The perfect storm is brewing for growth in the cannabis industry. There’s a push for expanding medical use. There’s a push for legalizing recreational use. And a growing body of research suggests cannabis can be helpful in the treatment of a wide range of physical, emotional and neurological conditions.

This is why you’re seeing CBD (cannabinoid), the non-psychoactive substance found in cannabis, in more stores and more product categories. Just this week, Carl’s Jr. announced it would offer a burger with CBD-infused Santa Fe Sauce… on April 20… at a price of $4.20. Despite the promotion’s obvious connection to National Weed Day on April 20, you won’t get high by using CBD. More importantly, consumer awareness of CBD’s reported health benefits is spreading, and retailers and brands have responded by introducing CBD products, particularly in food and personal care categories. One market forecast estimates that the CBD market will more than triple from $500 million in 2018 to $1.8 billion in 2022.

Given this sharp growth trajectory, it’s important to understand who CBD shoppers are, what they’re buying, how they feel about CBD products, what’s driving purchase behavior, and what retailers and brands can do to capitalize on these trends.

Who Is Buying CBD?

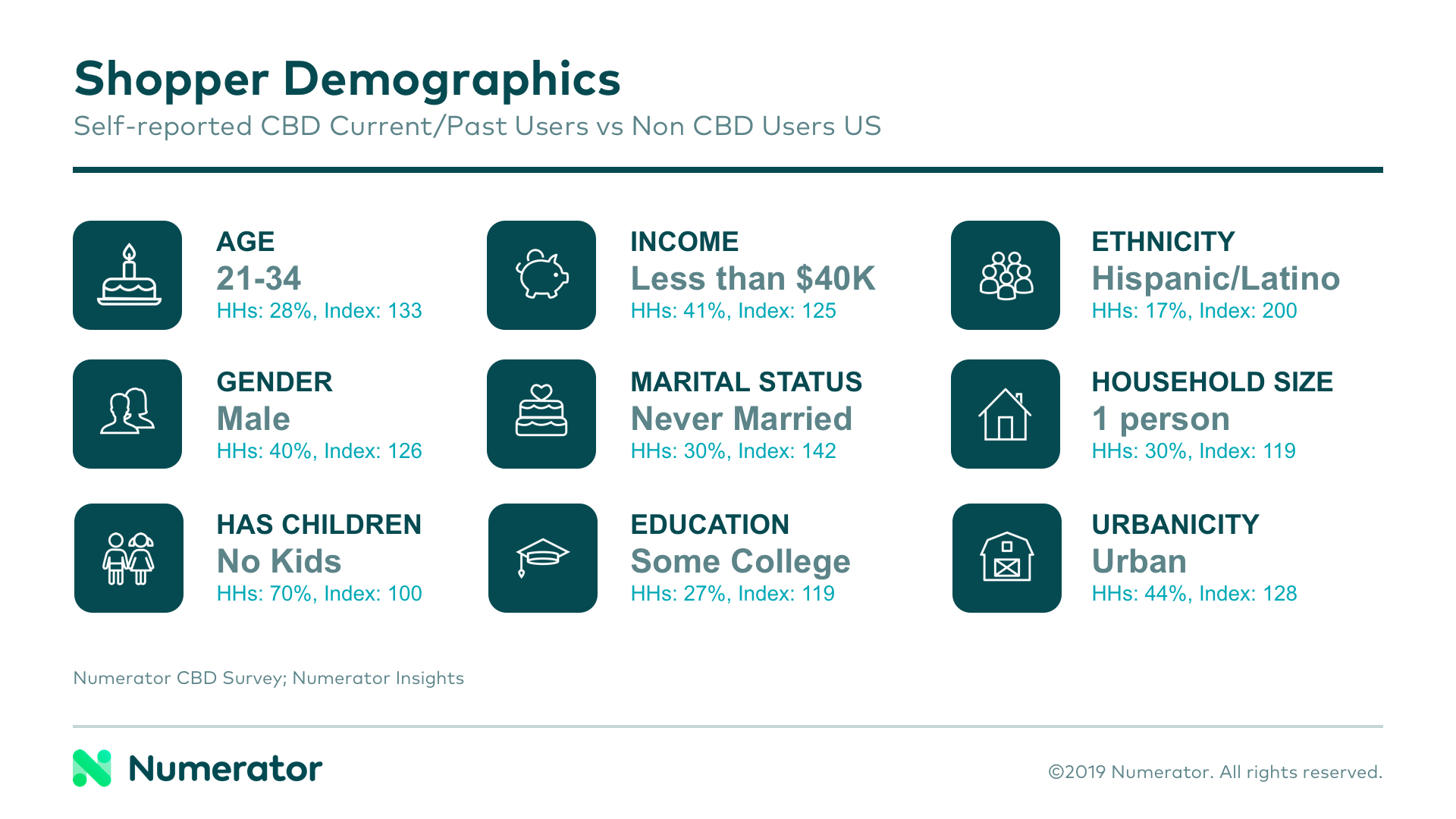

At this point, one in five shoppers indicate that they would buy CBD. For comparison – that’s about the same number of shoppers who buy coconut water. Current or past purchasers of CBD-infused products are more likely to be young, single Hispanic/Latino men who live in urban areas and have no kids.

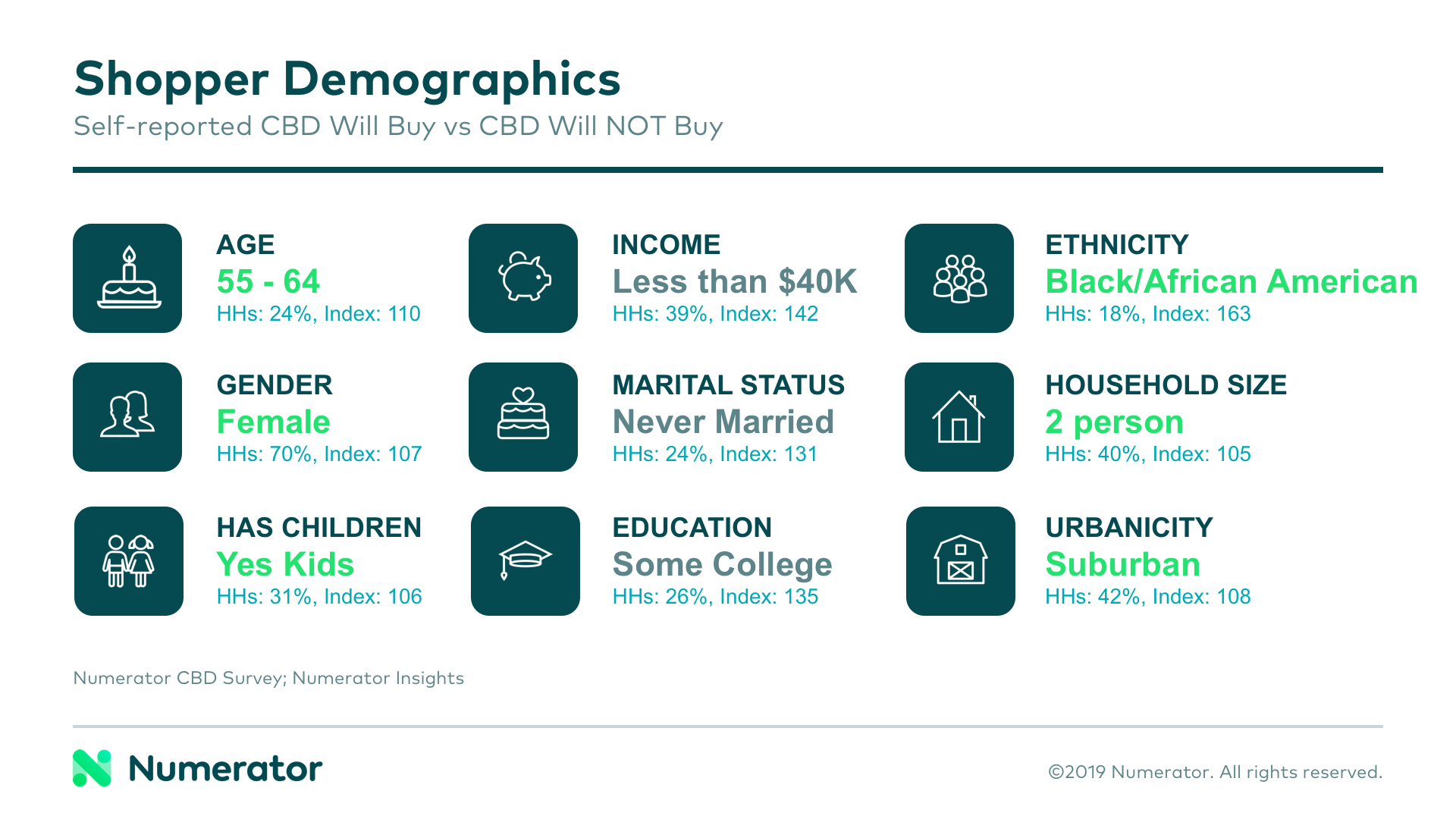

However, respondents to our Numerator Insights CBD survey who represent incoming CBD purchasers are more likely to be older, African-American women who live in suburban areas and have kids.

What CBD Products Are Shoppers Buying and Why?

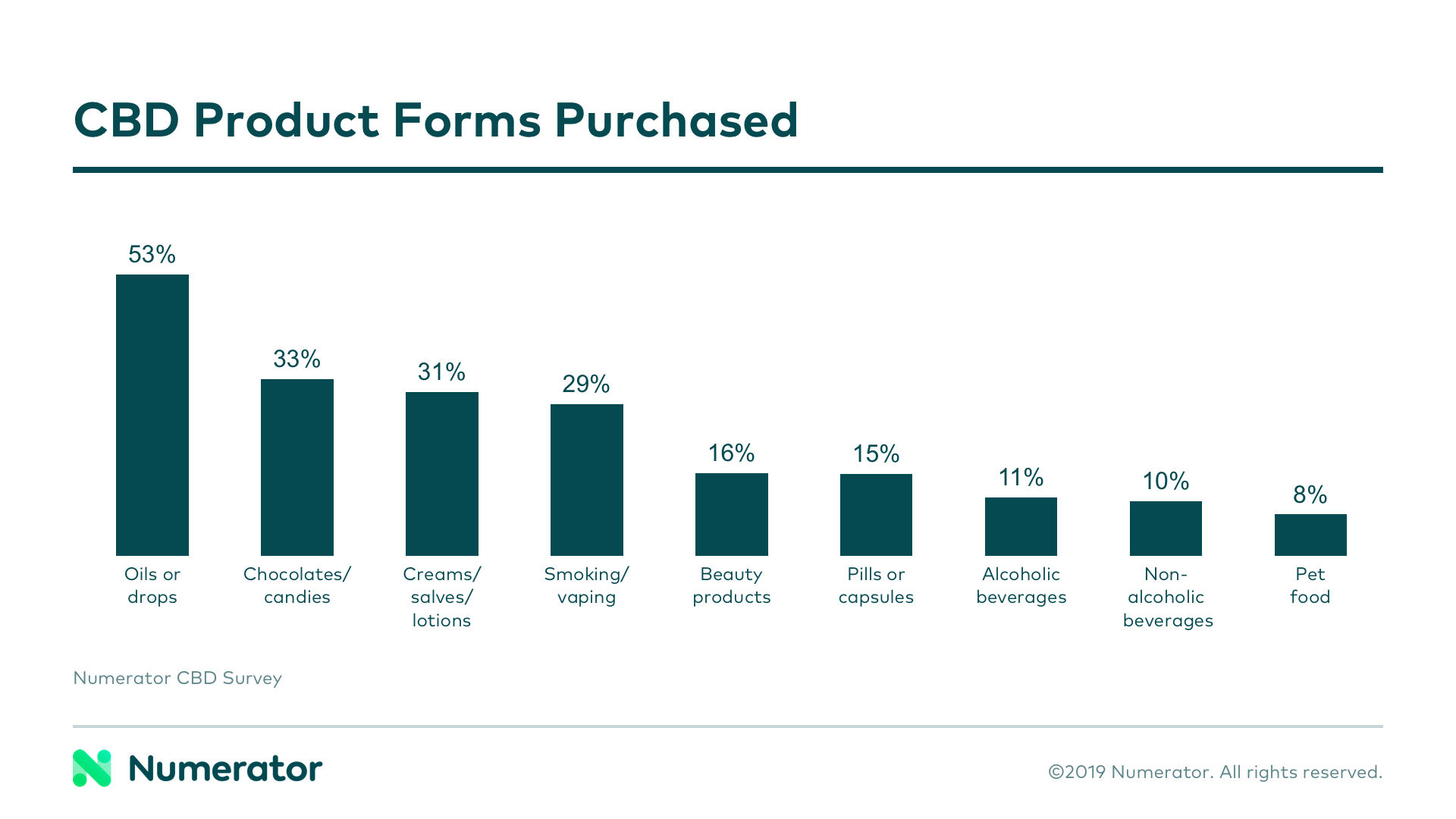

CBD products are gaining traction in many categories. Oils and drops are the most popular CBD products by far, purchased by 53% of survey respondents. But CBD isn’t just about oils anymore. Other top CBD categories include chocolates/candies (33%), creams/salves/lotions (31%), and smoking/vaping products (29%). Our survey found that CBD users spend $254 more per year on grocery products than non-CBD users.

Perceived benefits of CBD seem to be driving entry into the category as four in 10 purchasers said they sought out CBD products for benefits that could improve their quality of life. More specifically, the top reasons for purchasing CBD products were to reduce pain (60%), reduce stress and anxiety (58%), and improve sleep (50%).

CBD is already affecting the health sector. 23% of CBD users cut back on over-the-counter medication, while 19% increased consumption of vitamins and supplements.

How Should Brands and Retailers Approach CBD?

The early feedback on CBD products is overwhelmingly positive. 71% of shoppers said they were extremely or very satisfied with their purchase, while 82% said they definitely or probably will repurchase those products. 30% have even increased CBD consumption in the past six months.

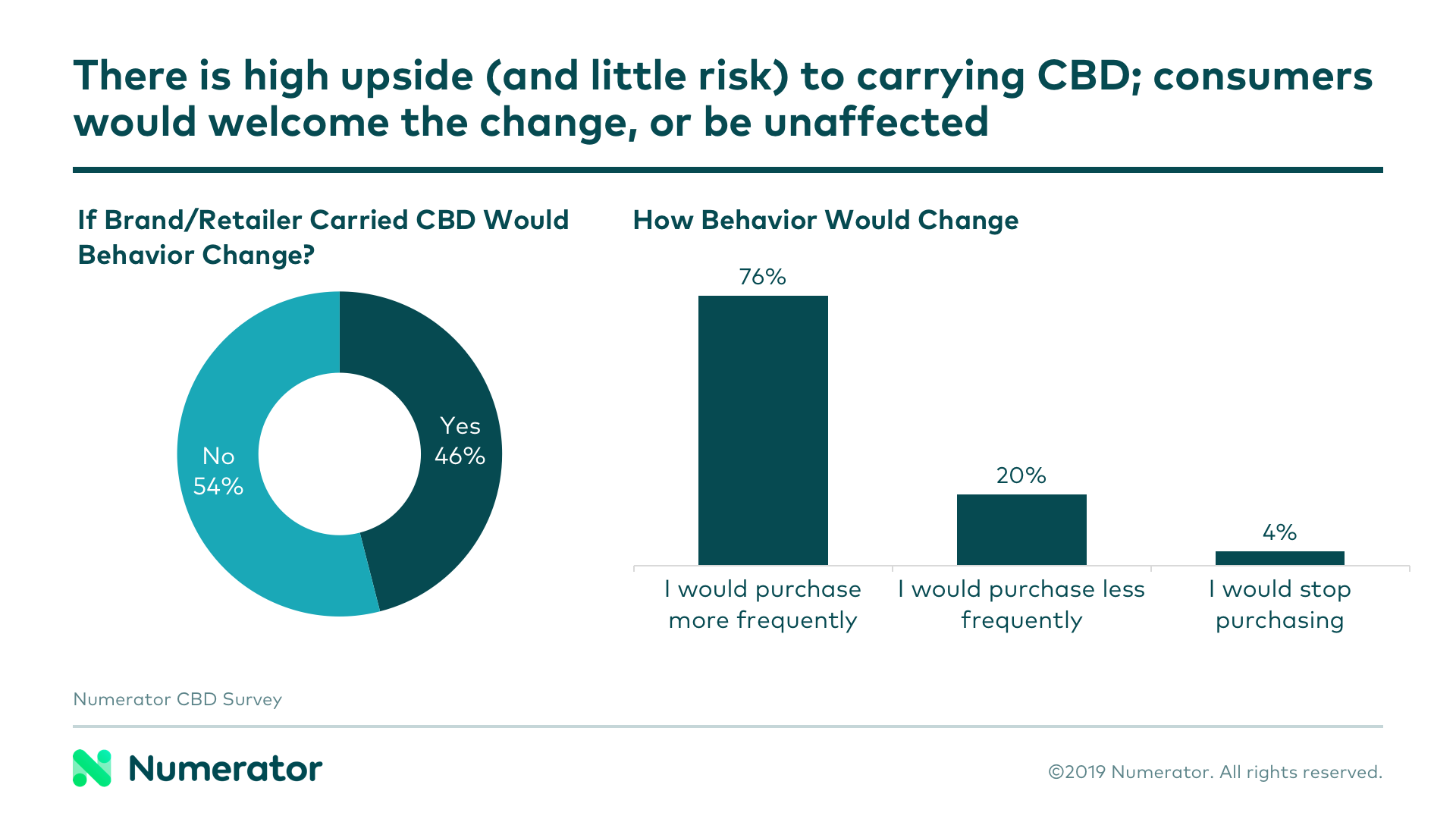

Among those who have never purchased CBD products, 75% said they either might buy or will buy CBD products in the future. If a brand or retailer started offering CBD products, nearly half (46%) of survey respondents said their shopping behavior would change, and mostly for the better. In fact, 76% of those shoppers said they would purchase more frequently. This shows that new CBD products would be a welcome change with high upside and little risk.

CBD usage and purchasing behavior are evolving. Based on our data analysis, brands have an opportunity to attract new shoppers with a benefits-led approach. For high-growth CBD categories, brands should develop marketing strategies and messaging that focus on the benefits CBD purchasers seek.

Want to formulate your own strategy that accounts for CBD growth? Contact us to find out how CBD is affecting purchase behavior in your specific categories and channels today!