The art of the impulse buy is something retailers have been finessing since the inception of modern shopping. A glance at nearly any checkout lane will reveal a similar assortment of candies, snacks, and trinkets designed to inspire a last-minute addition to the shopping cart. As shopping continues to shift online, though, how can brands and retailers continue to drive sales in these impulsive categories?

Many checkout lane items are intended for immediate consumption, making them a great last minute add to a brick-and-mortar shopping trip, but less enticing when you know you won’t be receiving the item for another 2-5 business days— depending on the retailer and delivery method, of course. So, how does impulsivity translate to online shopping, where craveability is less of a factor?

Though traditional “impulse categories” like candy, gum, and small snacks may not see a large volume of sales online, brands in these categories do have the opportunity to redefine the category landscape in ways they might not be able to in-store. High slotting fees and fierce competition make it difficult for smaller brands to compete with category leaders when it comes to prime, checkout lane real estate, a phenomenon outlined by NPR in their recent podcast on “How Grocery Shelves Get Stacked.”

When the competition moves online, though, the field can become more accessible for small players. While the digital shelf is still incredibly competitive, brands have more opportunities to get in front of consumers, whether it be through sponsored listings, optimized search ranking, or digital ad placements on websites and social media platforms.

Chew on That

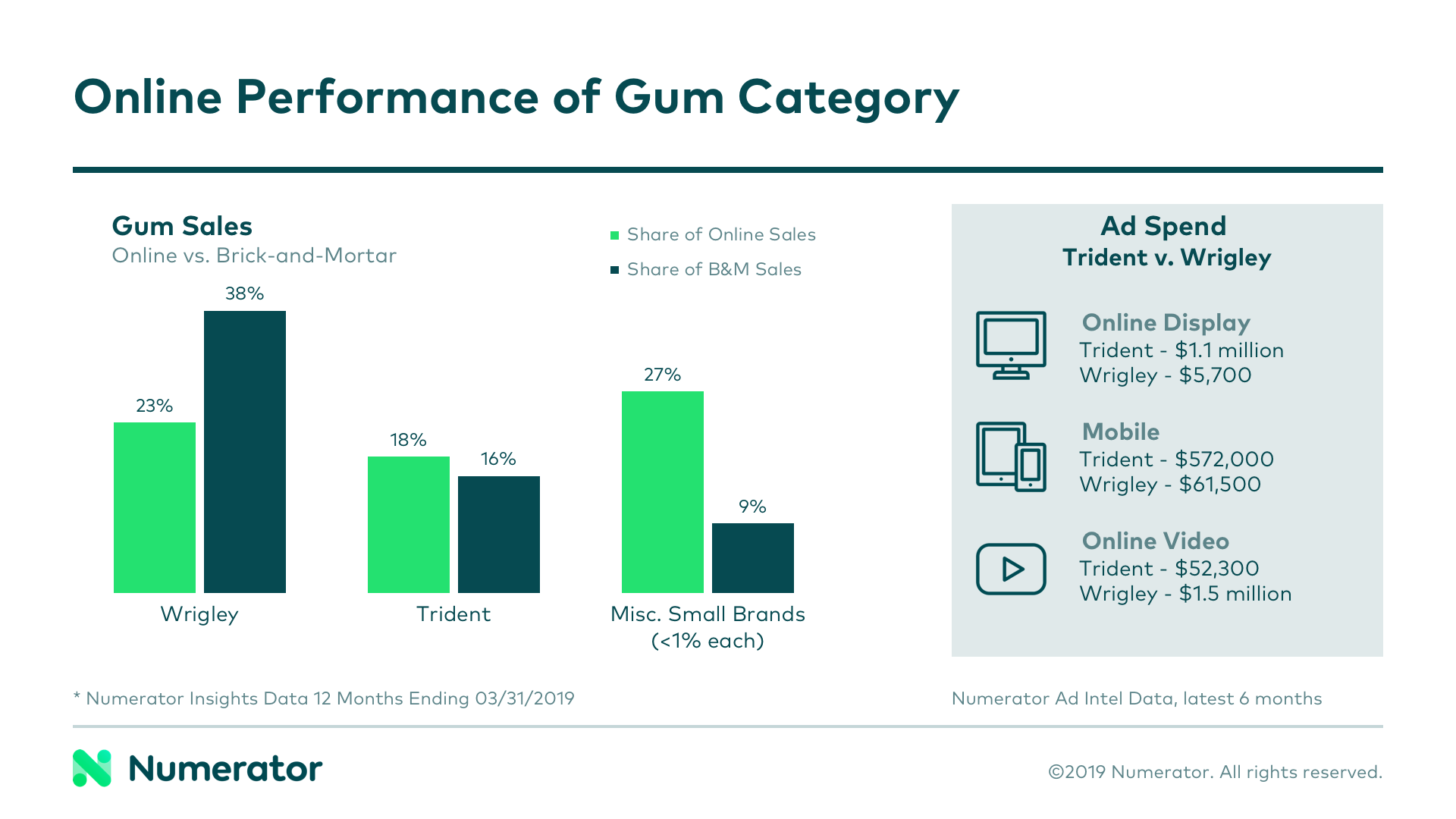

The gum category is an excellent example of a traditional impulse category where underdog brands are winning online. In traditional FMCG channels, Wrigley holds a 38% market share, more than twice that of runner-up, Trident. Online, however, Wrigley’s share is down 15%, dethroned by a culmination of smaller brands, each under 1% share individually.

Additionally, Trident’s online share is up 2%, perhaps due to their heavy investment in mobile and online ads. According to Numerator Ad Intel data, Trident is the top spender for mobile and online ads, spending a combined $1.7 million in the past six months versus Wrigley’s $1.6. Trident’s strategy is also much more heavily rooted in online display and mobile ads, while Wrigley’s is almost entirely (96%) dedicated to online video.

A look at advertising preferences among online gum buyers shows us that these individuals are more heavily influenced by online, social media, and mobile ads than the average shopper (46.9% vs. 40.3%). The mobile and online display strategy has appeared to pay off for Trident; how can other brands, particularly those in impulse categories, find similar success?

Presenting the “Impulse Buyer” Profile

According to Numerator Insights data, 17% of shoppers identify themselves as “impulse buyers.” Compared to the average shopper, they are more than twice as likely to enjoy browsing displays and trying new things, and are 1.6x as likely to be deal-focused brand switchers, meaning they’re more open to exploring new brands, particularly those with compelling deals.

These impulse shoppers are young, tech savvy, and spend a significant amount of time on their mobile devices, meaning their impulsivity is likely to translate to their online shopping habits as well. When it comes to advertising, impulse buyers are more heavily influenced by social media and mobile ads than other shoppers, and are more likely to make their online purchases via smartphone or tablet.

Digital ads that reach consumers on the same device they use for online shopping function similarly to an in-store display at traditional brick-and-mortar stores, and are a great way to entice an unplanned purchase. For shoppers who are already prone to impulsive purchasing, social media and mobile ads seem to be one of the best opportunities to capitalize on these spur-of-the-moment shopping decisions.

The New Impulse Categories

When we talk about impulse buys, we often limit our thinking to traditional brick-and-mortar, checkout lane items. Though these categories can definitely utilize digital advertising tactics to make the most of their online opportunities, it’s also important to note that the online marketplace has brought about a new crop of impulse categories.

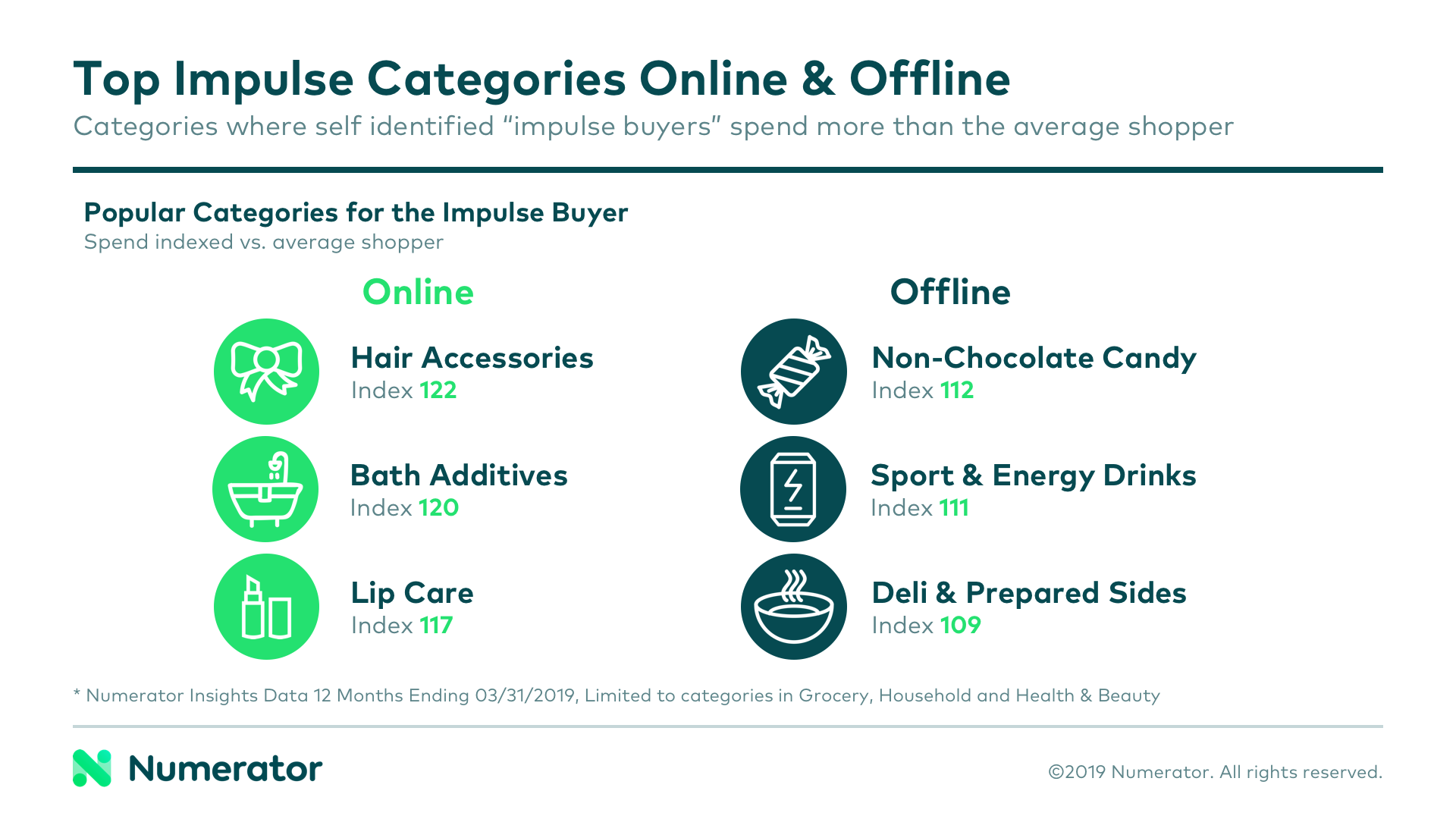

In traditional FMCG channels, self-identified impulse buyers spent more on candy, energy drinks, and prepared foods (exactly what we might expect). Online, they spent more on hair accessories, bath additives, and lip care products.

Interested in learning more about impulse buys, the shoppers making them, and how they differ on and offline? Give in to the urge and reach out to Numerator today.