Since its debut in 1932, LEGO has built a legacy that captures the hearts of consumers and the envy of competitors. Not only is LEGO the highest-selling toy brand in America, it is also the only major toy brand to have experienced growth this past year. While sales in the toy category as a whole stagnated this past year, LEGO continued to deliver another consistent year of growth. How are they doing it, and what can other toy brands learn from their success?

Foundational Figures

How is the LEGO brand performing?

One in four U.S. households purchased LEGO products in the past year, more than any other individual toy brand including Hot Wheels (21%), Squishmallows (18%), Barbie (15%) or Fisher-Price (12%). LEGO holds an 11.3% share of toy market sales, which is three times higher than its closest competitors. The LEGO brand also grew share by 1.7 points between 2023 and 2024, increasing sales by 5.2% while many of their competitors saw double-digit declines.

Although they primarily operate within the building toys category, LEGO products can be built into vehicles, action figures, artwork, decor and more, putting them in direct competition with many other traditional toy, puzzle and craft categories. LEGO’s breadth of offerings and willingness to shift into new ventures is one way they stave off stagnation in an ever-evolving market.

Blueprints for Best Sellers

What are the top LEGO products?

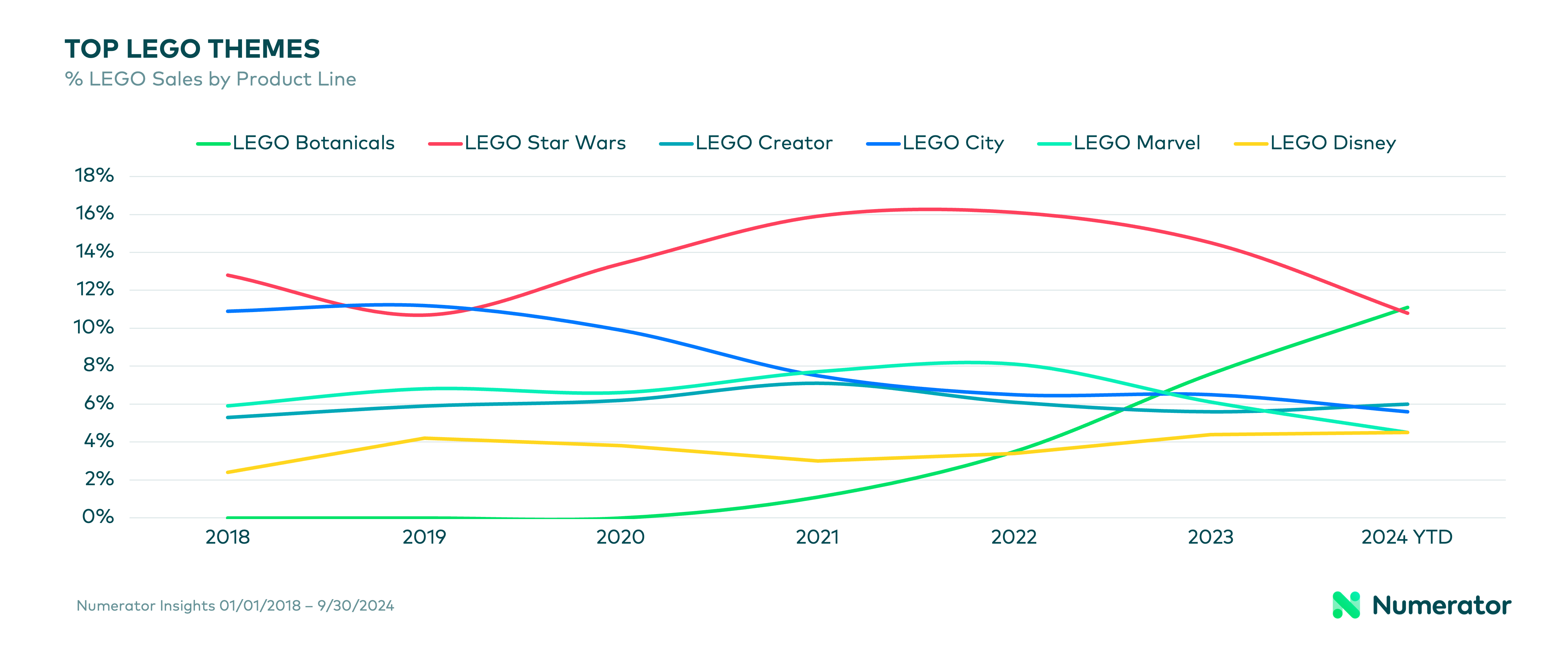

The LEGO brand may be over 90 years old, but they’ve managed to keep their assortment tailored to the times through various co-branding opportunities and ongoing innovations. While they continue to capitalize on their classic LEGO brick sets, take a peek into their toybox and you’ll find dozens of other themed sets that stretch their appeal to new audiences. From licensing agreements with hit movie franchises like Star Wars and Marvel to the faux fresh LEGO Botanicals line or the imaginative LEGO Creator sets, the diversity in LEGO’s offerings keeps them relevant among consumers with widely varied interests.

Looking at the popularity of certain product lines over time also gives insight into LEGO’s growth drivers. LEGO Botanicals has seen the most dramatic growth in the past few years, surpassing LEGO Star Wars as the best-selling LEGO themed sets in 2024 to-date. Other themed sets that have grown significantly in the past few years include LEGO’s Speed Champions, Technic, Ideas, Minecraft, and Harry Potter product lines, proving that both novel and recognizable named brands have the potential to succeed. LEGO’s mix of well-established product lines also helps maintain the bottom line while new innovations find their footing.

Cornerstone Customers

Who’s buying LEGOs?

The average LEGO buyer is a parent buying the products for their child—more specifically, these shoppers tend to be high-income, white Millennial women with children under the age of 12. Although this type of buyer is core to LEGO’s success, many of the brand’s newer innovations aim to expand their audience, and seem to be doing so successfully. LEGO’s household penetration grew 2.6% in the past year, an impressive feat for a brand that already had the highest penetration in the category. Compared to existing buyers, the brand’s new buyers are older, less likely to have children in the house, and more likely to be Black.

While much of the growth among older shoppers is likely driven by new grandparents, unique product lines also offer their own growth opportunities. For example, the blossoming LEGO Botanicals line attracts buyers who are younger, overindexing with Gen Z’ers and households with teens. The Botanicals line is one of LEGO’s many offerings for the 18+ crowd. This “Kidult” toy market is also extremely profitable, as non-parent adults who purchase toys for their own use or collection spend three times more than the average toy shopper.

Retail Reinforcements

What are the top LEGO retailers?

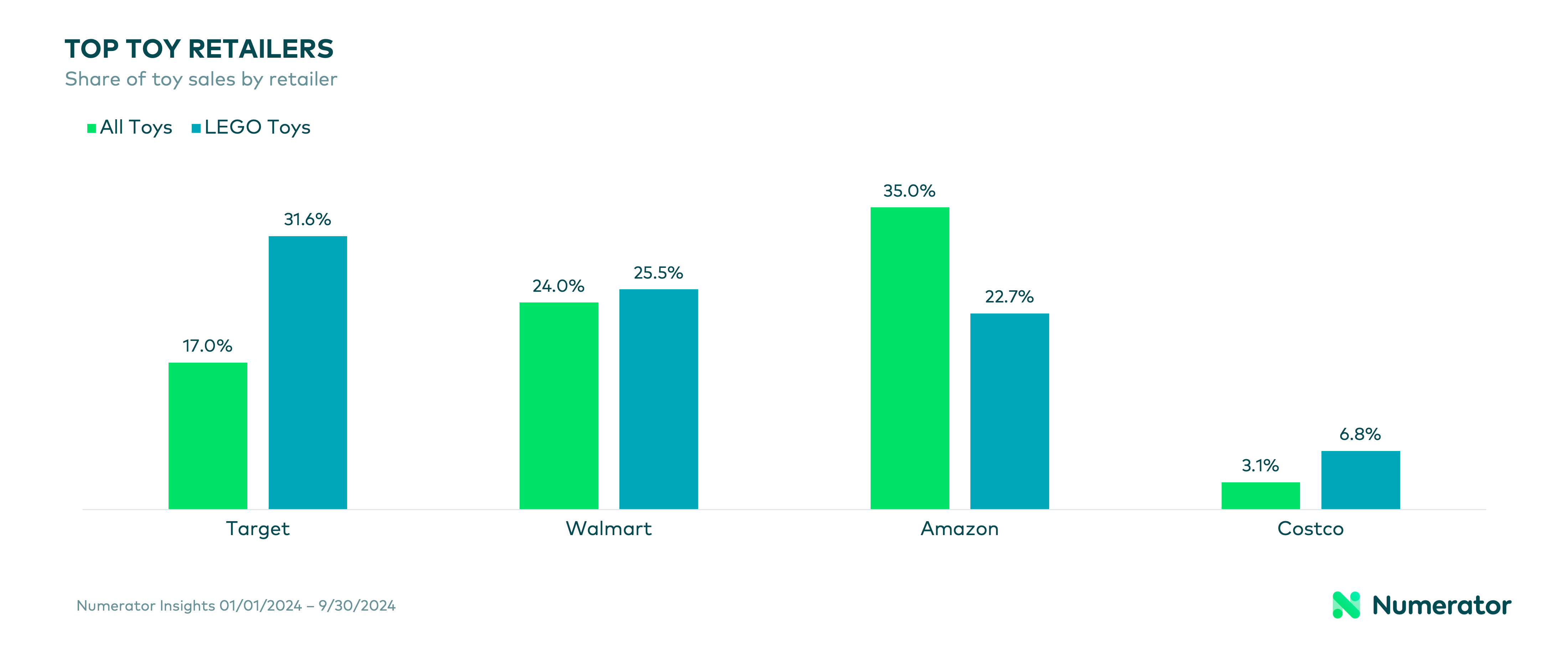

Reaching shoppers is the final brick in a successful toy brand’s path to playtime. Although Amazon is the top toy retailer overall with a 35% share of category sales, Target is the leading seller of LEGO toys specifically. Target’s share of LEGO sales (32%) is more than double their share of the total toy market (17%). Though LEGO has grown sales across all major retailers in recent years, growth at Target has outpaced the brand’s overall increases by at least 1.4x.

Target’s LEGO dominance began in 2020 when it overtook Walmart as the top seller of the brand. Since then, LEGO and Target have collaborated on a number of exclusive partnerships including their 2021 Lego x Target collection and their ongoing Replay initiative to donate used bricks for reuse. Target also has a dedicated LEGO page on their website with a unique user interface and navigation, something they don’t have for other toy brands. Strong retail partnerships like that between LEGO and Target are another key pillar of success for toy brands looking to replicate LEGO’s growth.

Cementing Success

LEGO may be a model in the industry, but their blueprints for success won’t work for every toy brand. Whether you’re an established brand looking to reinforce your foundation, a mid-sized brand ready to expand, or an emerging brand still laying the groundwork, our team can provide you with the insights necessary to build out your business. For more information on how our consumer insights, market measurement and shopper survey capabilities can help your brand succeed, reach out to our team.