We recently addressed this question in a special webinar discussing the pandemic’s impact on the QSR channel. Using Numerator Insights, Surveys and Ad Intel solutions, we analyzed a snapshot of QSR data from March through May. We’ll highlight a few key observations here on what changed, what worked, and where to focus going forward. Though the situation remains in flux as the country continues reopening, certain consumer patterns have emerged that can guide QSR chains as they navigate the road ahead.

COVID-19’s Impact on Advertising and Consumer Spend

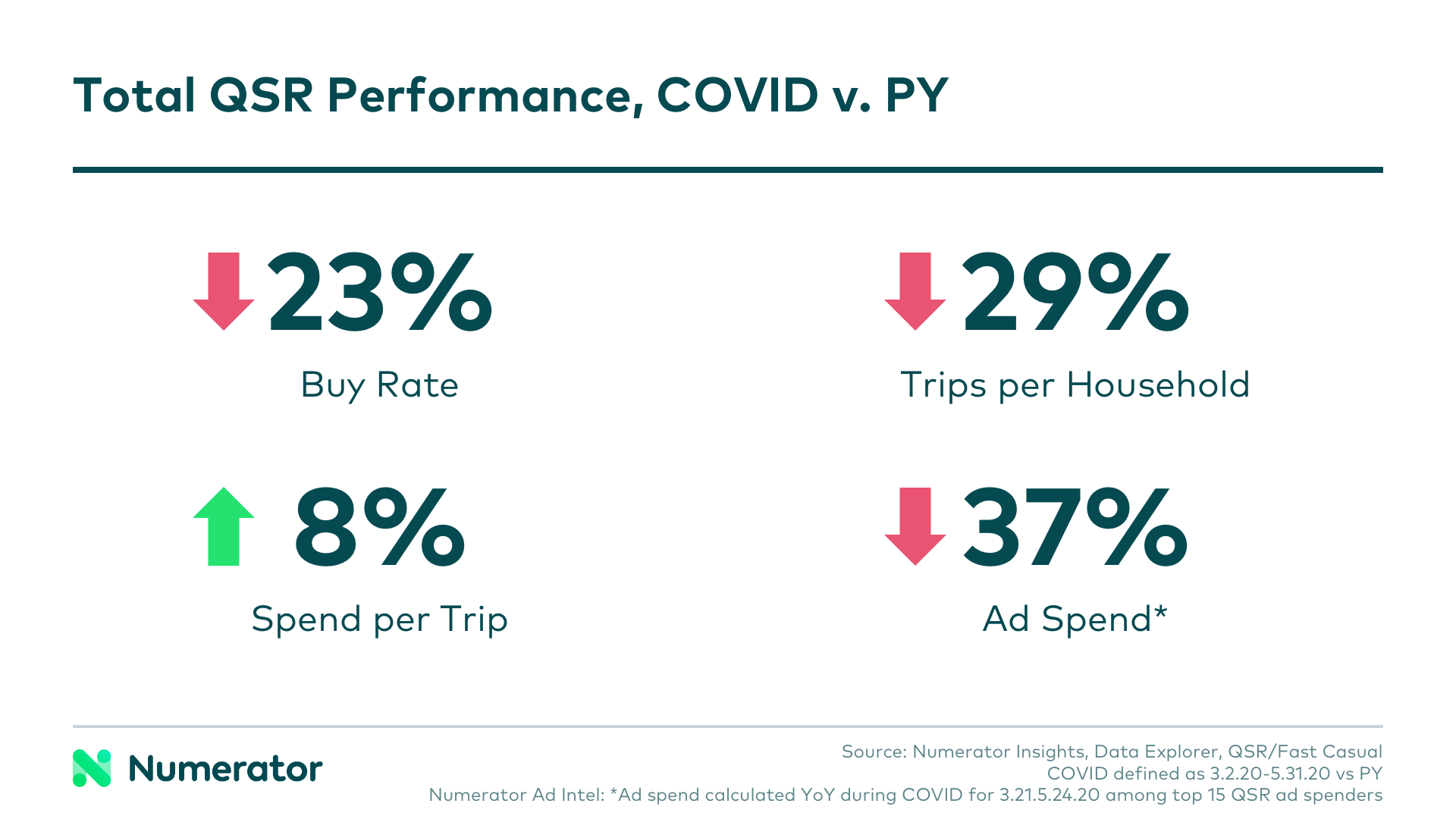

One of the more striking shifts was the drop in both advertising and consumer spending. With consumers sheltering at home to stay safe, QSR trips per household decreased by 29%. Though consumer spend per trip increased by 8%, likely due to households purchasing more meals to feed their families during this time, the overall drop in QSR performance was significant.

This drop in consumer spend impacted advertising spend as well, which dipped 37% during this period. This is a huge change and was fairly consistent with most restaurant chains. The good news is we see an opening for QSRs to explore ways of investing in more targeted advertising.

Pickup and Delivery Grows in Popularity

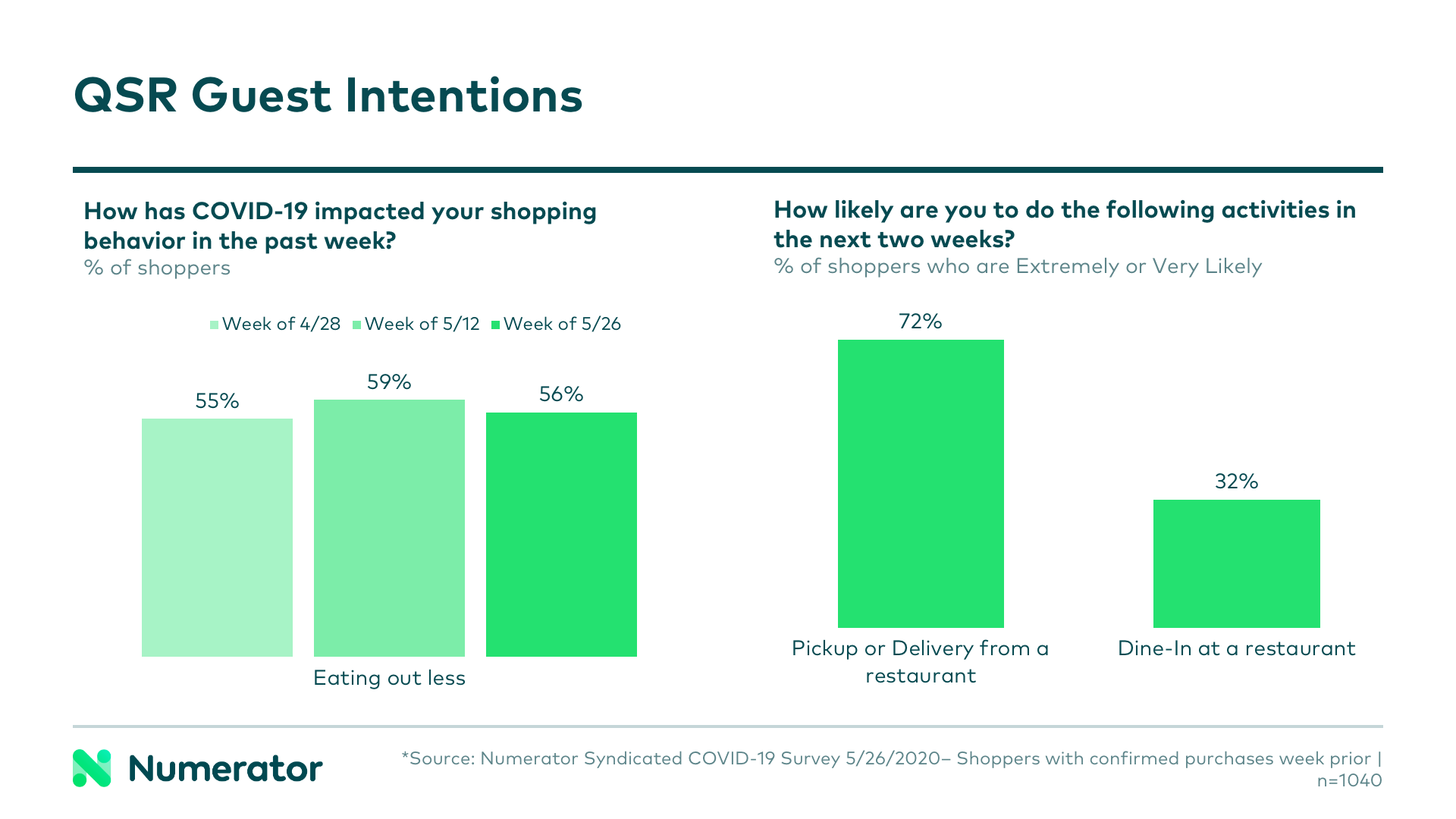

To better understand consumers’ crisis mindset and how their daily routines had been disrupted, we surveyed consumers to find out what they were avoiding during the pandemic. We found consumers were wary of dining out with over 50% eating out less due to the continued spread of the virus.

However, 72% of consumers were comfortable with pickup and delivery meal options. This indicates consumers are willing to spend at QSRs as long as they’re confident they can do so safely. While this behavior may shift as more restaurants reopen, we anticipate pickup and delivery services will remain important alternatives, especially for at-risk consumers.

3rd Party Delivery Sales Soar

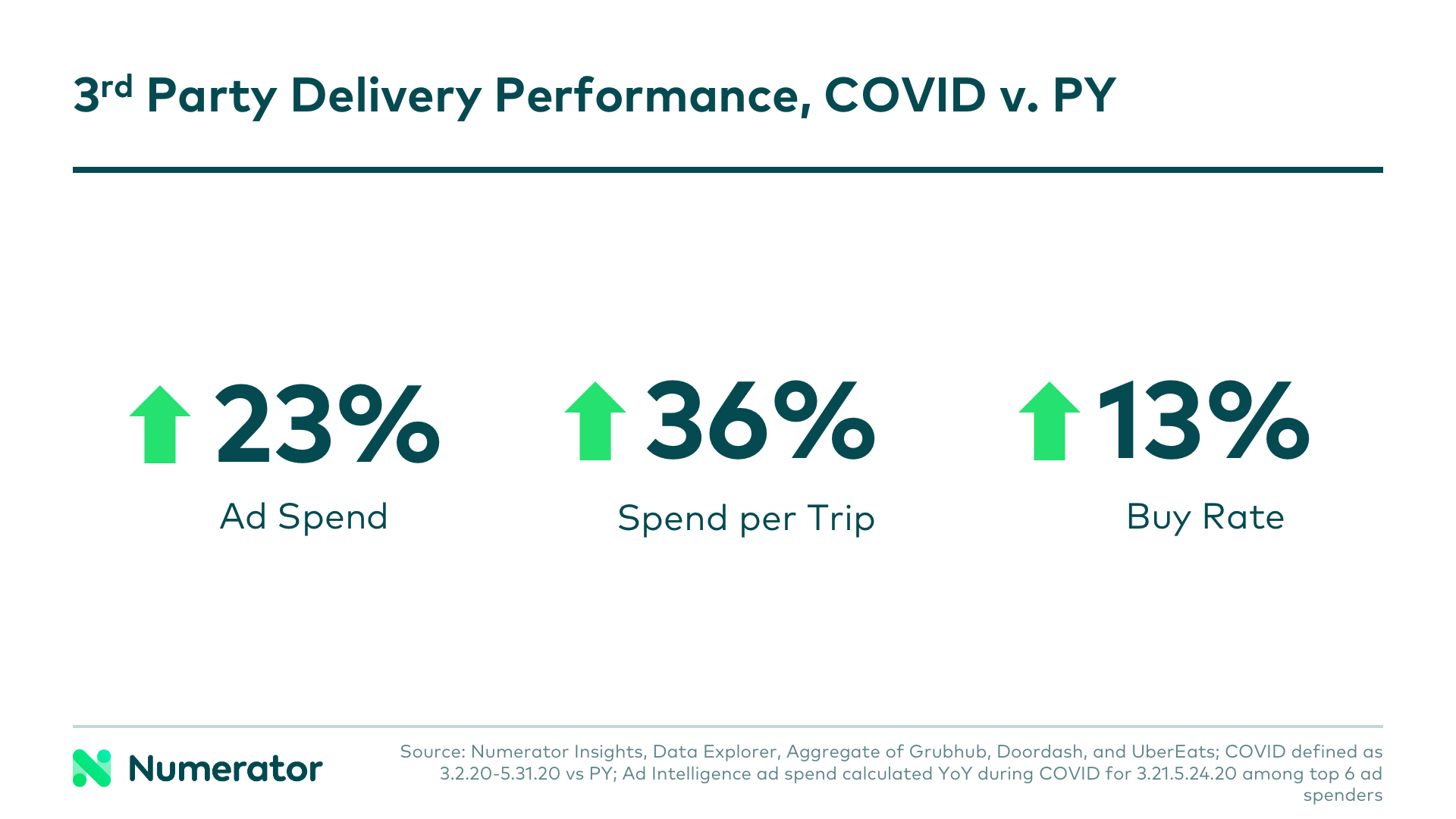

QSRs have reaped big benefits from consumers embracing 3rd party delivery services like Uber Eats, DoorDash and GrubHub during the pandemic. We saw a 23% surge in advertising spend, a 36% increase in spend per trip and a 13% rise in spend per household.

In fact, 3rd party delivery trips grew 6 times the previous average as the pandemic wore on. We even found that 89% of households using 3rd party delivery during this period had not used the service at all a year ago.

Building on this household base of busy parents wanting to feed their families will be crucial for QSR chains. These new users are accustomed to going out to eat and prefer not to cook, so access to 3rd party delivery has been vital during this difficult time.

The Advantage of a Targeted Messaging Approach

Given these essential changes in consumer habits, we recommend QSRs tune into and target specific audiences with their advertising messages. For example, focusing on the importance of family and positioning 3rd party delivery as a family helper could retain and grow that consumer base. Emphasizing the convenience of pickup and delivery, the variety of meal options available, and featuring family meal bundles are additional ways to resonate with consumers.

Wendy’s is one chain that succeeded using a targeted approach. Launching their breakfast menu just before the crisis hit, at a time when commuters became scarce, Wendy’s was not only able to grow their wallet share, they even helped to grow the category.

What’s Next for QSRs?

Though some factors on the path forward are hard to predict, consumer behaviors are what drive sales and are the leading indicators of what comes next. The new habits we’re seeing offer valuable insight into how QSRs can best serve the current needs of the COVID-19 consumer.

It’s clear consumers still want to eat out, though their concerns over doing so will likely remain for the foreseeable future. Even as more places reopen, some cities are already having to limit access to bars and indoor dining due to a rise in COVID-19 cases. QSRs will want to continue concentrating on and accommodating consumers who are seeking to minimize their exposure to the virus and protect their family.

We encourage you to view the 30-minute recording where we delve into additional details on how COVID-19 affected consumers and the QSR channel. The recording includes a closer look at both the financial impact of the pandemic as well as how Wendy’s scored a win with their brand new breakfast menu.

With a new normal being set, it’s crucial to have a cross-channel understanding of consumers and fast, flexible, and accessible data. Numerator has the tools to guide you through this process. We can help ensure you’re reaching the right people with the right message. This is why QSRs and retailers rely on Numerator to help them better understand and engage with their omnichannel consumers and stay informed during this unprecedented time.

To find out how your brand or category is affected by COVID-19, please contact your Numerator Customer Success Consultants or get in touch with us.