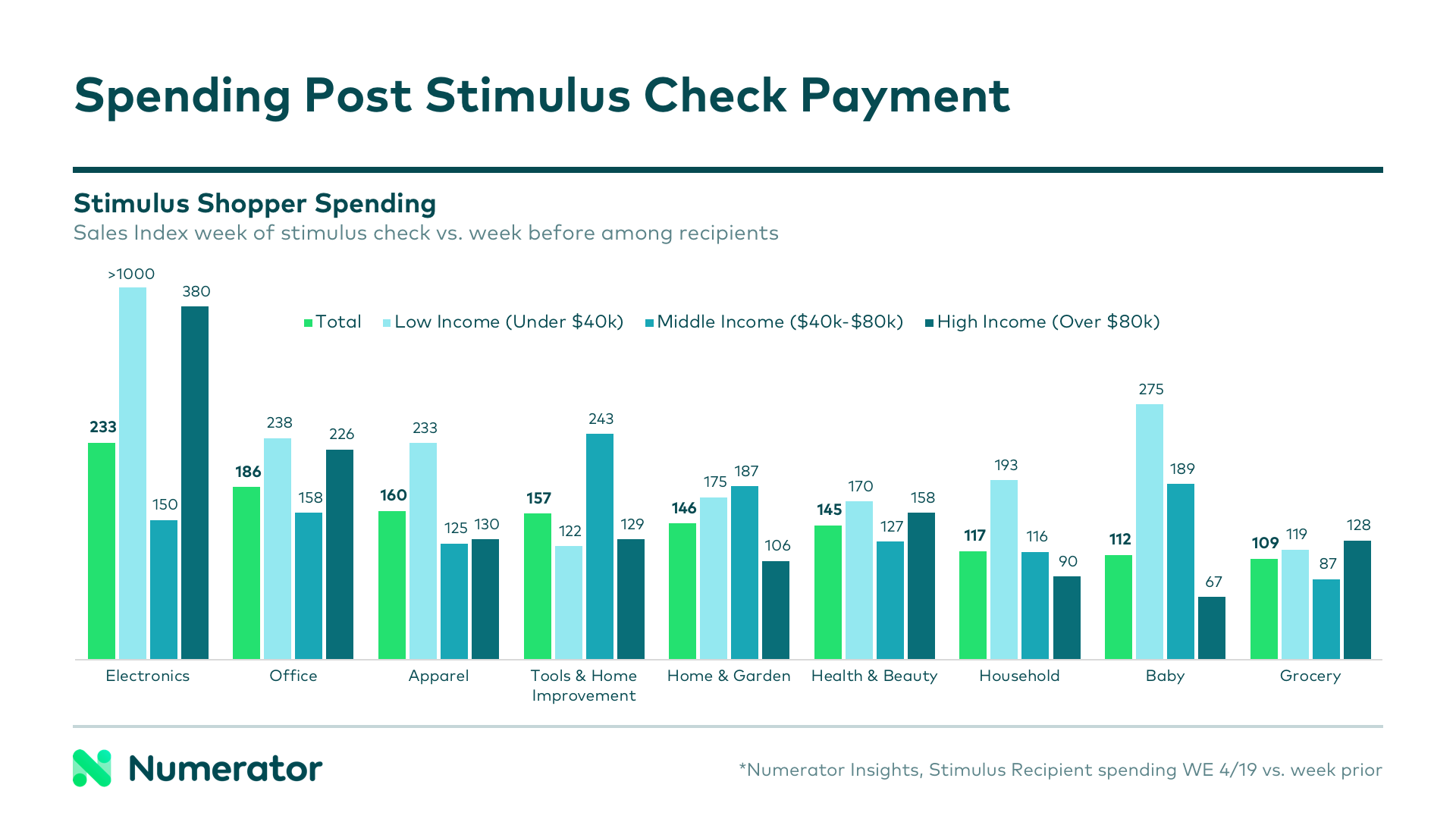

Stimulus Checks Boost Non-Essentials Spending

Prior to the initial stimulus payout, most consumers expecting a stimulus check from the federal government said they planned to use the funds to pay bills, bolster their savings, or purchase essentials. But once the first wave of checks went out, we saw non-essential items capture a surprising share of spending, though this varied among income levels.

Electronics and office supplies saw a surge, possibly due to people improving their home environment in preparation of sheltering and working from home. There was also a boost in baby items, particularly among low income consumers, indicating a desire to stock up on family supplies since they had the funds to do so.

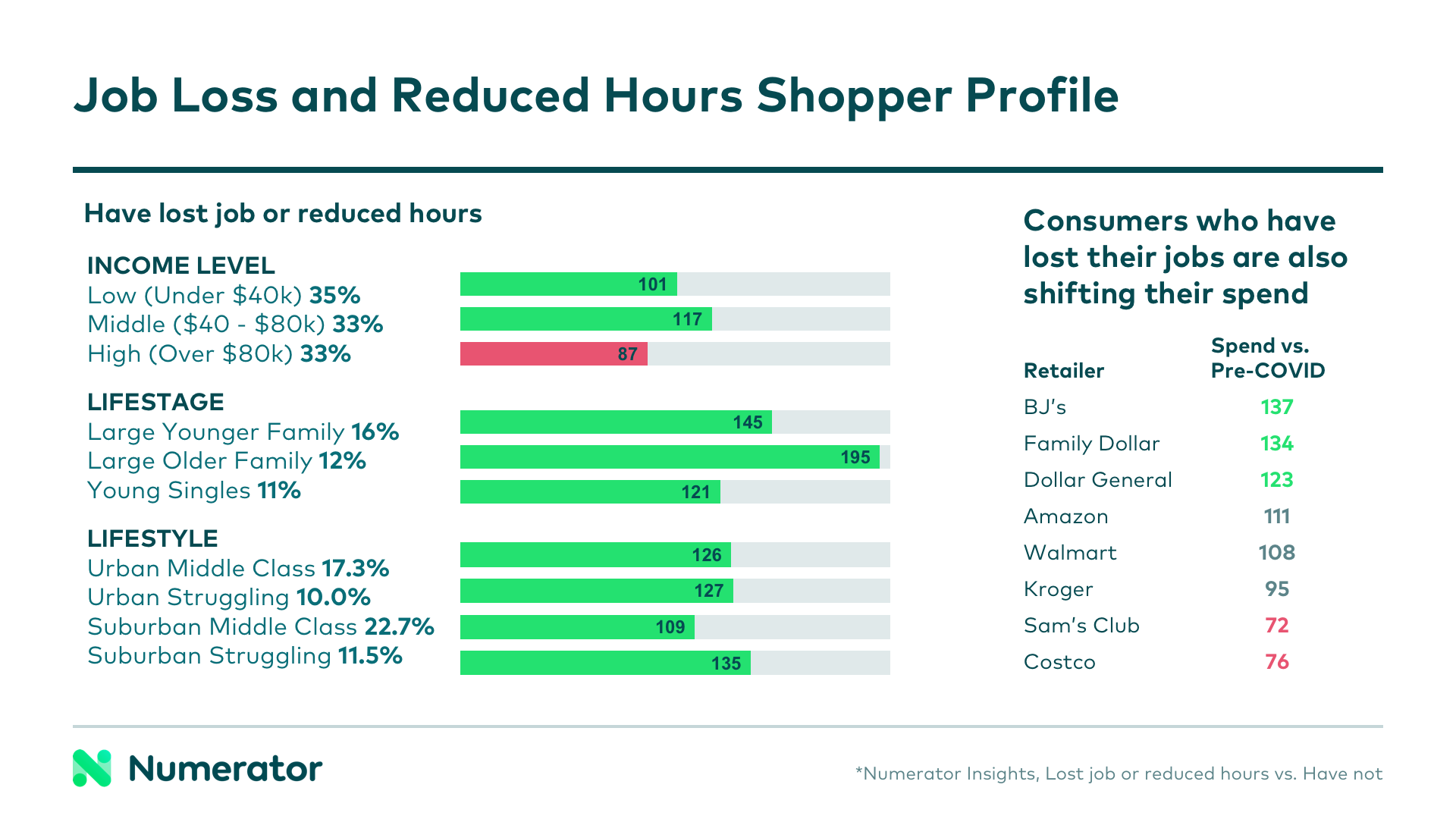

Budget-Driven Retailers Gain Over Quality-Driven Stores

While we anticipated the first wave of shoppers financially impacted by the crisis would be lower income, we’re now finding middle income consumers have also been affected, a trend that will only continue as larger corporations and professional services are forced to furlough or layoff employees. These shoppers have already begun to shift their spending to budget-friendly retailers and dollar stores.

This means quality-driven stores featuring natural, organic, and premium products are likely to lose consumers who are tightening their pocketbooks. This is typical behavior during a recession. Manufacturers invested in premium chains may want to consider adjusting their marketing in order to reach and appeal to consumers during this time, while retailers focused on premium assortments should prepare to offer more budget-friendly options in order to retain their shoppers.

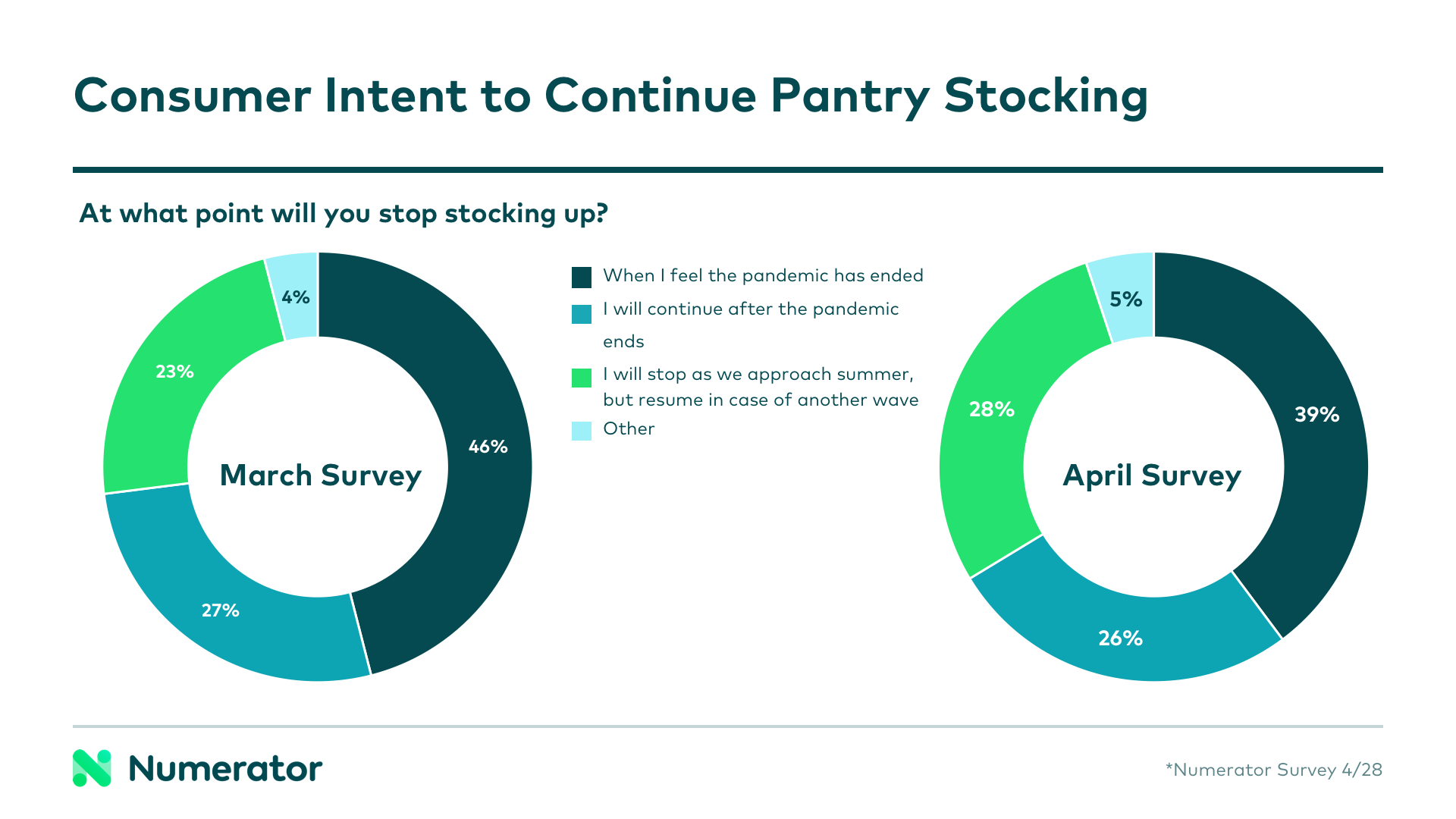

Consumers Will Continue Stocking Up

As anxiety over a second wave of COVID-19 infections increases, pantry stocking remains critical to consumers. Over 50% of shoppers surveyed said they intend to continue stocking up even after the pandemic ends or in preparation of another wave. We’re starting to see a gradual rise in stockpiling, as this behavior has become more normal, and we expect a potential second wave to be driven more by individuals already affected by the recession.

Looking Ahead

We’re in a time of unprecedented change. Anticipating the nature and needs of the post-COVID consumer allows brands and retailers to adapt more easily as circumstances evolve. Continued economic fluctuations among consumers are likely, and empathy will be key. For more information on this topic, download our latest research on Anticipating the Post-COVID Consumer.

Numerator is here to help you navigate this changing tide of consumer behavior and spending as the country moves forward through this crisis. Our Dynamic Recession Segmentation is another offering we’re providing during these times to help you understand consumer behavior changes as household finances and outlook is impacted by job loss and recession. For more information on how your brand or retailer can best succeed in light of COVID-19 and the recession, please contact your Numerator Customer Success Consultants or get in touch with us.