After the internet’s berry-hued, blob-like bestie Grimace took the fast food industry by storm last summer, Wendy’s October 2024 collaboration with Nickelodeon to celebrate the 25th anniversary of Spongebob Squarepants, the Krabby Patty Kollab meal, piqued our interest here at Numerator. We surveyed over 200 verified buyers of the meal to get to the (bikini) bottom of the limited-time offer’s performance with consumers. Are you ready, (kids) insights professionals?

Sweet Victory for Wendy’s

Consumer appetite for cartoon collaborations extends beyond Spongebob.

To celebrate Spongebob’s quarter-century run, Wendy’s collaborated with Nickelodeon on a special “Krabby Patty Kollab” meal featuring a burger alongside a tropical Pineapple Under the Sea Frosty. While some reviewers questioned the meal’s resemblance to the iconic Krabby Patty from the show— it was similar to a Dave’s Single with a special sauce— consumer feedback tells a different story: the ‘Kollab’ was a hit with those who participated in the promotion.

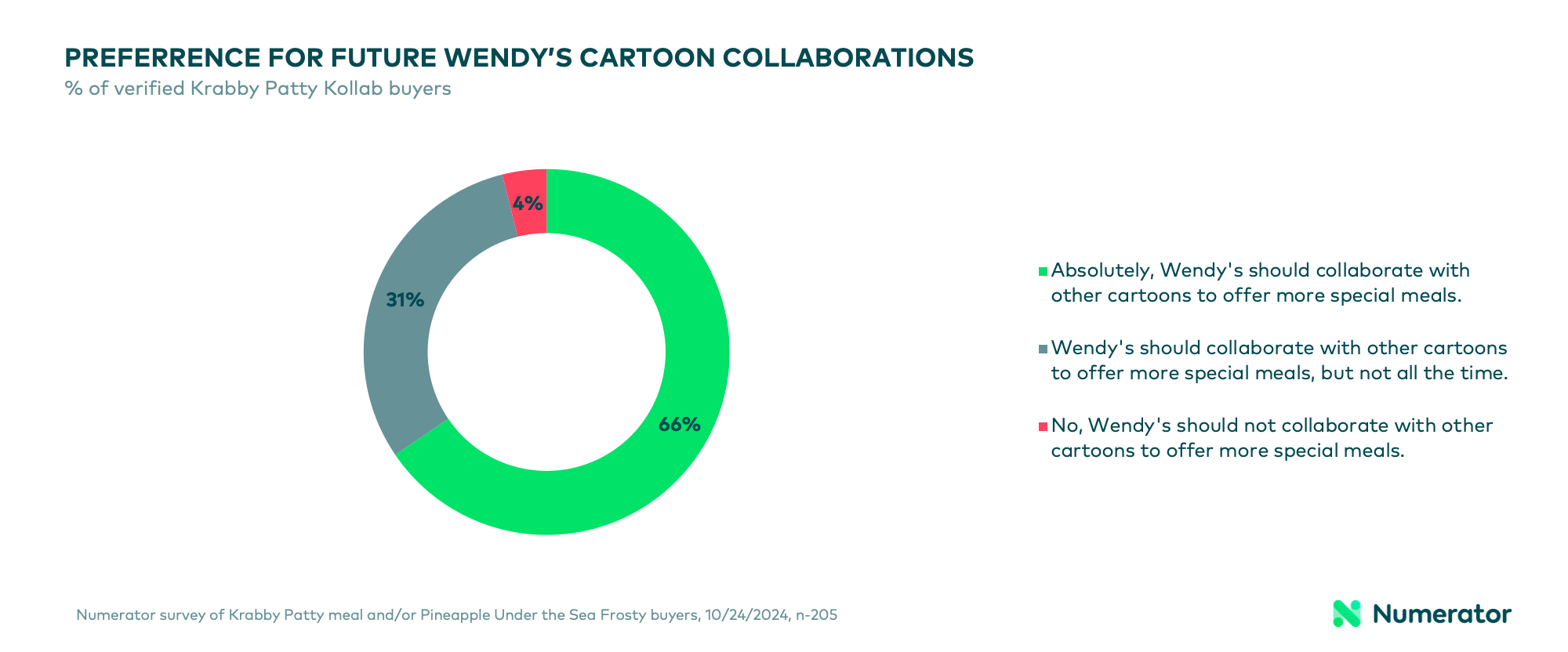

According to a Numerator survey of verified Krabby Patty meal buyers, the majority (62.6%) expressed enthusiasm about the tie-in with SpongeBob, showing that the meal’s branding was a key driver of consumer excitement. Only 3.4% of buyers thought Wendy’s should not collaborate with other cartoons to offer more special meals in the future— 65.5% were very receptive to the idea, while 30.6% approved but were more lukewarm.

Wendy’s didn’t have to spend the big ad bucks to generate interest, according to our survey: most Krabby Patty Kollab buyers found out about the offer via TV (29.1%) or social media (32.1%), though over one in four (26.2%) first found out about the offer when at a Wendy’s or driving past a Wendy’s.

Firmly Grasp the Insights

Nostalgia works, even when packaging might not deliver.

Spongebob may be marketed towards children, but consumers who tried the Krabby Patty Kollab thought the meal’s appeal was broader. While 64.6% of those who purchased the Kollab said they thought the offer was primarily targeted at kids under 13, nearly half of respondents (40.3%) also believed it appealed to Gen Z and Millennials, who also grew up watching SpongeBob. For fans who remember watching SpongeBob through their childhood and adolescence, the Krabby Patty concept is a reminder of childhood fun— and given that SpongeBob is still running strong after 25 years, it’s no surprise that consumers across generations tried the Kollab.

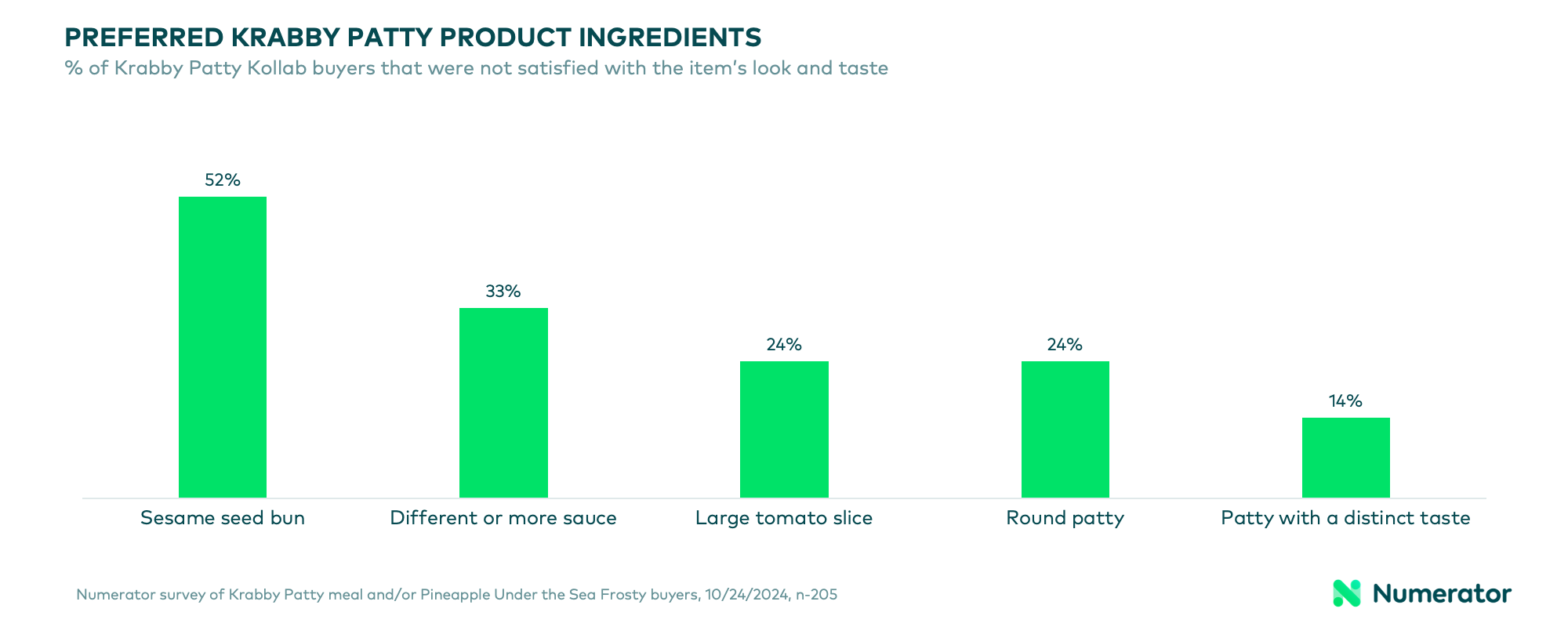

Despite feedback from online reviewers that Wendy’s Krabby Patty didn’t live up to the round patty and sesame seed bun regularly cooked up by Spongebob, the vast majority of verified buyers (79.1%) were satisfied with the look and taste of the Krabby Patty Kollab. In “This Grill is Not a Home,” Spongebob laments that a patty is just a patty, but one in ten buyers (10.2%) wanted something more from the meal. Among the less satisfied buyers, more than half (52.4%) wanted a sesame seed bun, followed by a different sauce or more sauce overall (33%), or a large tomato slice (24%) or round patty (24%) like in Spongebob.

Over 1 in 5 (22.8%) of all Krabby Patty Kollab buyers did not enjoy the packaging or specifically called out the lack of Spongebob-themed packaging. 72% of those guests wanted a Spongebob themed Wendy’s bag, and 56% wanted a Spongebob themed Frosty container.

Several Insights Later…

I remember the day they invented the Chocolate Frosty. I always loved it!

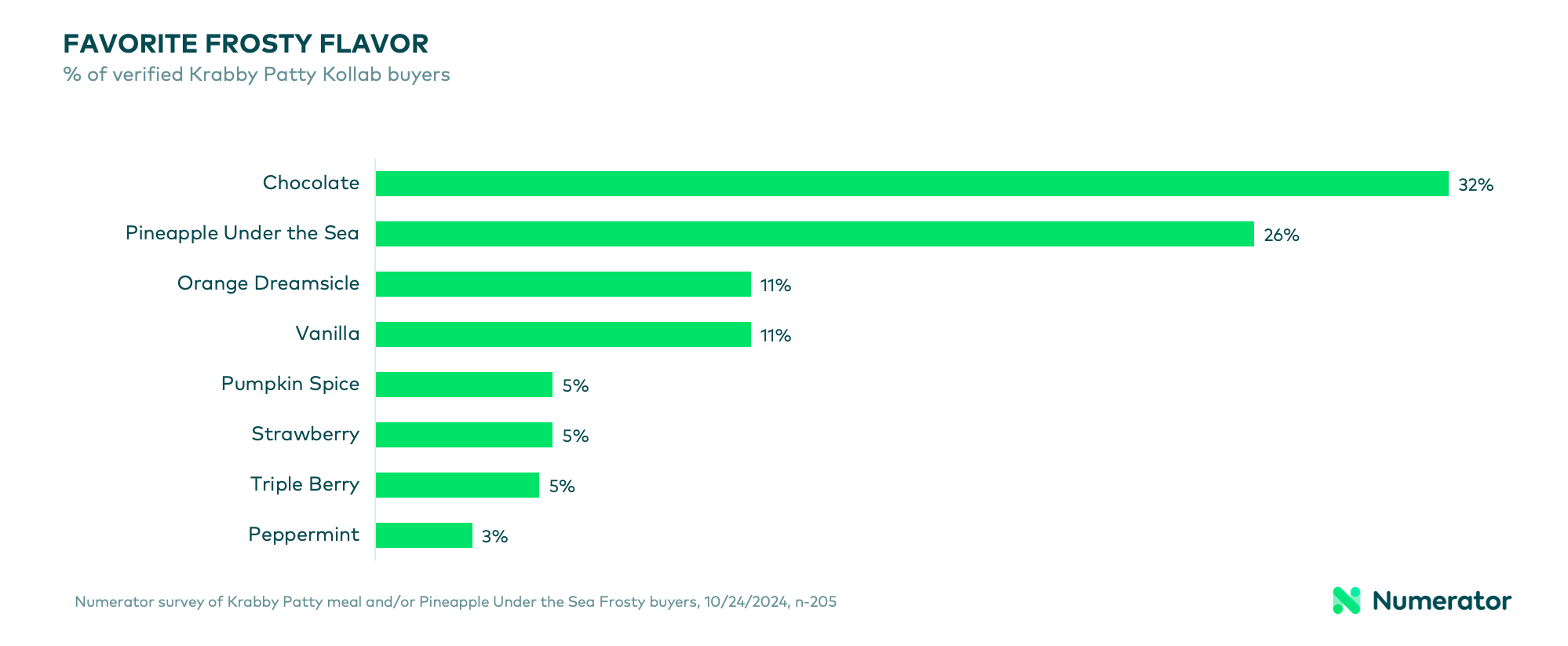

Consumers in particular enjoyed the Pineapple Under the Sea frosty flavor. The flavor ranked second when consumers were asked for their favorite flavor: 32% of consumers preferred Chocolate, followed by 26.2% who preferred the Pineapple Under the Sea Frosty. Orange Dreamsicle (11.2%) and Vanilla (11.2%) tied for third place. Wendy’s and other leading limited service restaurants have an opportunity to invest in more tropical flavors, which an increasingly diverse consumer base enjoys.

The (Insights) Magic Conch

Magic conch shell, will the Krabby Patty Kollab drive sustained interest?

According to buyers, the Krabby Patty Kollab meal seems to have delivered enough value that even notoriously stingy Mr. Krabbs would appreciate. Over half (59.7%) of consumers considered the meal to offer “good” or “excellent” value— a significant win, given that elevated prices are top of mind for consumers, who appear to be eating out less. The limited time offer resonated with a majority of verified buyers, suggesting that even in tough times, consumers are willing to splurge on nostalgic experiences they perceive as offering good value.

When asked if they would return to purchase the Krabby Patty meal before the promotion ended, 40.8% of respondents said they would, and another 37.9% were open to the idea. Given these numbers, there’s still room for Wendy’s to switch the setting from M for Mini to W for Wumbo and deepen engagement with this audience before the promotion concludes.

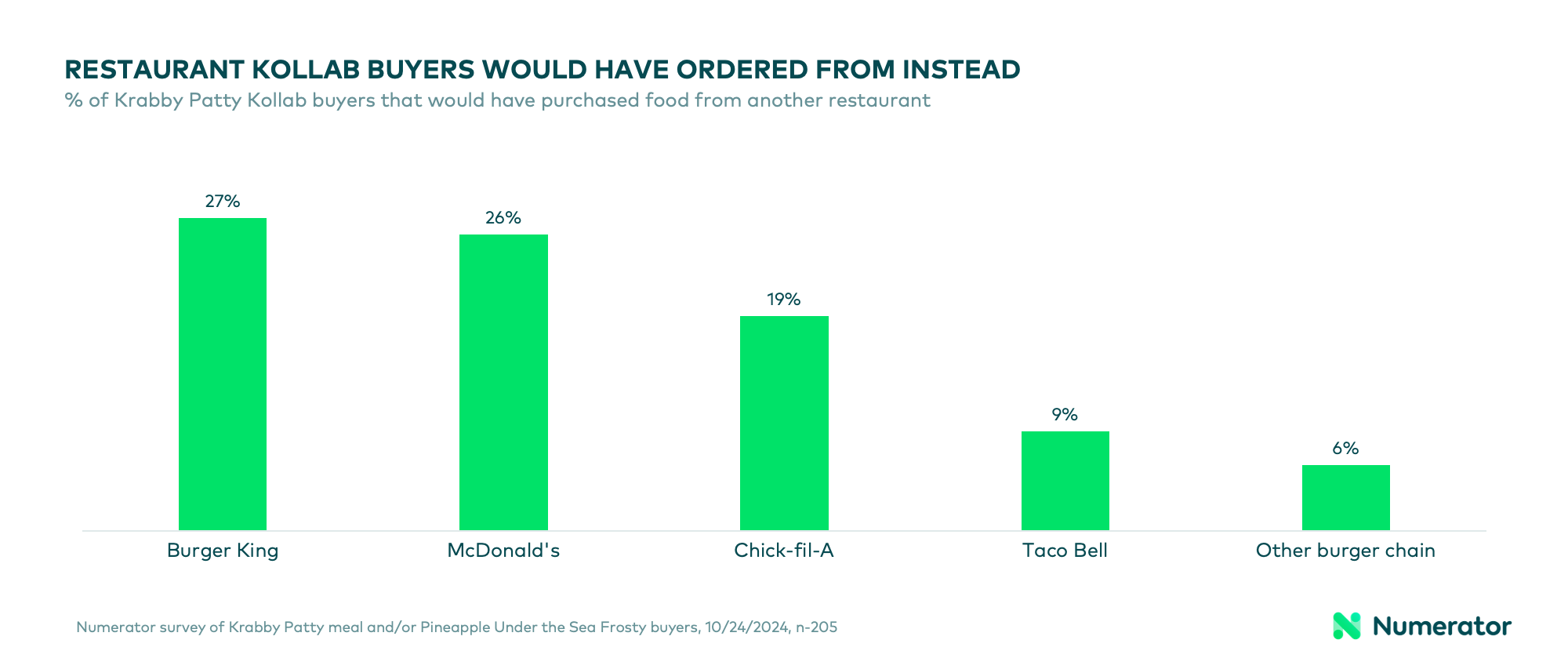

Most Krabby Patty Kollab buyers would have ordered from Wendy’s even if the meal hadn’t been available (62.6%), but Wendy’s did win over the 34% of buyers who claim they would have gone to another restaurant if Wendy’s didn’t offer the Krabby Patty Kollab. Among consumers that would have gone to another restaurant, most would have gone to Burger King (27.1%), McDonald’s (25.7%), and Chick-fil-A (18.6%)— the Chum Buckets (Plankton’s restaurant) to Wendy’s Krusty Krab in this scenario.

Ravioli, ravioli, give me the formuoli

The formuoli for restaurant growth

While the Krabby Patty Kollab meal was generally well-received, it offers some valuable insights into how brands can better execute nostalgic promotions. Wendy’s succeeded in attracting attention with a collaboration that appealed to SpongeBob fans and fast food lovers, but the opportunity for improvement lies in the finer details—namely, packaging and offering a more distinct product experience.

As we learned from McDonald’s Grimace Birthday Meal, nostalgia, when done right, has the power to connect with a wide audience and drive engagement. Wendy’s has laid the groundwork, and now it’s time to build on that success for future limited-time offers.

Are you feeling it now, (Mr. Krabs) blog readers?

Grill up more restaurant insights

Numerator’s Restaurant solutions help restaurants identify opportunities for share growth, develop strategies with a deep understanding of omnichannel behavior, and connect to verified buyers for concept testing, in-market feedback, and insights on competitive offerings. In addition to tracking the top product launches of 2024, we maintain a library of over 100 new restaurant items launched in 2023 to enable granular analyses. Reach out today to get the insights you need to optimize your new item strategies.