In recent weeks, international trade policy has dominated headlines as the Trump administration rolled out sweeping tariffs on imports from Canada, Mexico, and China, as well as key raw materials like aluminum and steel. With trade discussions heating up, shoppers—and the brands that serve them—are bracing for potential price hikes, supply chain shifts, and evolving consumer behaviors.

Numerator’s latest survey of U.S. consumers sheds light on how tariffs are shaping sentiment and shopping habits, offering insights into consumer concerns and strategic opportunities for brands, manufacturers, and retailers.

Five Key U.S. Tariff Figures for February 2025:

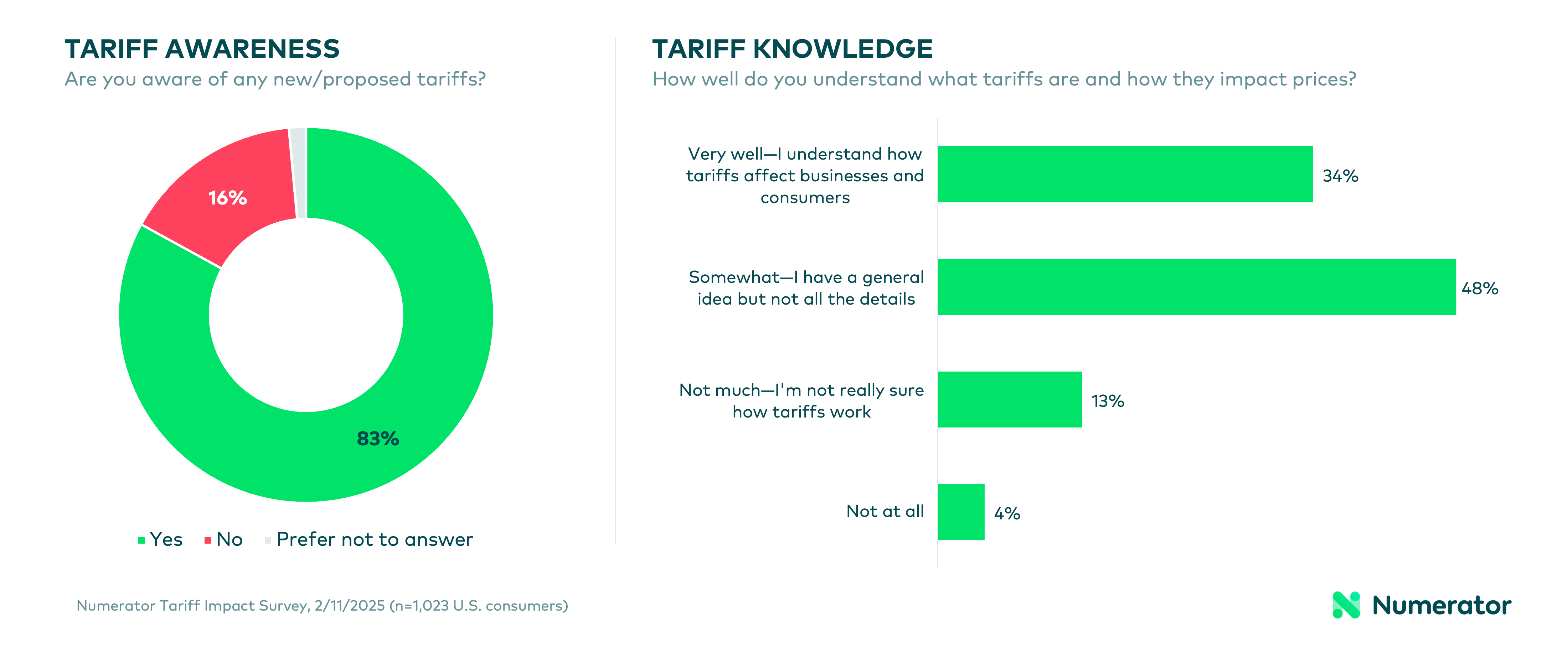

- 83% of U.S. shoppers say they’re aware of new or proposed tariffs

- 80% are concerned about the impact of tariffs on their finances or shopping

- 76% anticipate making changes to their shopping habits in response to tariffs

- 64% are worried about tariffs raising the price of everyday goods

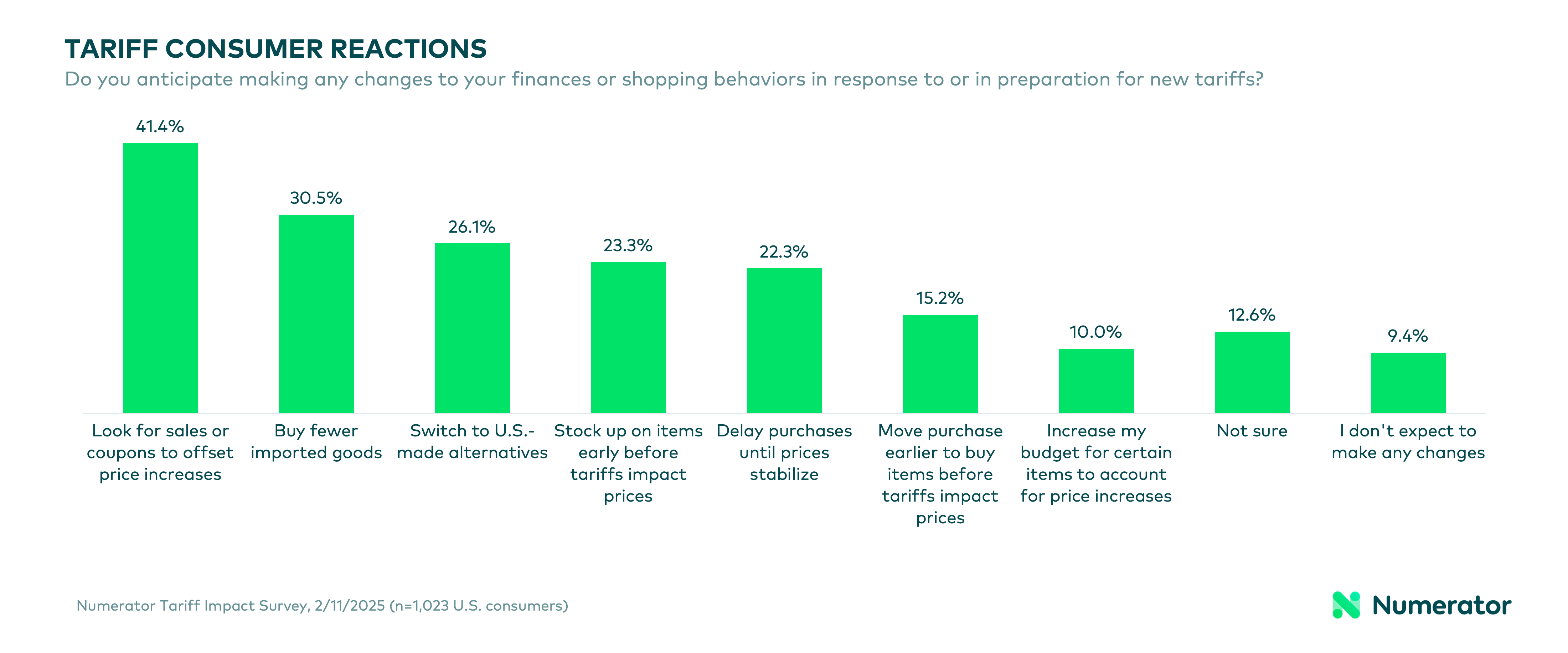

- 41% will look for sales or coupons to offset tariff price increases

Consumers Track Tariffs Closely

What do U.S. shoppers know about tariffs?

The majority of U.S. consumers are keeping tabs on the latest tariffs. As of February 11, more than four out of five shoppers (83%) say they’re aware of new or proposed tariffs on imported goods—up significantly from 53% in December 2024. While awareness is high, understanding remains mixed. Only a third (34%) of shoppers say they fully grasp how tariffs affect prices, while nearly half (48%) have a general idea but lack details. Another 17% admit to having little-to-no understanding of the issue.

Concern Surrounding Tariff Impacts

Are consumers worried about new tariffs?

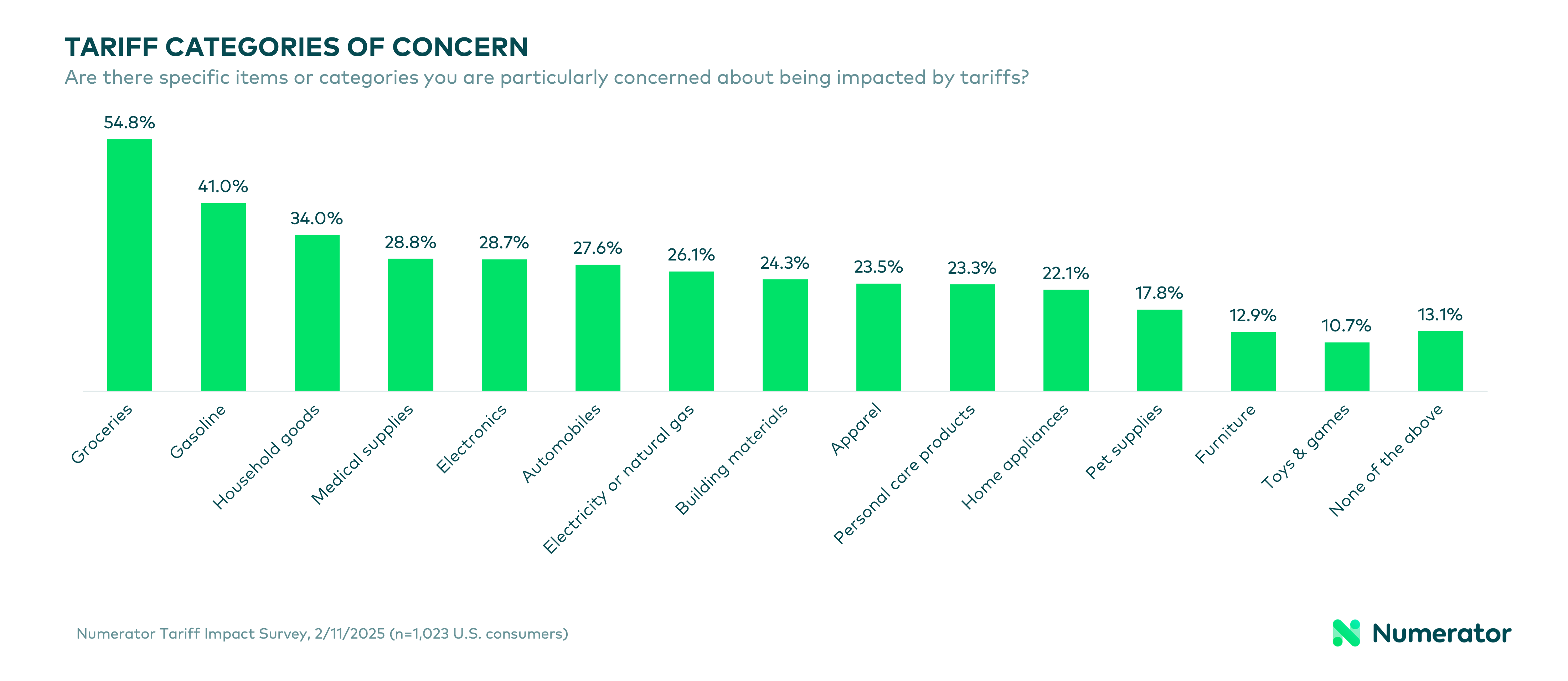

Consumers are feeling uneasy about the financial impact of tariffs. Four-fifths (80%) express concern about how tariffs will affect their personal finances and shopping behaviors. Two-thirds (64%) are worried about higher prices on everyday goods, two-fifths (44%) about limited availability of certain products, and a quarter (25%) about a potential slowdown in economic growth. Another 13% expressed concern that tariffs may impact their job or industry. Shoppers worry most about tariff-related price increases in essential categories like groceries (55%), gasoline (41%), household goods (34%) and medical supplies (29%).

Tariff-Induced Trade-Offs

How will tariffs impact shopping behaviors?

Three-fourths of shoppers (76%) anticipate making changes to their finances or shopping behaviors in response to or in preparation for new tariffs. The most popular reaction is looking for sales or coupons to offset price increases (41%), followed by buying fewer imported goods (30%) or switching to U.S.-made alternatives (26%). Some shoppers plan to shift the timing of their purchases in response to tariffs, stocking up ahead of price-increases (23%) or alternately, delaying purchases until prices stabilize (22%). One-in-ten (10%) shoppers said they’d increase their budget for certain items to account for price increases.

Shoppers Torn On Tariff Policy

Do U.S. shoppers support the new tariffs?

Nearly half of American consumers (46%) think tariffs in general have pros and cons depending on how they’re implemented, while a fifth (21%) think they’re harmful and a sixth (16%) think they’re helpful. Many Americans (53%) also believe opinions on tariffs are largely shaped by political affiliation. When it comes to the latest waves of tariffs, shoppers are understandably split: 35% support the tariffs, 23% feel neutral or have no opinion, and 38% oppose. Opinions are stronger on the negative side, with those who “strongly oppose” outnumbering those who “strongly support” two-to-one (28% vs. 14%).

Tariff Considerations for Businesses

How can brands, manufacturers and retailers respond to tariffs?

Shoppers are keeping a close eye on prices right now, meaning sudden spikes could drive them to competitors. If price increases are unavoidable due to new tariffs, companies should implement them gradually to minimize consumer pushback. Running targeted promotions or loyalty rewards can also be a bridge strategy to retain price-sensitive shoppers. Companies should consider monitoring sentiment and switching behaviors through surveys and verified purchase data to ensure their strategies are on track, course-correcting as needed. Exploring alternative materials sourcing from non-tariffed countries and evaluating domestic production feasibility will also set up businesses for future tariff resilience.

Keeping Tabs on Trade Policy

As tariff uncertainty lingers, consumer shopping habits will continue to evolve. Businesses that proactively adjust pricing strategies, marketing messages and supply chains will be better positioned to retain consumer trust and minimize revenue disruptions. Whether through smart promotions, highlighting U.S.-made alternatives, or adjusting sourcing strategies, the key to thriving in a tariff-heavy landscape is adaptability. For more information on how to safeguard your business against tariffs, reach out to our team of experts who can provide you with more targeted insights and recommendations specific to your organization’s needs.