Expo West’s 43rd annual conference was held March 12-16th at the Anaheim Convention Center, with over 70,000 attendees exploring the most exciting brands in the CPG sector. Many innovations and marketing strategies were highlighted on the floor, all with a consumer-first mindset.

The Numerator team noted many differentiated benefits that brands are delivering to their consumer base but identified a handful of emerging trends that were most common. Condensed into four key themes, these trends focus on the needs that consumers are looking for brands to satisfy: Ready-to-eat Dishes with an ethnic influence, plant-based innovations, Non-Alcoholic Beverages with functional benefits, and exotic fruit flavor innovations.

Ready-to-Eat Ethnic Dishes

Kevin’s Natural Foods was on display with their Thai-inspired ready-to-eat dishes, which have seen steady growth over the past year in both household penetration (5.6%, increase of 1%) and buy rate ($26.43, increase of $0.97) in the Refrigerated Meals category. However, challenger brands are growing the competitive landscape with a focus on quality ingredients and ethnic flavorings, including Maspanadas’ empanada bites, Too Good to Be Foods’ new launch of dumplings, and Kula Kitchen’s fresh infusion of Afro-Caribbean faire.

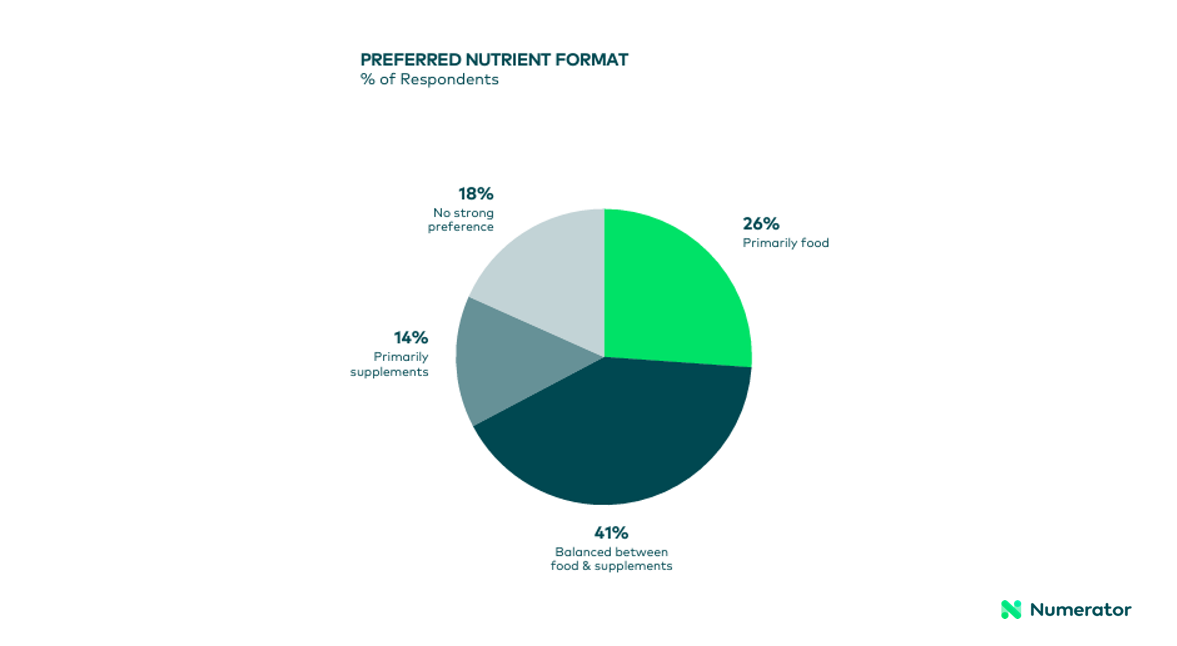

According to Numerator’s annual Visions report, ethnic flavors combined with nutrient-dense items will help brands tap into highly sought-after consumers, such as Gen Z, higher-income households, and multicultural consumers. There’s been a nearly twofold increase in consumers who favor obtaining nutrients primarily through food rather than supplements, and these consumers are at the forefront. Brands that innovate toward nutrient-dense items and ethnic flavors will capture key households and increase their share within a competitive category.

Plant-Based Innovations

Plant-based items appeared in a wide array of categories across the floor, including cookies, milk, pasta, crackers, sushi, and shrimp. One brand, Beamy – a dry mix for burger and veggie balls – focused on promoting its healthy ingredients free of soy, gluten, GMOs, and allergens, while still being a source of fiber and rich in protein. Other brands that stood out were BranchOut, with their bright, colorful packaging and promise of being the “perfect nutritious, fun snack for all ages,” comprised of dried, real banana pieces, and ZENB with their pasta made from 100% yellow peas, as well as their newer ZENB cracker crisp line.

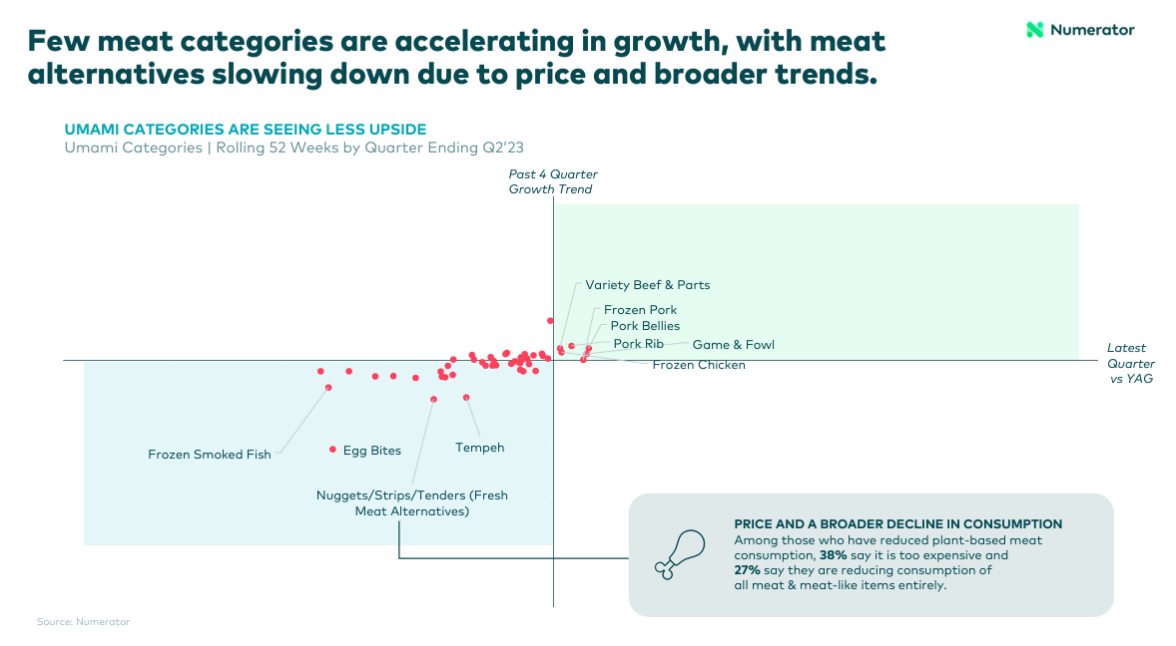

Although there are plenty of exciting new entrants entering the broader category, meat alternatives are slowing in growth due to price and broader trends. According to Numerator’s Stomach Share report, 38% of shoppers who have reduced plant-based meat consumption say it’s too expensive and 27% say they are reducing consumption of all meat and meat-like items entirely. As personal finances are the top concern for most households, developing consumer-centric promotional and pricing strategies will be critical to winning shoppers in the plant-based sector.

How to read: Umami categories in the top right quadrant have seen continued growth in both the long and short term, while Umami categories in the bottom left quadrant have been contracting in both the long- and short-term

Better-for-you Soda Meets Non-Alcoholic Beverages

Existing Better-for-you Soda brands have seen incredible growth in household penetration in the past year, including Olipop (+6.5%), Poppi (+5.9%), and Culture Pop (+1.8%), so naturally new, challenger brands are looking to capture a piece of this growth in Better-for-you Beverages. Products have moved beyond being low-calorie or natural to providing true functional benefits. Newer products within this space include “social tonics” that promote a high without a buzz, such as Hiyo and Three Spirit. De Soi is another brand that provides adaptogen-rich aperitifs for a mood-boosting buzz.

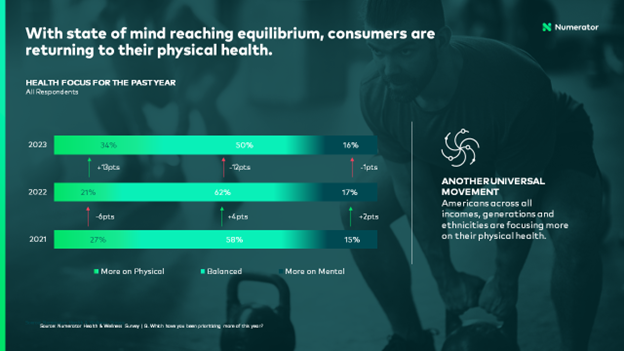

Functional benefits will resonate with consumers more this year – according to our Numerator Visions Webinar, 34% of consumers now prioritize their physical well-being, an increase of 13 percentage points from last year across all income levels, generations, and ethnicities. Consumers will also be tracking what they eat and drink more often, as 11% of the population is looking to start using or use more nutrition and mental health apps in the next year– the highest of any health tools we surveyed. As Better-for-you Beverages looks to win share from the Better-for-you Soda category leaders, understanding who these shoppers are, what their occasions are, and the cross-purchasing habits happening within sub-categories will lead to sustainable growth.

Exotic Flavors

Functional food and beverages centered on exotic flavor innovations this year, exemplified by Dahlicious Lassi debuting their mango yogurt smoothie with probiotics, Shaka Tea with Guava flavors providing herbal hydration, and Golden Farms providing a natural, no sugar added fruit sauce with a flavor blend of pineapple, papaya and passion fruit. As Numerator’s Stomach Share report states, these exotic flavors are what consumers are searching for as they’re starting to switch out dessert ingredients with fresh fruits to get a sweet fix. Brownies, cookie dough, and low-calorie sweeteners are being replaced in favor of lychee, pitahaya/dragonfruit, coconut, sapote, and soursop, which are just a few of the fastest-growing fruit categories that originate outside of the U.S.

Expo West was incredibly successful this year in networking and educating the industry. The expo continues to highlight consumer trends and expectations that are here to stay, and how innovative brands are capitalizing on these trends to drive growth. If you’re interested in exploring how any of these trends relate to your brand specifically, reach out to our team today to learn more.