Many consumers are heading into summer feeling as sunny and upbeat as the season itself. Per the CDC, 53% of US adults are now fully vaccinated, meaning more consumers are venturing back into the world each day. Trips and spending are rising along with the temperature outside, while at-home consumption remains strong. Is the vaccine giving brands and retailers a booster shot of hope for a bright, post-COVID future?

Numerator checked the pulse of consumer attitudes around the COVID-19 vaccinations and revealed the results in our most recent webinar. Leveraging Numerator Insights data and Vaccine Premium People Groups, along with our Sentiment and Holiday Intentions Surveys, we delve into the vaccination status of U.S. consumers, how the vaccine has impacted their in-store and online shopping behavior, and what to expect as summer gets underway.

Consumer Vaccination Status: Shifting From Complicated to Confident

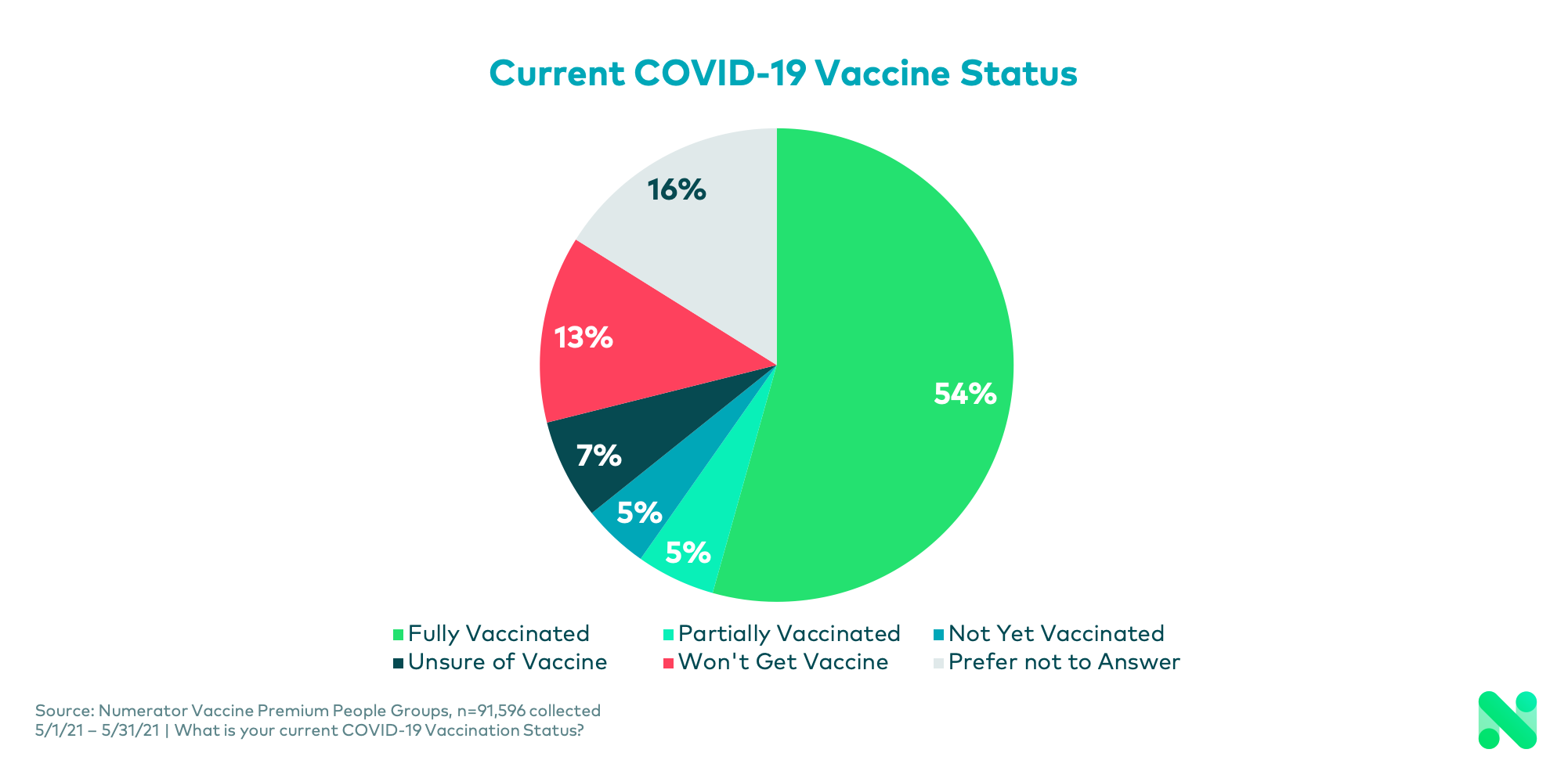

Responses to our most recent Vaccine Microsurvey, collected throughout the month of May, match up with national CDC data and show 54% of adult shoppers are fully vaccinated. Overall, 64% of shoppers are either already vaccinated or intend to be. This leaves roughly 20% of shoppers still on the fence or choosing not to get the vaccine at all, and another 16% who prefer not to share their vaccine status or intentions.

Diving into the demographics, we find the vaccination status of shoppers varies. Vaccinated shoppers tend to be in the Boomer age range and beyond. On the flip side, Gen Z and Millennial shoppers are the most hesitant or unlikely to get vaccinated. Uncertainty is also higher among Black and Hispanic households.

However, confidence is growing among vaccine-cautious consumers. Since our last survey in February, respondents were 33% more likely to say they intended to get vaccinated, which includes an increase among African-American, Asian, and Hispanic consumers. This is a notable change and points to the positive impact ad campaigns along with government and state initiatives are likely having in addressing vaccine hesitancy in these communities.

The Influence of Inoculations on Shopping Behavior

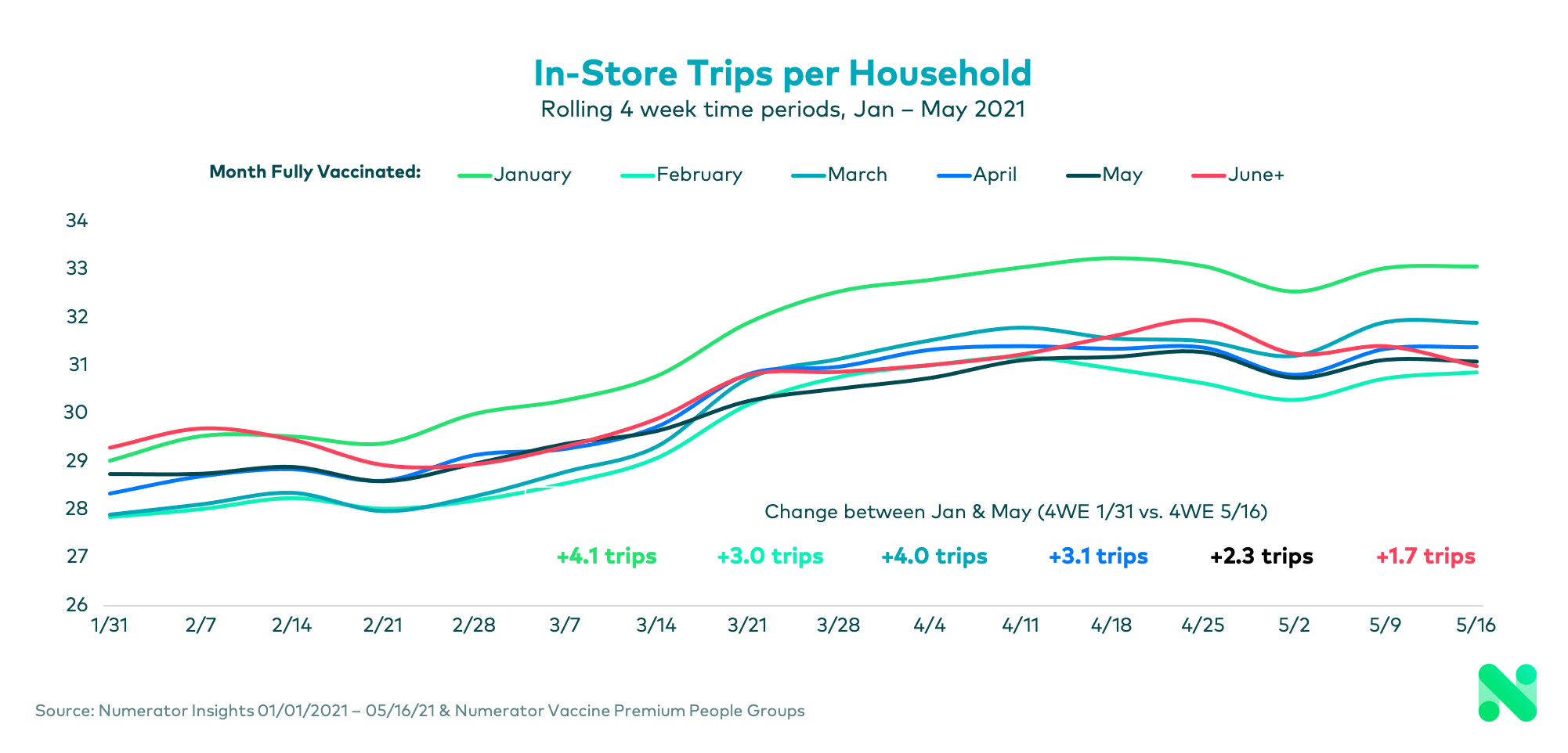

Throughout the pandemic in 2020, in-store shopping trips decreased dramatically, with fewer trips resulting in bigger basket sizes as consumers stocked up for the long-term. Meanwhile, online spending surged, though spend per trip was much lower than in-store visits. This trend was consistent across all consumer groups, regardless of vaccination timing or status.

Once the vaccine rollout began in 2021, a common assumption was that consumers would reduce online spending as their comfort level around returning to stores rose. Instead, the online spend trend remains steady. In fact, though shoppers vaccinated early on in the year are relying somewhat less on ecommerce, recently vaccinated shoppers have actually slightly upped their online spending.

Consumers are coming back to brick and mortar stores, but caution remains the name of the game. Shoppers vaccinated in the first months of the year are slowly wading back into the in-store pool with an increase of 3-4 trips, while consumers vaccinated in May and June are only dipping their toes in the water with an increase of just 1-2 trips. A full return to pre-pandemic shopping levels will be gradual one.

Hope Runs High for Summer

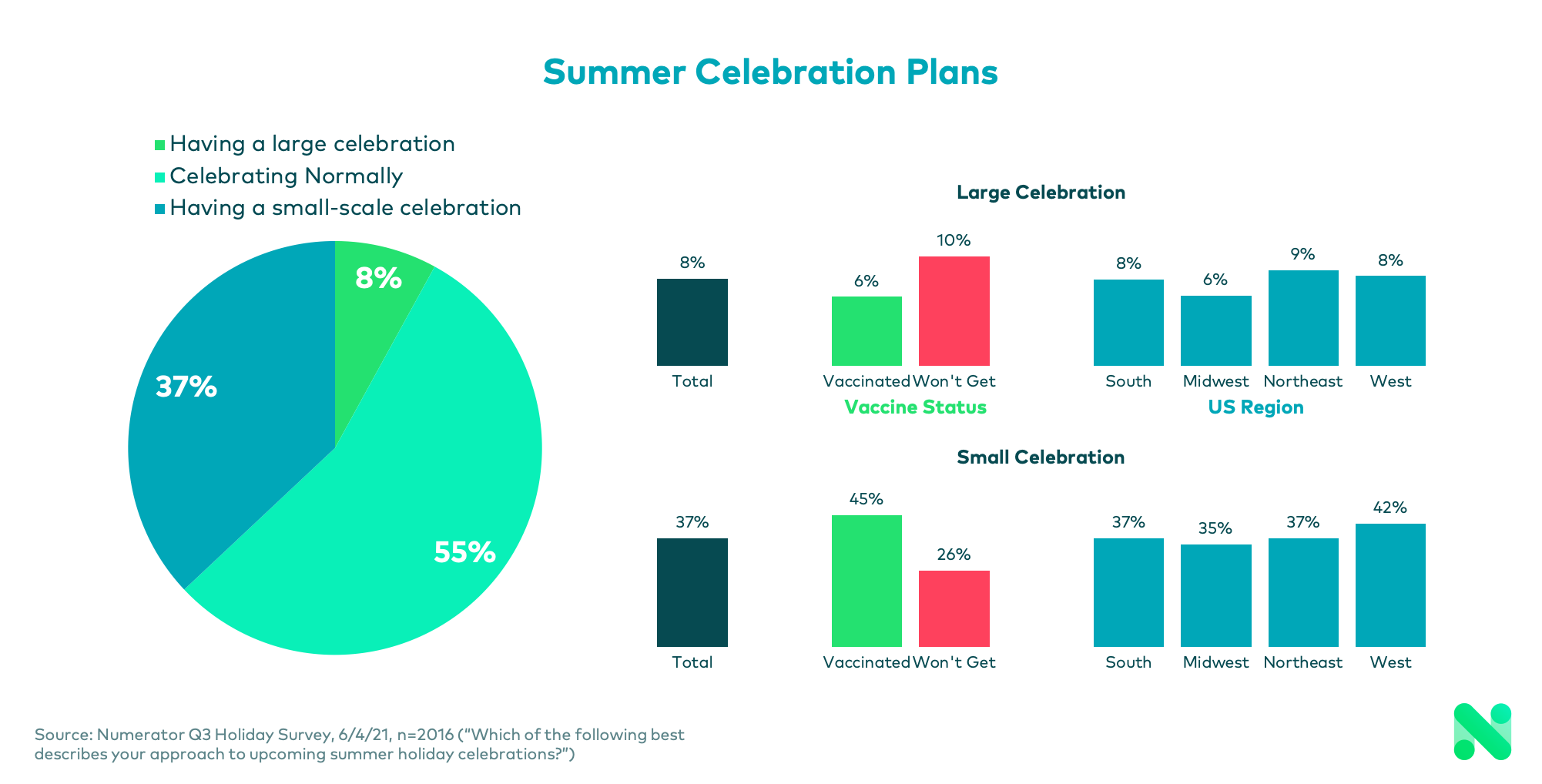

While still somewhat wary, the summer months do find consumers feeling more and more confident about returning to their favorite pre-COVID activities like travel, going to concerts, dining out, and gathering with family. Two-thirds of vaccinated shoppers anticipate a return to normal life by the end of this summer, and unvaccinated shoppers share they’re already comfortable returning to their regular routines.

This is welcome news for summer holiday celebrations. Over 50% of consumers expect to enjoy the upcoming July 4th and Labor Day holidays just as they have in the past and are even more excited about them this year than usual. Vaccinated consumers, however, do plan to keep their guest list limited and continue hosting smaller gatherings.

Looking Ahead

Although pandemic shopping patterns remain and there is still a group of shoppers planning to remain unvaccinated, consumer vaccination status is an indicator of a return to normal. Pre-COVID behavior is steadily making a comeback among vaccinated consumers, and summer 2021 will see more in-person get-togethers and holiday celebrations, even if those gatherings are on the small side. Consumer optimism is also growing, so there is an opportunity for brands and retailers to experiment with their messaging this season.

We invite you to listen to the webinar replay for more in-depth detail on how consumer sentiment around the COVID vaccine is affecting attitudes and shopping behavior. Additional resources like our Holiday Sentiment Survey and Monthly Consumer Sentiment Study provide you with the most up-to-date information so you can make the right decisions as you guide your business through this unusual time.

To learn more about accessing resources like our Vaccine Segment Premium People Groups or how your brand or category is affected by post-vaccine behavior, please contact your Numerator Customer Success Consultants or get in touch with us.