Numerator Consumer Price Index (CPI)

Key findings from Numerator’s January CPI:

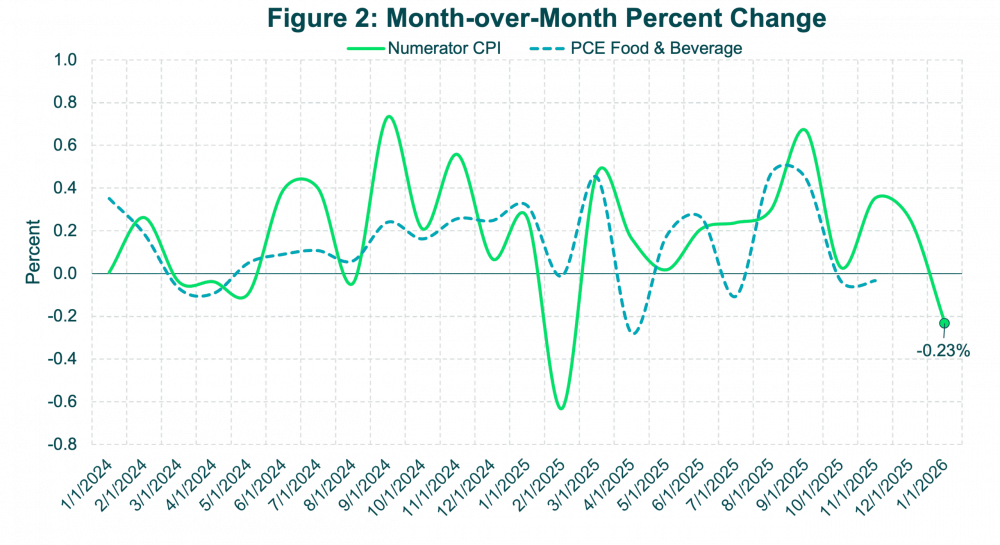

- Prices for everyday household purchases declined 0.23% in January 2026, its first month-over-month decline in nearly a year, after having increased 0.25% in December 2025 and 0.35% in November 2025.

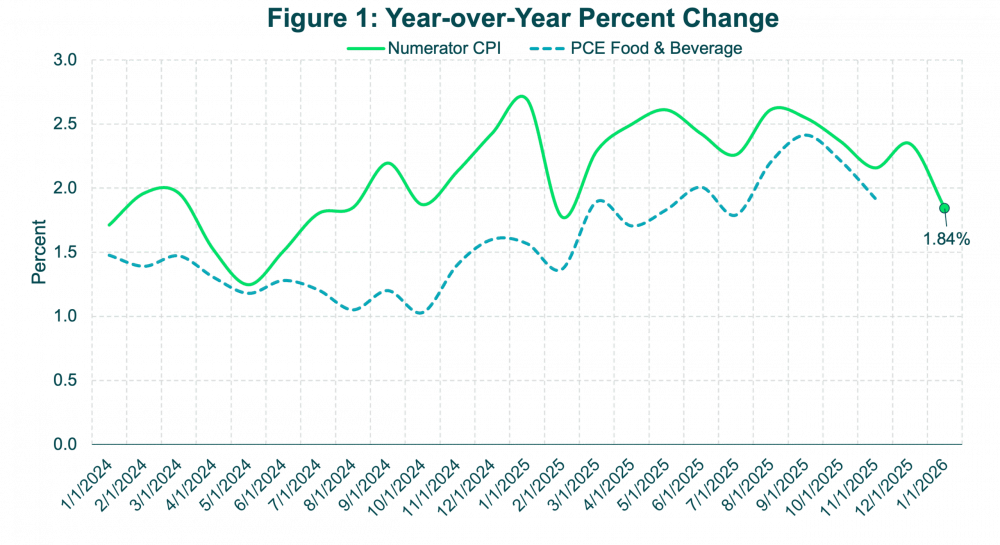

- Over the past 12 months, prices for everyday household purchases are up 1.8%.

- Over the past several months, annual inflation for everyday household purchases has been cooling, providing some much needed relief to consumers.

METHODOLOGY:

Numerator’s consumer inflation measure is constructed using both base-period and current-period quantity weights to combine item prices, an approach that is consistent with the structure of the U.S. Bureau of Economic Analysis’ PCE Price Index.

The index is calculated from verified, item-level transactions provided by a panel of 200,000 geographically and demographically representative U.S. households. These data include purchases across categories such as grocery, household goods, and health and beauty. The data capture changes in consumer purchasing behavior when prices change, including brand switching, downsizing, and shifts in where consumers buy.

Values are aggregated monthly to produce index levels and month-over-month and year-over-year percent changes, providing a current view of inflation trends. The dataset uses verified household purchase data from the demand side, offering visibility into consumer behavior as prices evolve.

The Numerator CPI’s year-over-year inflation measure has a 0.93 correlation with the PCE Food and Beverage index since 2019.

Learn More

Contact us to learn how Numerator can help you understand the impact of inflation on your business.

Thank you!

A member of our team will get back to you within 24 hours. In the meantime, explore our content to get a pulse on the latest consumer and shopper insights trends.

Get the Latest Economic Research from Numerator

For a deeper view into shifting economic conditions and the impact on consumer behavior, check out Numerator’s Economic Research