The countdown to Cyber Weekend 2024 has commenced. As shoppers gear up for the biggest five-day shopping spree of the year, retailers and brands are stocking their shelves and prepping their distribution centers for increased demand. Over the decades, this period has grown beyond blockbuster Black Friday sales to encompass a full weekend of holiday bargains, spanning in-store retailers and online e-tailers alike. Read on to learn more about past Cyber Five trends and what to expect this year.

What is the Cyber Five?

First things first…what exactly is the “Cyber Five”? Some call it Cyber Weekend, some call it Black Friday Weekend or Thanksgiving Weekend, but they’re all really referring to the same thing: the five-day period spanning from Thanksgiving Thursday through Cyber Monday, known for its staggering lineup of holiday sales. Despite its “cyber” branding, most businesses look at this period holistically across both in-store and online shopping.

Highlights from 2023 Cyber Five Weekend

Last year, 84% of U.S. households shopped during the Cyber Five period— 72% in-store and 52% online, with significant overlap between the two. Online spending skyrocketed in 2023, up 23% compared to 2022, while in-store spend took a slight dip, down 1% in key categories. The average Cyber Five shopper spent $234, made five separate trips/orders, and shopped at two or more different stores/websites.

Nearly all shoppers surveyed over the five-day period (92%) said they took advantage of the sales to purchase holiday gifts, though only half (51%) said gifting was their primary shopping goal. Over half of the weekend’s spending came from products within electronics (22%), home & garden (19%) and health & beauty (14%) categories, while apparel (10%), party & occasions (8%), tools & home improvement (7%) and toys (6%) also pulled in significant spend.

Predictions for 2024 Cyber Five Weekend

#1: Online sales will outpace in-store sales in the Cyber Five period.

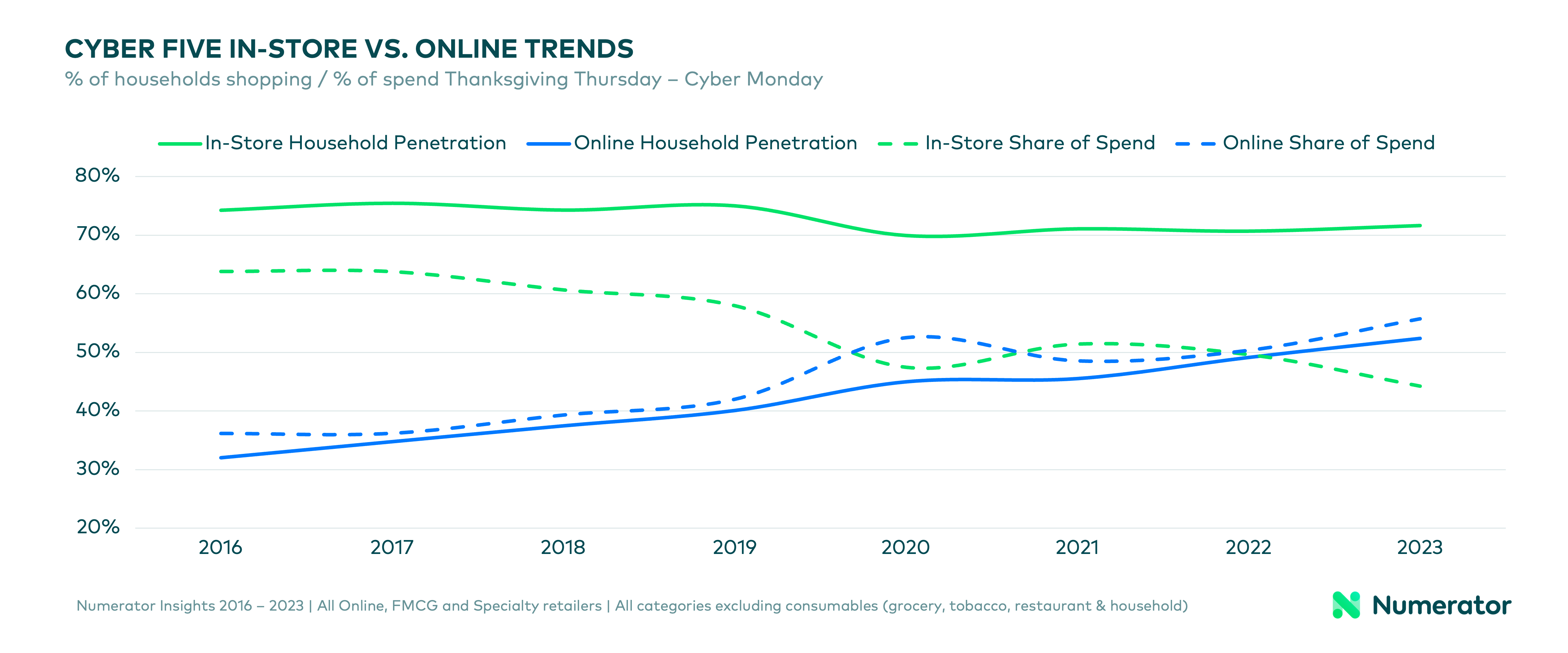

Last year was the first time ever that over half of U.S. households (52%) made an online purchase during the Cyber Five period. We expect a similar number—if not more—will shop online again this year. Although more shoppers visit physical retail locations during this period, online retailers captured 56% of total Cyber Five spending in 2023. This is because online Cyber Five shoppers spend significantly more than their in-store counterparts—the average spend per unit online during this period is three times higher than in-store, and the total buy rate for these shoppers is nearly twice as much as in-store shoppers.

#2: Higher prices will play into higher Cyber Five spending.

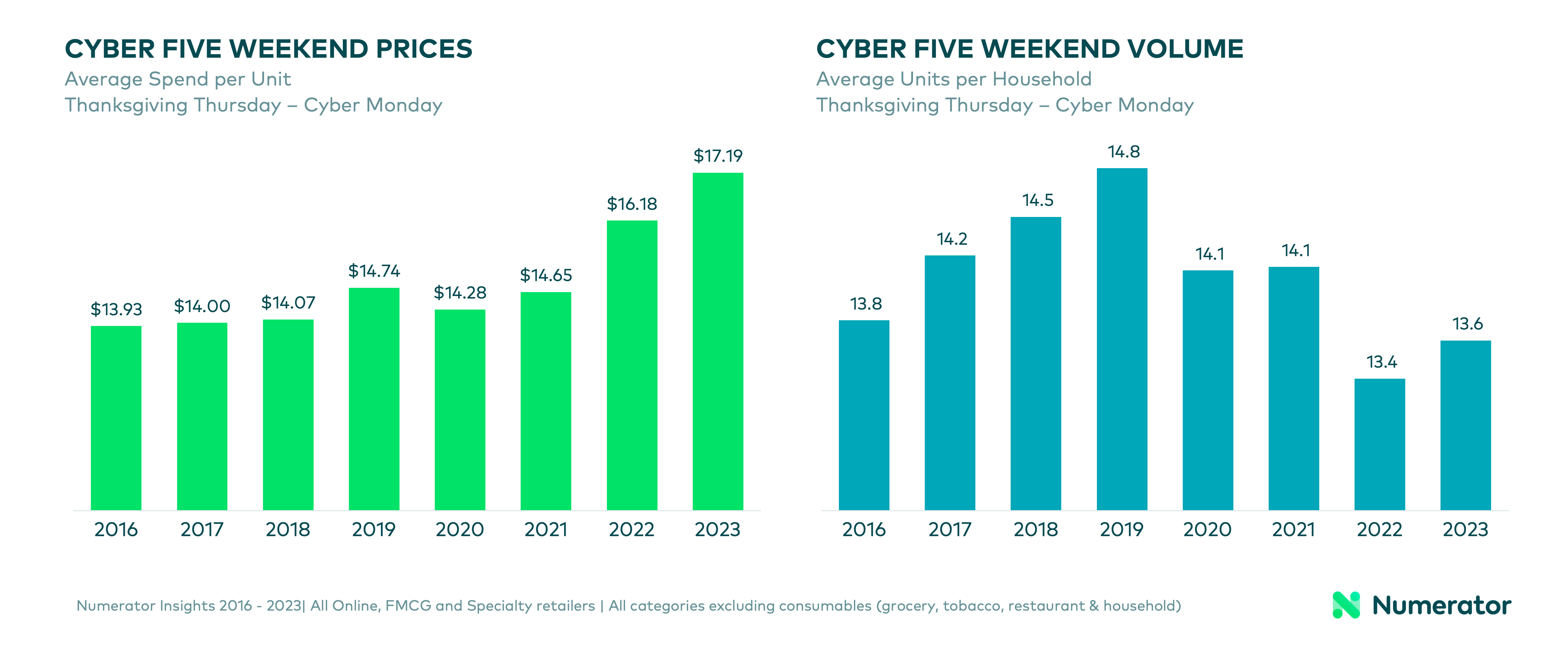

Both household spending and the average spend per unit have increased steadily since Cyber Weekend 2016, apart from a dip in 2020 caused by pandemic pullbacks. Average spend per unit increased the most between 2021 and 2022, rising 10%, and then grew another 6% from 2022 to 2023. Increasing unit prices reflect both inflationary pressures and a shifting assortment of purchases. Since 2019, Cyber Five shoppers have been purchasing fewer items overall while spending more to do so.

Although the Cyber Five period is typically touted as a gift-buying occasion, many shoppers also use the sales to purchase items for themselves or their households. Nearly a third (32%) of last year’s shoppers said they purchased items exclusively or primarily for themselves. With many economists predicting future price-hikes due to tariffs and other government policies, shoppers may also use this year’s holiday sales as a way to safeguard against future increases, shifting up major purchases or stocking up on sale items.

#3: Early holiday sales will pull some traffic from Cyber Five sales.

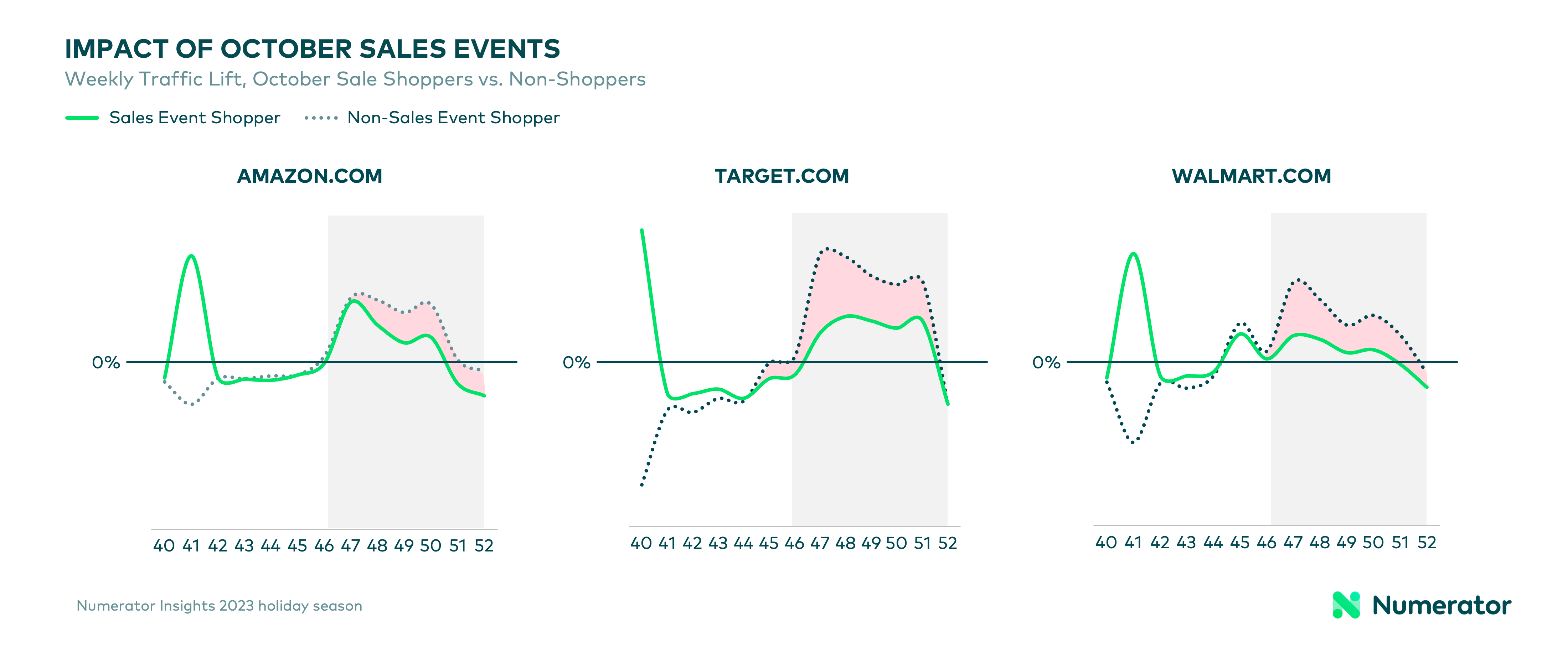

According to our pre-holiday survey, three-fourths (75%) of shoppers participated in October early holiday sales like Prime Big Deal Days, Target Circle Week, or Walmart’s Holiday Kickoff, and a similar number expect to shop during the Cyber Five. Despite high participation in both periods, our past research on retailer sales events shows that in 2023, those who participated in early holiday sales at Amazon, Walmart and Target were less likely to shop at these retailers again in the back half of the holiday season, effectively shifting their holiday spend earlier.

#4: Amazon will dominate Cyber Five traffic and spending.

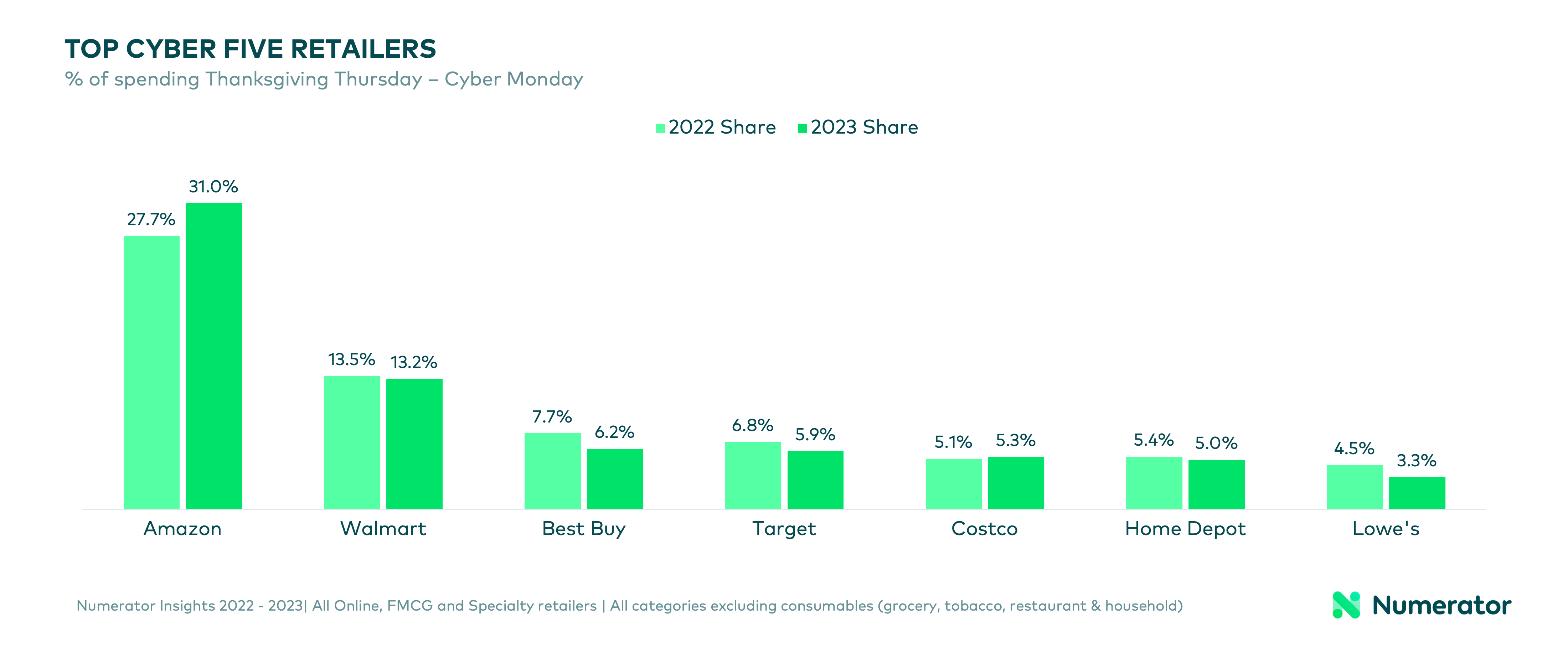

Amazon captured nearly a third (31%) of Cyber Five spending last year with orders from 44% of U.S. households. The e-tail giant grew share three points from 2022, resulting in declines at most other major retailers, apart from Costco who saw a 0.2 point increase. Amazon’s propensity for capturing multiple orders from single households also drives up its share of occasions. Last Cyber Weekend, a third (33%) of all purchase occasions—including in-store trips and online orders—took place on Amazon.

#5: Black Friday traffic will continue to outpace Cyber Monday.

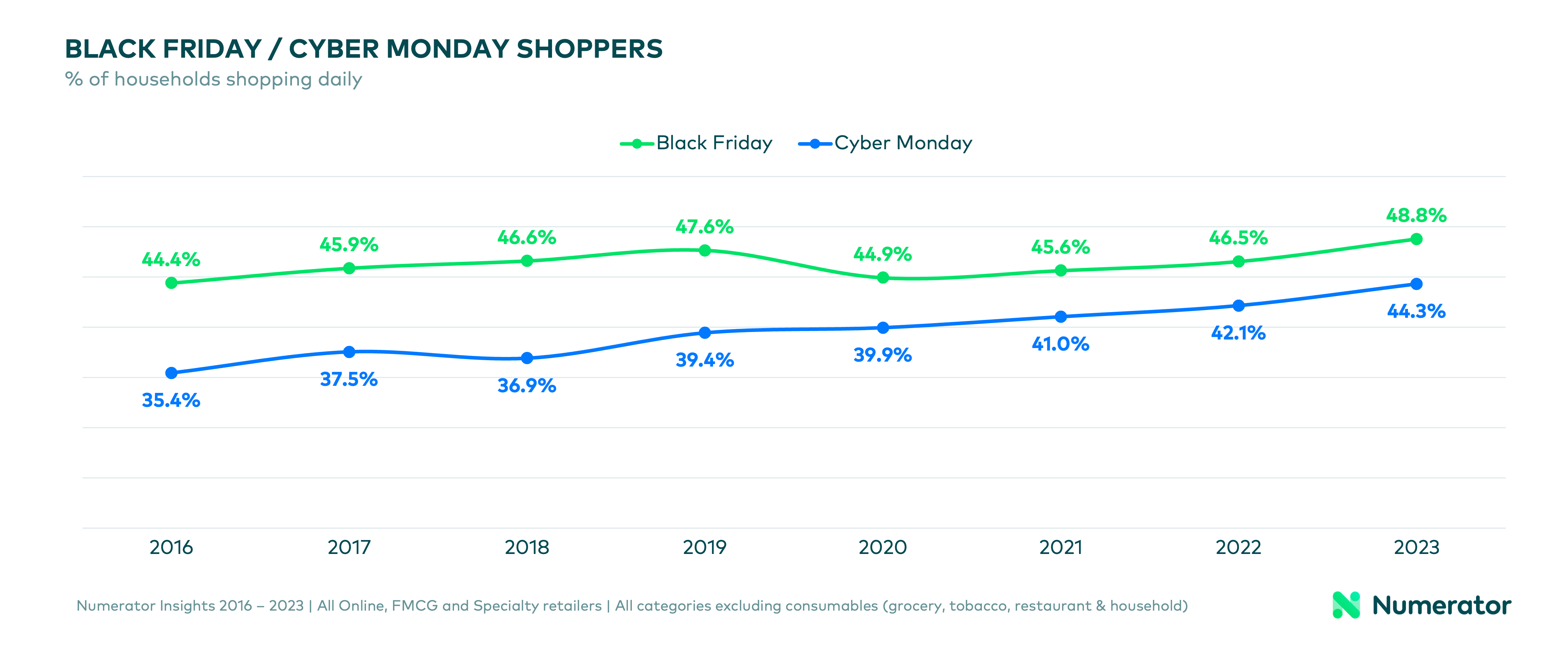

Although Cyber Monday has continued to grow each year, it’s unlikely to surpass Black Friday in terms of total shopping occasions or percent of households shopping. The gap has been narrowing slightly each year but not at a pace that would suggest an overtake any time soon. The most significant narrowing of the gap came in 2020, but since then, the percentage of households shopping each day and the total trips made have increased at roughly the same rate. With decades of dominance, the benefit of both in-store and online presences, and a sweet spot on the calendar, Black Friday remains at the core of the Cyber Five period.

Stay Tuned for More Merry Insights

Numerator is staying on top of the holiday season with ongoing insights into holiday trends. Check out our Q4 Holiday Preview—out now— and bookmark our Cyber Weekend page for future looks at what verified 2024 Cyber Five shoppers have to say about their purchases, with the first wave of insights coming 12/2. Reach out to our team or contact your Numerator representative for more information on how your brand can measure your holiday performance this season.