Retailers are reassessing product lines, stressing the need for brands to educate buyers on consumer needs and demonstrating how they meet demand. However, this task is complicated by macro-level trends affecting category growth and changing shopper profiles.

This article explores how brands leverage panel data to craft compelling narratives, securing shelf space and driving long-term sales growth. We’ll analyze how Delta Faucet Company can justify or increase their shelf allocation in Lowe’s within the Bathroom Faucets category, including Sink Faucets, Faucet Parts, and Shower/Tub Faucets.

1. Understand the Retailer and Category Context

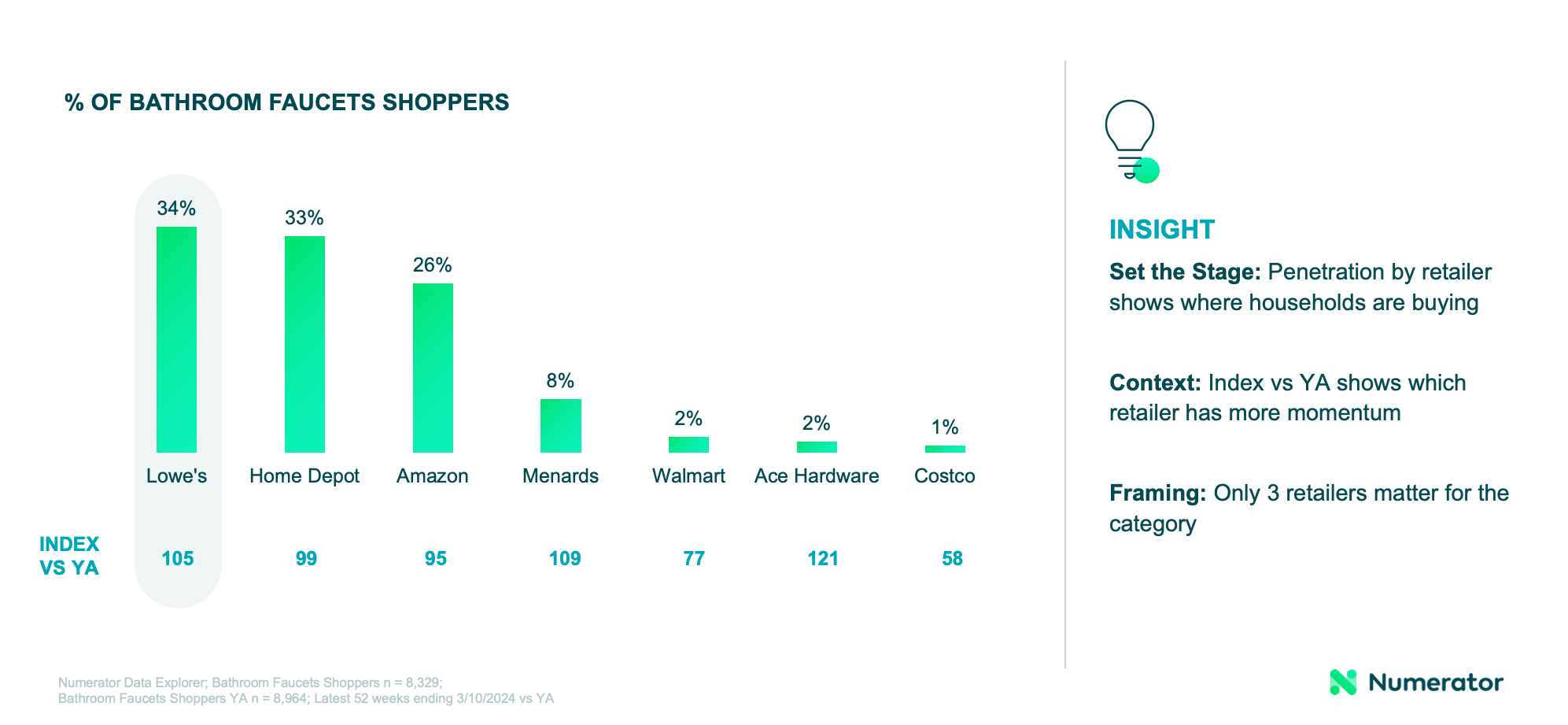

To showcase Delta’s value proposition, it’s important to know where consumers buy Bathroom Faucets. Analyzing household penetration and trends from the previous year highlights retailers gaining momentum, with Lowe’s emerging as a prime candidate for strengthening their partnership.

Analyzing the category within Lowe’s, key metrics such as projected sales, shoppers, and buy rate show a decline (-15%, -10%, -6% respectively). With declining sales, Lowe’s may reduce assortment, risking Delta’s shelf space. Therefore, Delta must emphasize its value proposition to Lowe’s.

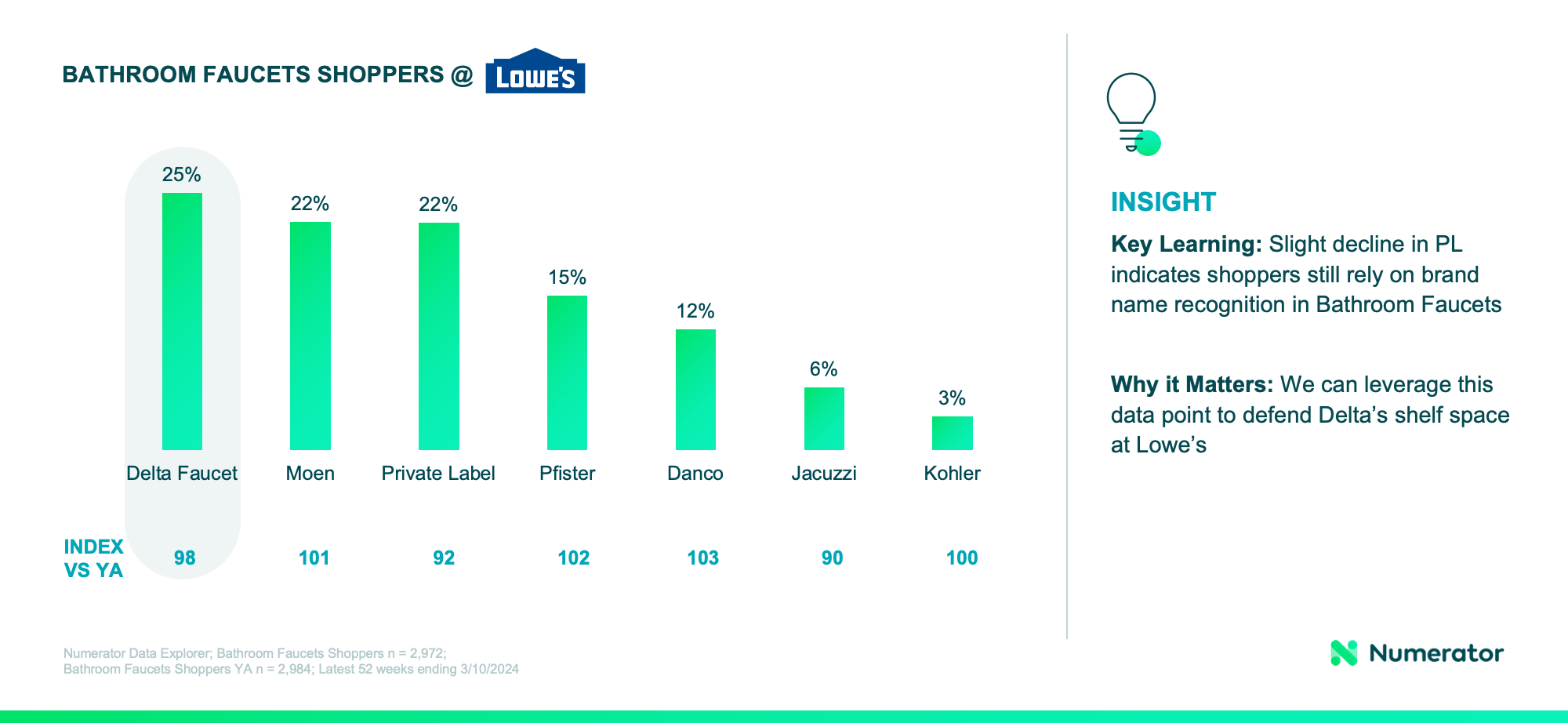

Delta (25%) currently leads in household penetration among Lowe’s shoppers, followed by Moen (22%) and Private Label (22%). While Private Label shows decline since last year, brand recognition remains pivotal in this category. This insight strengthens Delta’s position in defending its shelf space at Lowe’s.

2. Introduce the Category Opportunity Presented to the Retailer

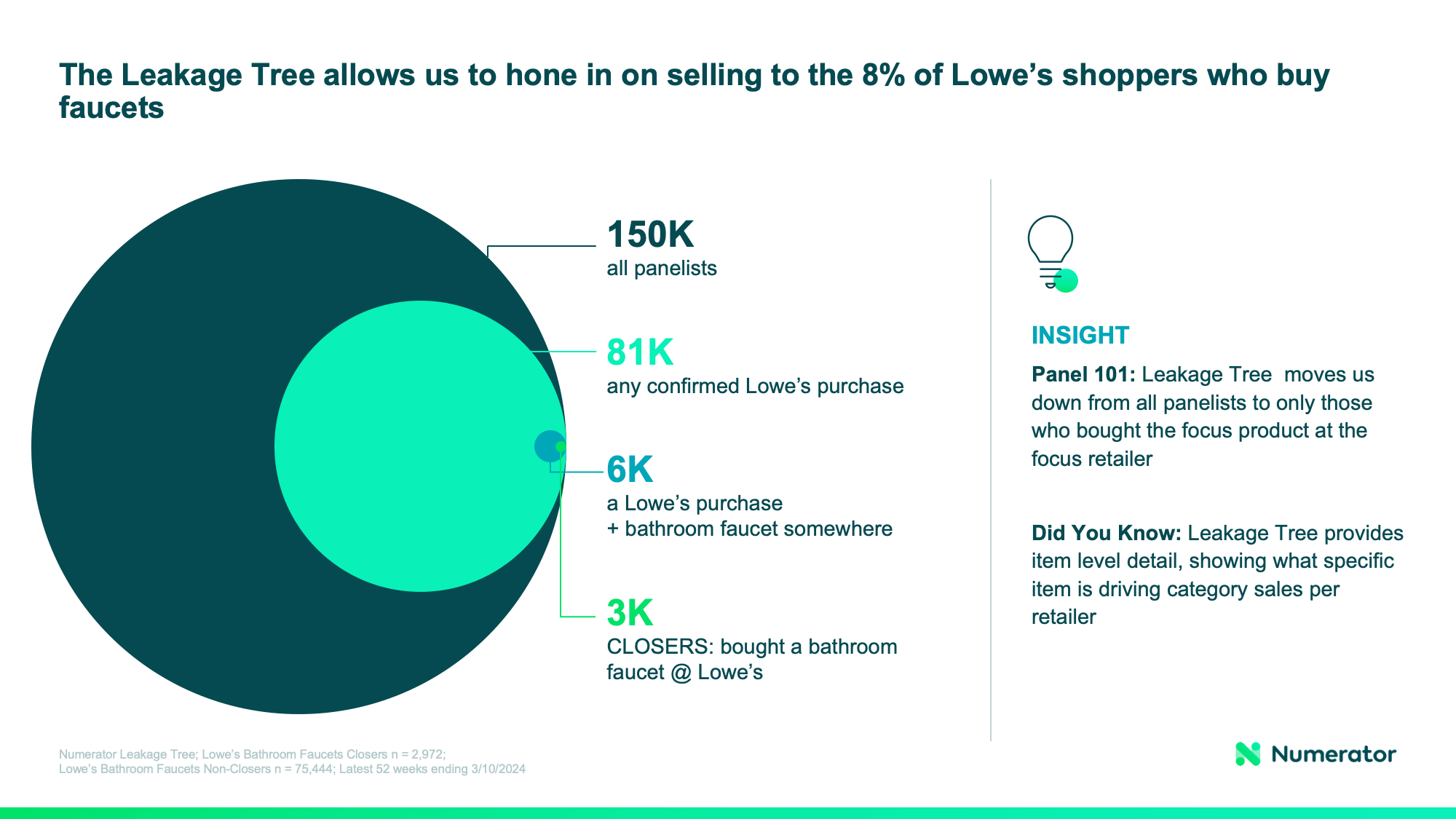

To appeal to Lowe’s buyers, Delta needs to assess the current purchasing behavior of Lowe’s shoppers compared to those buying elsewhere within the category. Using Numerator’s leakage tree, starting with 150k panelists, Delta can track those who made confirmed purchases at Lowe’s (81k panelists), have purchased at Lowe’s prior but bought bathroom faucets elsewhere (6k panelists), and specifically purchased bathroom faucets at Lowe’s (3k panelists).

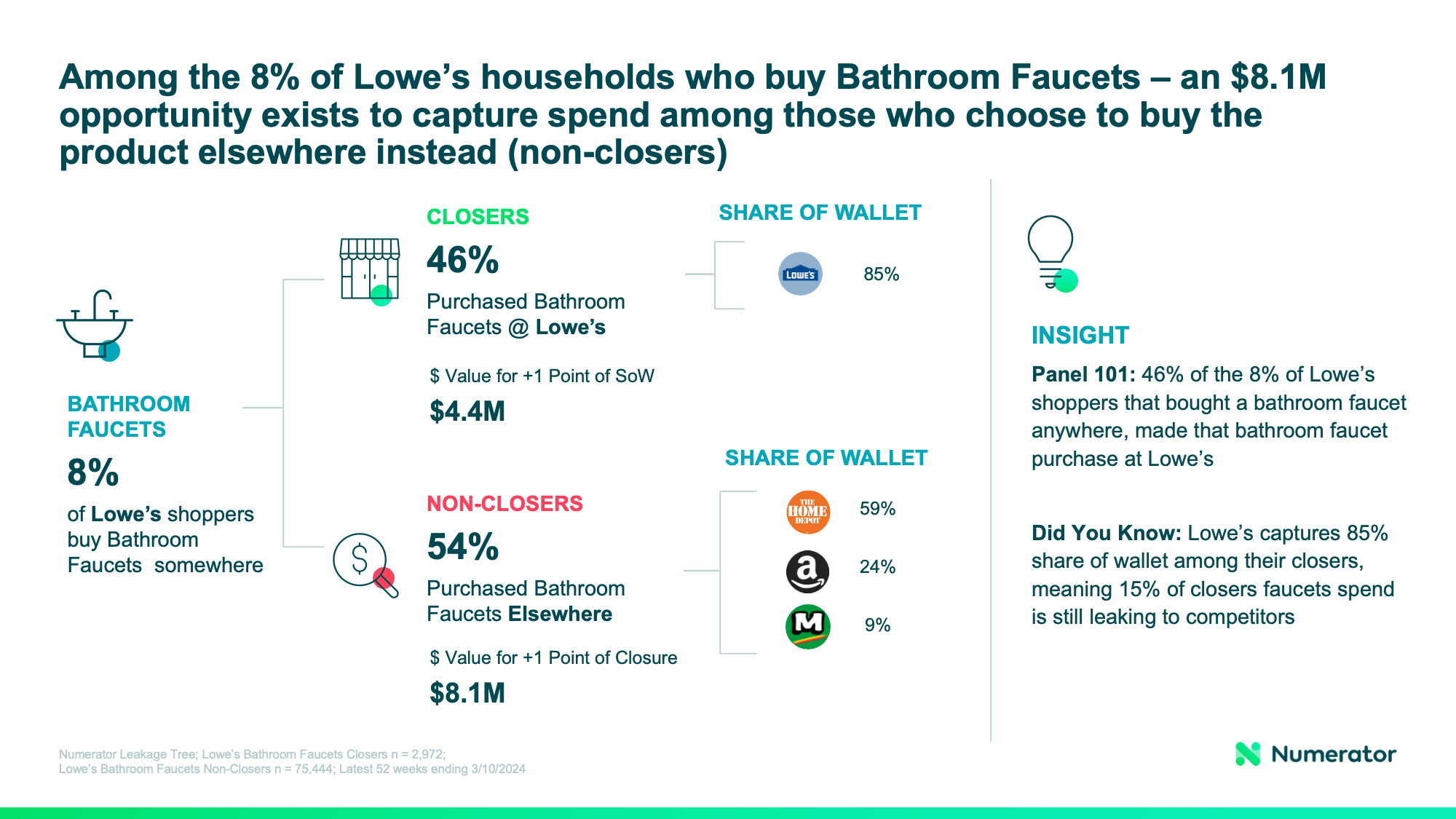

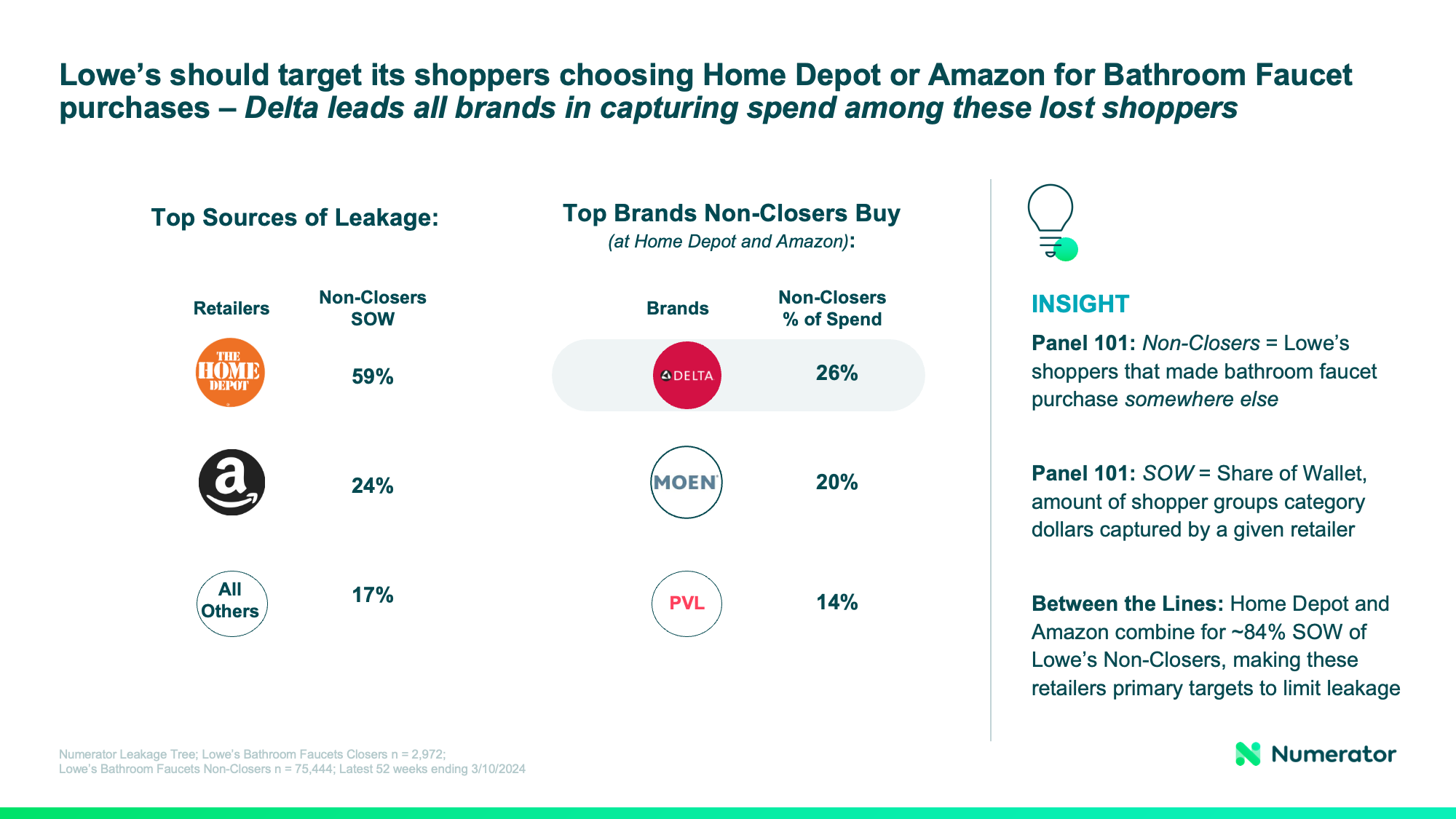

The leakage tree reveals 8% of Lowe’s shoppers buy faucets, with 46% of this subset of shoppers buying bathroom faucets at Lowe’s. Each point values the share of wallet (amount of a shopper group category dollars captured by a given retailer) to a $4.4 million gain for Lowe’s. Still, Lowe’s is losing 15% of this share of wallet to competitors. For the 54% of non-closers (buying bathroom faucets elsewhere), each point of closure increase is valued at $8.1 million, with these shoppers mainly purchasing their Bathroom Faucets at Home Depot (59%) and Amazon (24%).

Understanding these dynamics allows Delta to advise Lowe’s on targeting new buyers or increasing the spending of existing ones, forging a clear and beneficial partnership direction. This indicates Lowe’s should not reduce Bathroom Faucet assortment as there’s significant potential to convert more shoppers in the category.

3. Prove your Brand is Essential to Converting more Shoppers

Delta advises Lowe’s to target non-closers (Lowe’s shoppers buying bathroom faucets elsewhere), particularly those shopping at Home Depot and Amazon to capitalize on a greater dollar opportunity presented through increasing the closure rate. Understanding what these shoppers are purchasing outside Lowe’s is crucial. Among non-closers, the top brands by percent of spend are Delta (26%), Moen (20%), and Private Label (14%). Since Home Depot and Amazon capture 84% of Lowe’s share of wallet, these retailers should be prioritized to minimize losing Lowe’s shoppers to their competition.

Anticipating pushback from Lowe’s, Delta should compare key brand metrics with Moen and private label in-store. While Moen may attract more valuable shoppers to Lowe’s, Delta is chosen by Lowe’s non-closers at a higher rate than Moen, making Delta the preferred brand for converting more shoppers to Lowe’s. This helps to set the stage that if Lowe’s could convert 10% of the shoppers leaking to buy Delta at Home Depot or Amazon, they will gain over $6M in incremental value. Lowe’s now understands the potential impact of converting non-closers by identifying top Delta items that Lowe’s shoppers purchase at Home Depot or Amazon.

Understanding what non-closers are looking for, what they like about shopping at competitive retailers, and if they considered purchasing at other stores will be crucial to identify the right assortment. Through Numerator’s AskWhy solution, Delta can identify 53% of shoppers look for style when buying Bathroom Faucets, 61% like the variety when shopping for bathroom faucets, and 48% have considered purchasing Bathroom Faucets at other stores. This proves that having an assortment of styles and price points is key to winning in the Bathroom Faucet category. As for the top Delta items purchased elsewhere among Lowe’s non-closers, they include three SKUs that are not currently on the shelf at Lowe’s. Leaked buyers are going to competitive retailers for features and finishes missing from the Delta assortment at Lowe’s, demonstrating that if Lowe’s wants to appeal to non-closers, they’ll need to consider expanding the Delta assortment since these shoppers value variety.

Conclusion

Lowe’s can gain households from Home Depot and Amazon through a closer partnership with Delta, as their non-closers prefer Delta over other brands when shopping at competitive retailers. Delta can argue that they deserve to maintain or expand shelf space since non-closers primary reasons for purchasing elsewhere include style and variety. Delta has styles that non-closers are looking for since the SKUs are purchased the most by non-closers at Home Depot and Amazon. The brand can also do additional research to determine what specific product characteristics convert non-closers the most to help Lowe’s stop leakage to Home Depot and Amazon.

Product line reviews (PLRs) allow brands to set the stage with high-level macro trends, filter down to granular brand performance across retailers, and highlight how they bring value to the retailers’ category and store. For any upcoming product line reviews, reach out to us today to help defend or expand shelf space.