To help our brands and retailers better understand this considerable change in post-COVID consumer behavior, Numerator Solutions Consultants Patreece Smith and Erich Ritz put together an in-depth webinar on the shifts we’ve seen over the last eight months. We looked at how shoppers have adapted, the unique trends unfolding in the category, and how brands and retailers can adjust to reach the new, post-pandemic beauty buyer.

Quarantine disrupts the status quo

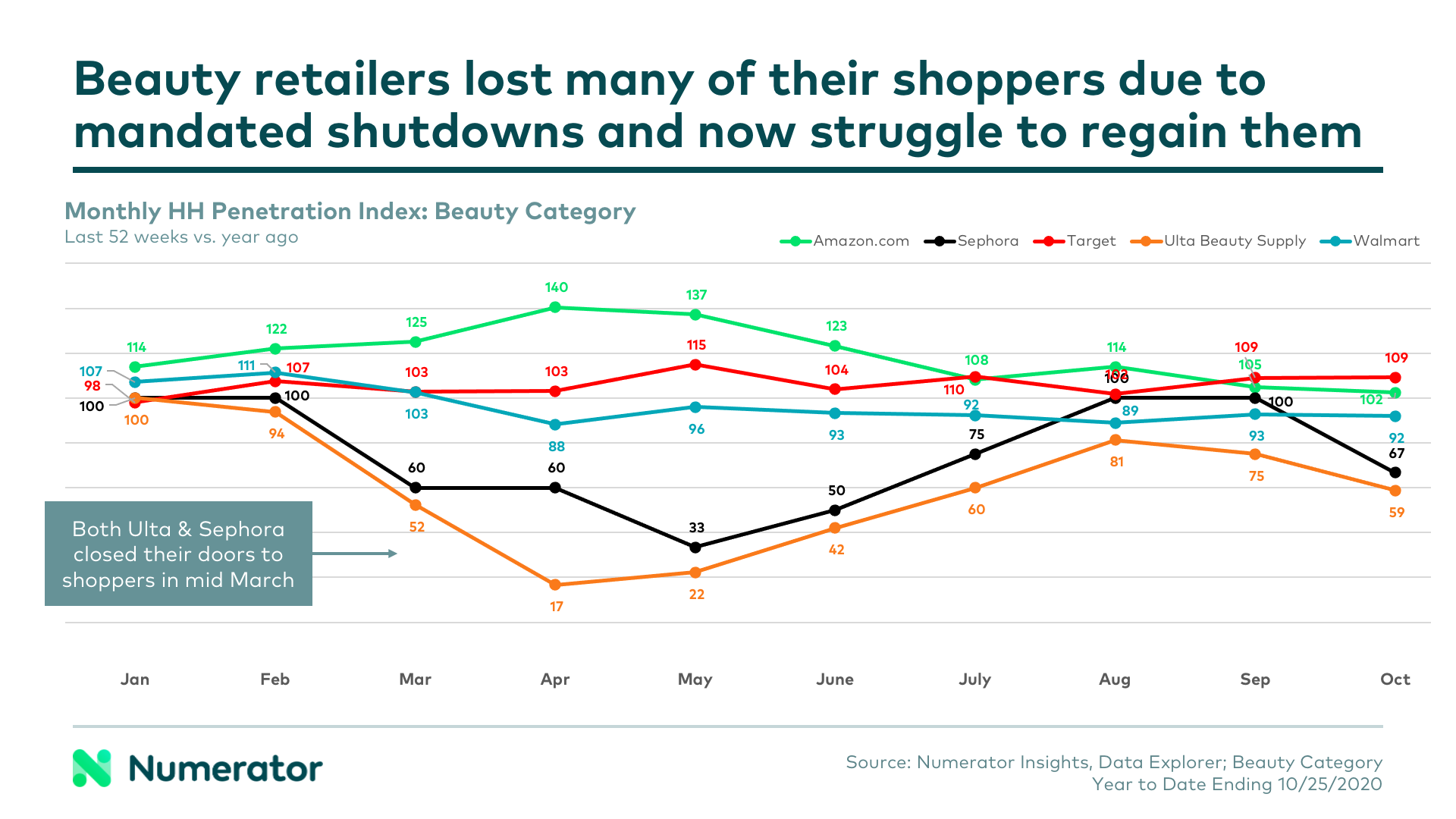

Mandatory lockdowns in the early months of the pandemic forced beauty retailers such as Ulta Beauty and Sephora to shutter their stores. This meant their bottom line took a big hit. Though sales have improved since reopening their doors, these stores have struggled to regain ground.

Traditional and online channels become beauty destinations

With 98% of consumers continuing to shop in the category, it’s clear beauty supplies such as facial, skin, and hair care are still in demand. However, over 65% of shoppers have turned to traditional and online channels for these products. Target, Walmart, and Amazon have all captured a notable increase in wallet share.

As a result, mass retailers have begun to place more emphasis on their beauty promotions, especially on the digital side. Target specifically has invested heavily in this area and seen significant gains in sales as a result.

The new face of the post-COVID beauty buyer

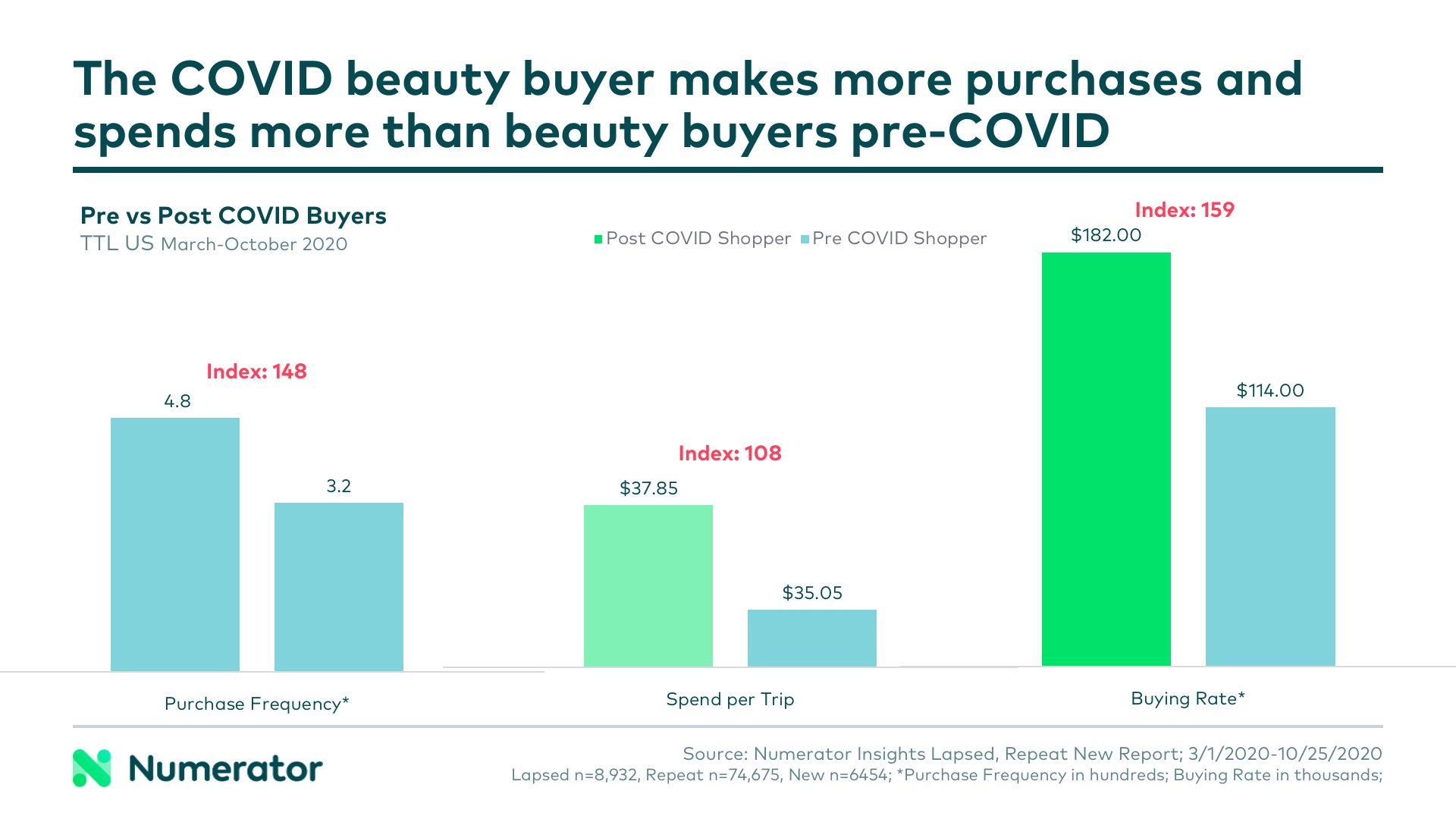

Another reason retailers like Target have been upping their digital marketing spend in this category is because of the emergence of a new, post-pandemic beauty buyer. Much different from the pre-pandemic buyer, these new shoppers are younger, higher-income, and heavily influenced by social media. Though they prefer traditional retailers for beauty supplies, they’re not fans of private label brands.

More importantly, this post-COVID beauty shopper is 18% more likely to stock up on beauty supplies. They buy more frequently in the beauty category than the pre-COVID shopper and spend more per trip, making them an important consumer to capture and keep moving forward.

Marketing to match the beauty buyer’s complexion

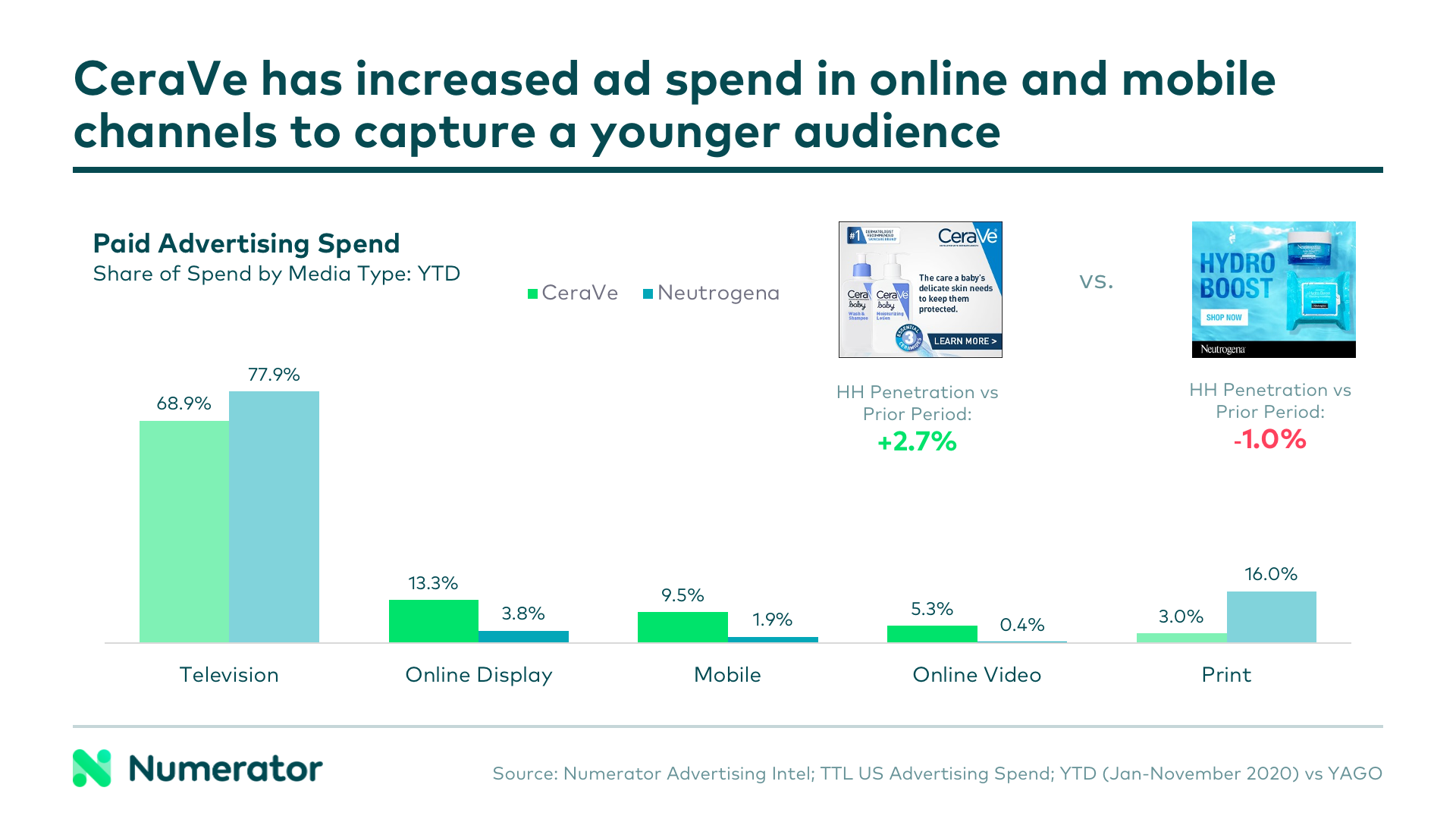

Reaching these new beauty buyers means understanding their shopping patterns. Popular social media platforms like Tik Tok are playing a big role in how young beauty consumers learn about trending brands and have led to an increase in product trials. CeraVe is one national brand finding success with this audience by focusing more advertising attention on their online and mobile presence.

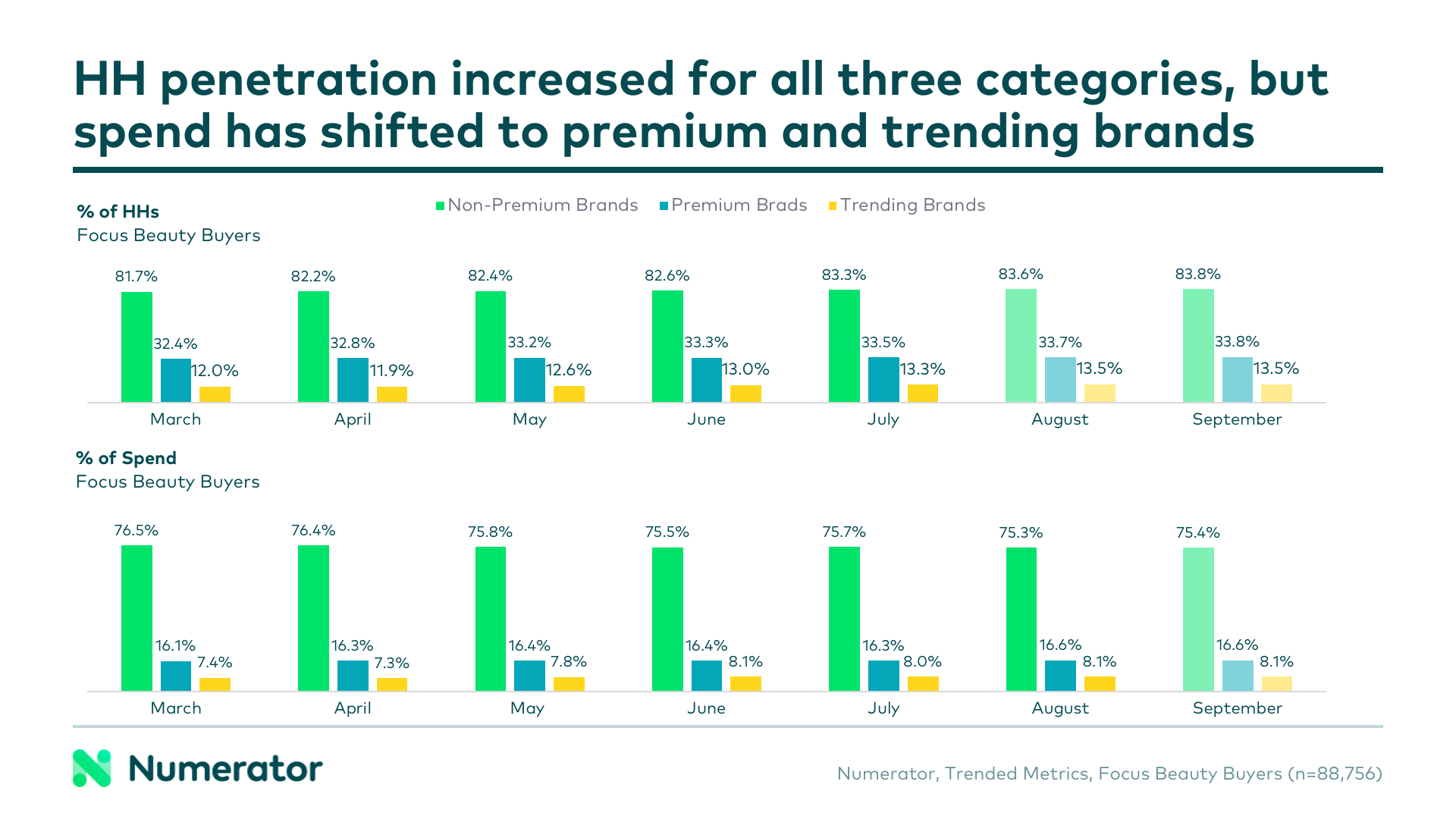

Given their poor perception of private label brands, these beauty shoppers prefer premium, non-premium, and trending national brands. Repeat spending in these three categories has remained steady, though we are starting to see a slight uptick in sales of premium and trending brands.

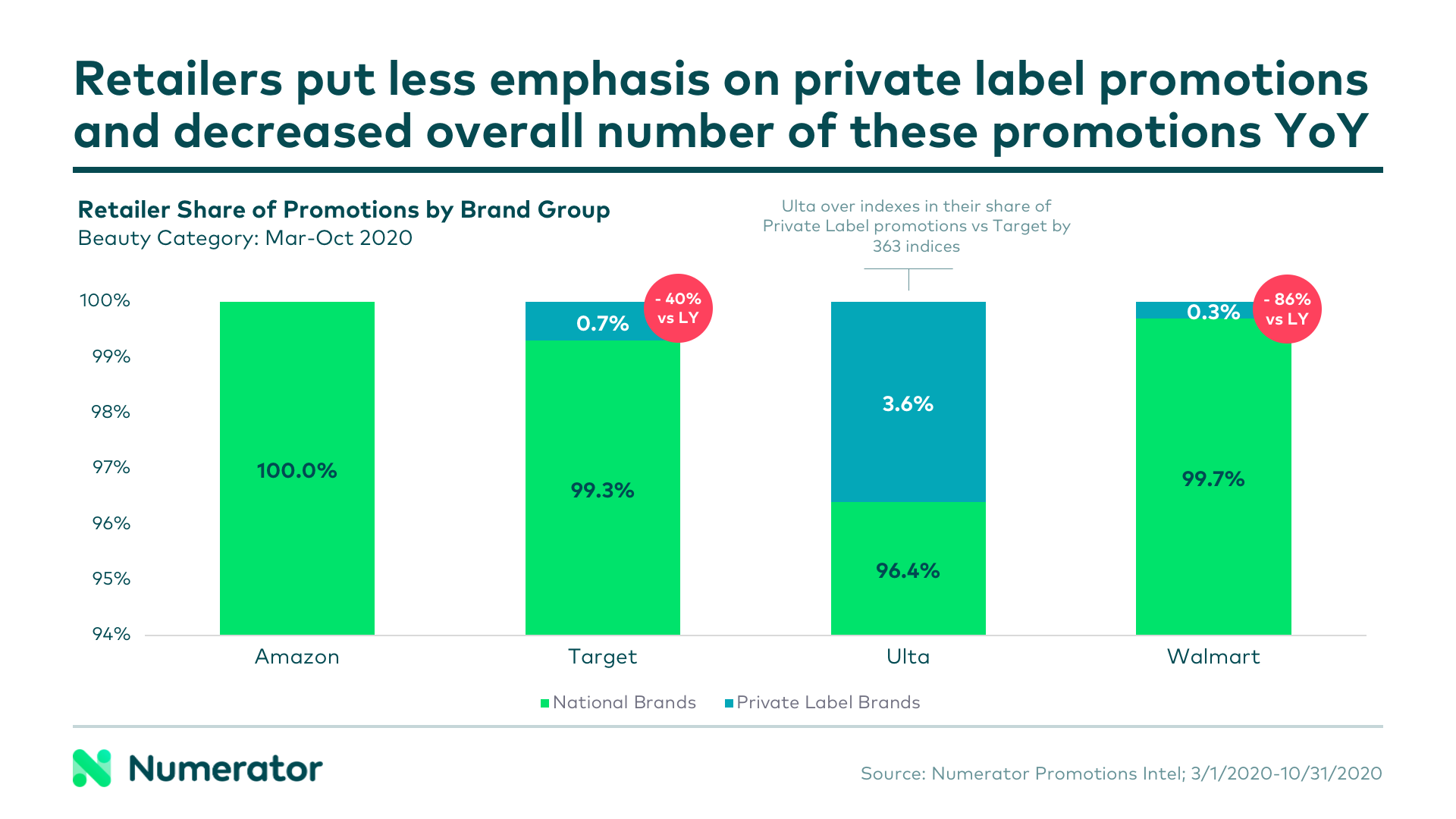

Online and mass retailers like Amazon, Target, and Walmart have made note of these new trends. They’ve reduced their promotion of private label beauty brands and now almost exclusively advertise national names. And, they’re boosting their digital reach. This has likely been a key factor in their ability to pull in recurring beauty category business compared to niche retailers like Ulta.

Looking ahead

With no clear end to the pandemic in sight, we expect these changes to continue long-term. For beauty retailers in particular, understanding where buyers are shopping in this category and why will be critical to their recovery. But all brands and retailers in the Beauty channel will want to implement marketing strategies that appeal to and attract the new post-pandemic shopper.

We invite you to listen to our webinar replay for even more detail on the behavioral shifts of the beauty buyer and their impact on the Beauty channel. Our goal is always to provide our brands and retailers with the most up-to-date information on consumer behavior, so you can make the right decisions as you guide your business through this unusual time.

To find out how your brand or category is affected by COVID-19, please contact your Numerator Customer Success Consultants or get in touch with us.