The familiar clang of the school bell resumes this fall as most major school districts nationwide plan to reopen and welcome students back for in-person classes. With most online and hybrid learning classes being dismissed, what does this mean for brands and retailers? What shifts will soon-to-be bustling school hallways bring about during this year’s back-to-school shopping season?

Doing our data homework, we shed light on the attitudes and behaviors of back-to-school shoppers in the latest Numerator webinar. Using our back-to-school survey and Numerator Insights, Promotions and Ad Intel data, we revisit the trends of 2020 and uncover consumer intentions for the 2021 season. Nearly two-thirds of parents and guardians expect their kids to be at their school desks full-time come September, meaning back-to-school shopping is back in session, with a season that offers promising signs of a return to normal.

All Aboard the Back-to-School Shopping Bus

Like much of 2020, last year’s back-to-school shopping season was far from typical. The uncertainty around how and where classes would be held led to an extended season, which peaked in October and resulted in flatter sales overall. The lengthened season also impacted back-to-school promotions and messaging. We saw a marked decrease in circulars and ads during the summer months as retailers shifted their promotional focus to September.

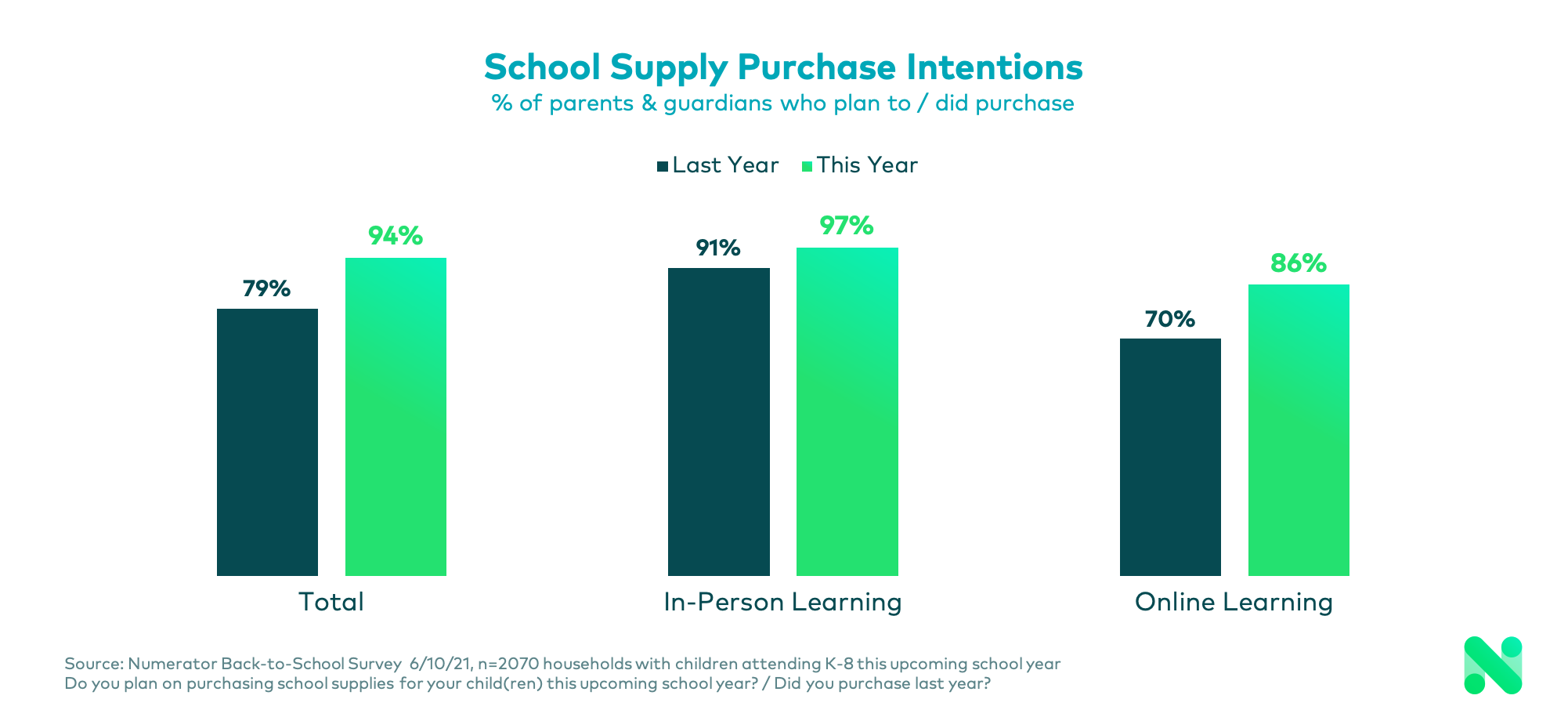

This year, as students prepare to rejoin their classmates on school grounds, parents are also back on track with back-to-school shopping. We found 94% of parents plan on purchasing school supplies, a 15% increase from last year. Plus, a majority of parents state they’ll return to the school supplies aisle by late July, so we expect back-to-school shopping to peak in early August, which signals a return to a more typical back-to-school season.

The Lessons of Distance Learning on Back-to-School Shopping Behavior

Although parents primarily rely on brick-and-mortar stories for school supplies, the sudden switch to distance learning in 2020 produced a significant shift to online purchases. In general, spend per household on school supplies was low last year with specialty retailers especially hard hit as parents consolidated trips and sought out one-stop shopping solutions. The exception was electronics, which finished the season strong both online and offline. Ecommerce retailers like Target.com and BestBuy.com experienced nearly 4X their usual sales in electronics compared to 2019.

Retailers took their cue from this shift and began leaning more heavily on digital web promotions in 2020. This online attention gave traditional school supplies like dry erase markers, pencils and pencils, and meeting materials a helpful boost, while less digital space was dedicated to electronics accessories, likely because demand was already high in that category.

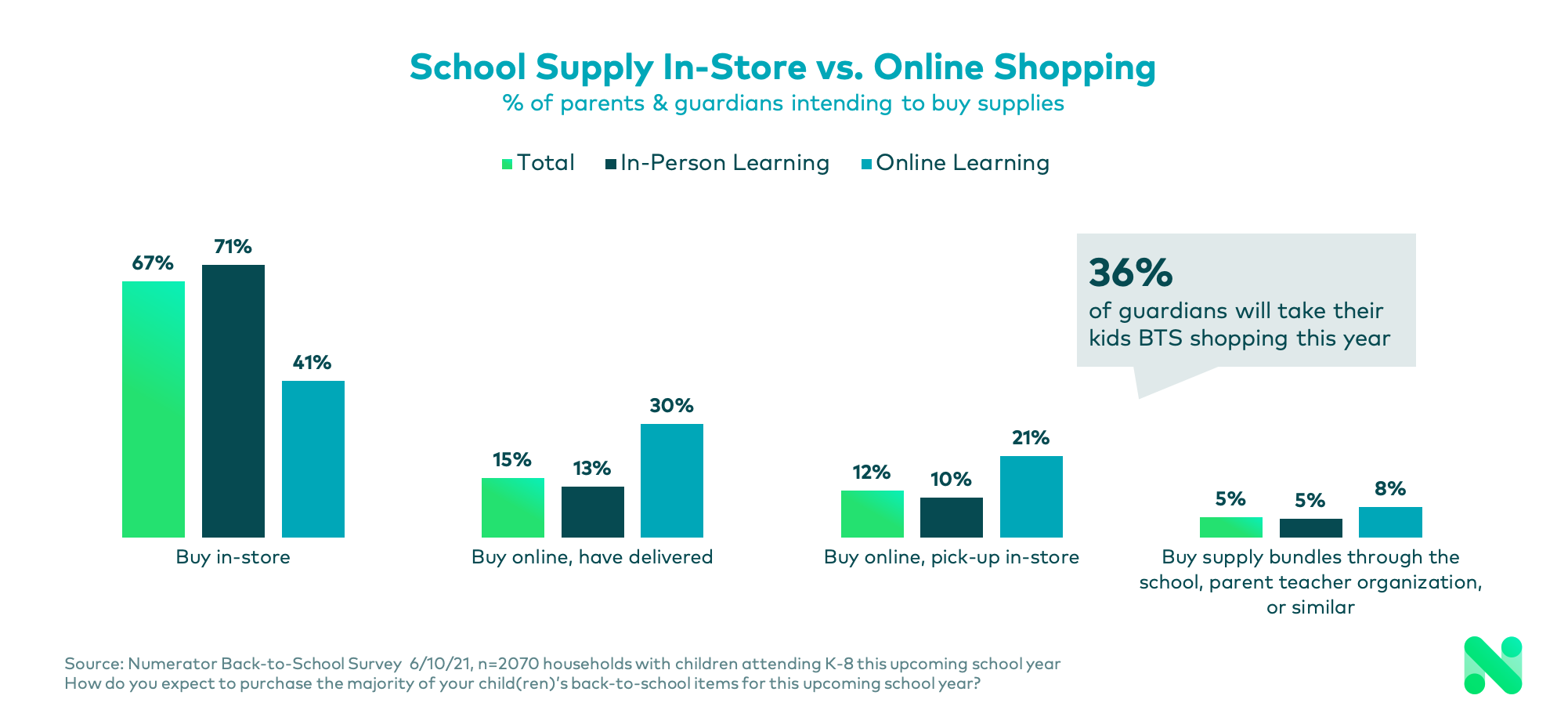

What does a return to in-person learning mean for back-to-school shopping behavior in 2021? With many students shifting back to in-person classes, the answer is good news. While households with students still studying online will continue to shop online, almost two-thirds of parents say they expect to return to brick-and-mortar stores for their school supply shopping and 36% plan to bring their kids along with them.

Back-to-School Basics Recapture a Seat at Head of the Class

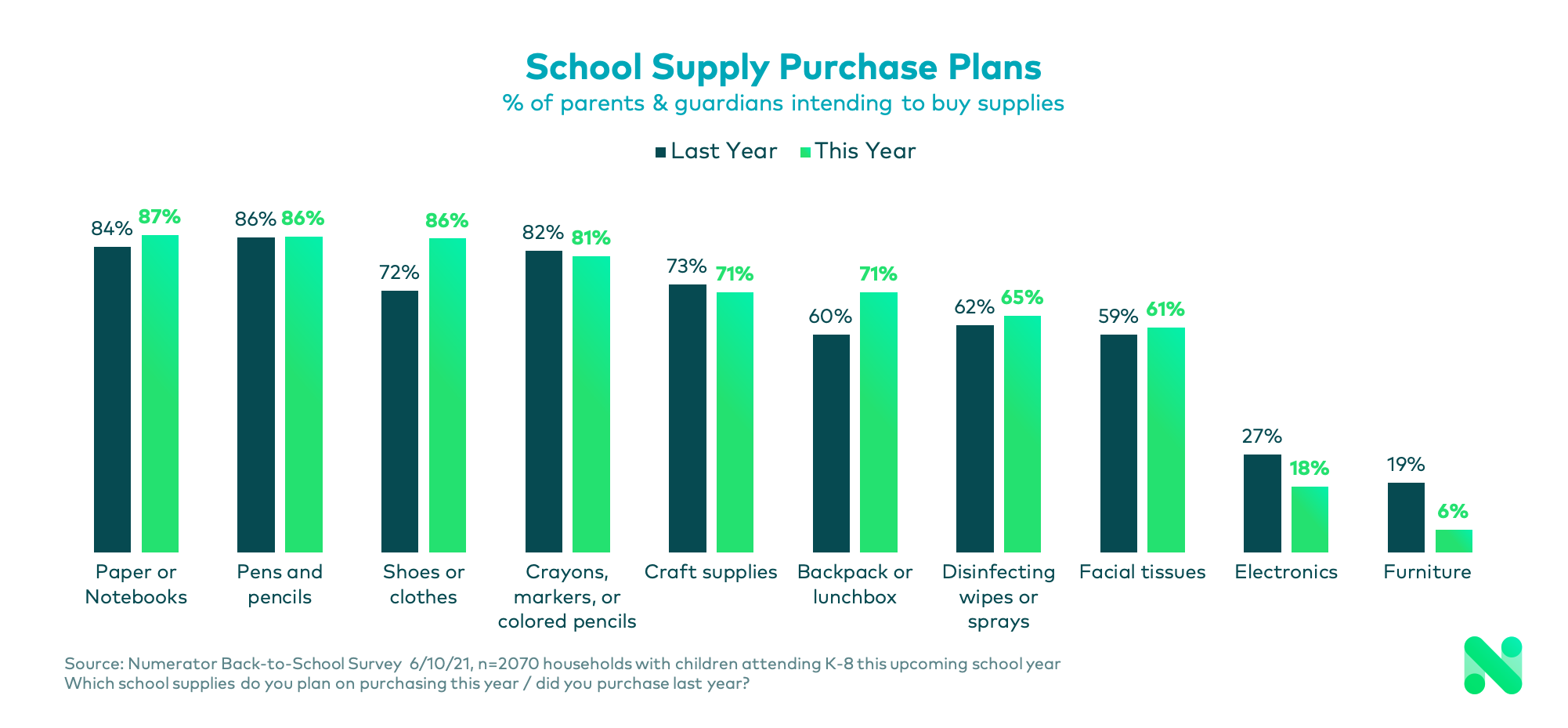

For students resuming in-person learning, school staples like clothes, shoes, backpacks, and lunchboxes are reclaiming the top spot on the list of supplies their parents intend to buy in 2021. This is a notable change from 2020 when electronics dominated back-to-school spending, its growth assisted by retailers promoting this category throughout the pandemic. Now, both electronics and furniture purchases are on the decline for these parents.

However, online learning is still a fact of life for some families. Those parents will continue to rely more on electronics and furniture purchases and less on back-to-school basics or household categories like hand sanitizer, facial tissues, and wipes since their kids will remain at home.

Looking Ahead

Overall, the 2021 back-to-school season is on track to earn good grades. As students prepare to reconnect on school campuses in September, parents are planning to shop for back-to-school supplies by late July, purchasing from categories they skipped last year. Since they’re also more likely to shop in-store, we are likely to see online sales soften. As a result, we expect the 2021 back-to-school season to peak in early August in anticipation of classes getting underway. These are all key indicators that back-to-school shopping is moving toward a return to normal.

We invite you to listen to the webinar replay for additional details on the shifts in consumer intentions and behavior as well as category trends heading into the back-to-school season. We also suggest subscribing for updates on Numerator’s Back-to-School Tracker, launching mid-July.

To learn more about how your brand or category is affected by the back-to-school season, please contact your Numerator Customer Success Consultants or get in touch with us.