With another 365 days in the books, consumers are now shifting their sights towards new habits and, as a consequence, new shopping behaviors. A variety of categories traditionally see high levels of fluctuation at the turn of the year and, with seasonal health trends like Dry January taking hold, alcoholic beverages are no exception.

Insights from Numerator’s OmniPanel show uniform declines in alcoholic beverage sales at the start of the past 2 years. Just over 1 in 10 households did not make a purchase in the category in January 2021, but did purchase 6 or more times throughout the remainder of the year. To discover why, Numerator fielded a survey of these shoppers and found that 19.6% of them had participated in Dry January in the past, and 22.4% plan to participate again in 2022. With participation on the rise, it is increasingly important to understand what motivates these consumers and what’s to come for alcohol and adjacent categories.

New Year, High Proof, Low Sales

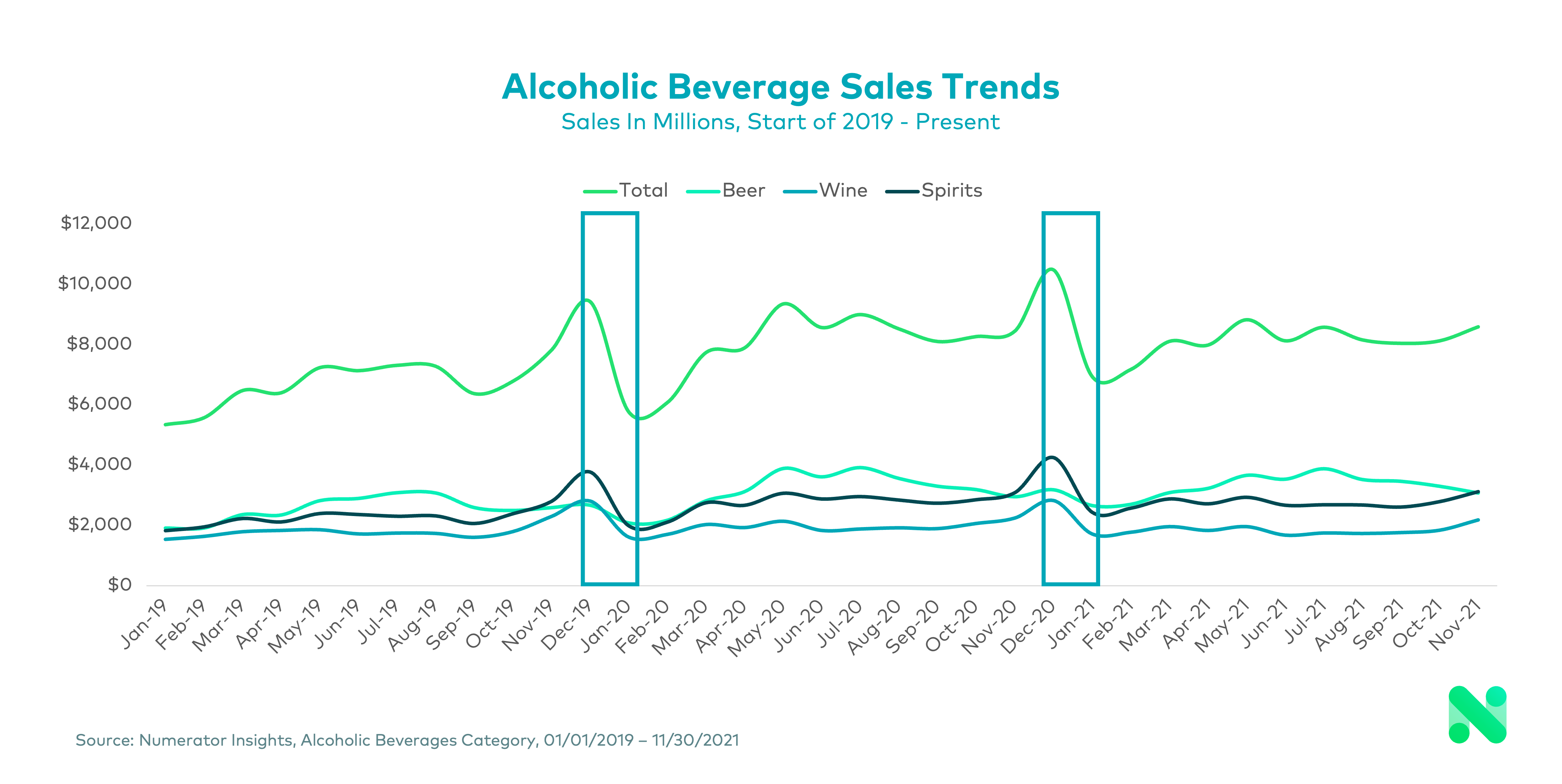

Consumers have shown that they are more than willing to keep alcohol shelves stocked after rushing to clear them during the holiday season. January 2020 sales were 18.4% lower than the average of the prior 11 months, and January 2021 followed suit, with sales 17.4% below the previous year’s average. Fewer shoppers visited their local alcohol aisle– household penetration dropped 5 percentage points in January 2020 and 4.1 points in January 2021 compared to the average– and those that still did spent less. Intentional or not, the shoppers who drove those declines adopted Dry January shopping behaviors.

Why January?

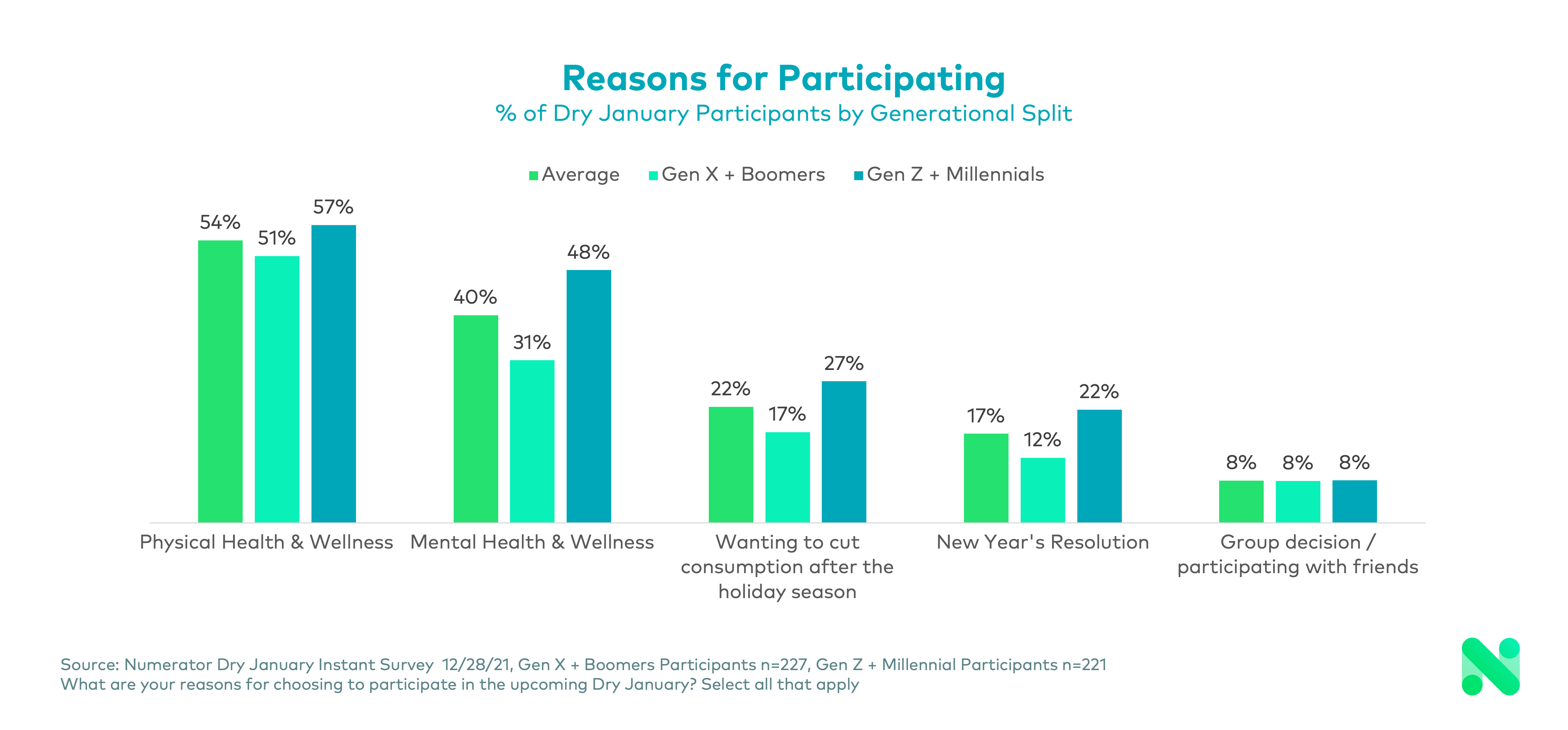

There’s even more to top off the glass when it comes to those who actively and knowingly participated.The growing popularity of the trend (+3 percentage point participation vs. past years) is evident in all generations 21-and-over, but Dry January remains slightly more popular amongst younger shoppers. A quarter of Gen Z and Millennial consumers are signing on compared to 1 in 5 Gen X and Boomer shoppers. Despite this slight split in number of participants, the motivations to participate in this trend are similar across generations. Physical & mental wellness are the primary drivers of participation for all ages– with mental health taking more of a precedent for younger shoppers especially. Overall, almost 2 in 3 of those surveyed are using Dry January as an opportunity to live a more holistic, health focused lifestyle– and their grocery baskets will shift to help meet that goal.

Sipping on Something Nu

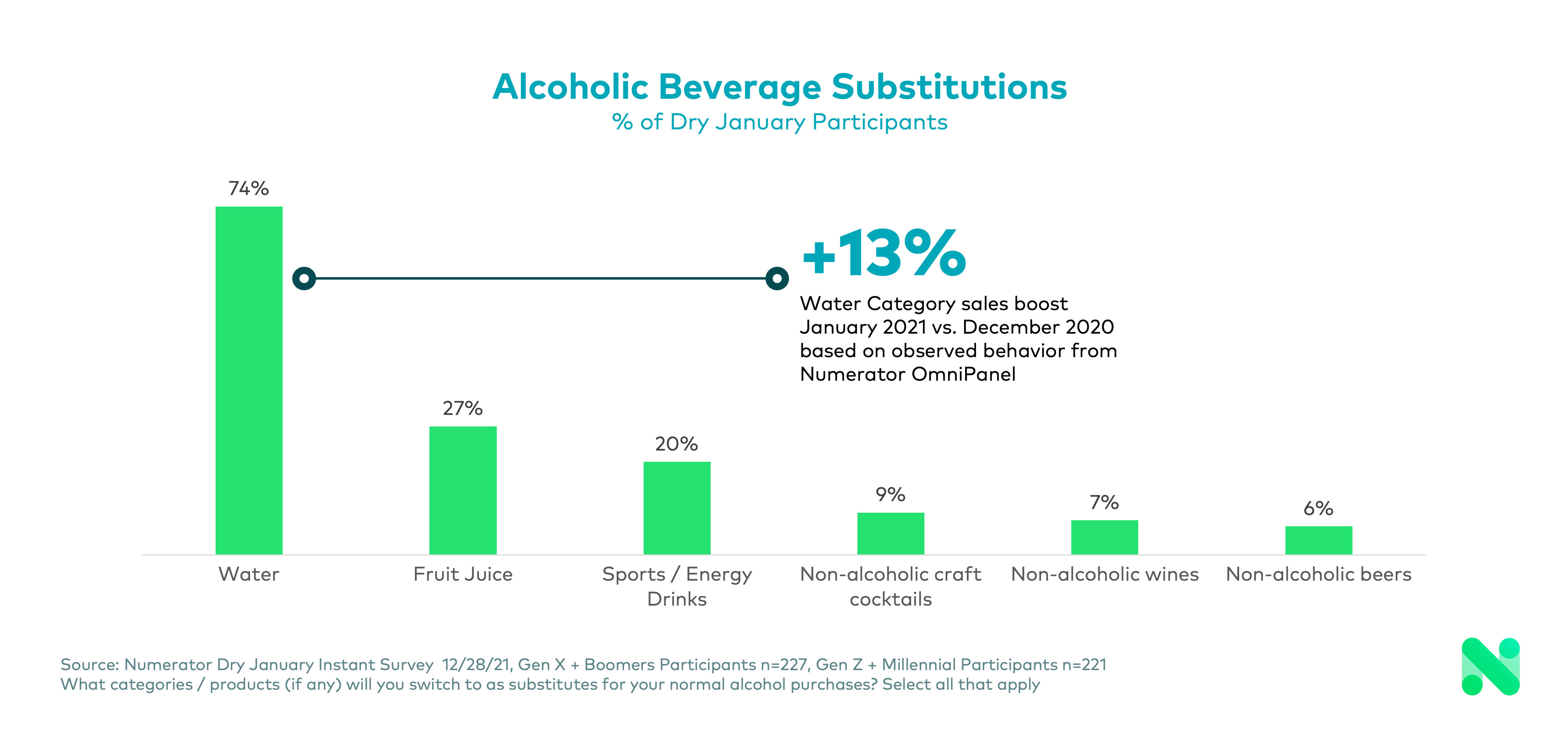

Contrary to its name, Dry January doesn’t mean participants are planning to be less hydrated– less alcohol means more water, juice, and non-alcoholic alternatives. Water and non-alcoholic beer have become January staples, with observed sales growth in the past year to match expected participant substitutions. On the opposite end of the spectrum, a third of participants are looking to cut soda and salty snacks, complementing that holistic health goal.

These shifts may grow to have more staying power than in years past, as a majority of those surveyed (55%) plan to extend their sobriety past the end of January and over 1 in 4 will practice more moderation (23%). Additionally, this planned teetotalism expands beyond in-home consumption, with roughly 1 in 4 saying they plan to frequent fewer bars (21.5%) and social events involving alcohol (18.6%).

Non-alcoholic wine could have a unique opportunity as a result of this extended sobriety. This category hasn’t seen the same sales growth as other alternatives in January, but has seen tremendous category growth in the past year, plus a sales spike in February of 2021 that stretched into the summer months. While experiencing similar seasonality to alcohol, the growth of the category could cement itself as a potential long-term option for those looking to maintain sobriety moving forward.

Putting a Cork in Dry January

Dry January is a growing trend that spans all generations. As alcohol consumption begins to dip at the start of yet another year, consumers are expected to shift focus to their health and find viable low-proof substitutions for their alcohol purchases. With many participants expecting to maintain these changes past January, alcohol and it’s adjacent categories could be affected past the first four weeks of the year. For more insights on how this trend can impact your brand or category performance, get in touch with us today.