NUMERATOR SUSTAINABILITY RESEARCH

Making Sustainability Matter

Sustainability has become a near-universal movement among consumers, with 95% claiming at least some level of commitment to a sustainable lifestyle. As a result, there is growing expectation for the businesses they shop to support, and even lead the charge towards, green initiatives. But for many reasons, gaps exist in how consumers purchase sustainably—so as brands and retailers work to meet their demands, how can they close those gaps and make sustainability sustainable for consumers?

Sustainability for All: What do consumers really think about sustainability?

Sustainability is a universal concern as nearly all American households contribute to sustainability initiatives & practices, but they also look to brands to help them meet their goals of a more sustainable future.

95%

of Americans feel some level of commitment to living a sustainable lifestyle.

Over 9 in 10

Americans engage in some sort of recycling, energy & water conservation practices.

91%

of Americans find it at least somewhat important for brands to become more sustainable.

Sustainability Deep Dives

What sustainable practices are consumers doing?

Numerator research suggests that most American consumers are engaging in sustainability practices such as recycling, energy conservation, and water management. However, there are areas where whitespace exists, such as sustainable purchasing decisions for food, durable goods, and transportation.

In terms of recycling, consumers are aware of single-use plastics and taking steps to reduce their use (52%), yet minimal packaging remains an opportunity (36%). Brands can address this gap by introducing packaging innovations that reduce waste and educating consumers on the benefits of minimal packaging, which could also reduce costs over time and improve profitability.

Energy conservation is widely practiced, with many households adopting energy-efficient appliances (65%) and LED lights (71%), as well as regulating home temperatures. Brands operating in this space should continue to highlight their products’ efficiency and convenience. Given the current economic environment, it is also important to monitor how changing interest rates and housing prices may impact consumer demand for home upgrades.

Water conservation is another common practice. Consumers are mindful of their water usage during daily tasks like limiting their bathing time (51%) and laundry (49%). For companies in home and personal care, this trend may lead to longer product lifecycles. As a result, brands must explore ways to remain relevant through premiumization or encouraging new occasions.

Sustainable food consumption, however, lags behind. Consumers are less willing to reduce meat (28%) and dairy intake (21%), and few prioritize eco-certifications when making purchasing decisions (23%). Only USDA Organic is widely recognized, highlighting the need for increased consumer education on sustainability certifications to close this awareness gap.

Transportation remains a challenge, particularly with rural households and even among urban consumers. Despite this, many consumers feel their individual actions can impact the environment and expect brands to lead in offering sustainable solutions.

While there is strong engagement in some sustainability practices, the path towards a more carbon neutral as the climate changes remain open with opportunities. Brands that can effectively educate and offer convenient, sustainable choices will be well-positioned to drive both consumer adoption and environmental impact.

Why do some consumers decide not purchase sustainably?

The primary barrier preventing consumers from purchasing sustainably is higher costs – over two-thirds (67%) of consumers find price to be a barrier in purchasing sustainably. While lowering prices is a long-term goal, it is not immediately feasible due to rising material costs and inflationary pressures. Instead, the focus for brands must be on demonstrating the value of sustainability in their products.

To do so, brands must focus on communicating the benefits of sustainable choices and offering solutions that appeal to different consumer groups. Numerator’s four sustainability consumer groups are identified through utilization of real-time sentiment and purchasing behaviors to inform targeted strategies for driving sustainable consumption.

Which categories do consumers care about in terms of sustainability?

When looking at which consumer product categories are considered important for sustainability, there’s a broad range across both consumables and durables. Unsurprisingly, paper products (59%) top the list, followed closely by household cleaning supplies (57%) and food and beverages (55%) rounding out the top three. It’s notable that food and beverages rank so high, yet the practices tied to sustainability in this category are less emphasized, indicating a gap that can be addressed.

Most other categories fall in the middle of the spectrum, with children-specific products like baby items (39%) and toys (35%) ranking lower in importance. However, even for these lower-ranked categories, very few consumers view sustainability as unimportant. In fact, across all categories, fewer than 21% of respondents place sustainability in the bottom two levels of importance, showing that overall, more people see sustainability as important than not.

Four Sustainability Consumer Groups

Numerator categorized consumers into four groups based on verfied purchases and continuously tracked surveys among 100,000 households to discover how brands can align with the consumer’s need. Read below to learn who these consumers are and what actions are to be taken with each group.

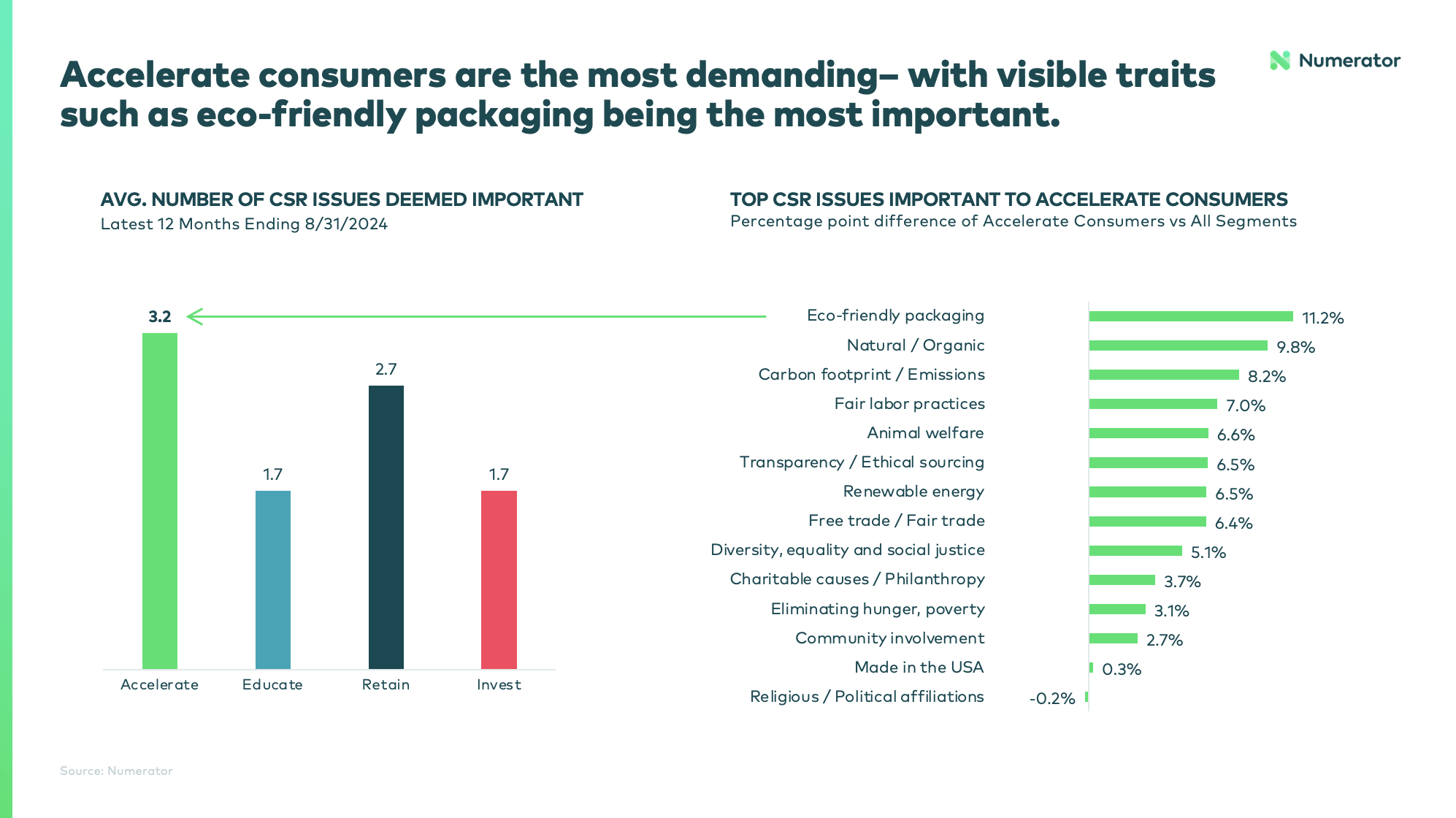

The Accelerate Consumer: Able and demanding more.

This high-income, urban, predominantly Asian group is found primarily in regions like the Mid-Atlantic, New England, and the Pacific. Sustainability is central to their purchasing decisions. They shop at premium retailers like Whole Foods, Trader Joe’s, and Costco, seeking out eco-friendly and socially responsible products. Common purchases include organic produce, cage-free eggs, and other categories like protein powders and red wine. Inflation has had little impact on their spending, as they prioritize high-quality, sustainable goods. This group values transparency and environmental responsibility in the products they choose.

Invested and expecting of brands to achieve ESG goals.

The Accelerate group places the highest demands on brands regarding sustainability and ESG-related activities. They expect brands to meet fundamental sustainability standards, such as using eco-friendly packaging, offering natural and organic products, and reducing carbon emissions. Additionally, they prioritize ethical concerns like fair labor practices and animal welfare.

This group tends to align their purchasing with these values, demonstrating a strong preference for products that uphold these principles across all aspects of production and sourcing. Their expectations reflect a commitment to environmental responsibility and social equity.

The Retain Consumer: On trend yet unaware.

This group consists mainly of higher-income, urban-dwelling Gen Z and Millennial families, primarily Hispanic. They are trend-driven and inclined toward brands with a progressive or forward-looking image. Though they shop at sustainable retailers like Trader Joe’s, Whole Foods, and Costco, their awareness of corporate social responsibility and sustainability is relatively low. They often purchase culturally relevant brands like El Mexicano and Nongshim. Despite their lack of strong sustainability awareness, their shopping habits suggest an openness to brands with family-oriented or culturally resonant offerings.

Driving growth through awareness of ESG disclosures.

A recent study conducted by the University of Chicago Booth and NYU Stern, utilizing Numerator’s Test Panel, explored the effect of ESG disclosures on consumer purchasing behavior. The research revealed two key insights particularly relevant to the Educate group—who underindex in their awareness of CSR practices.

First, the exposure to ESG information generated a notable increase in purchase intent compared to other types of data, such as financial reports. This suggests that when consumers are made aware of a brand’s ESG efforts, they tend to associate the brand more favorably, which positively influences their buying decisions.

However, the study also found that this effect diminishes after approximately two weeks, as many consumers tend to forget the initial information. This indicates the need for ongoing communication about ESG initiatives to sustain consumer awareness and purchasing intent. Regular reinforcement through marketing materials, product packaging or other communication channels is necessary to keep the brand’s sustainability efforts in consumers’ minds.

The Educate Consumer: Interested but conflicted.

The Educate consumer group, while caring about the environment, tends to lag in translating that concern into sustainable purchasing behaviors. This group is predominantly made up of older consumers, often located in suburban areas across the central U.S., with an overindex on being Hispanic males. Unlike the Invest group, which leans more toward highly processed foods, Educate consumers prioritize “better-for-you” options, such as salad kits, soups, and frozen vegetables. They also purchase health-conscious brands like V8 and Lean Cuisine, driven by their focus on health and longevity. While this group’s health focus tends to outweigh their inclination towards sustainability, there is potential for overlap in certain cases.

Incorporating sustainability into other benefits.

Looking at two sustainable brands with strong growth in recent years—Vital Farms, known for organic eggs, and GoMacro, offering organic nutrition bars—we see interesting trends. Despite being in the lower end of purchasing, the Educate group has increased spending significantly on these brands, even surpassing the Accelerate group in the case of GoMacro.

This trend aligns with sentiment research showing that Educate consumers are the second most likely group to purchase organic products, just behind the Accelerate group. This suggests that while sustainability may not be their primary driver, they are open to sustainable products, especially when framed through other priorities like organic and health-conscious choices.

Brands appealing to the Educate consumer may need to focus on communicating how sustainability can contribute to good health, as this group is currently the least likely to view living sustainably as part of a healthy lifestyle. If health messaging is challenging, it may be worth exploring other benefits of your product that align with their values to drive purchases.

The Invest Consumer: Open but habits are hard to break.

Invest consumers are lower-income, consisting mainly of White and Black households in rural East South Central regions. They shop at retailers like Walmart, Dollar General, and Sam’s Club, with a focus on comfort foods and everyday necessities. Common purchases include hot dogs, snack cakes, and personal care items like flouride toothpaste and deodorants. They also engage in purchasing private label the most out of any consumer group. Sustainability awareness is low, and this group is less likely to engage with eco-conscious practices. Their purchasing habits are shaped by convenience and affordability rather than environmental considerations.

Break habits to win shoppers.

To appeal to the Invest consumer, it’s important to consider the deeper reasons behind their hesitance to buy sustainable products. Aside from price, the biggest challenge is their tendency to stick with familiar habits and resist change. Interestingly, concerns about quality or lack of product variety don’t factor in as much for this group, while they have actually become bigger issues for the Accelerate group, who are more concerned with sustainability.

For the Invest group, changing their purchasing behavior requires breaking this habitual mindset. Research like the study from the University of Bath shows that people are more open to new habits during major life changes, particularly within the first few months of transitions like moving to a new home. This insight aligns with the idea that significant life events can create opportunities for consumers to adopt new behaviors, including choosing more sustainable products.

Brands looking to engage with the Invest consumer might want to focus on connecting sustainable options to key life milestones. For instance, sustainable products could be positioned as a fresh start during important moments like having a child, adopting a pet, or moving to a new home. In home goods, moving can prompt consumers to rethink their household choices with sustainability in mind. In food and beverages, opportunities such as starting GLP-1 or changes in diet could provide an opening to encourage more sustainable living.

Watch the webinar on-demand to see all the insights.

In the full report and webinar, you will discover more about the current sustainability trends, how to get consumers to buy sustainably and how to leverage Numerator to accelerate your sustainability goals. More insights include:

- What impact does product certification have on consumer sentiment?

- Which sustainability practices do consumers currently follow?

- How does ESG disclosure and messaging affect consumer purchasing intent?